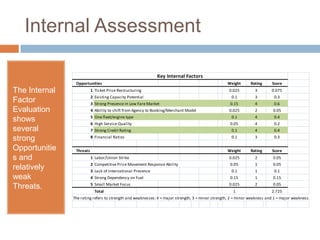

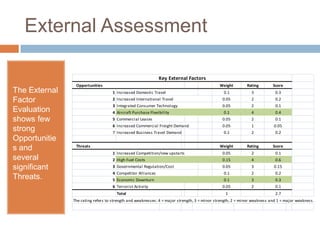

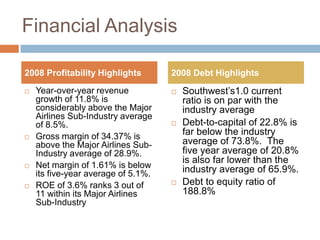

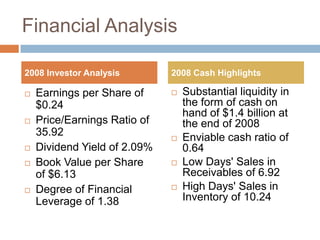

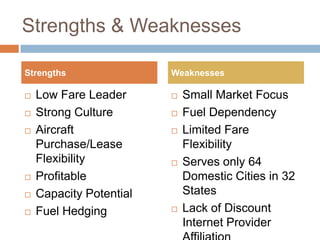

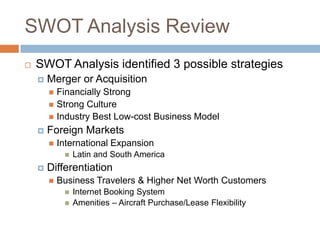

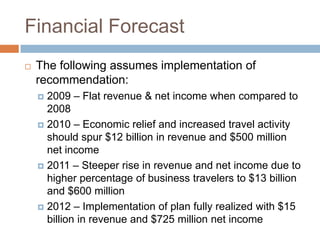

Southwest Airlines began in 1971 with 3 aircraft serving 3 Texas cities. It now serves 64 cities in 32 states with 537 aircraft. The presentation analyzes Southwest's competitive position, internal and external factors, financial performance, strengths/weaknesses, opportunities/threats, and identifies possible strategies like international expansion or mergers.