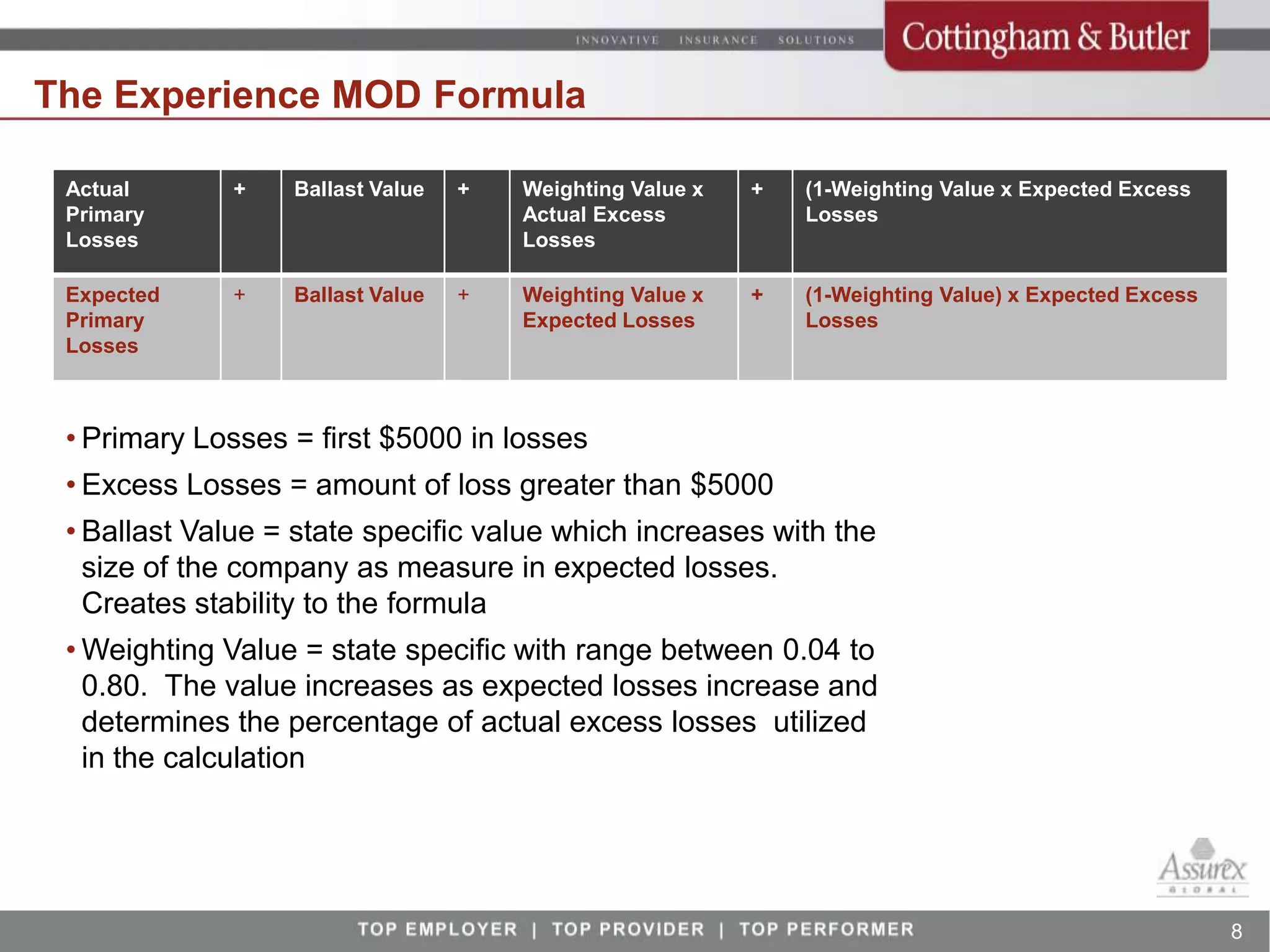

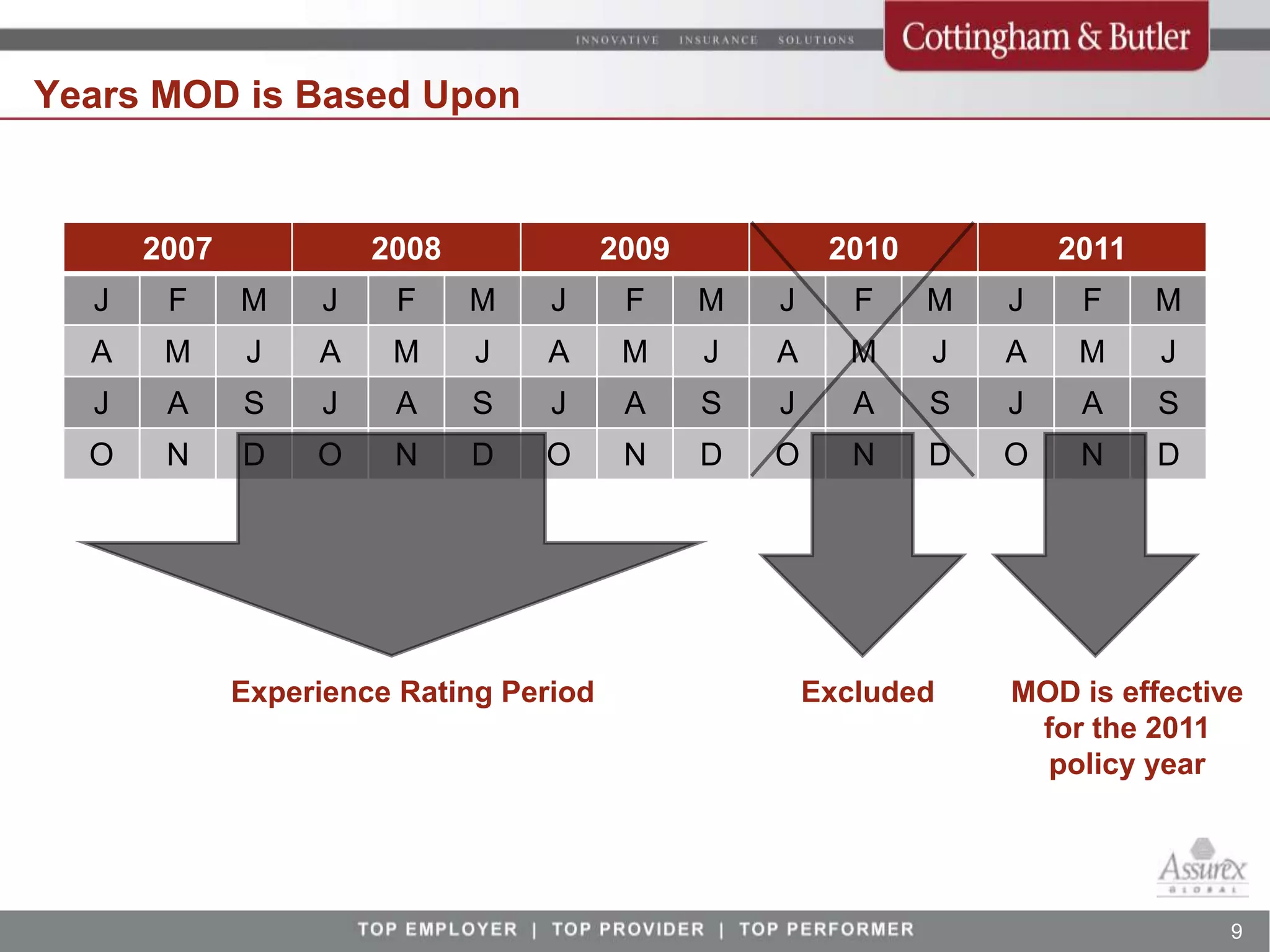

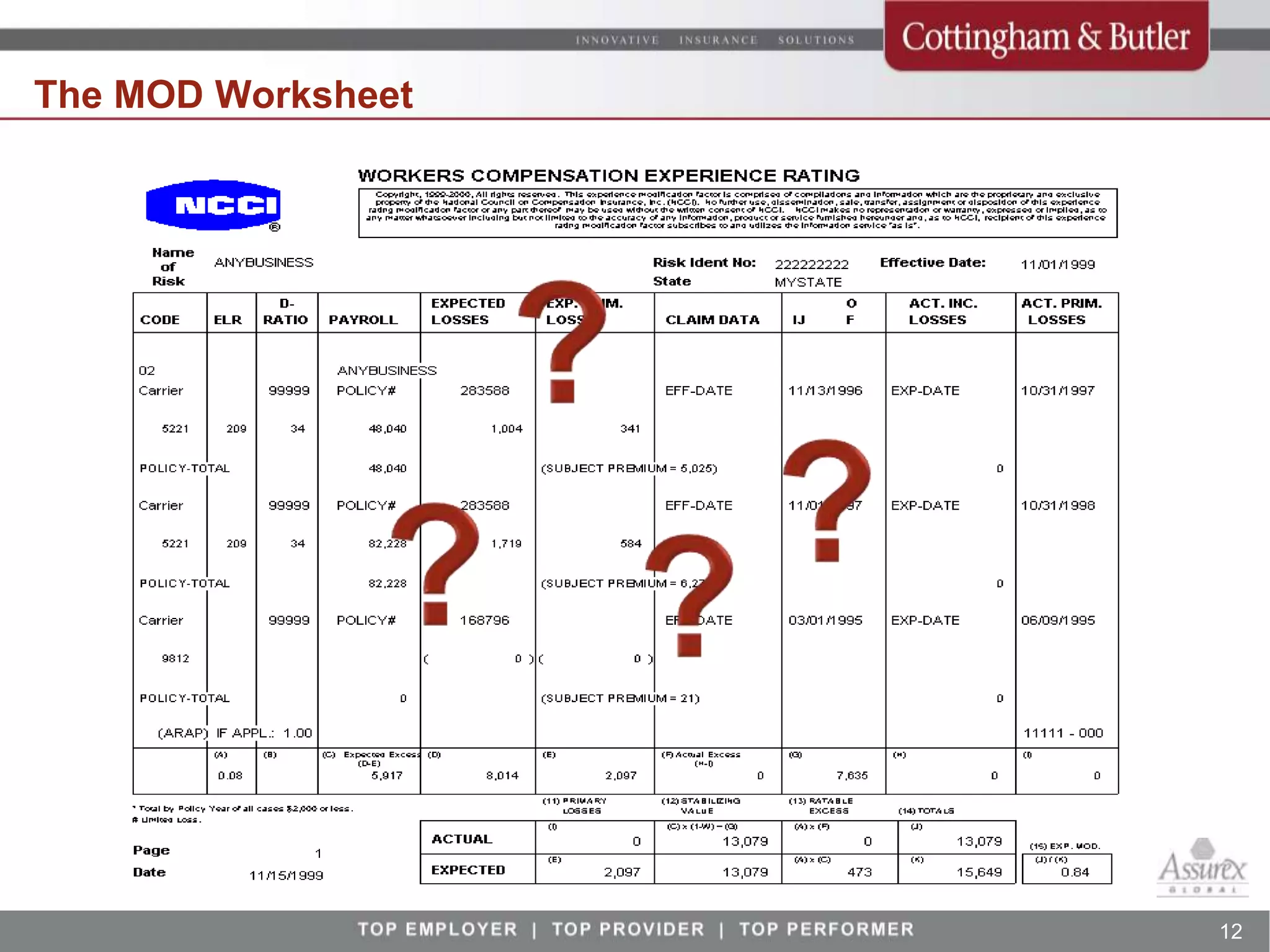

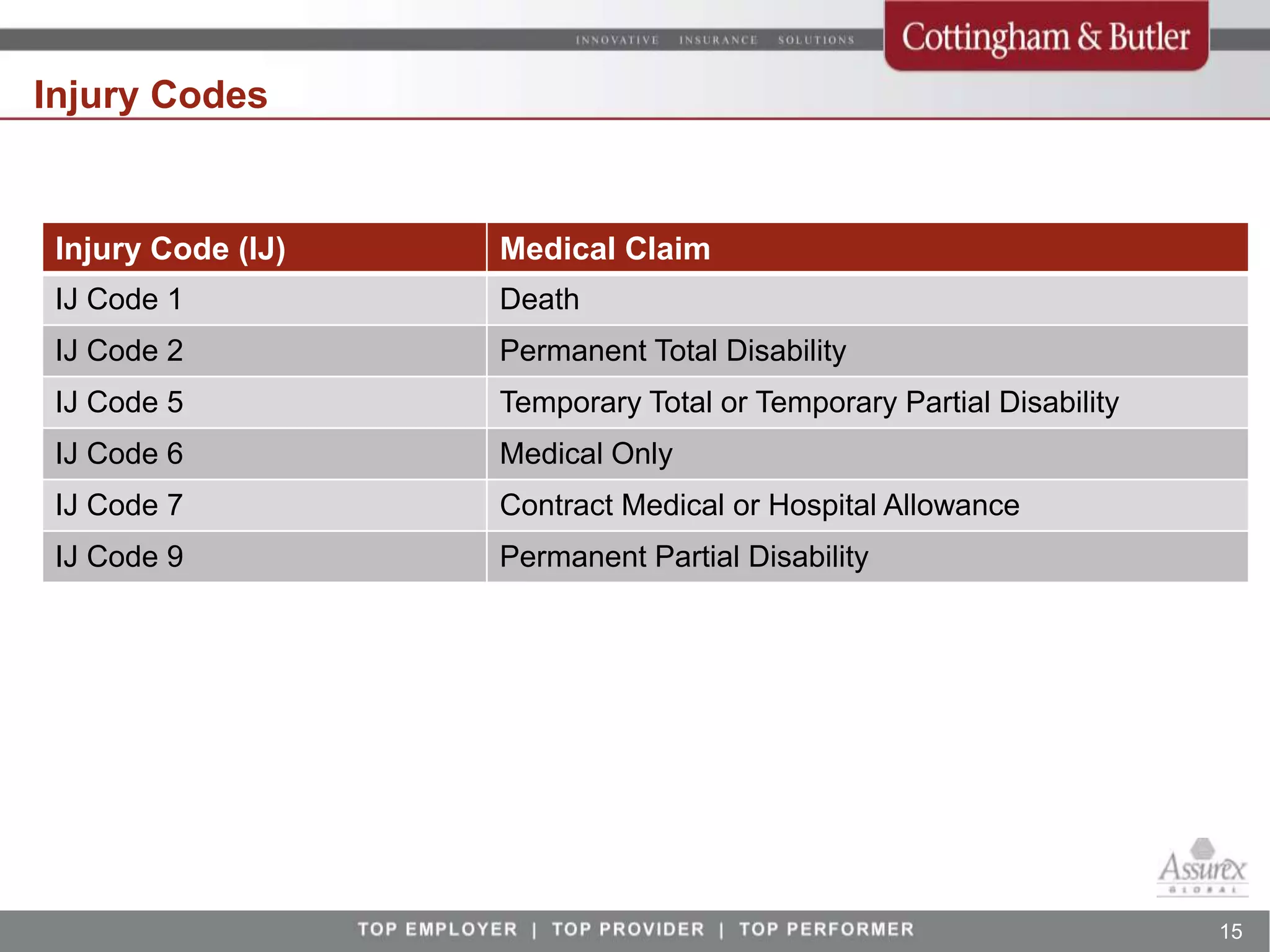

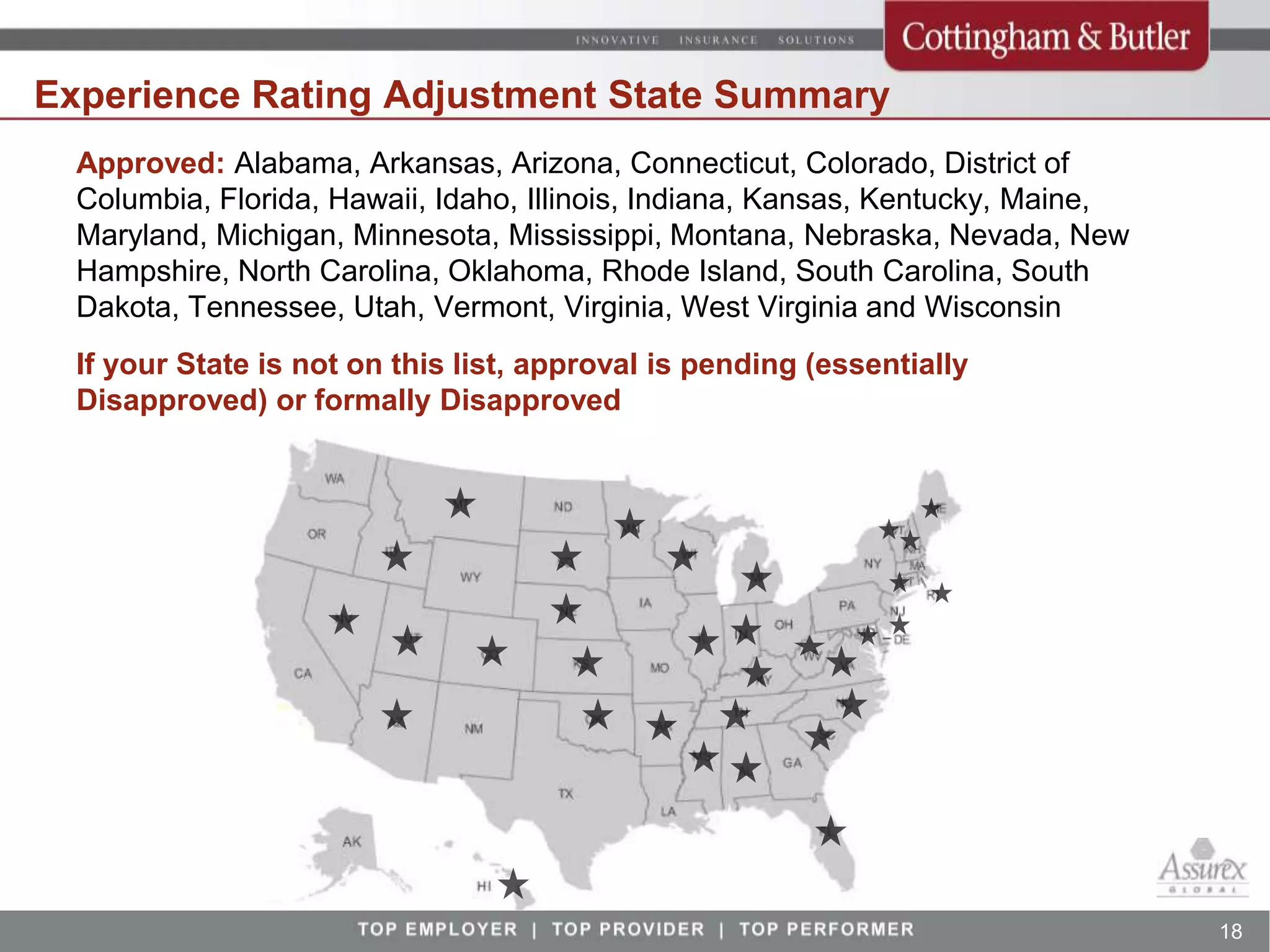

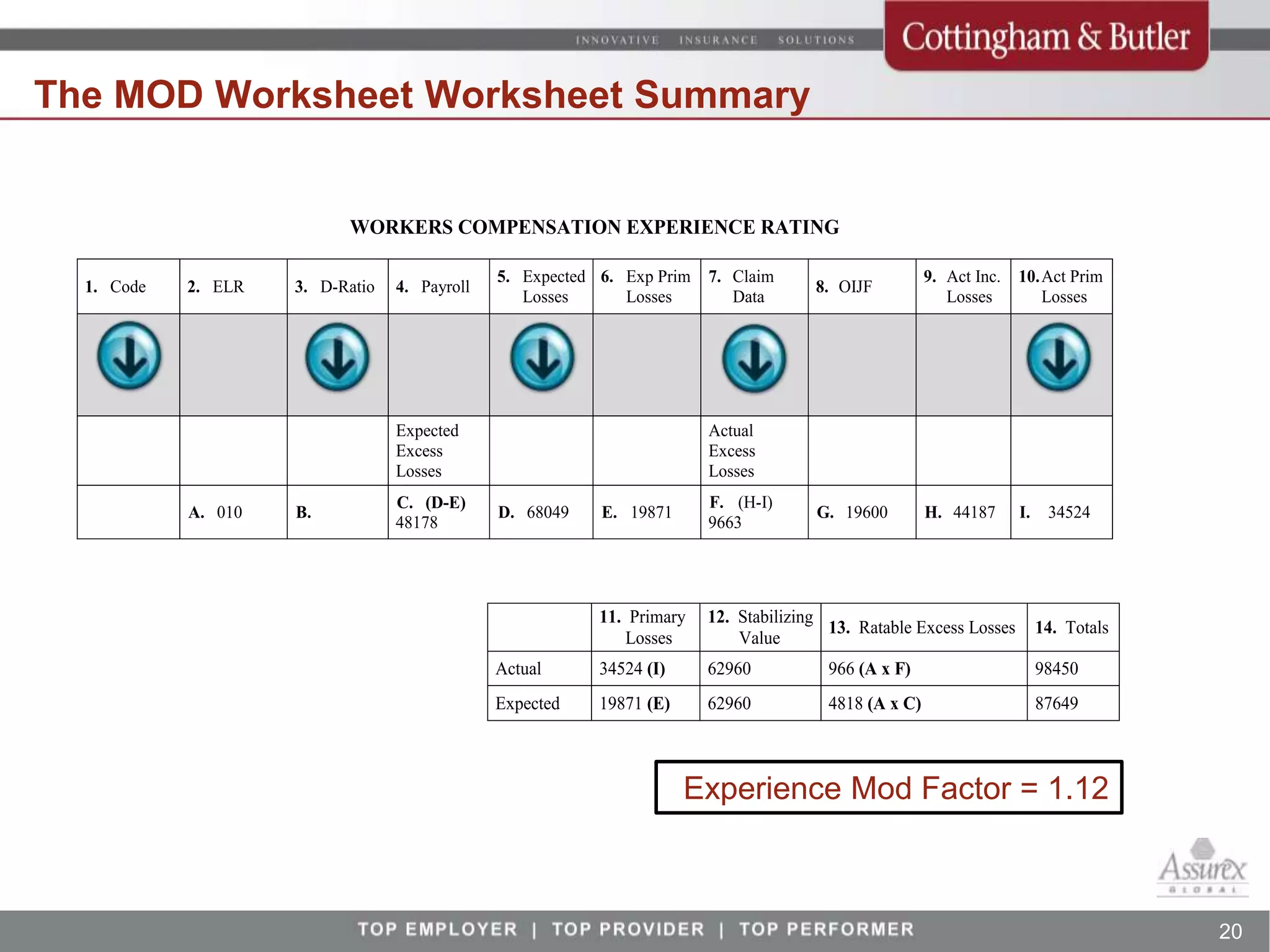

The document explains the experience modification factor (mod) in workers' compensation and its impact on insurance premiums. It details how the mod is calculated based on actual versus expected claims and highlights the importance of maintaining a mod below 1.0 to reduce costs. Additionally, it provides insights into analyzing mod data and implementing loss control measures to minimize increases in the mod.