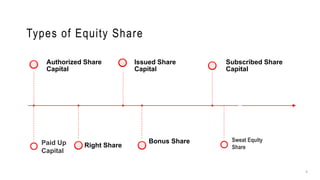

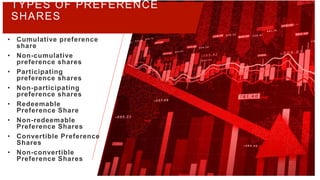

Companies issue shares to raise funds for expansion and other developments, effectively making shareholders part owners. There are three main types of shares: equity shares, which grant voting rights and dividends based on company profits; preference shares, which provide fixed dividends but no voting rights; and deferred shares, which are paid after other shareholders in liquidation. Each share type has unique characteristics and implications for investors.