Textile PLI Scheme Guide

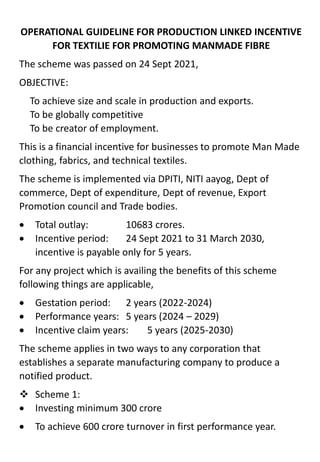

- 1. OPERATIONAL GUIDELINE FOR PRODUCTION LINKED INCENTIVE FOR TEXTILIE FOR PROMOTING MANMADE FIBRE The scheme was passed on 24 Sept 2021, OBJECTIVE: To achieve size and scale in production and exports. To be globally competitive To be creator of employment. This is a financial incentive for businesses to promote Man Made clothing, fabrics, and technical textiles. The scheme is implemented via DPITI, NITI aayog, Dept of commerce, Dept of expenditure, Dept of revenue, Export Promotion council and Trade bodies. Total outlay: 10683 crores. Incentive period: 24 Sept 2021 to 31 March 2030, incentive is payable only for 5 years. For any project which is availing the benefits of this scheme following things are applicable, Gestation period: 2 years (2022-2024) Performance years: 5 years (2024 – 2029) Incentive claim years: 5 years (2025-2030) The scheme applies in two ways to any corporation that establishes a separate manufacturing company to produce a notified product. Scheme 1: Investing minimum 300 crore To achieve 600 crore turnover in first performance year.

- 2. Scheme 2: Investing minimum 100 crore Achieve 200 crore turnover in first performance year. The incentive is applicable thereafter to every next year with prescribed increment of 25% on turnover from preceding year with maximum cap of 35%. If the targets are not met in any given year then it will be applicable to subsequent years till the scheme year period ends. Any approved applicant has to take care of following details, Approved applicant will have to form new company before commencement of investment. Investment in anticipation of the scheme approval will also be accounted. There will be no restriction on higher investment to reach the stipulated target of turnover. Only 1 project under PLI scheme will be approved for any group of companies. The new establishment will only produce declared notified product. Same product produced by other subsidiary will not be considered in turnover.

- 3. Scheme allows the applicant to avail other Government benefits like duty exemption, duty remission etc. On despatch “MADE IN INDIA” tag is to be attached to each product. Maintain details of all the data monitored during the production for minimum 5 years or till government audit whichever is later of the incentive year. Plant and machinery should be purchased in the name of applicant, and same shall be used for production of notified product and is allowed to manufacture other products too. Applicant may establish more than 1 unit for production with letter of intent. Investment of only 10% of the total project for R&D will be accounted in eligibility. Quality of the notified product has to be maintained by the company and if required MoT can ask for reports or may get the product tested from Internally accredited lab.

- 4. Investment of the company will be considered us under: Building and construction: plant, machinery, erection, commissioning, associated utilities like captive generation, effluent treatment plant, water and power supply systems, this also include IT related services like servers, software ERP etc. Usage of existing utilities will be allowed but only fresh investment with intent to use in manufacturing of notified product will be eligible under scheme. Office and guest house will not be considered as investment. Expenditure and consumable raw material will not be considered in investment. The company has to employ new machineries, no second hand/used machinery will be considered valid for the threshold investment under the scheme. Criteria for selection: Financial capacity of applicant Relevant experience and technological capacity Location of manufacturing activity Investment Additional direct employment in 1st performance year. Product line from notified product. Captive consumption of notified products in group companies will be accounted for calculation for incentives though GST invoices. Lowest Sale price of notified product will be considered to determine the value of transaction when sold to group company or non-group company. Applicant has to submit claim for incentive on yearly basis via statuary auditor of company. It is possible for change in ownership with due consent from MoT and its applicable conditions. Risk management system will be detailed out and inspected by MoT on random basis.

- 5. Notified products list as declared by MoT (Ministry of Textile), KNIT: Jersey, Pullovers, Cardigans, Waist Coat all from Man Made fibre Anorak, Wind Cheaters, Wind Jackets, Trousers, Bibs from synthetic fibres Overall Breeches, Over Coat, Rain Coat, Car Coat, Capes Girls Dress material knitted, Stockings, Socks, Blazers, Swim wear Sports Garments, Under Garments, Track Suits, Skirts, Shirts Night Dresses, Scarves, Mufflers, Gloves, Mittens, Babies garment. WOVEN: More than 85% textured polyester filament, dyed warp knit with 85% polyester fibre. For fabrics lower than 85% polyester, Viscose and nylon is advised. TECHNOLOGICAL TEXTILE: Geo Grids, Nets, Agro Textile, Medical Textile, Defence Textile, Automobile Textile, Protective clothing, Building construction, speciality fibre, smart textile with embedded tech.