- Social Security was originally created in Germany in 1883 by Otto von Bismarck as a way to gain popular support. He set the retirement age much higher than average life expectancy at the time.

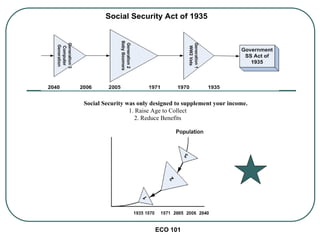

- In the US, Franklin D. Roosevelt created Social Security in 1935 to gain popular support during the Great Depression. However, it has become a "Ponzi scheme" that relies on new contributions to pay existing beneficiaries rather than individual accounts.

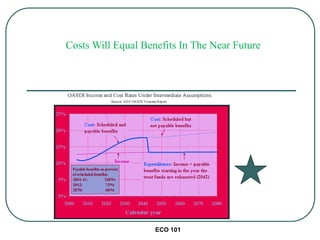

- As people live longer and the population ages, the ratio of workers to beneficiaries is declining, threatening the program's viability without reforms. Politicians have raided Social Security funds and there are concerns about its long-term funding and structure.

![ECO 101

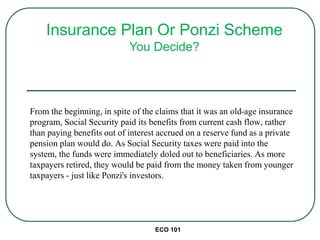

In practice, it is a "Ponzi scheme." Historian Mark Knutson, writes that in the summer

of 1920, [Charles K.] Ponzi claimed he was giving investors just a portion of the

400% profit he was earning through trade in postal reply coupons. As Ponzi paid

the matured notes held by early investors, word of enormous profits spread through

the community, whipping greedy and credulous investors into a frenzy. Investigation later

revealed that there were no coupons or profits - earlier notes were

paid at maturity from the proceeds of later ones. The simplicity and

grand scale of his scheme linked Ponzi's name with a particular

form of fraud.

This type of fraud is called a pyramid scheme. To pay off earlier "investors" in such

a scheme, an ever larger number of participants must to be added.

In Reality Social Security is a form of "insurance.“

(Not a fully funded pension plan.)](https://image.slidesharecdn.com/socialsecurityfinal-160627150720/85/Social-security-final-11-320.jpg)