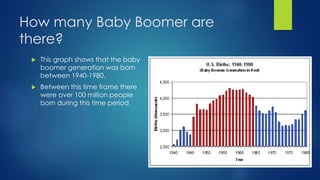

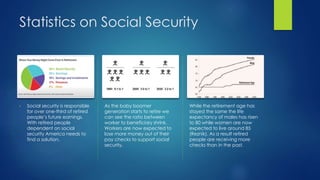

The document discusses the challenges facing Social Security as the baby boomer generation retires. As life expectancy increases and more baby boomers retire, there will be fewer workers paying into Social Security to support the growing number of retirees collecting benefits. This will strain Social Security's finances unless changes are made. The document proposes examining data on Social Security's current state and future projections to develop a plan that would adjust the retirement age, benefits amounts, and payroll taxes to help ensure the long-term sustainability of Social Security.