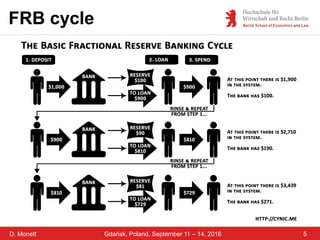

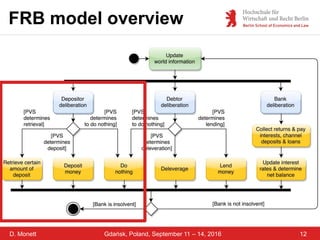

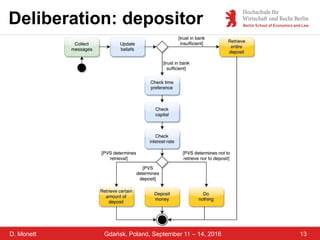

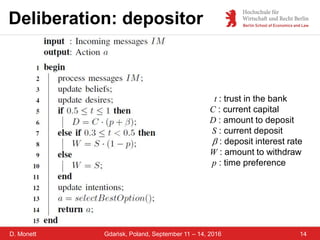

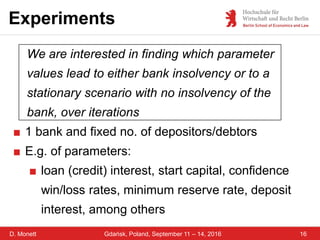

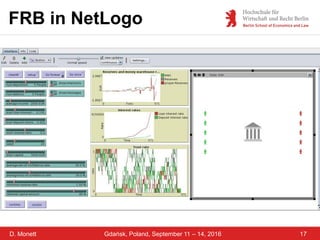

The document presents a talk on simulating the fractional reserve banking system using agent-based modeling with NetLogo, focusing on enhancing understanding through simulations and graphics. It explores the dynamics of the banking system, identifying conditions leading to bank insolvency and emphasizing the importance of depositor confidence. The findings reveal that decreased confidence and low reserves significantly increase the likelihood of bank failures.