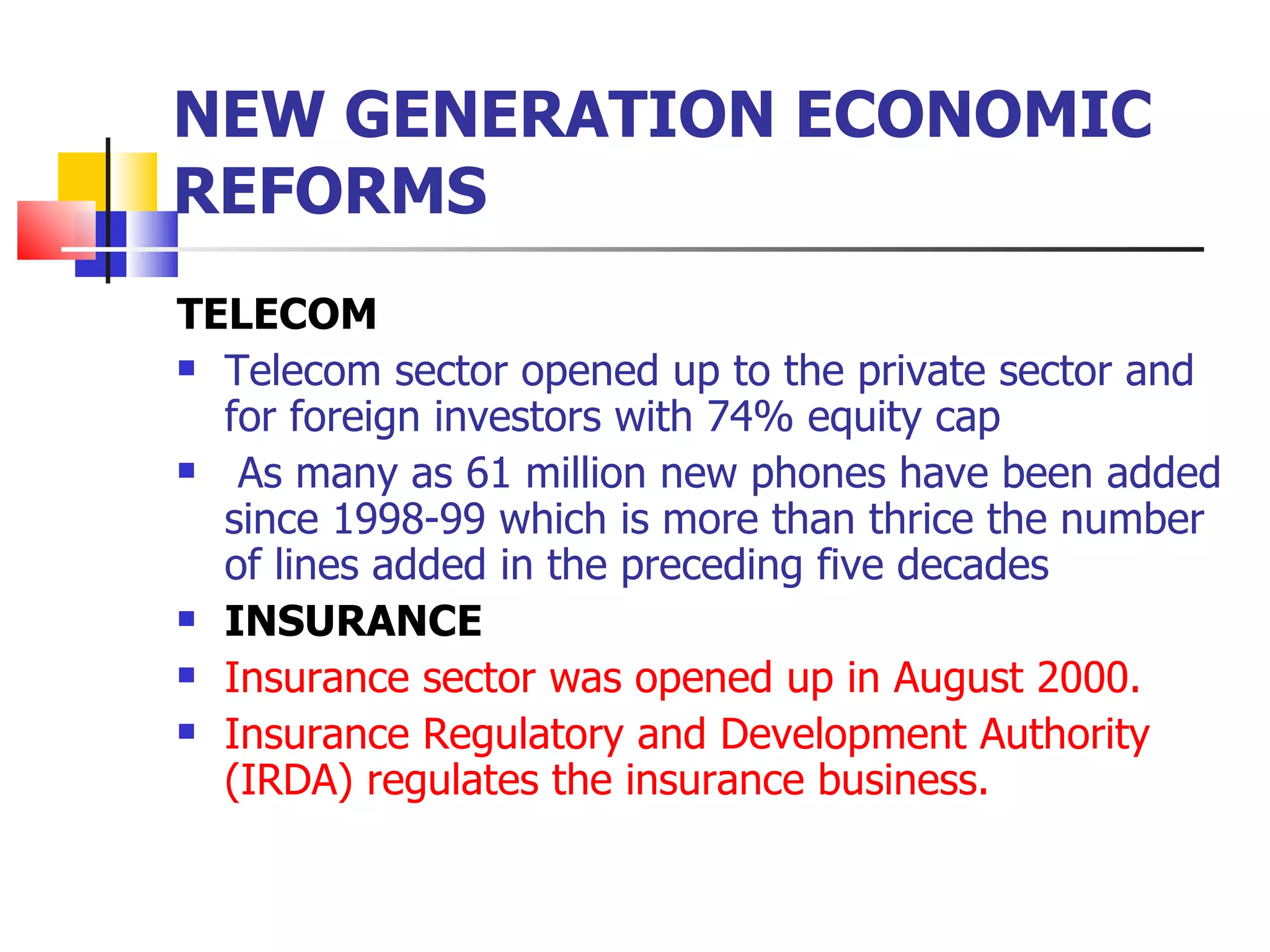

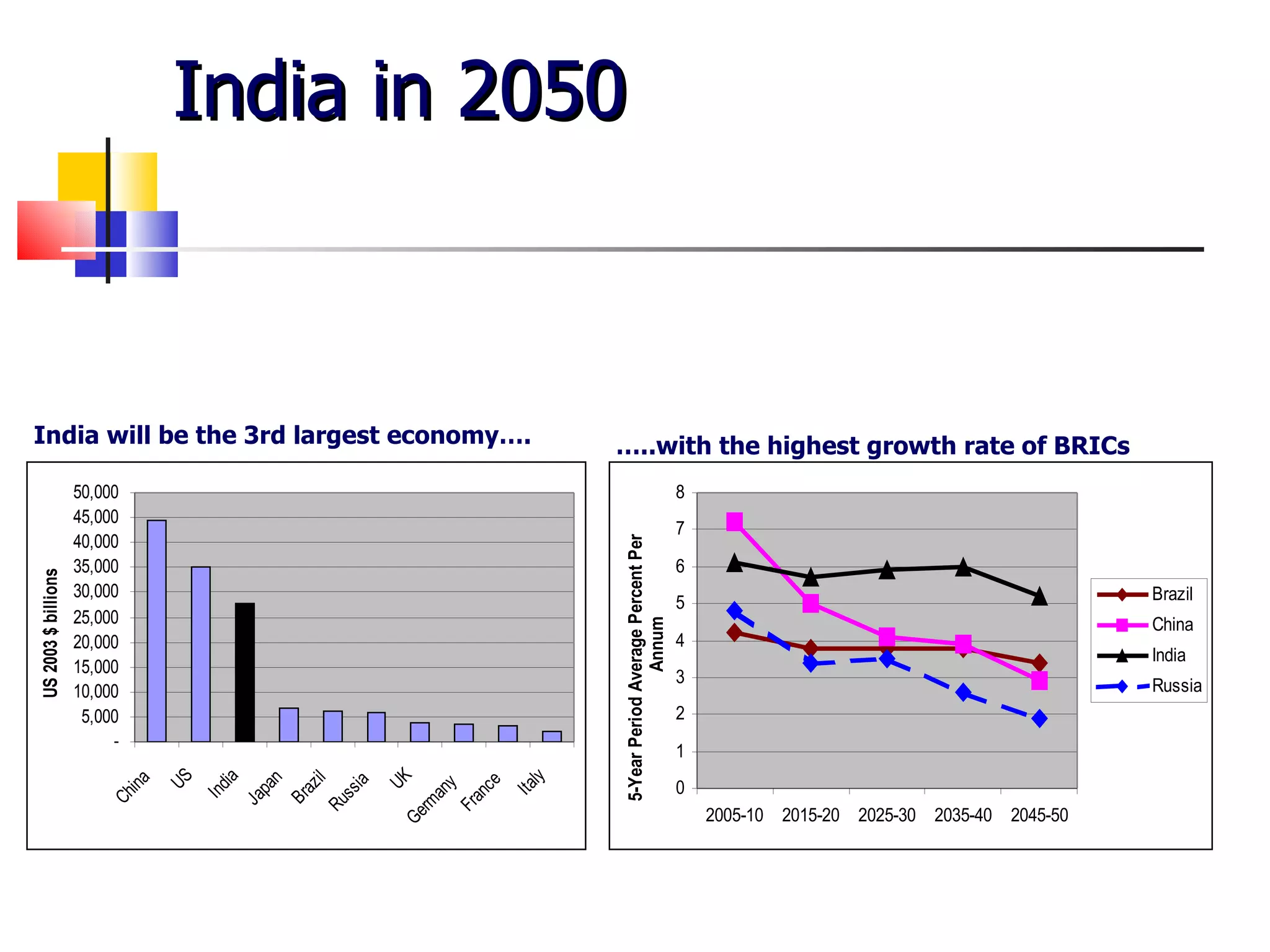

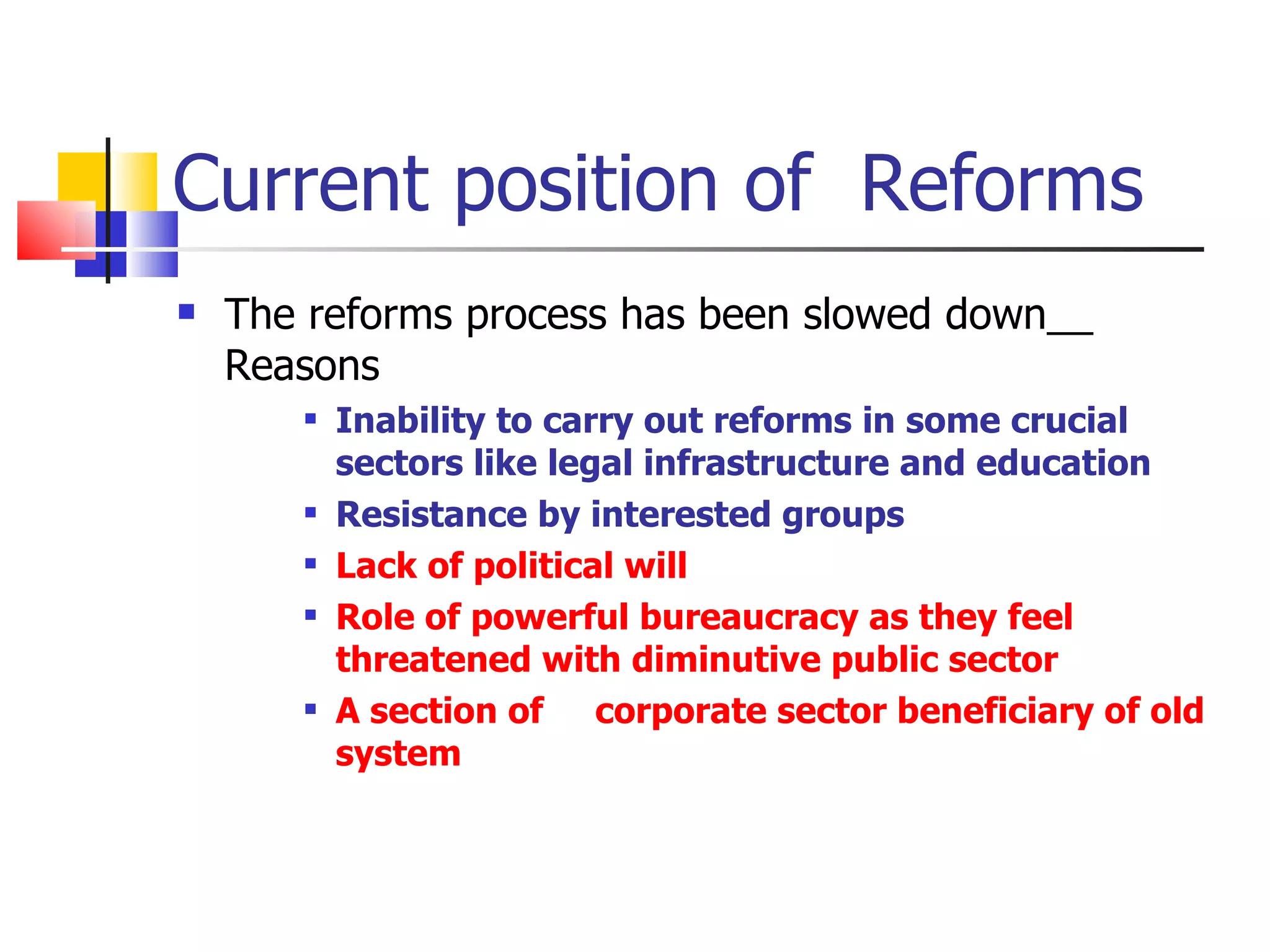

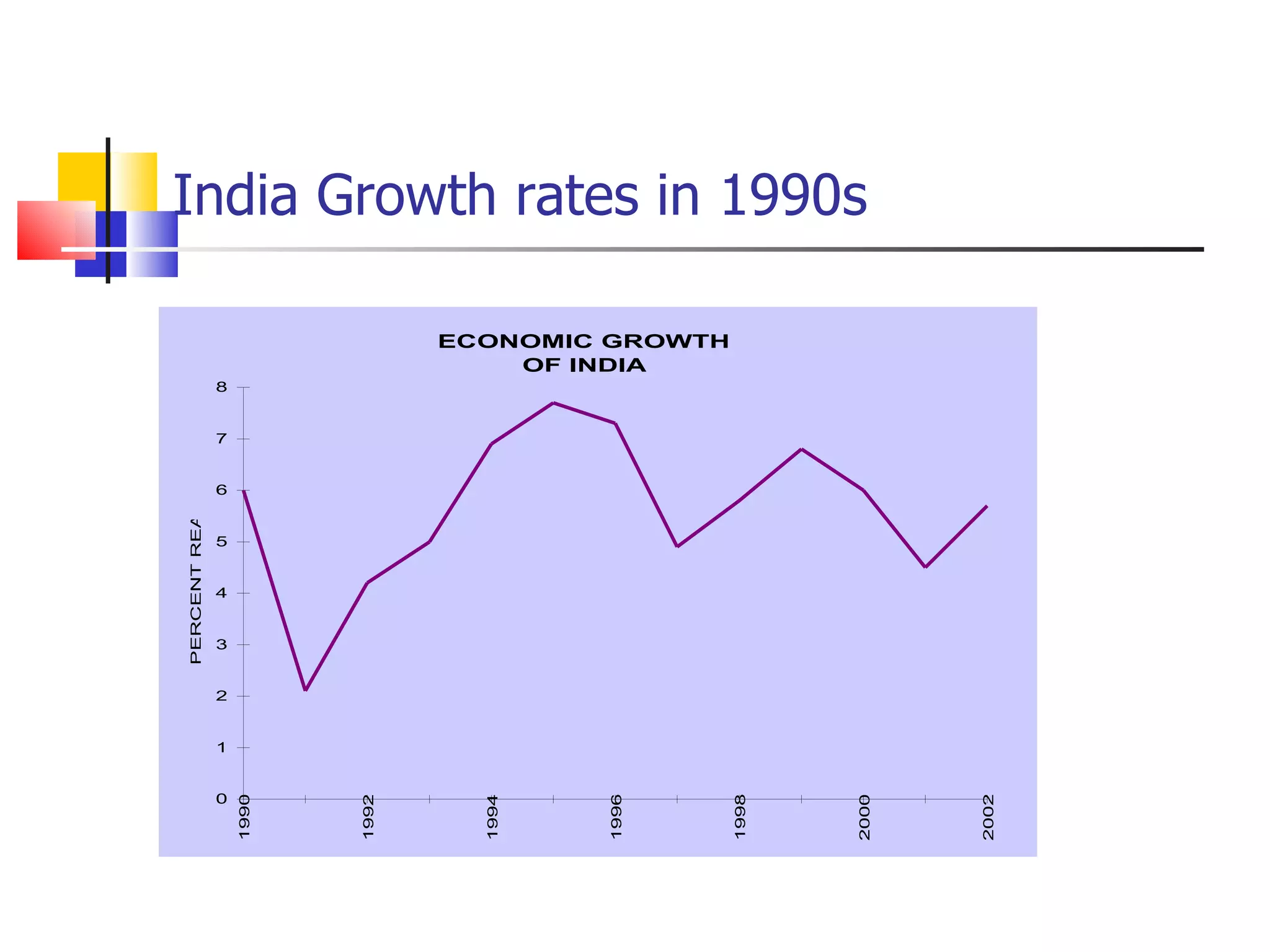

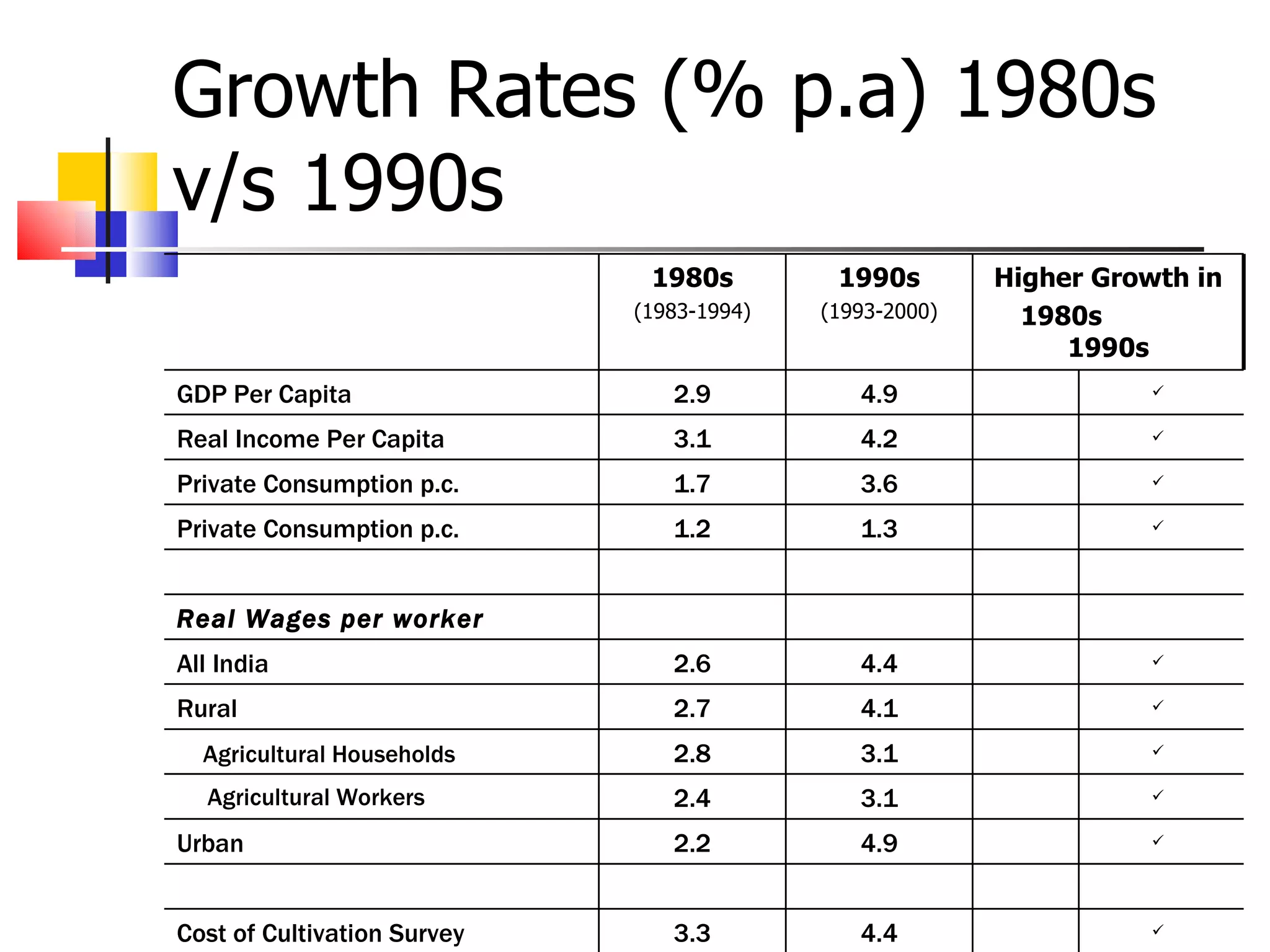

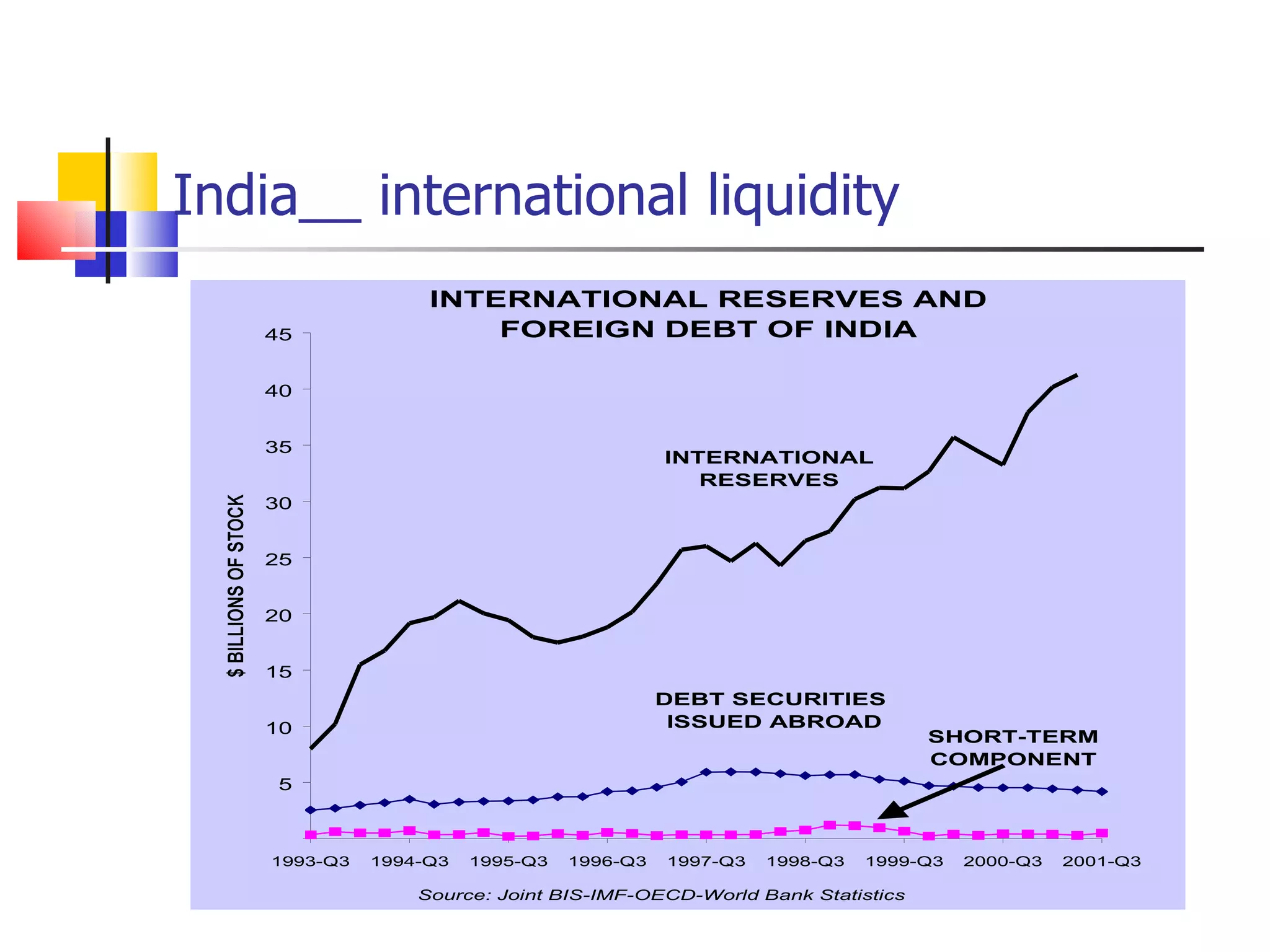

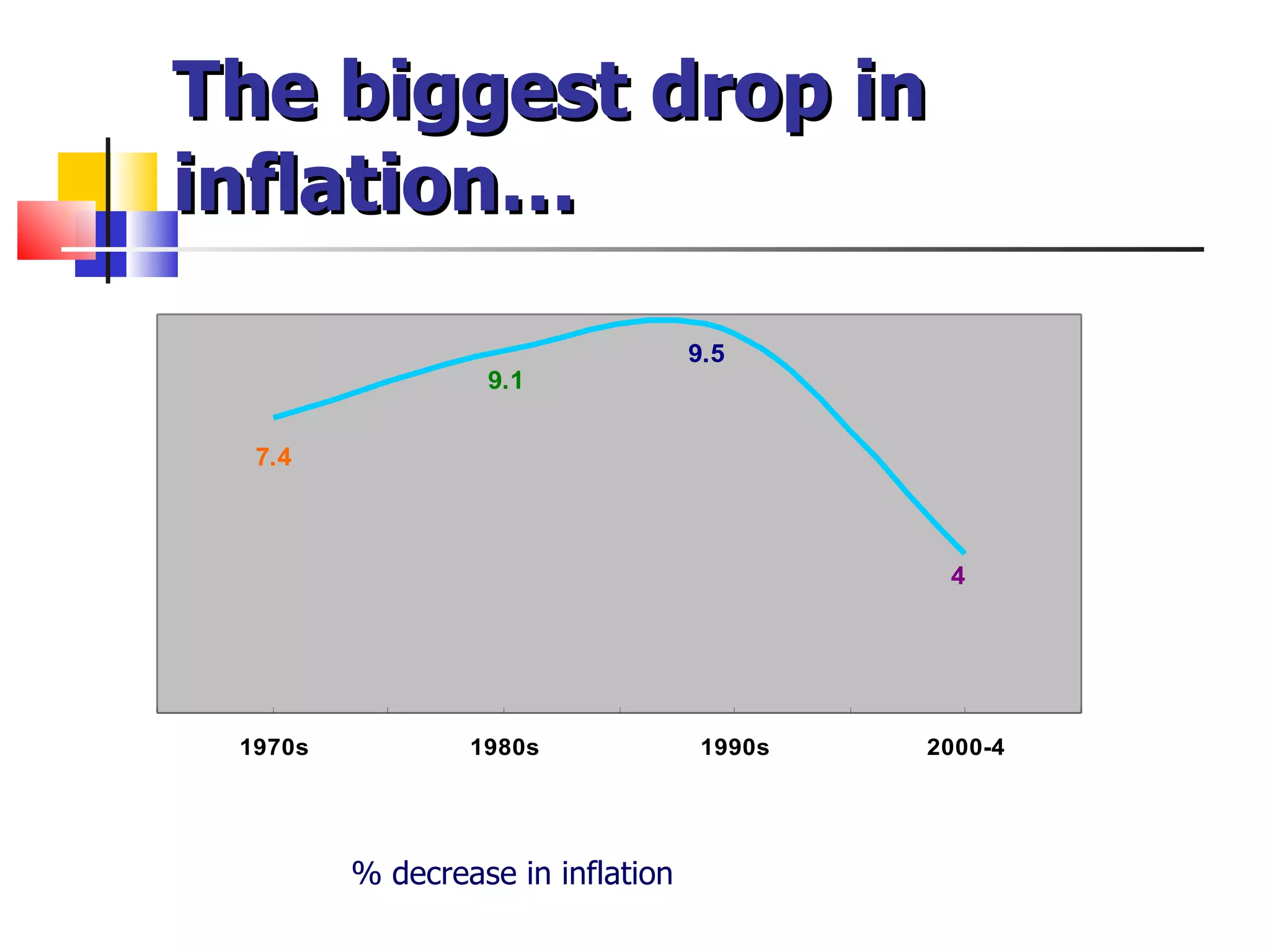

Economic reforms were introduced in India in the 1990s led by then Finance Minister Manmohan Singh to liberalize the socialist economy. Prior to reforms, India faced high deficits, low growth at 3.2% annually, and a large unproductive public sector. Reforms aimed to reduce state control over production, establish economic freedom, and dismantle the permit system. Initial results were positive with inflation and interest rates falling and higher growth rates of 4-6% annually in the 1990s compared to 2.9% in the 1980s. However, the reform process has since slowed due to resistance to further changes and a lack of political will to implement additional reforms.

![Perspective: year 1990-91 International reserve came down to $ 1.3 billion, less than 1 month import bill, and India was on the verge of default in foreign obligations [ short term debt] Stagnant exports India’s ratings down High deficits in domestic budget Public sector banks having large NPA PSU incurring huge losses](https://image.slidesharecdn.com/shubham-100720225245-phpapp01/75/Indian-Economy-reforms-6-2048.jpg)

![Real GDP growth rates of selected countries during 1990--- 2000 [ per cent] China 10.3 Ireland 7.3 India 6.0 USA 3.5 Japan 1.3 Russia -4.8 Ukraine -9.3](https://image.slidesharecdn.com/shubham-100720225245-phpapp01/75/Indian-Economy-reforms-17-2048.jpg)