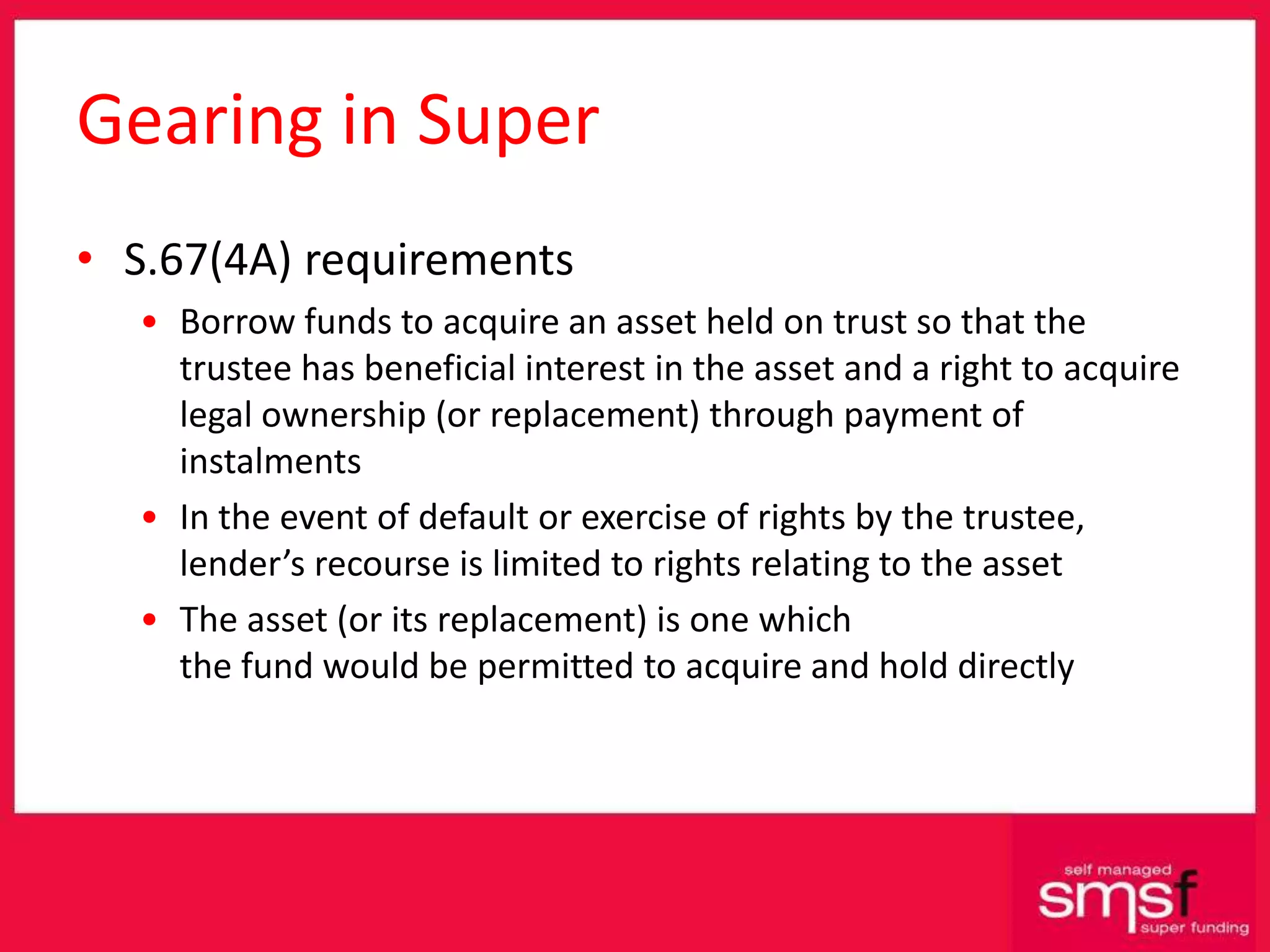

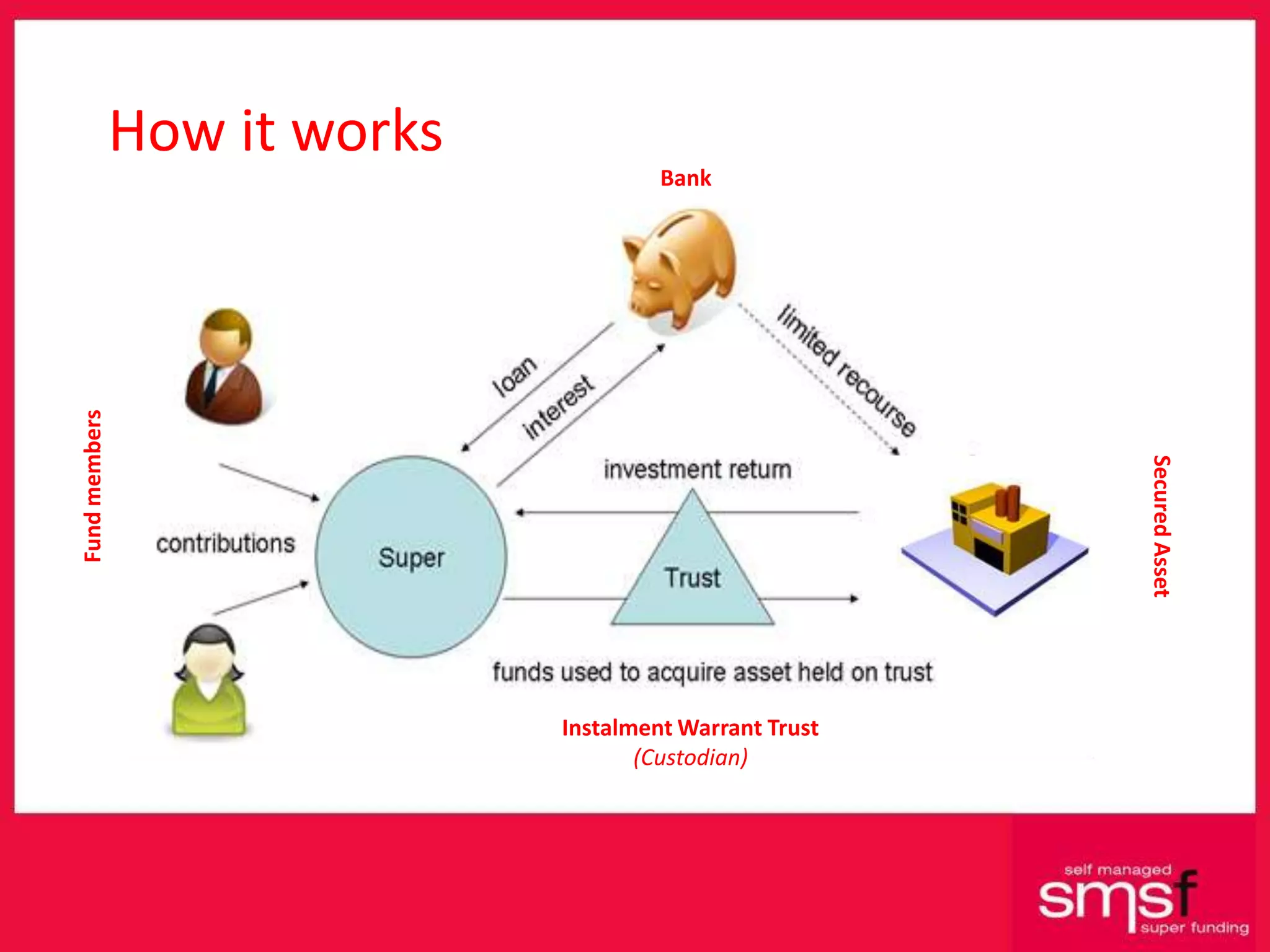

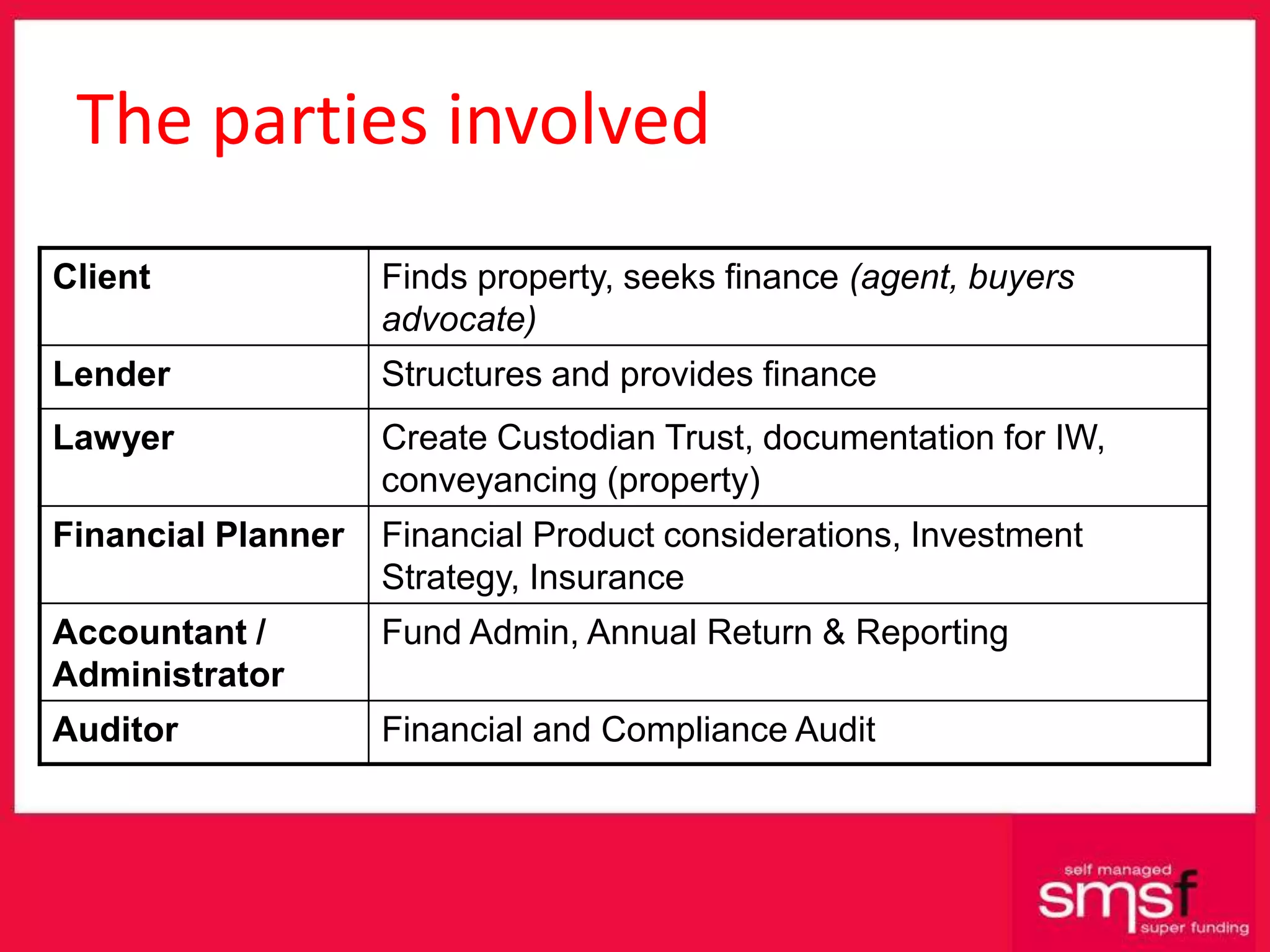

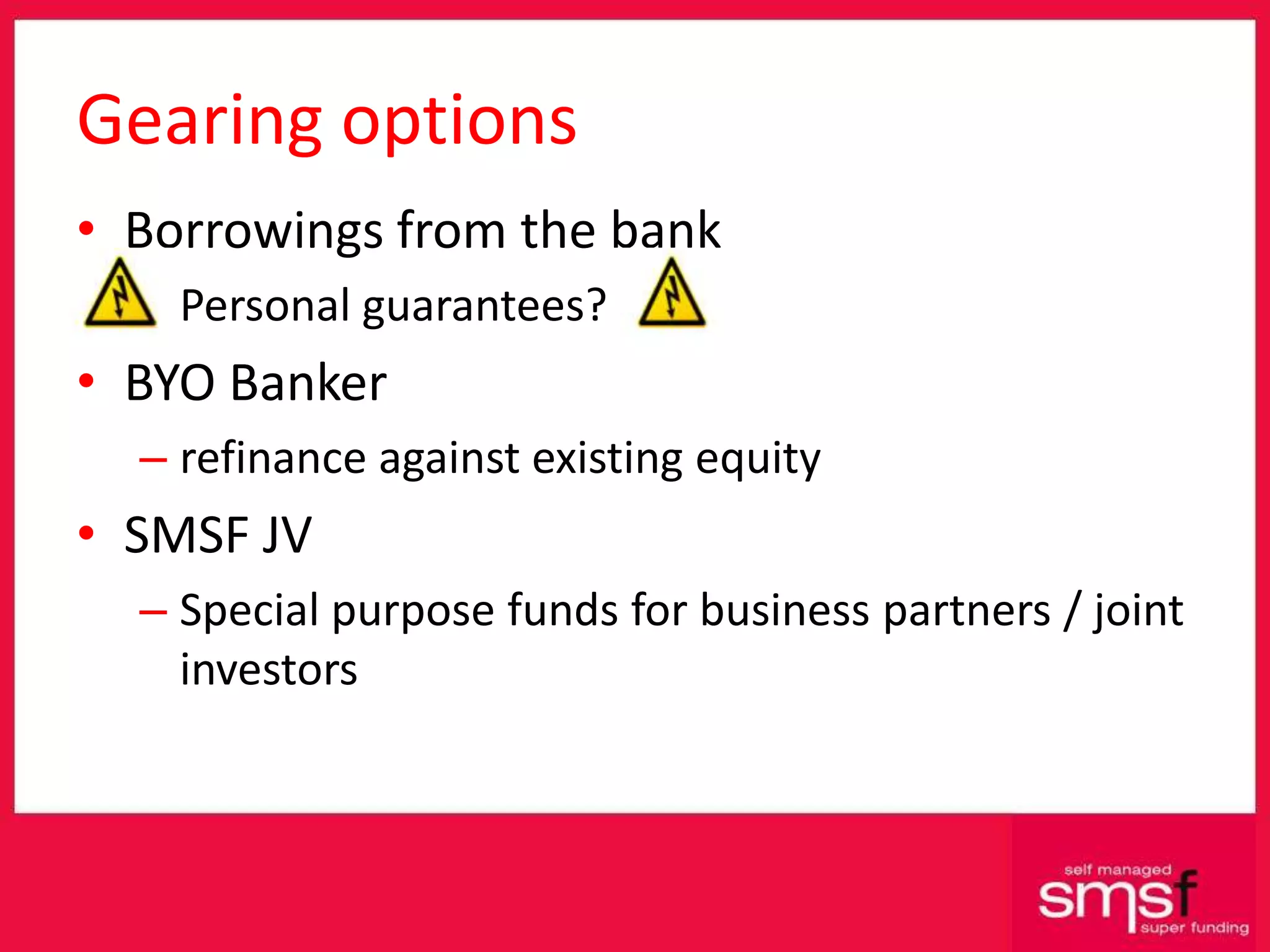

The document presents an overview of SMSF (Self-Managed Superannuation Fund) instalment warrants and the associated financial structures for property investment. It emphasizes the importance of assessing individual financial circumstances before acting on the general advice provided and outlines potential target client scenarios for utilizing SMSF instalment warrants. Key considerations include leveraging superannuation for property acquisition, benefits of capital gains tax elimination, and strategies for various client profiles, particularly business owners and retirees.

![Self Managed Super Funding Pty Ltd [email_address] http://www.smsfunding.com](https://image.slidesharecdn.com/smsfgearinginsuper-091021053450-phpapp01/75/Shift-your-super-into-a-higher-gear-16-2048.jpg)