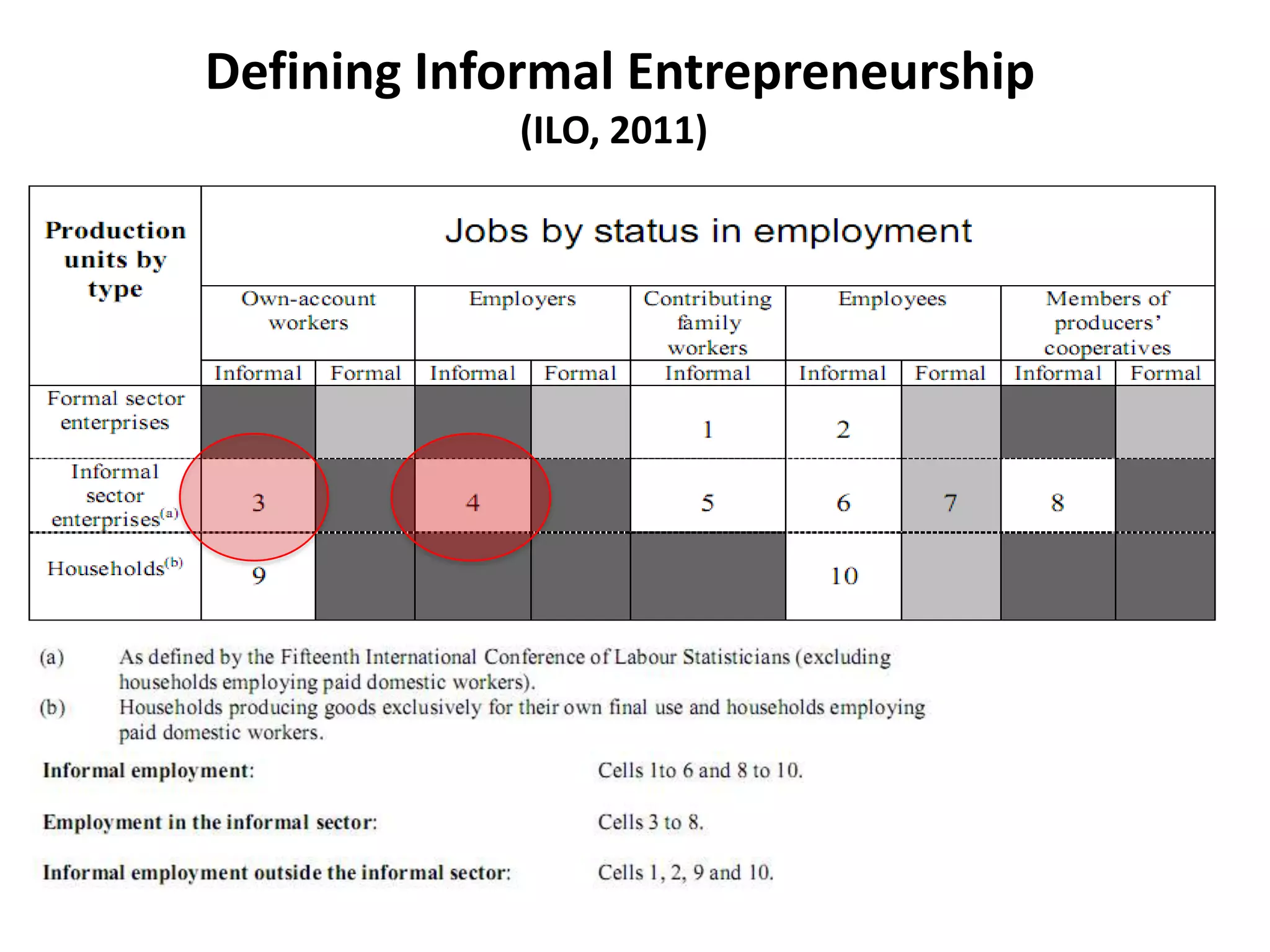

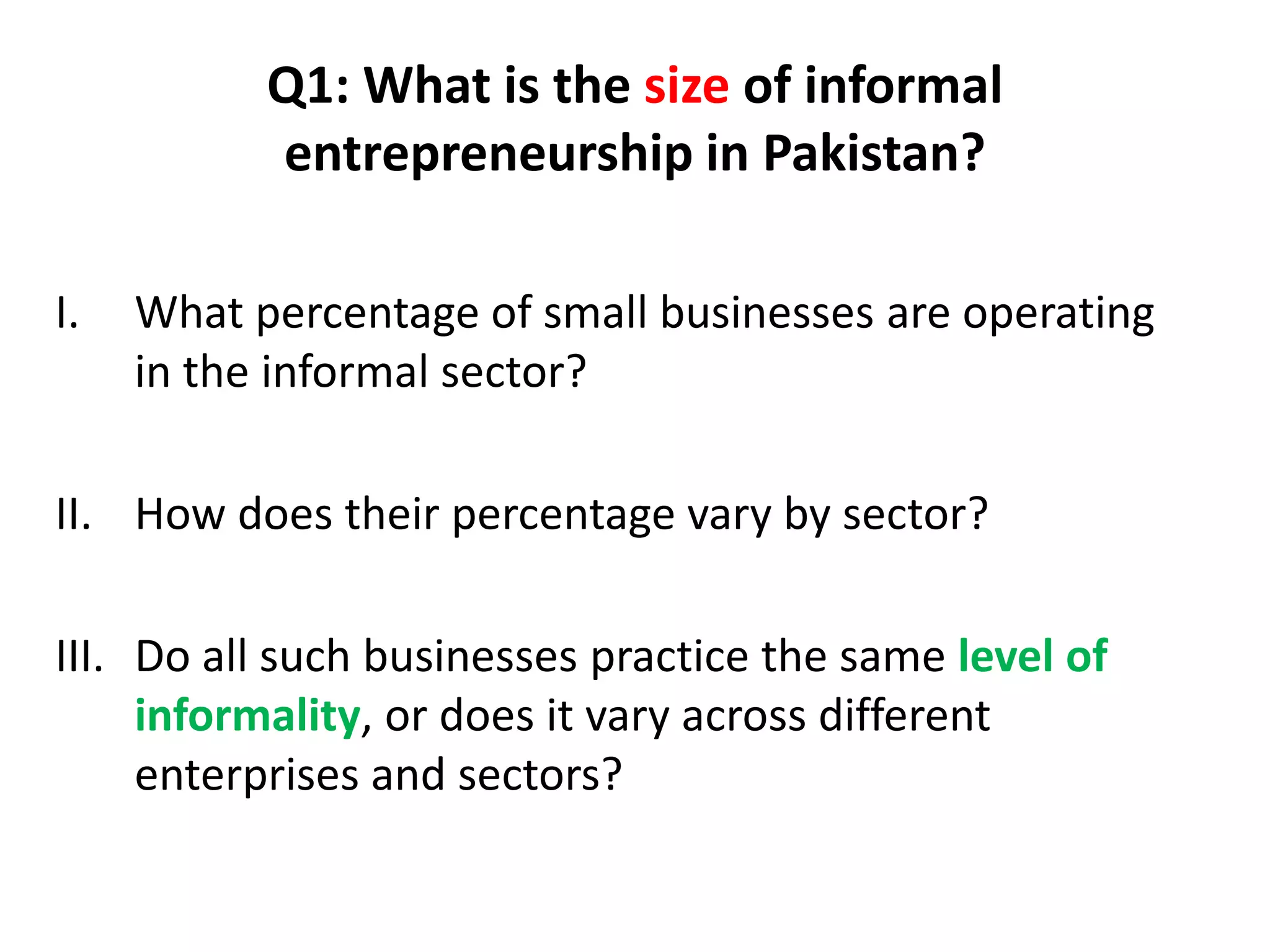

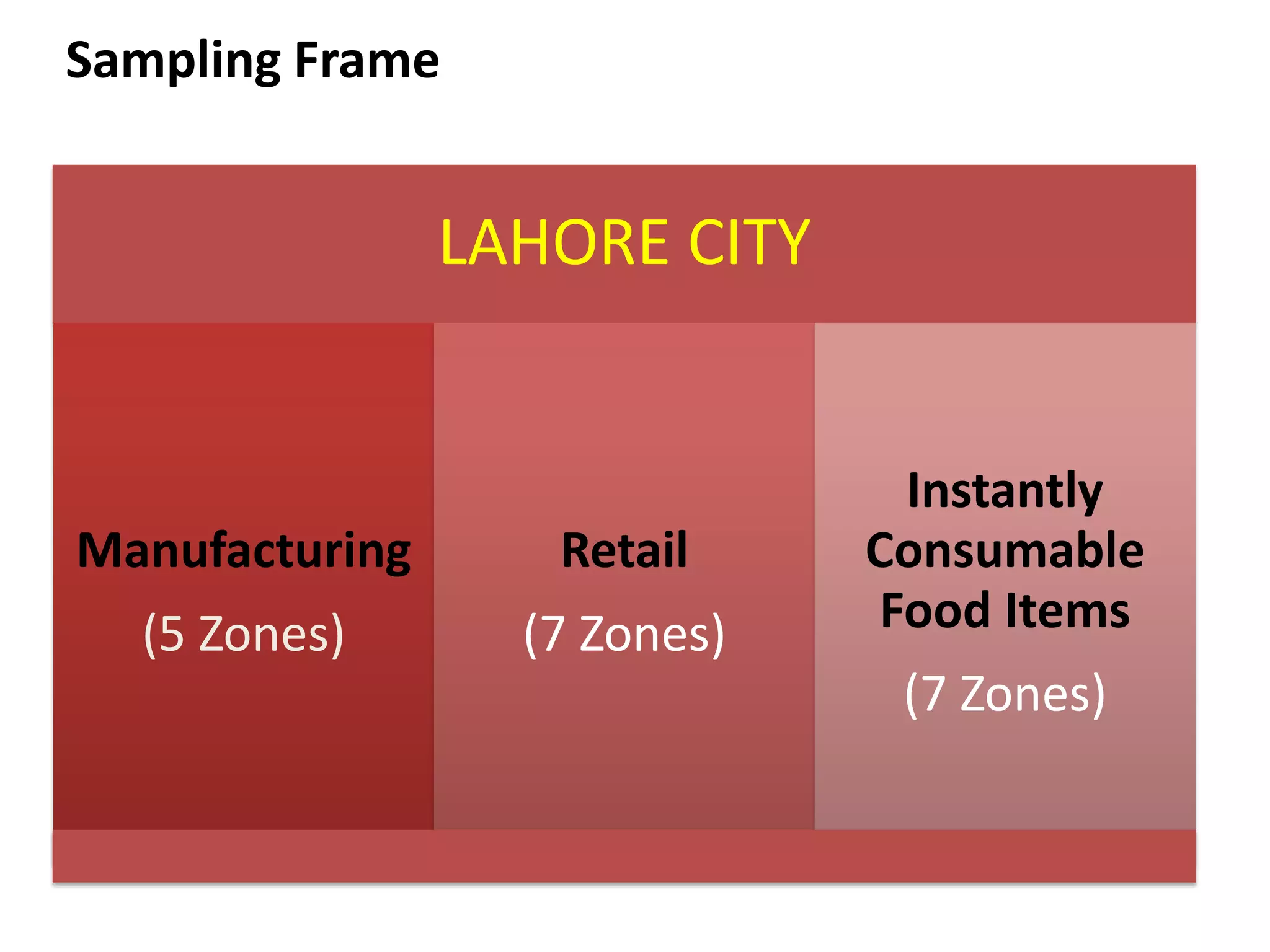

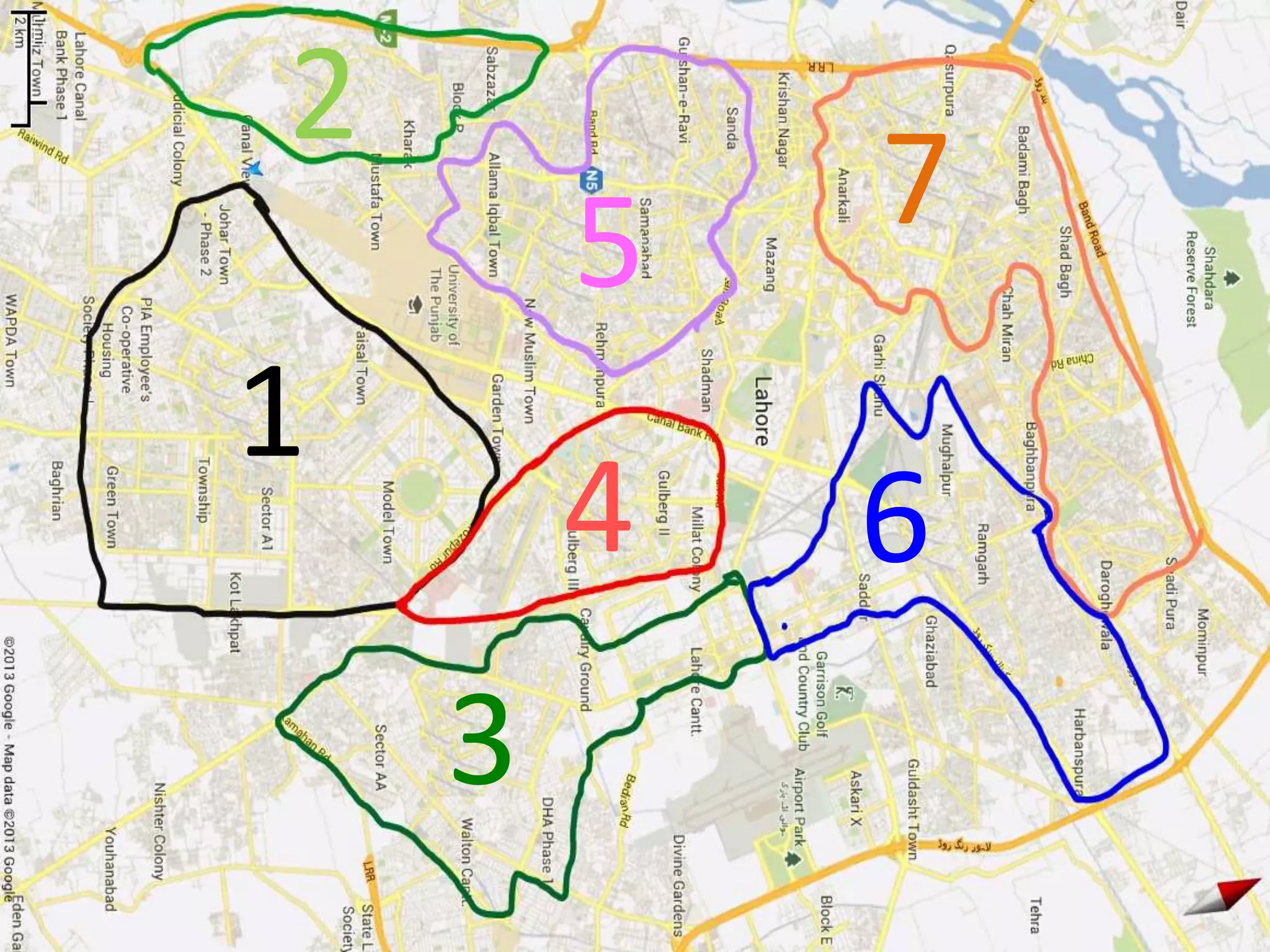

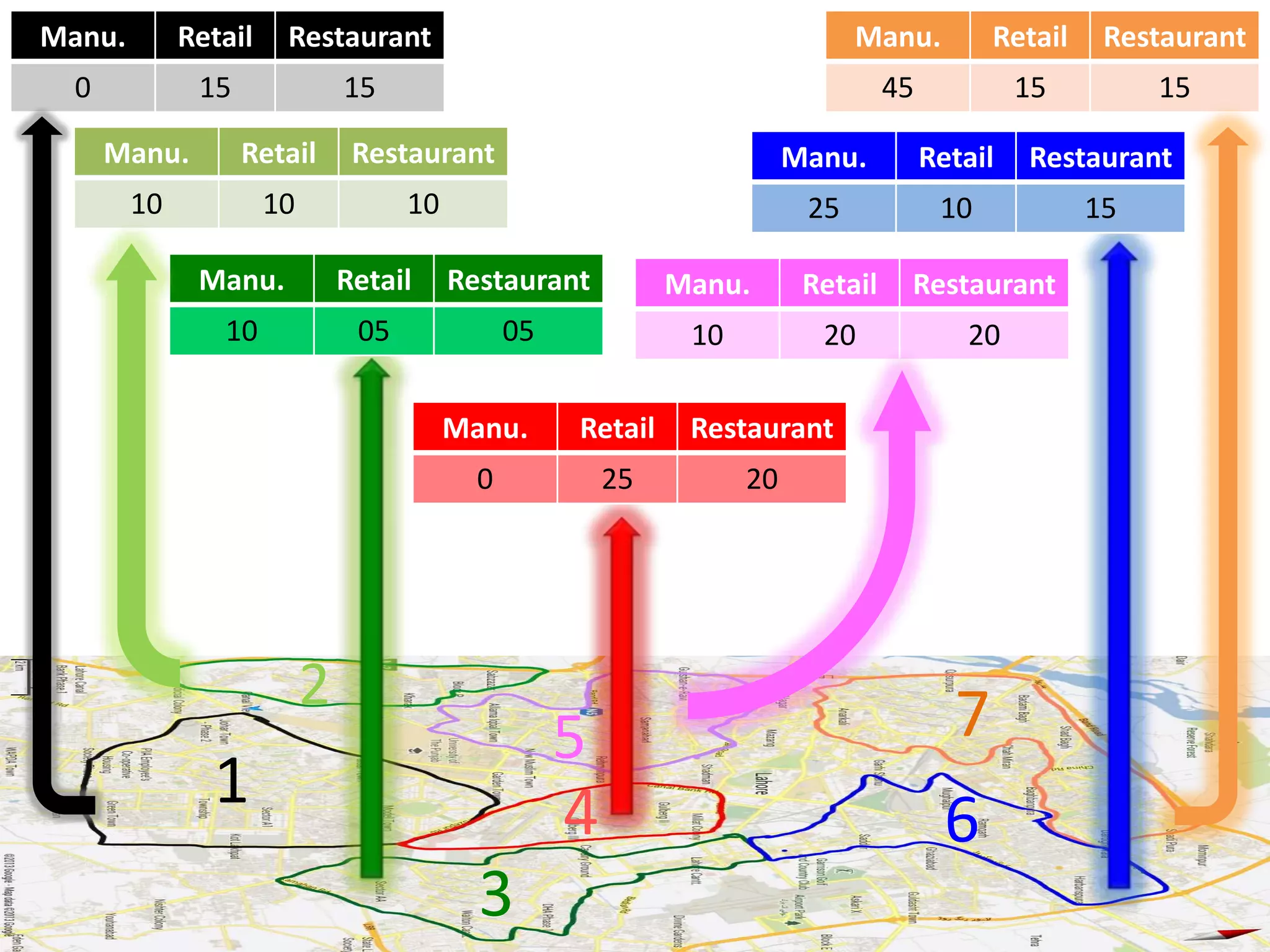

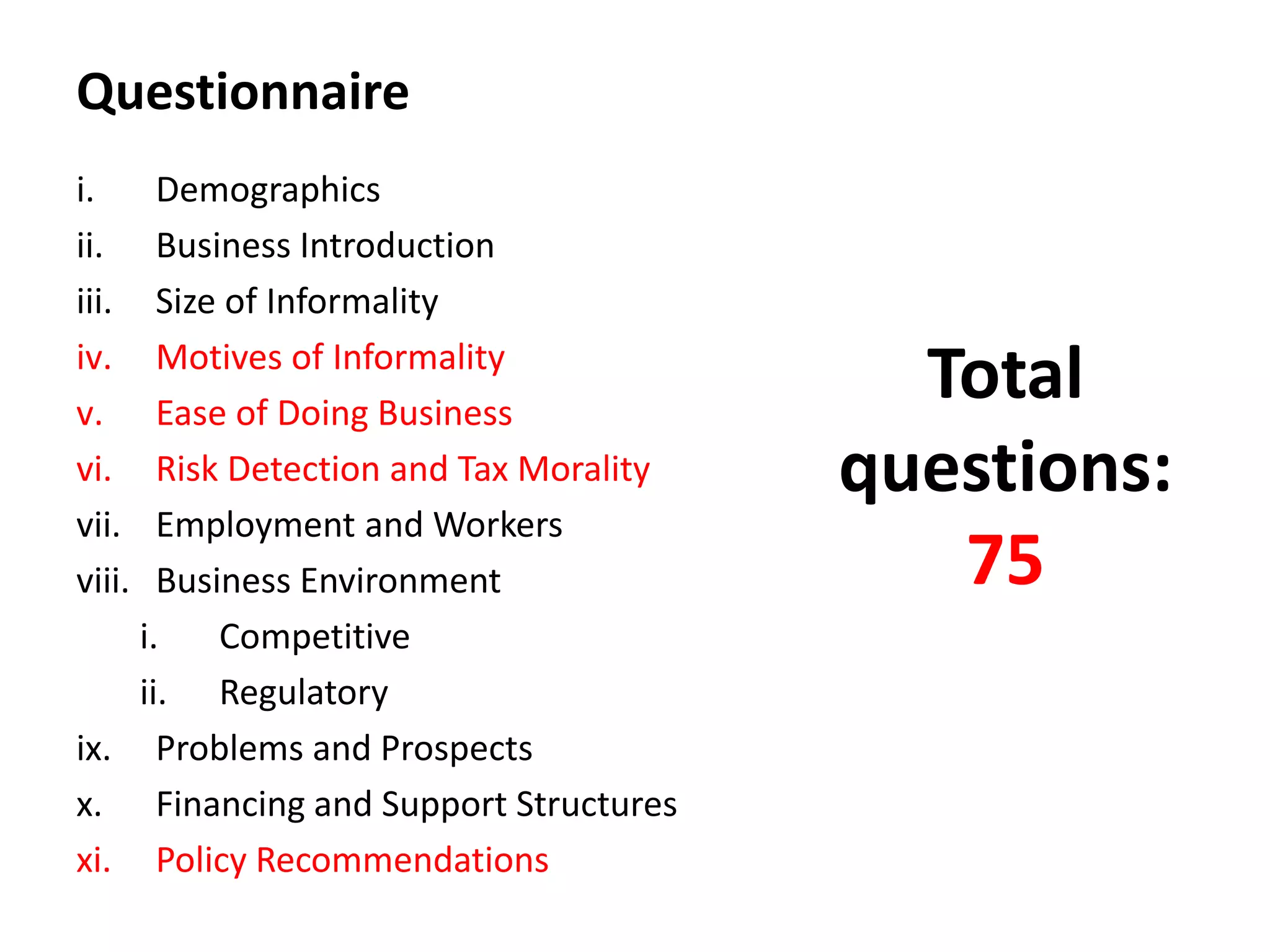

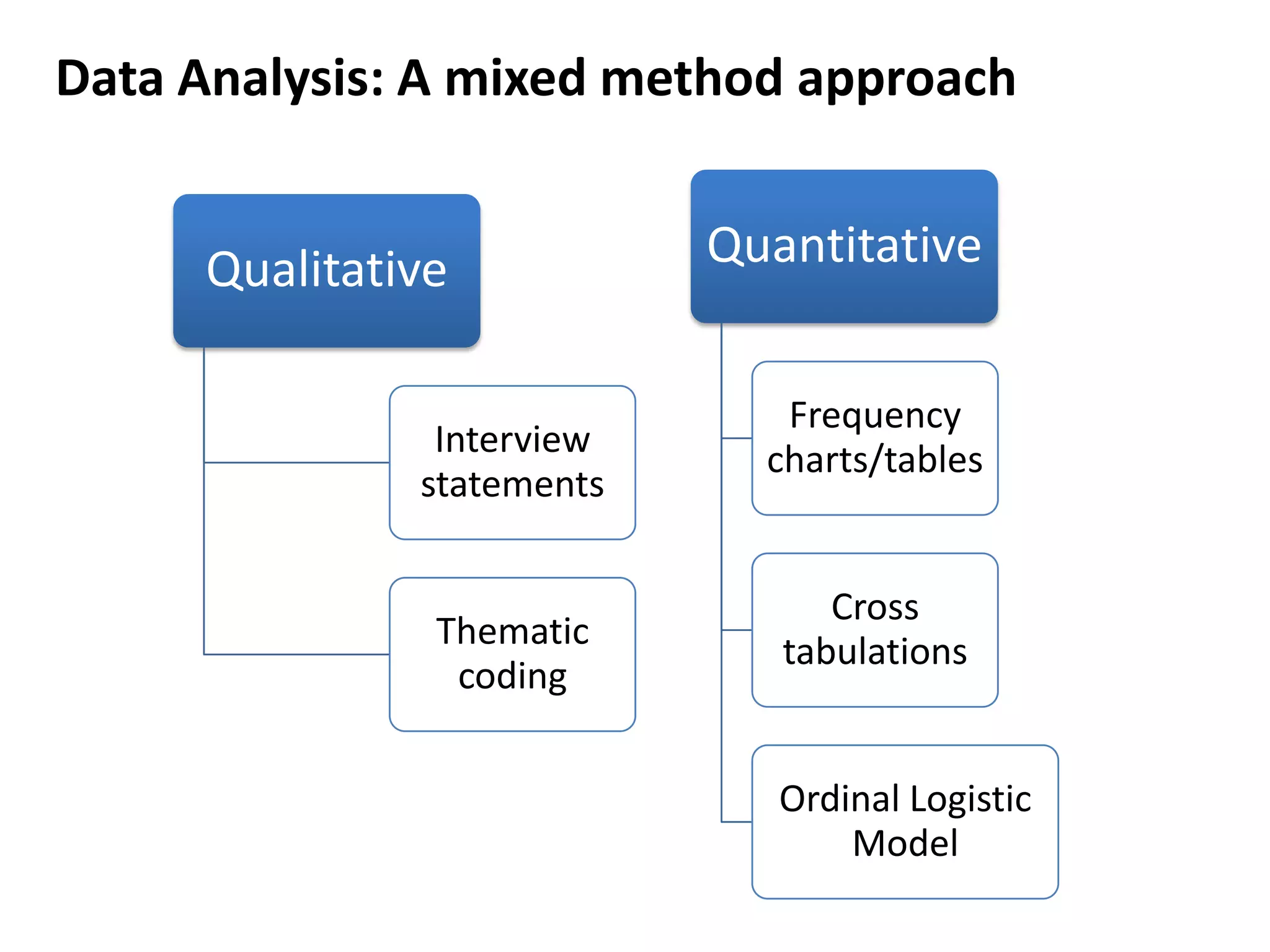

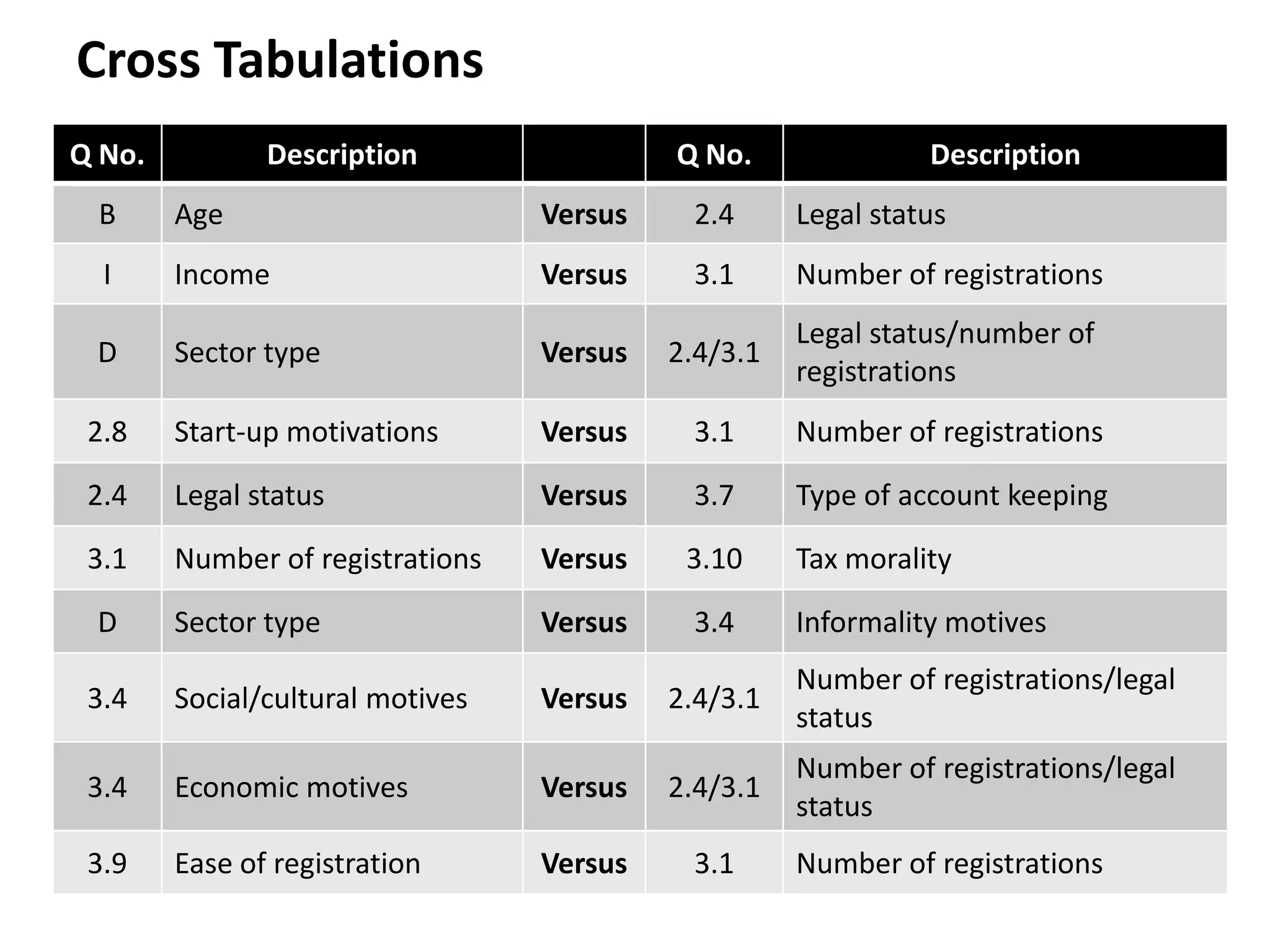

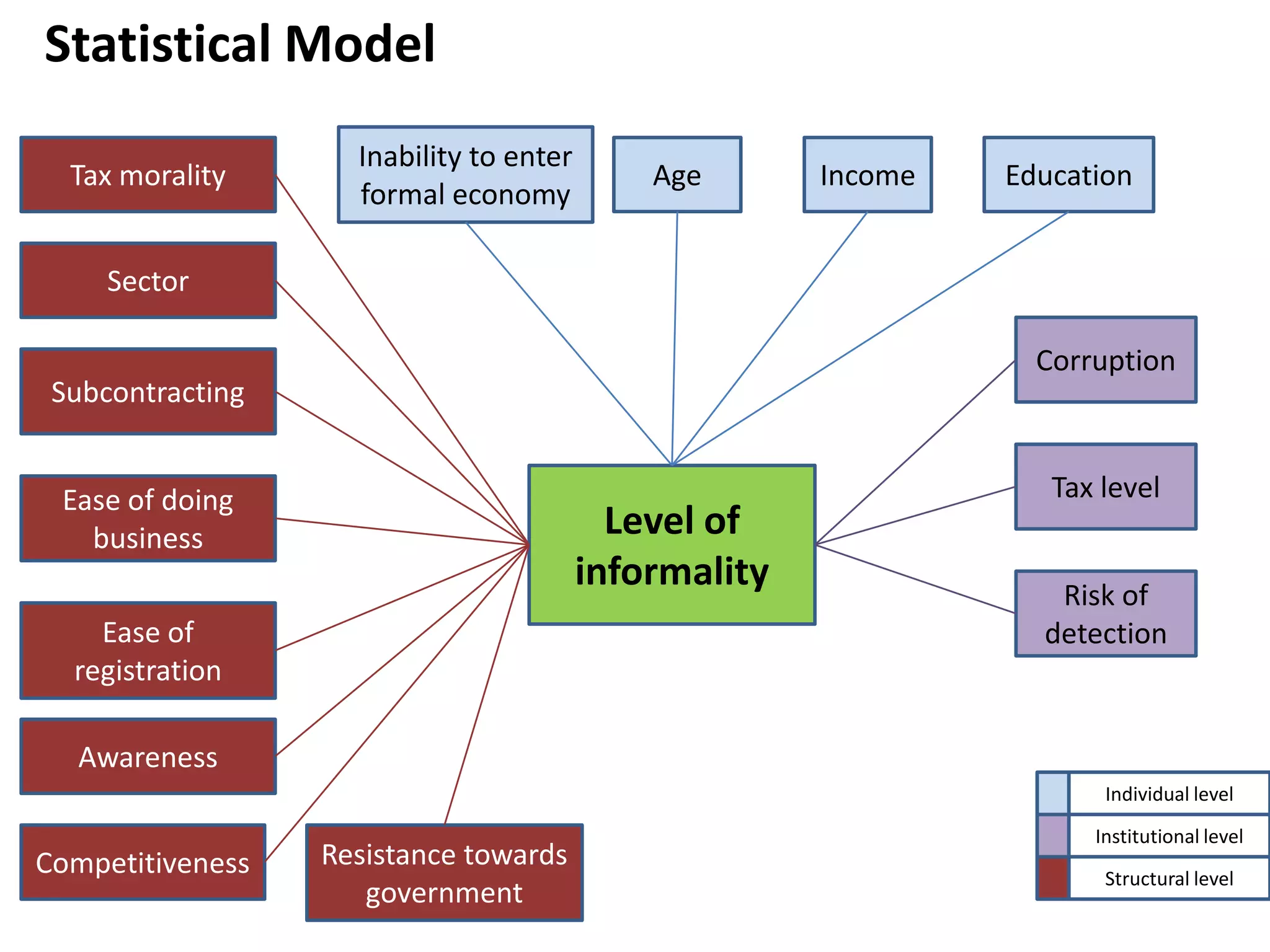

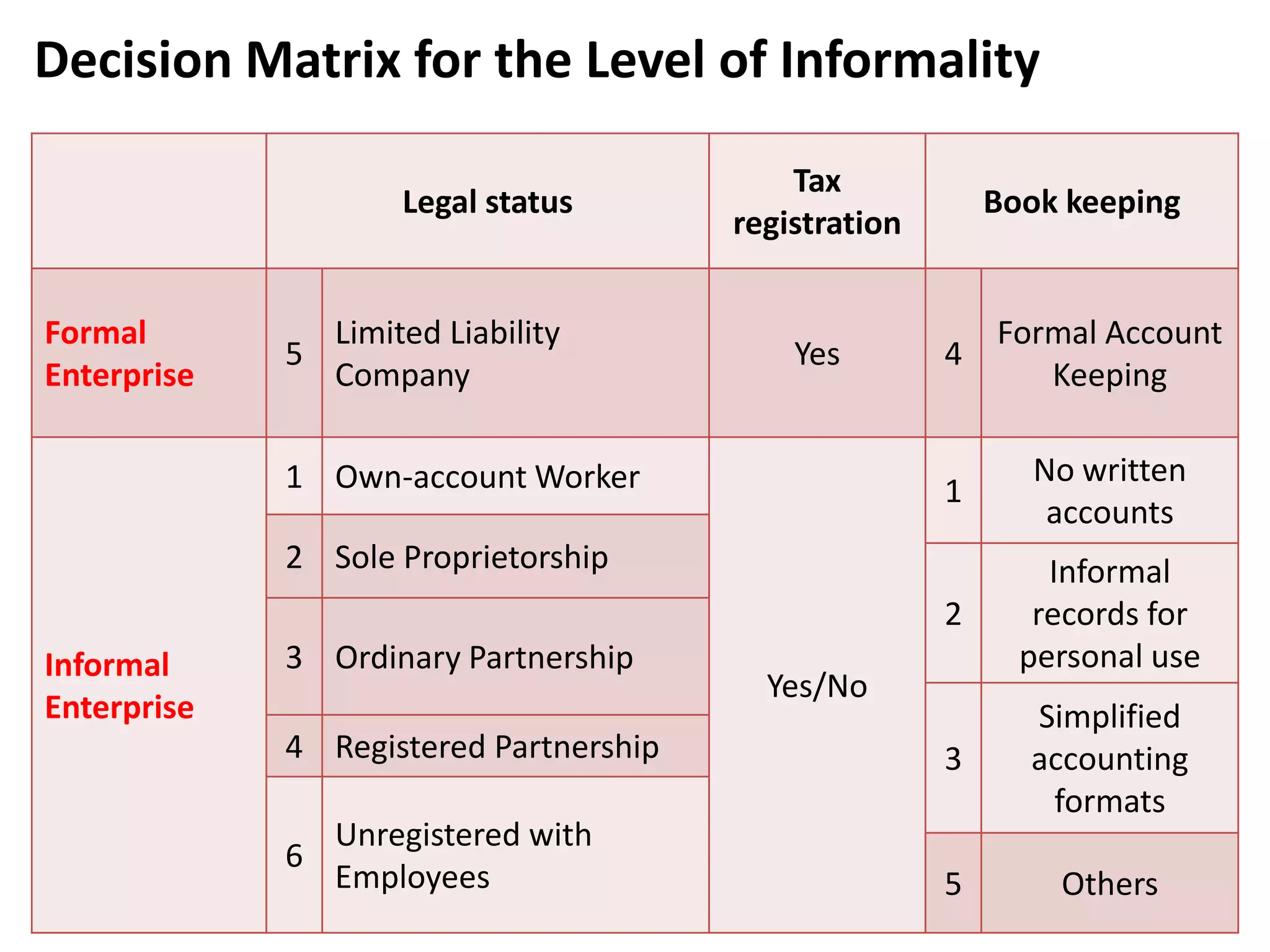

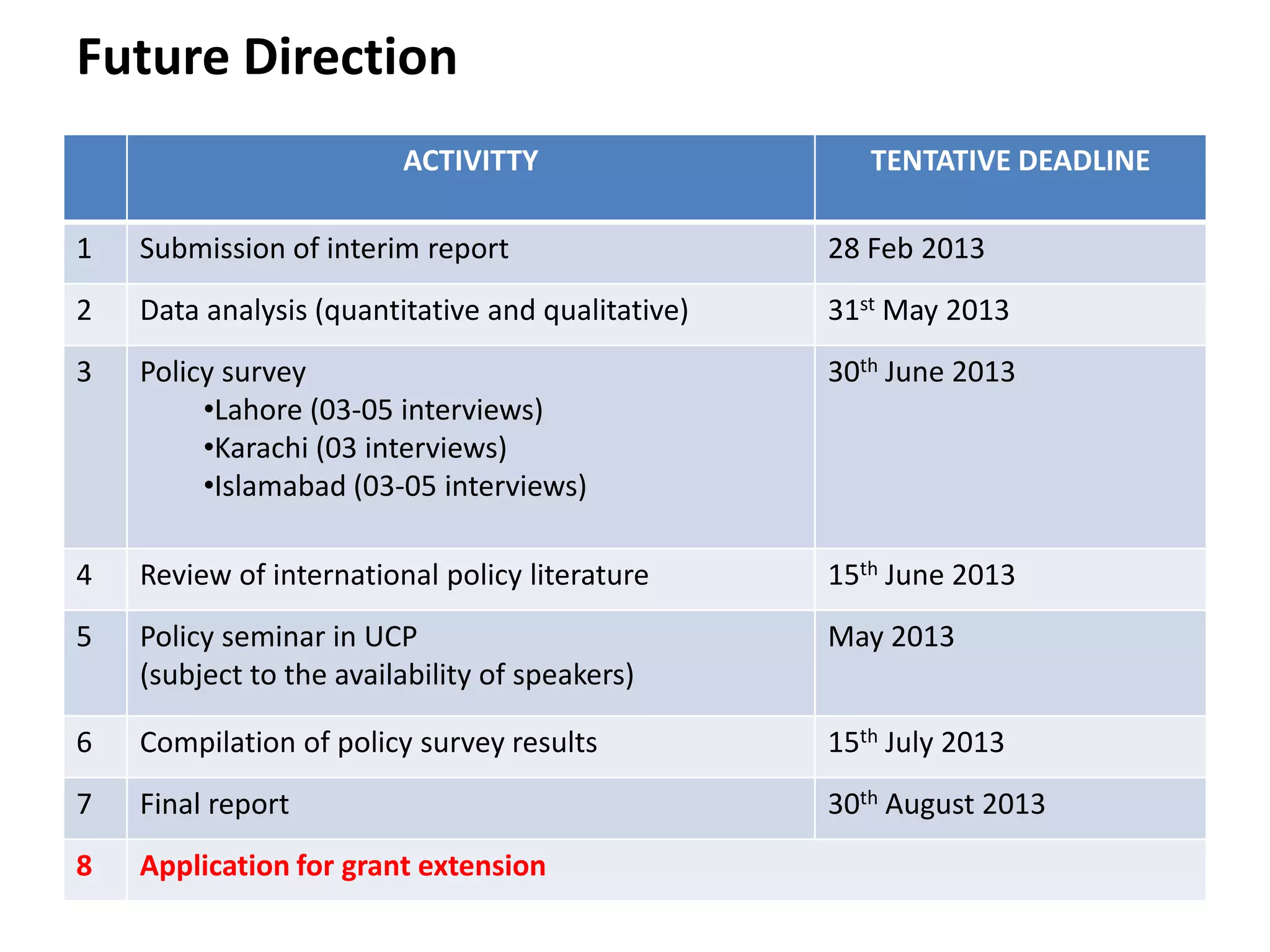

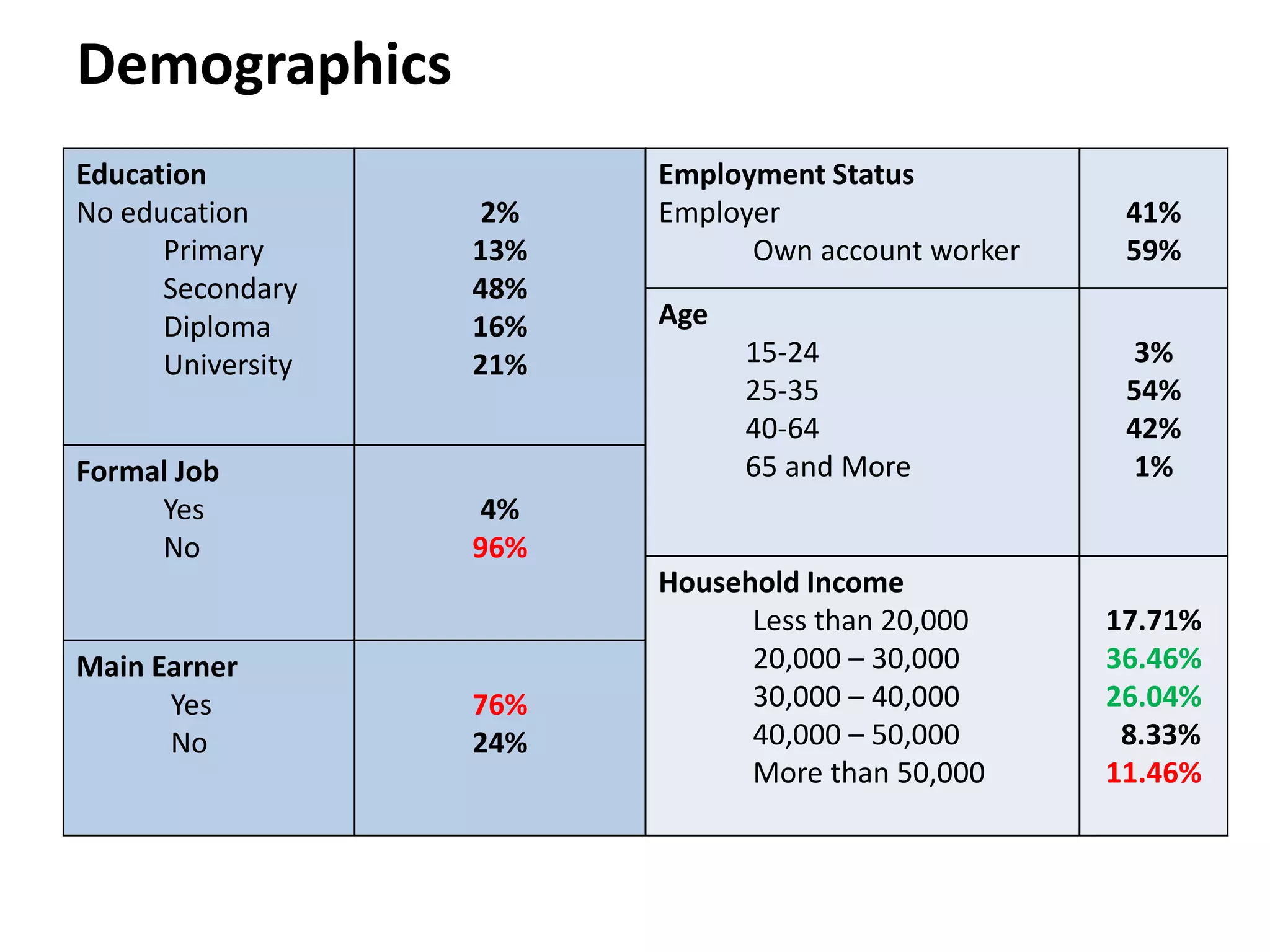

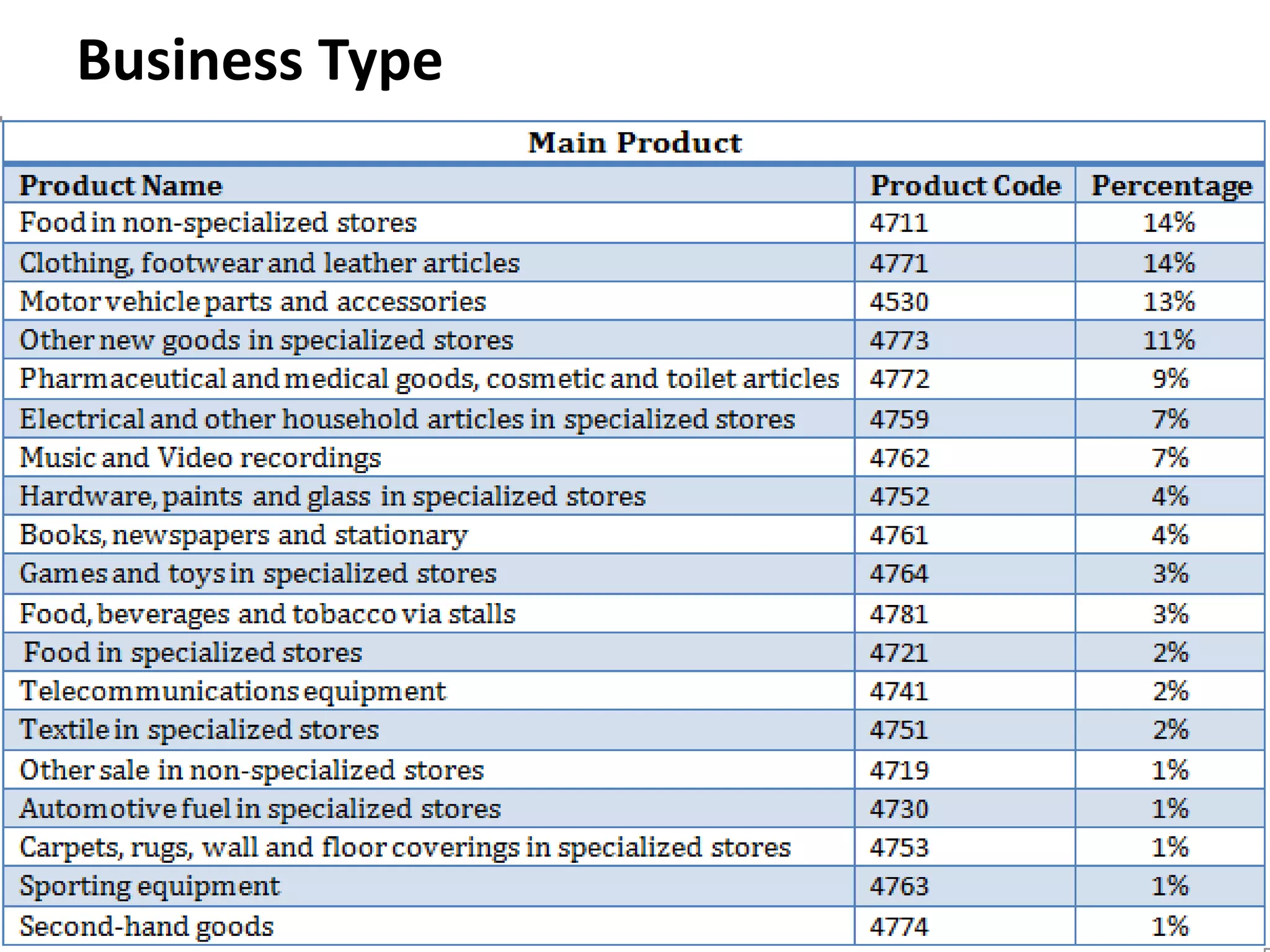

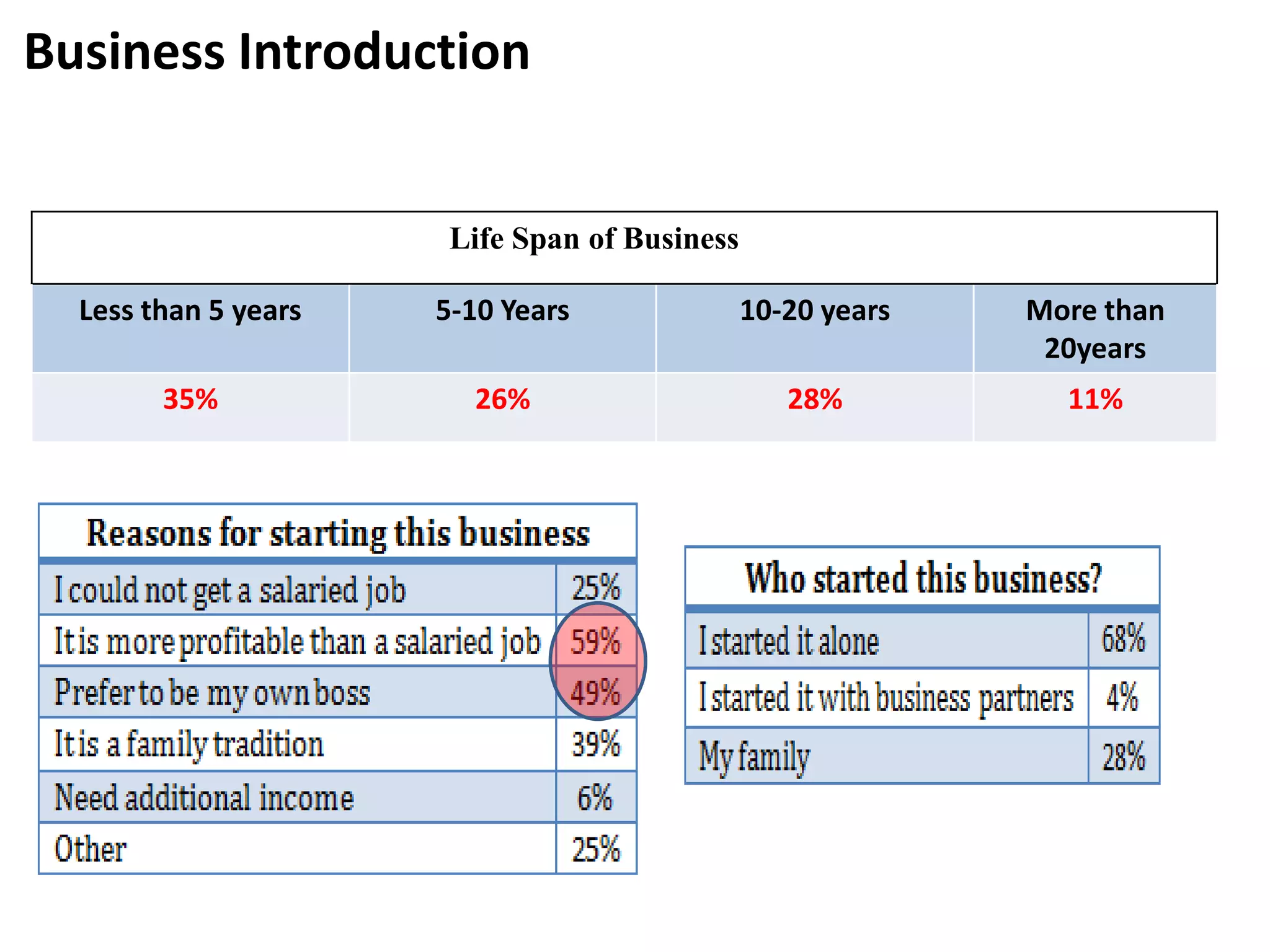

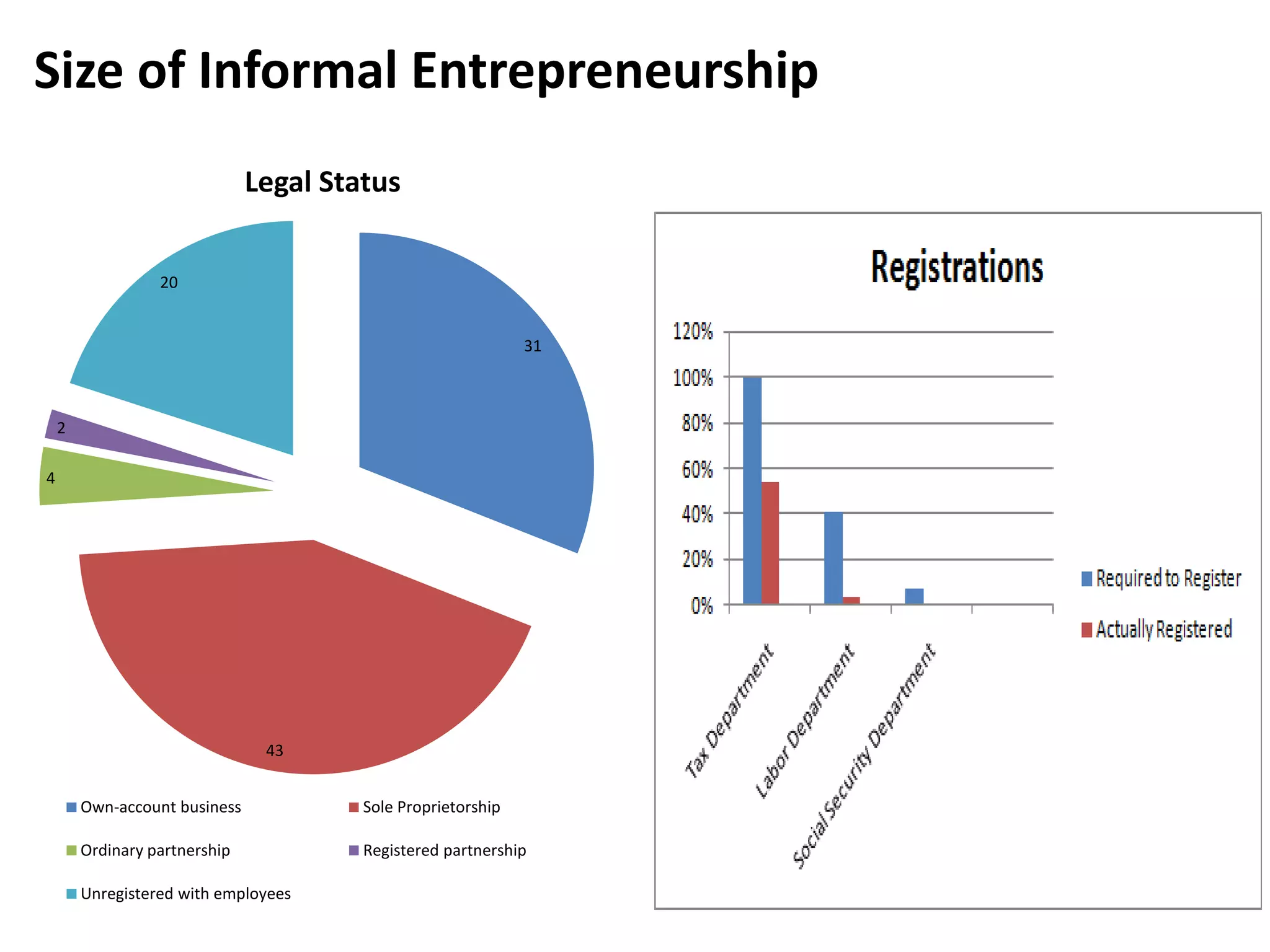

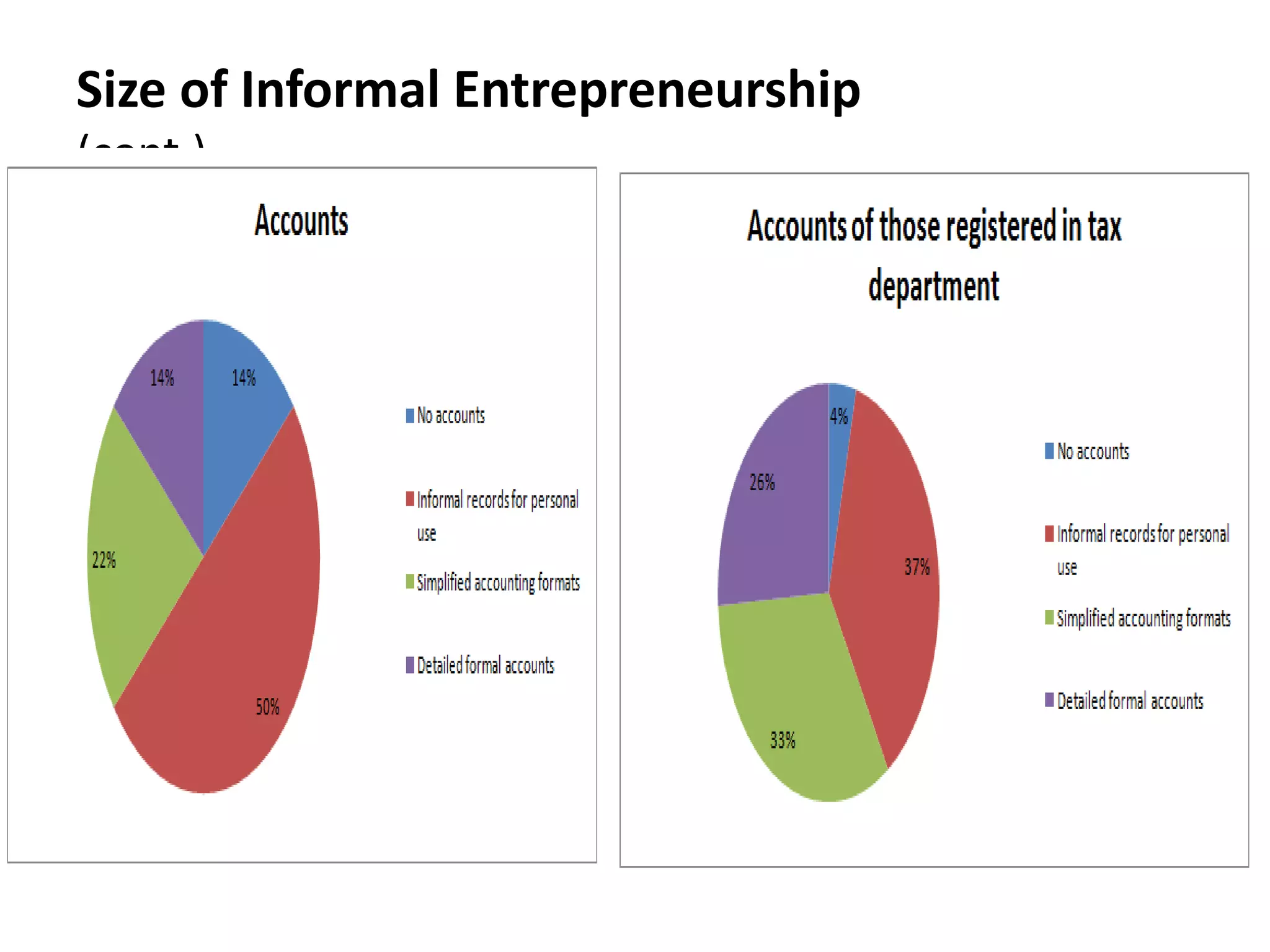

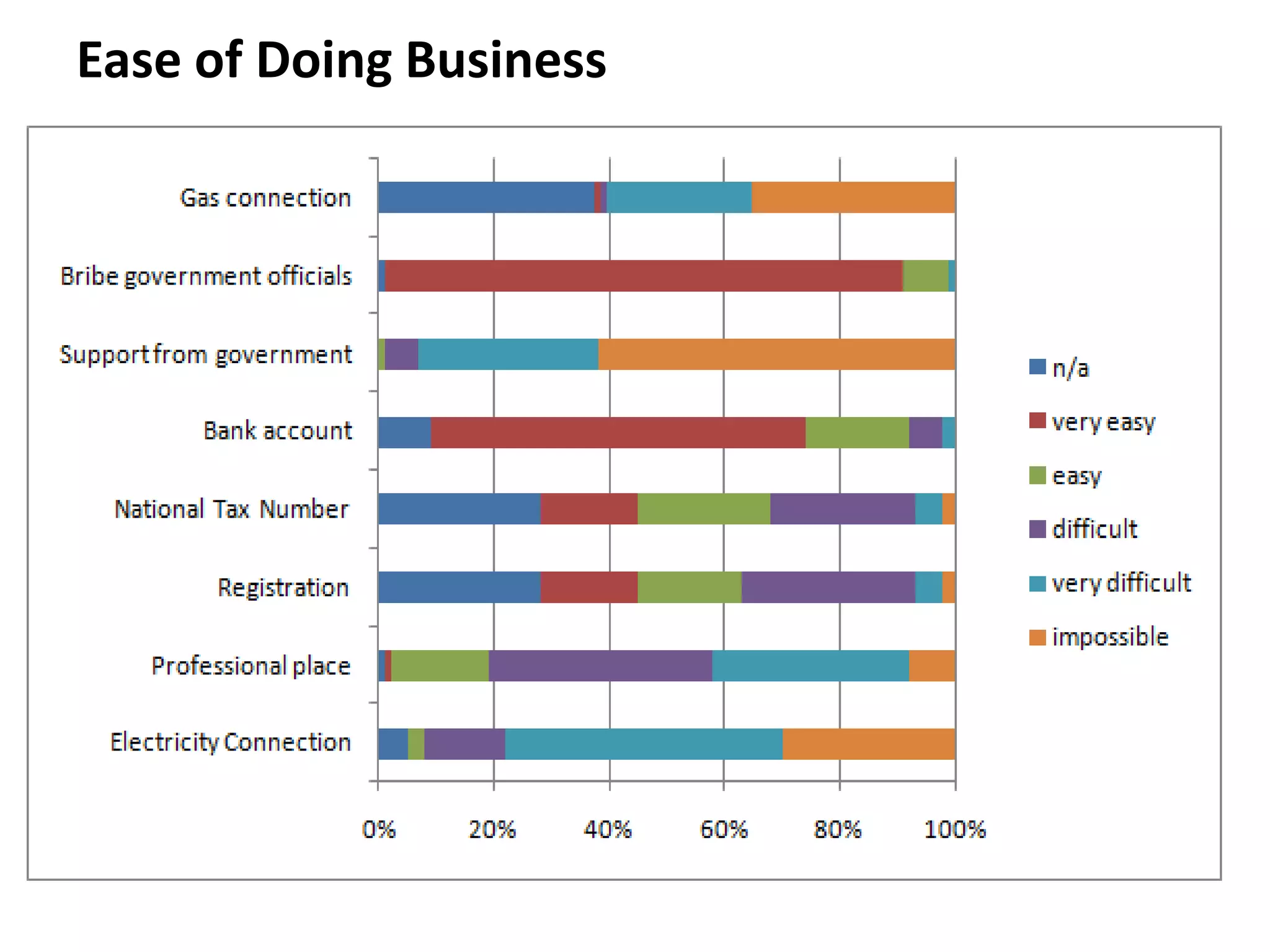

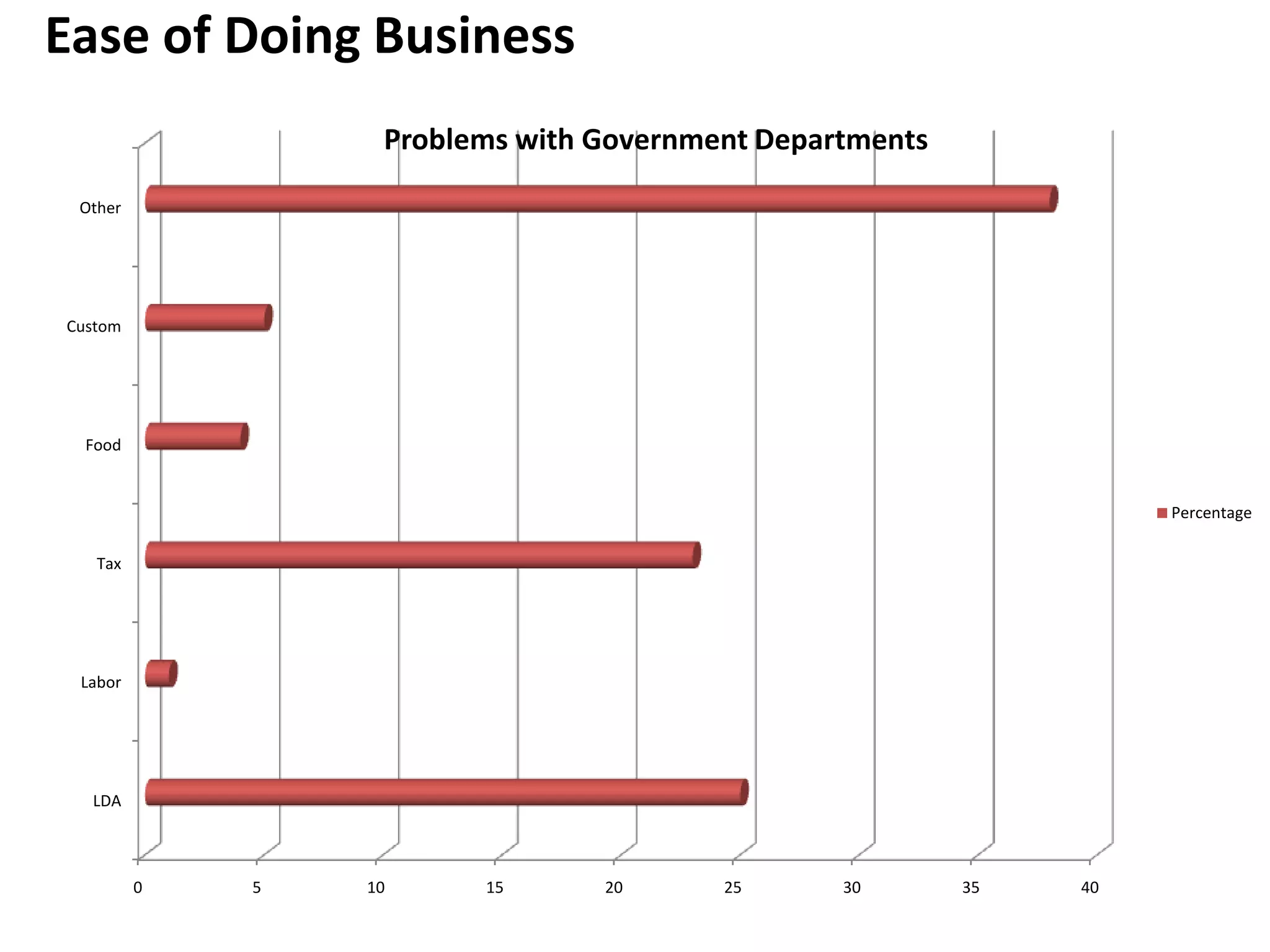

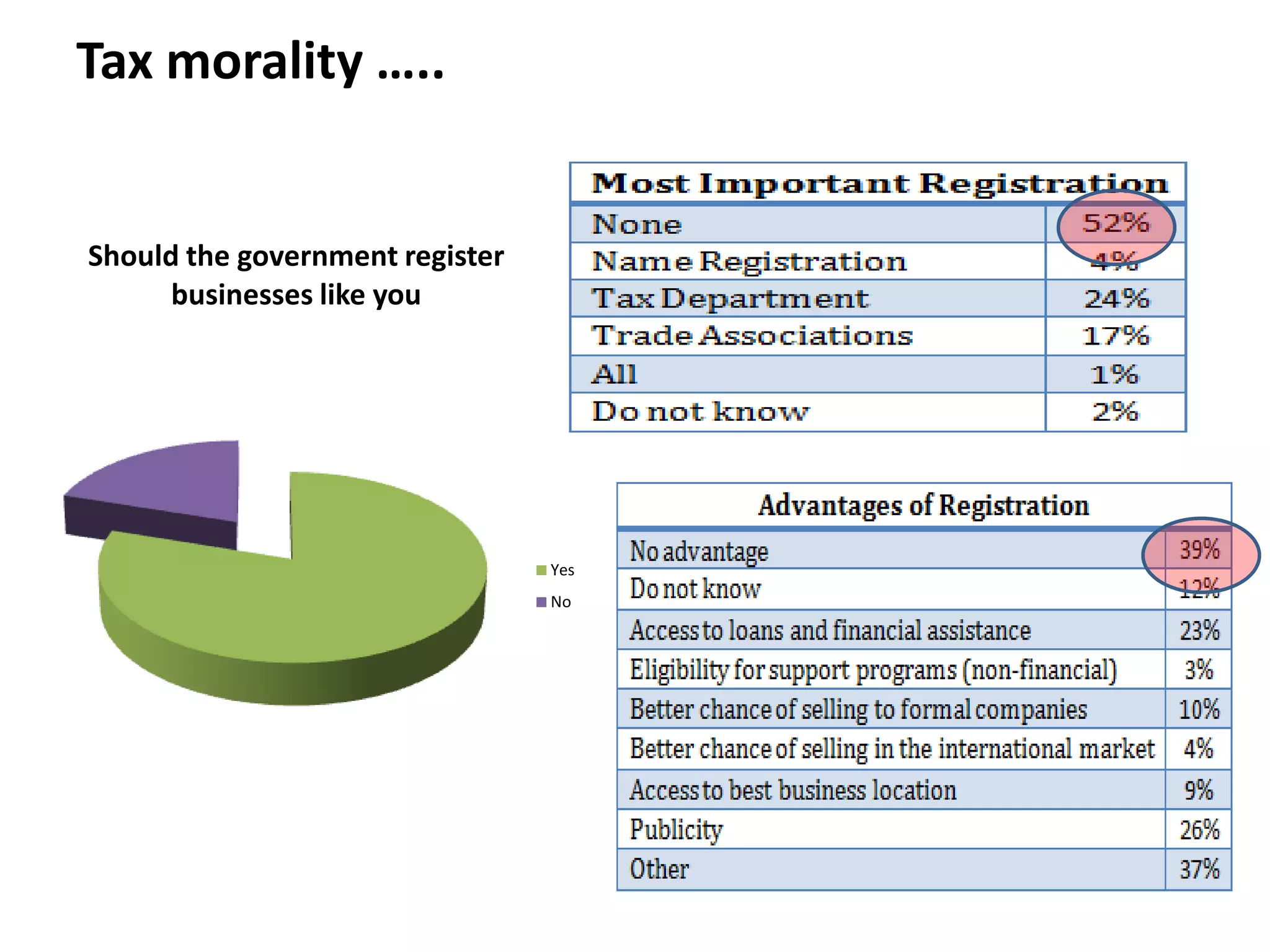

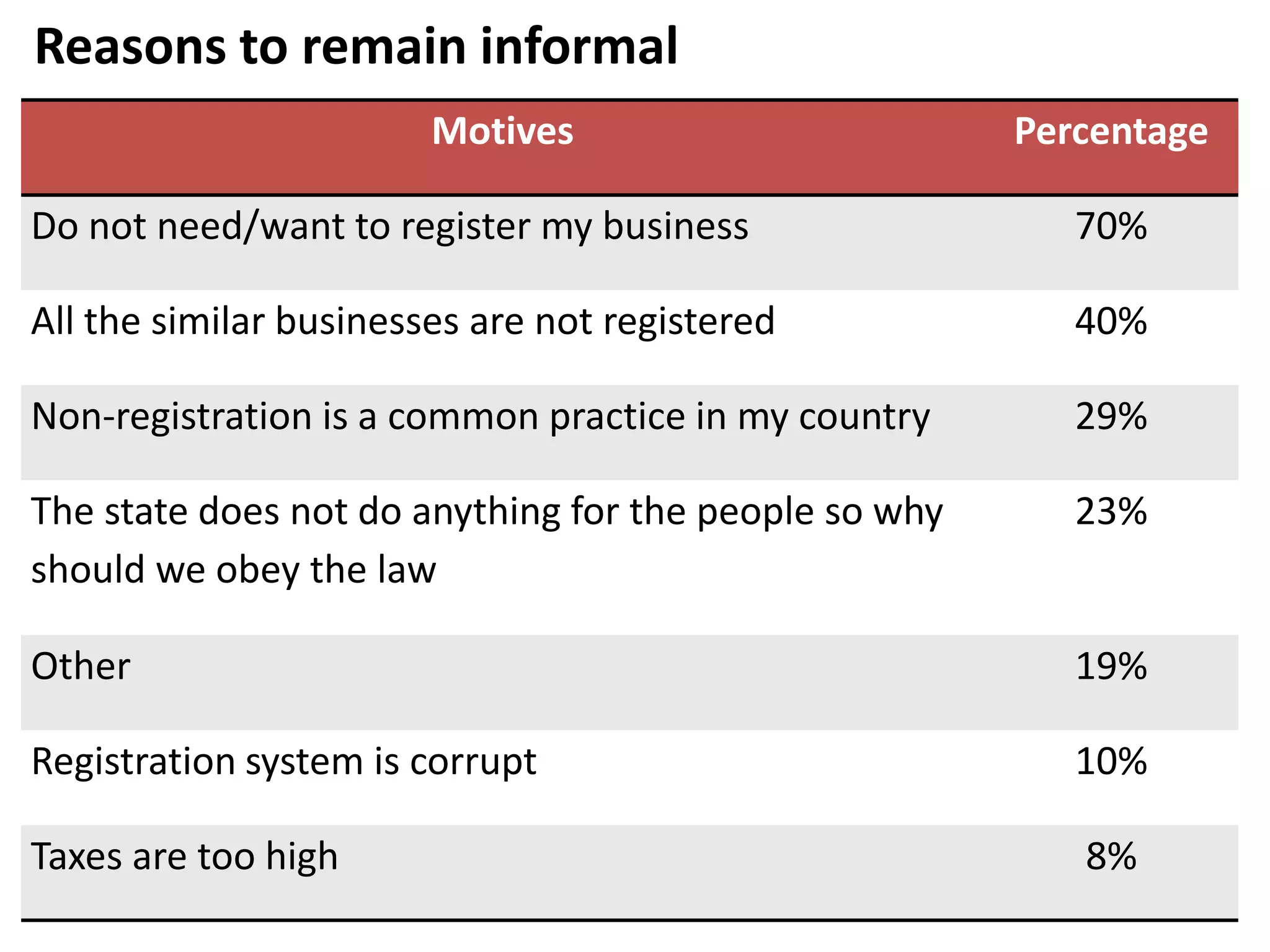

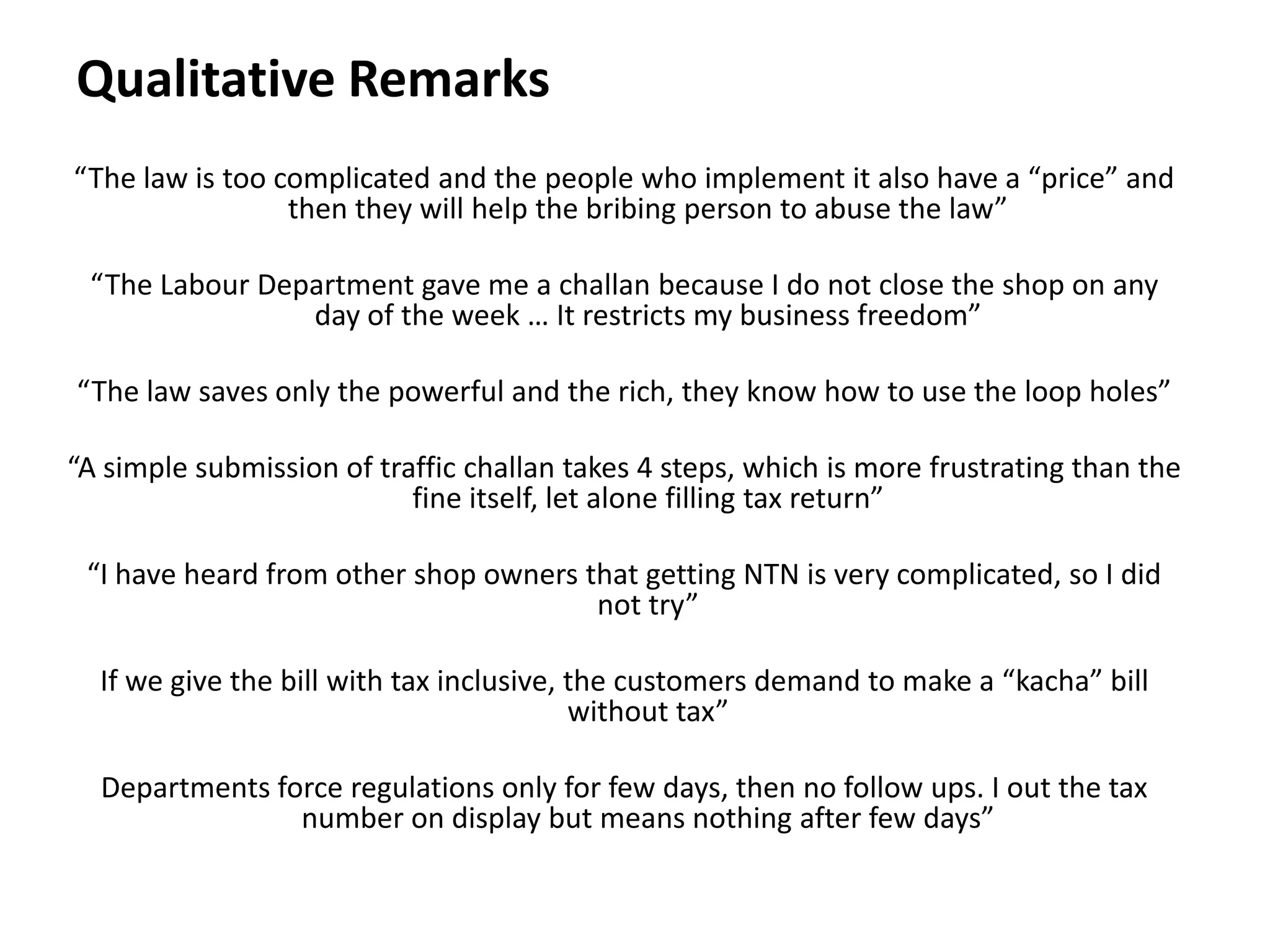

The document summarizes research conducted on the size and nature of informal entrepreneurship in Pakistan. It provides details on how the research was conducted, including defining informal entrepreneurship, developing research questions, sampling methodology, data collection tools, and analysis plan. Key findings include that over 40% of small businesses operate informally, with the majority citing complex regulations and taxes as barriers to formalization. Qualitative interviews found small business owners face challenges like complicated laws that officials exploit for bribes and restrictive regulations. The research aims to inform policy measures to better support and formalize Pakistan's informal entrepreneur sector.