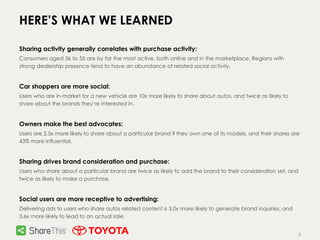

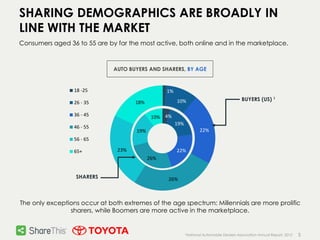

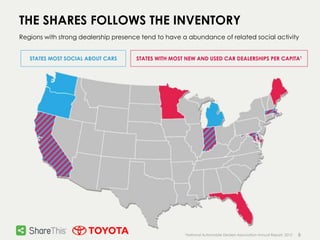

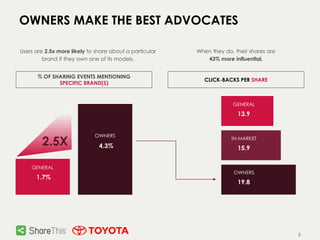

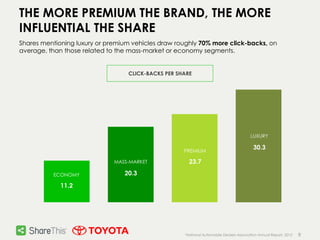

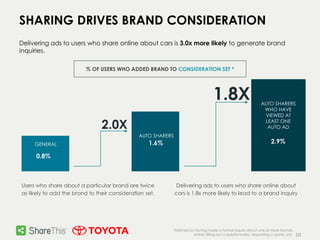

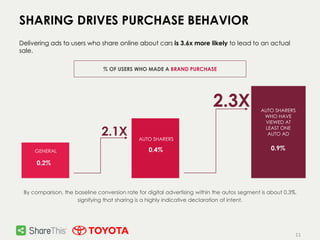

The study by ShareThis analyzed online social patterns among 13 million users and identified a strong correlation between automotive sharing and purchasing activity, notably among consumers aged 36 to 55. It found that users in-market for vehicles are significantly more likely to share about brands and that ownership of a vehicle greatly enhances advocacy and sharing influence. Furthermore, targeting users who share automotive content with ads significantly boosts brand inquiries and sales compared to traditional advertising methods.