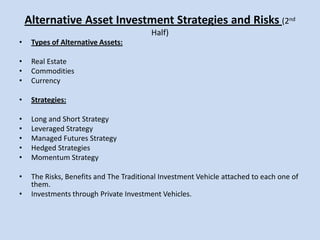

The document outlines a two-day financial risk management and asset management workshop. Day one covers essentials of financial risk management including topics like credit, liquidity, and market risk, while day two focuses on asset management strategies, investment vehicles, performance measurement, and the risks associated with alternative assets. Participants will gain comprehensive knowledge of financial markets and receive support even after the course completion.