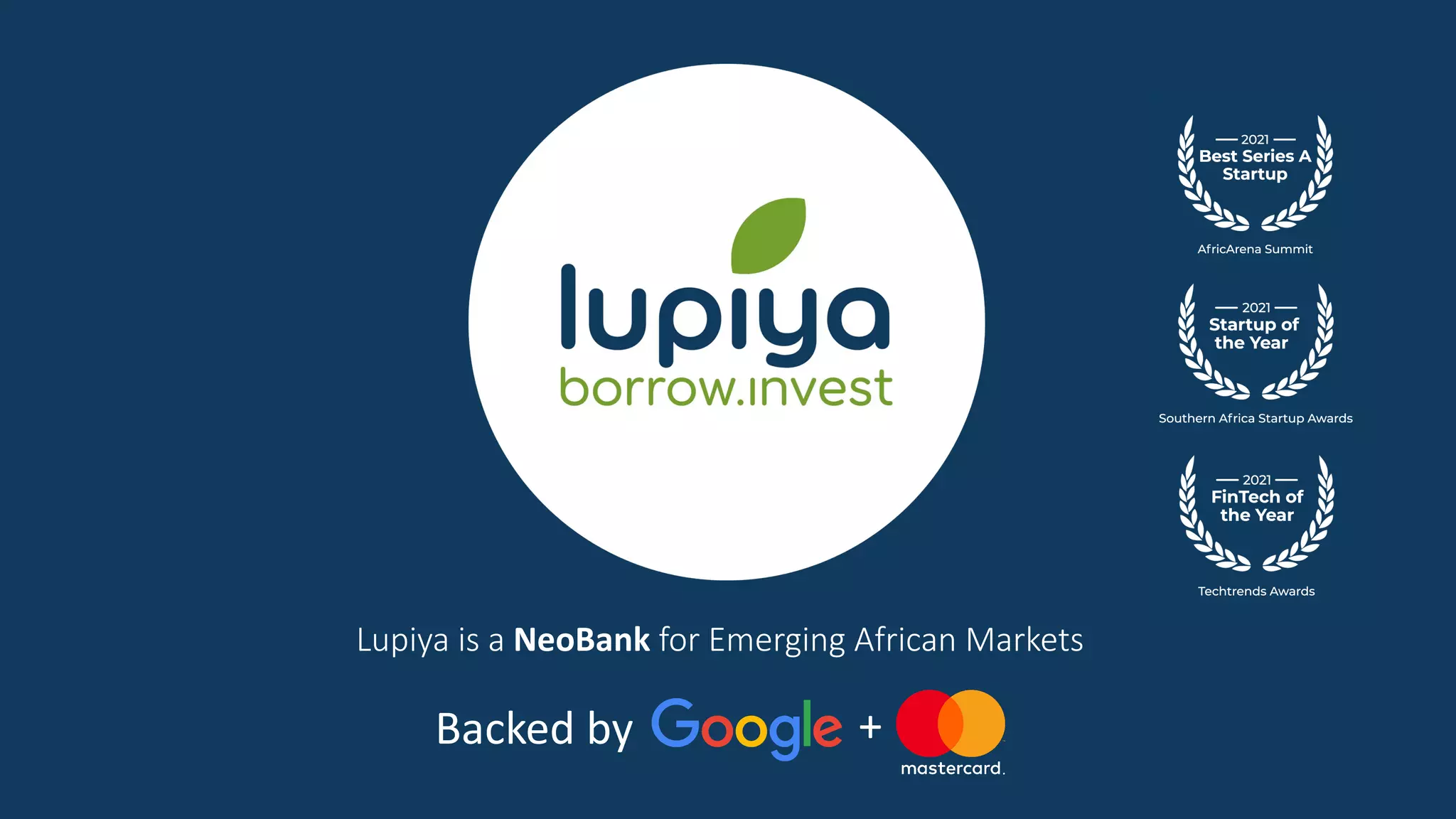

Lupiya is a neobank serving emerging African markets that provides online lending, peer-to-peer lending investments, and online payments. It addresses inefficiencies in traditional financial services in Africa by offering faster loan processing times and greater access for women and those in rural areas. Lupiya operates in Zambia and plans to expand to other African countries, with an initial target market of $140 million in Zambia. It has experienced strong growth and won several awards for its work in financial inclusion.