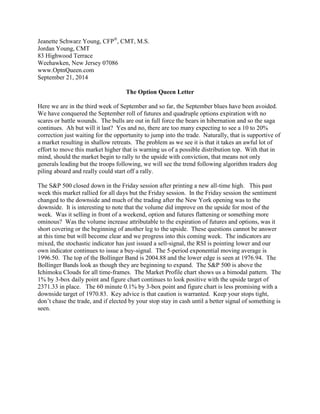

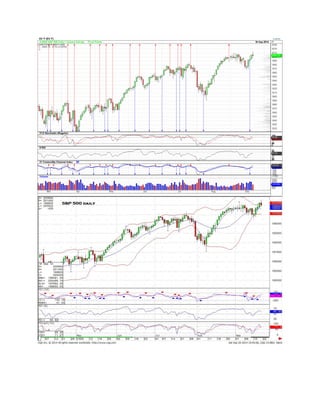

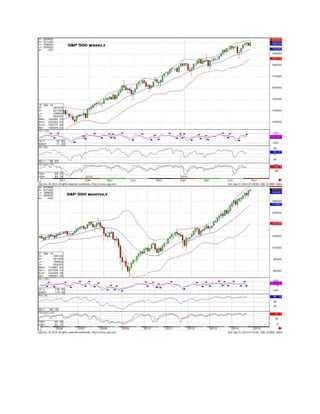

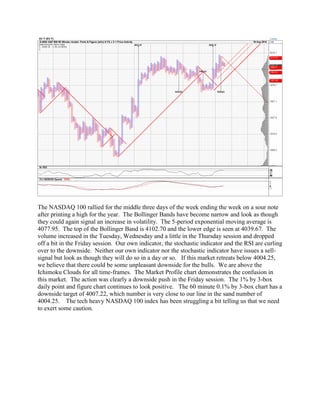

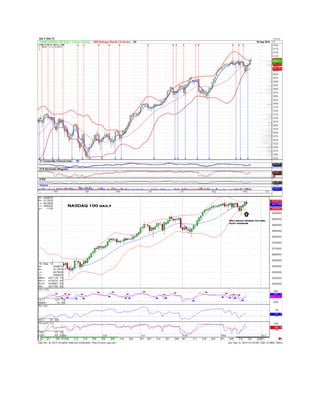

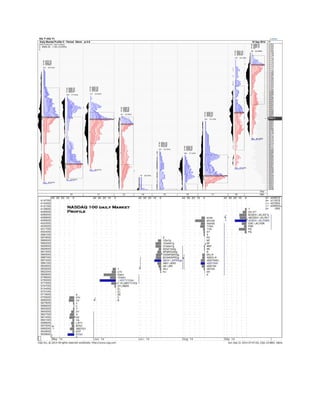

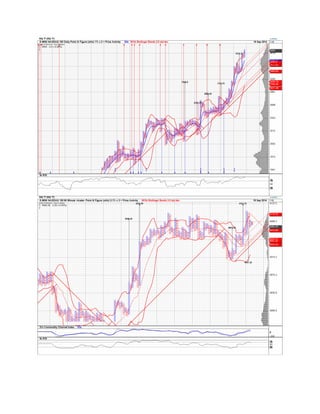

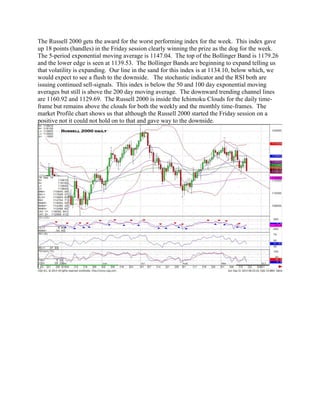

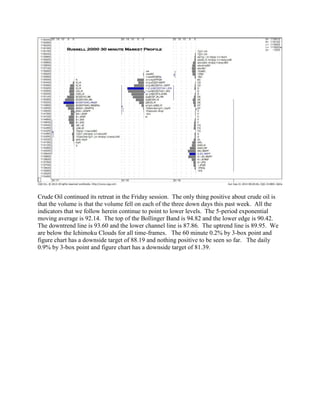

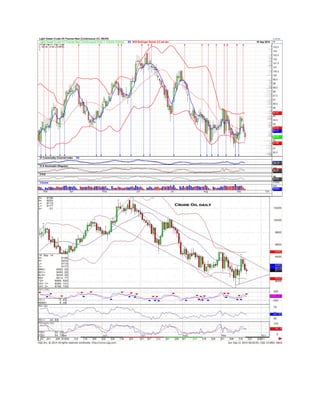

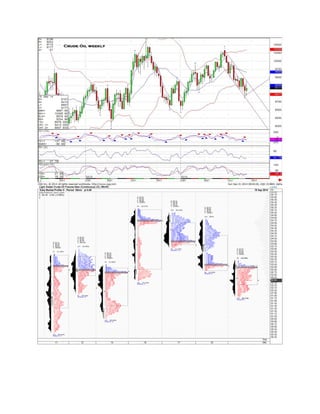

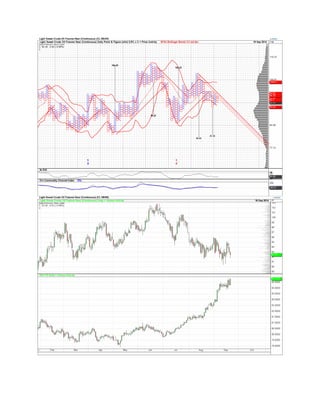

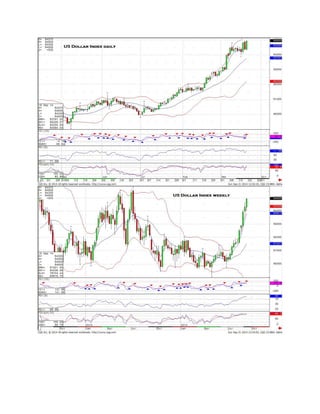

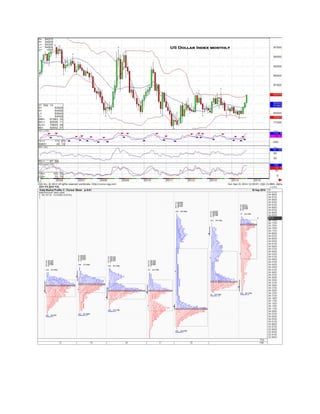

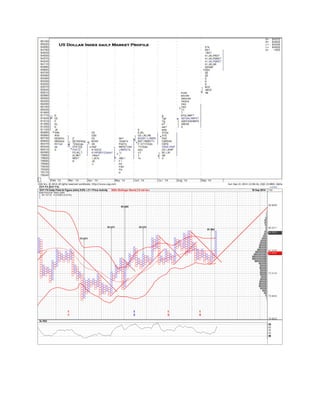

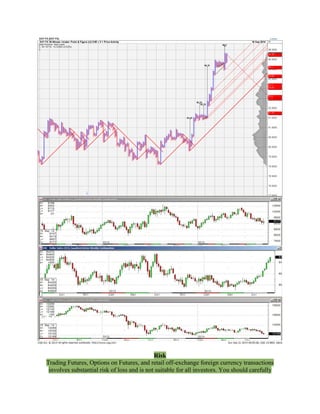

The document provides a weekly market summary and outlook for various indexes and commodities. It notes that the S&P 500 and NASDAQ 100 ended the week lower after reaching new highs earlier. The Russell 2000 and crude oil performed poorly, with indicators pointing lower. Gold also looks weak with support at $1182. The US dollar index remains strong with indicators pointing higher still. In closing, the author advises caution given mixed signals in markets and recommends tight stops if positions are held.