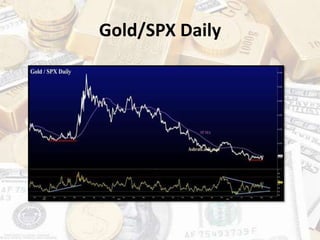

Gold prices rose for a third straight day ahead of the Federal Reserve's policy decision. Traders are watching for clues about the Fed's plans to taper its asset purchase program. The document discusses factors influencing gold prices such as the debt crisis at Chinese property giant Evergrande and the Canadian election results. Technical analysis suggests gold needs to close above $1778 resistance for the recovery to extend to $1800.