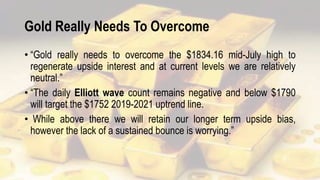

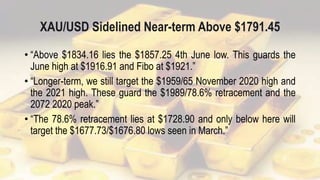

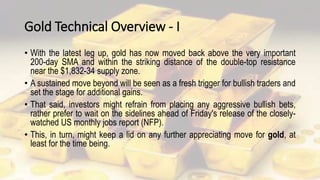

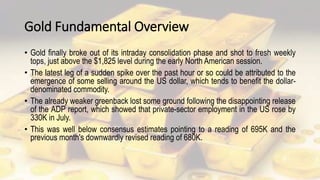

Gold prices jumped to fresh weekly highs above $1,825 after the weaker-than-expected ADP employment report reinforced expectations that the Fed will keep monetary policy accommodative. The disappointing jobs data boosted gold by adding to dollar weakness and increasing demand for safe-haven assets. However, gold faces resistance around $1,832-34 and traders are waiting on the upcoming nonfarm payrolls report before taking aggressive bullish positions. Technical indicators show gold remains in a broad neutral range between $1,755 support and $1,917 resistance.