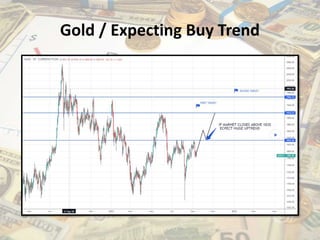

Gold prices stabilized around $1800 despite the recovery of the US dollar. Technical analysis indicates gold may climb to resistance levels of $1819, $1827, and $1845 if it remains above $1800, but support levels of $1775 and $1760 could threaten further gains. Central bank announcements from the ECB, BOE, and Fed this week may impact gold prices as speculators have increased net-long futures positions and data suggests traders remain bearish.