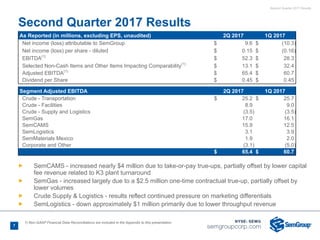

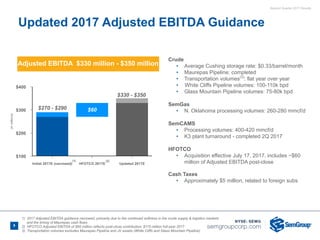

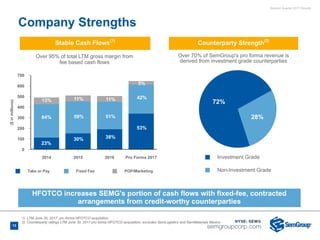

The document discusses SemGroup's second quarter 2017 results and HFOTCO acquisition. Key points include:

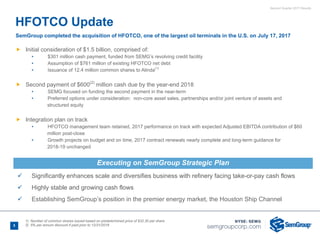

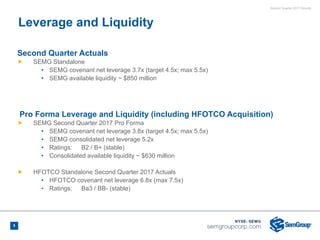

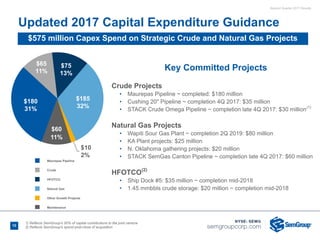

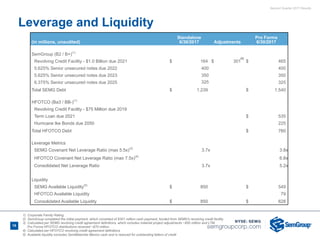

- SemGroup completed its acquisition of HFOTCO in July 2017 for initial consideration of $1.5 billion including cash, debt assumption, and shares issued. A second $600 million cash payment is due by end of 2018.

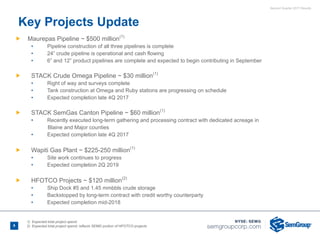

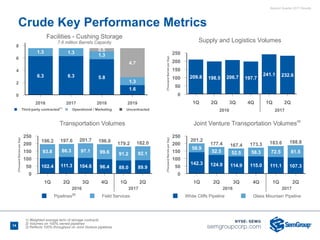

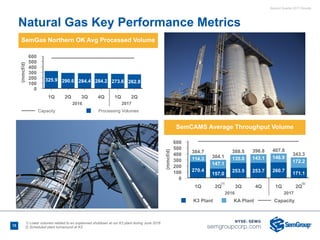

- Base business performed as expected in Q2 2017. Several new pipeline projects were completed or are under construction to expand infrastructure.

- SemGroup is focused on funding the second HFOTCO payment through options like asset sales, partnerships, or equity offerings. Integration of HFOTCO is proceeding as planned.