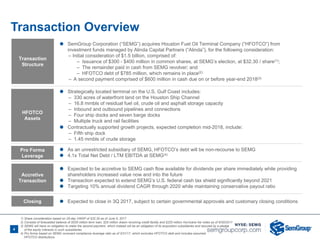

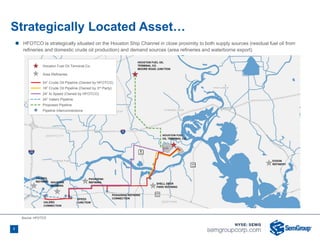

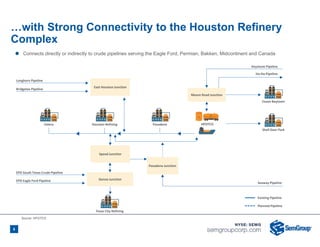

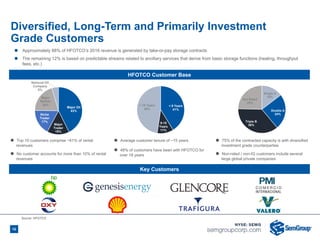

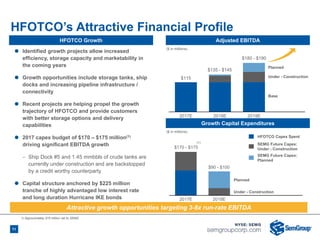

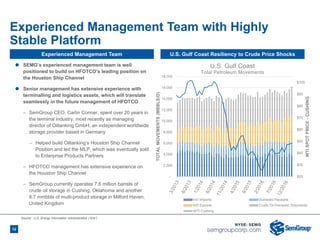

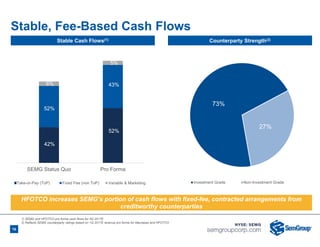

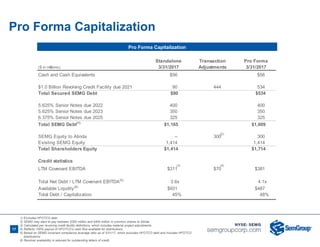

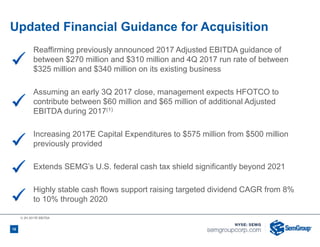

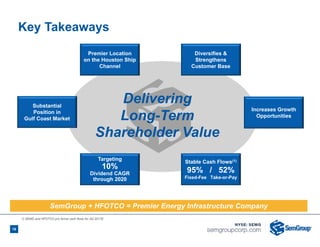

SemGroup acquired Houston Fuel Oil Terminal Company (HFOTCO) for $1.5 billion initially, with a second $600 million payment due by end of 2018. HFOTCO owns 330 acres and 16.8 million barrels of storage on the Houston Ship Channel with connections to major pipelines and refineries. The acquisition enhances SemGroup's scale and diversification with take-or-pay contracts from investment-grade customers. Growth projects are expected to increase HFOTCO's adjusted EBITDA to $180-190 million by 2019.