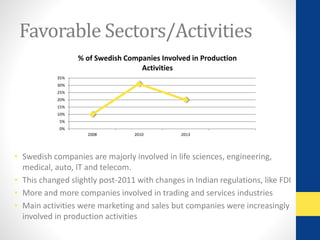

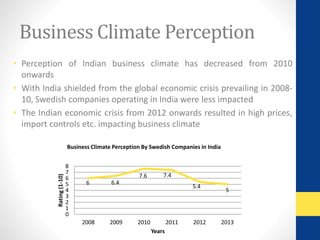

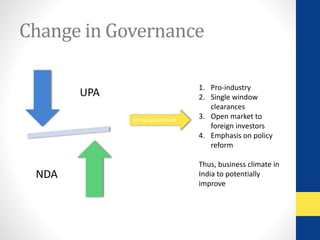

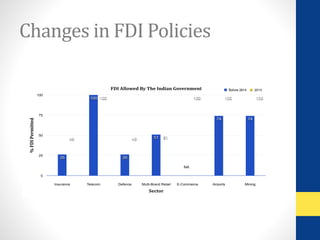

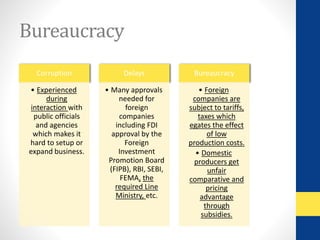

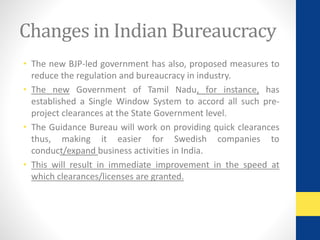

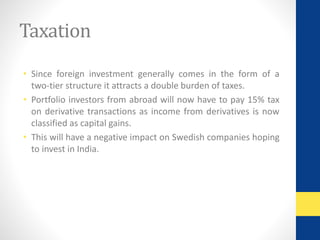

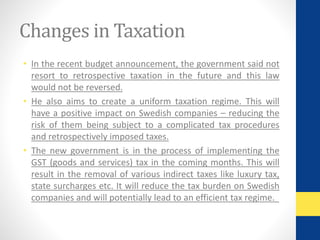

The project examines business climate surveys from Swedish companies operating in India between 2008 and 2013, aiming to identify major concerns, advantages, and trends affecting their operations. It highlights the challenges of corruption, bureaucratic red tape, and taxation, while noting favorable conditions such as a low-cost labor force and opportunities in various sectors. The conclusion suggests that, despite a declining perception of the business environment, recent government reforms may improve conditions for Swedish companies in the near future.