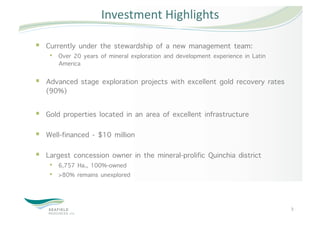

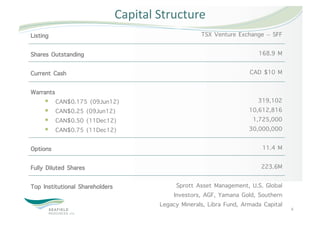

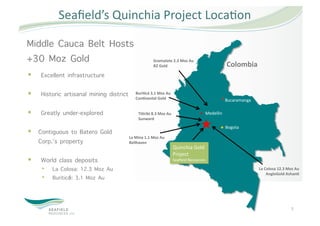

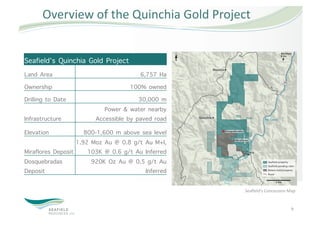

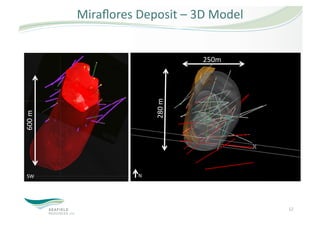

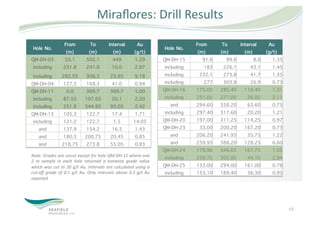

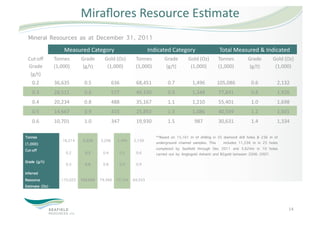

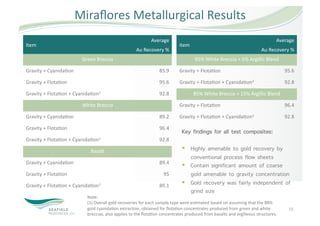

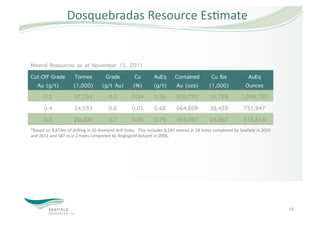

The document discusses Seafield Resources' advanced gold exploration project in Colombia. The project includes the Miraflores deposit located within Seafield's 100%-owned 6,757 hectare Quinchia Gold Project. Drilling at Miraflores has outlined a breccia pipe with over 1.9 million ounces of gold in measured and indicated resources. Metallurgical testing shows excellent average gold recoveries of over 90% for the mineralization. Seafield is well financed with $10 million cash and is exploring additional targets on its highly prospective and largely undrilled land package.