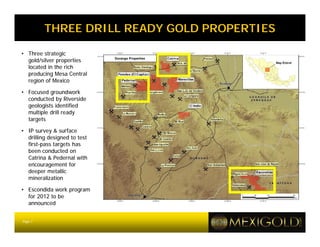

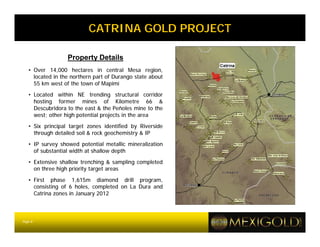

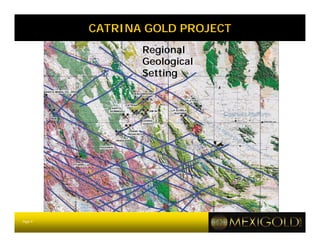

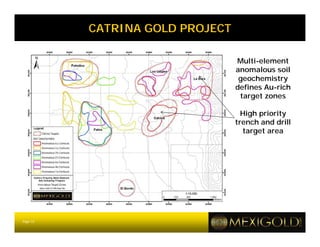

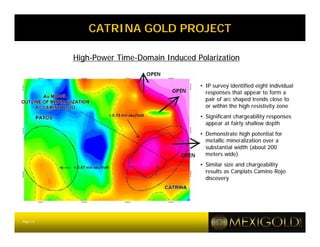

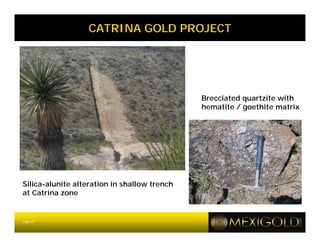

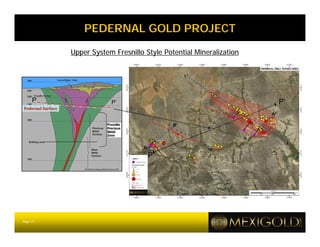

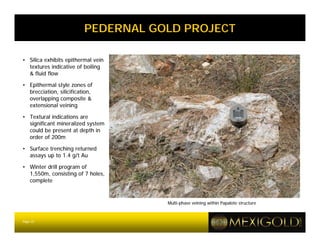

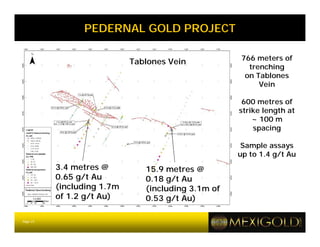

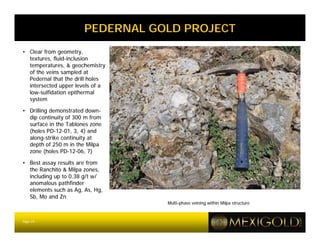

Gold/silver exploration is being conducted in the prolific mining states of Durango and Zacatecas in Mexico. Three properties, Catrina, Pedernal, and Escondida, show potential for open pit and underground exploration based on soil and trench sampling that has identified gold and silver anomalies. Recent drilling at Catrina intersected indicator minerals associated with the upper levels of an epithermal system. At Pedernal, drilling demonstrated continuity of vein structures at depth and along strike, indicating a mineralized epithermal system is present. Further exploration is planned for 2012 to test additional targets across the three properties.