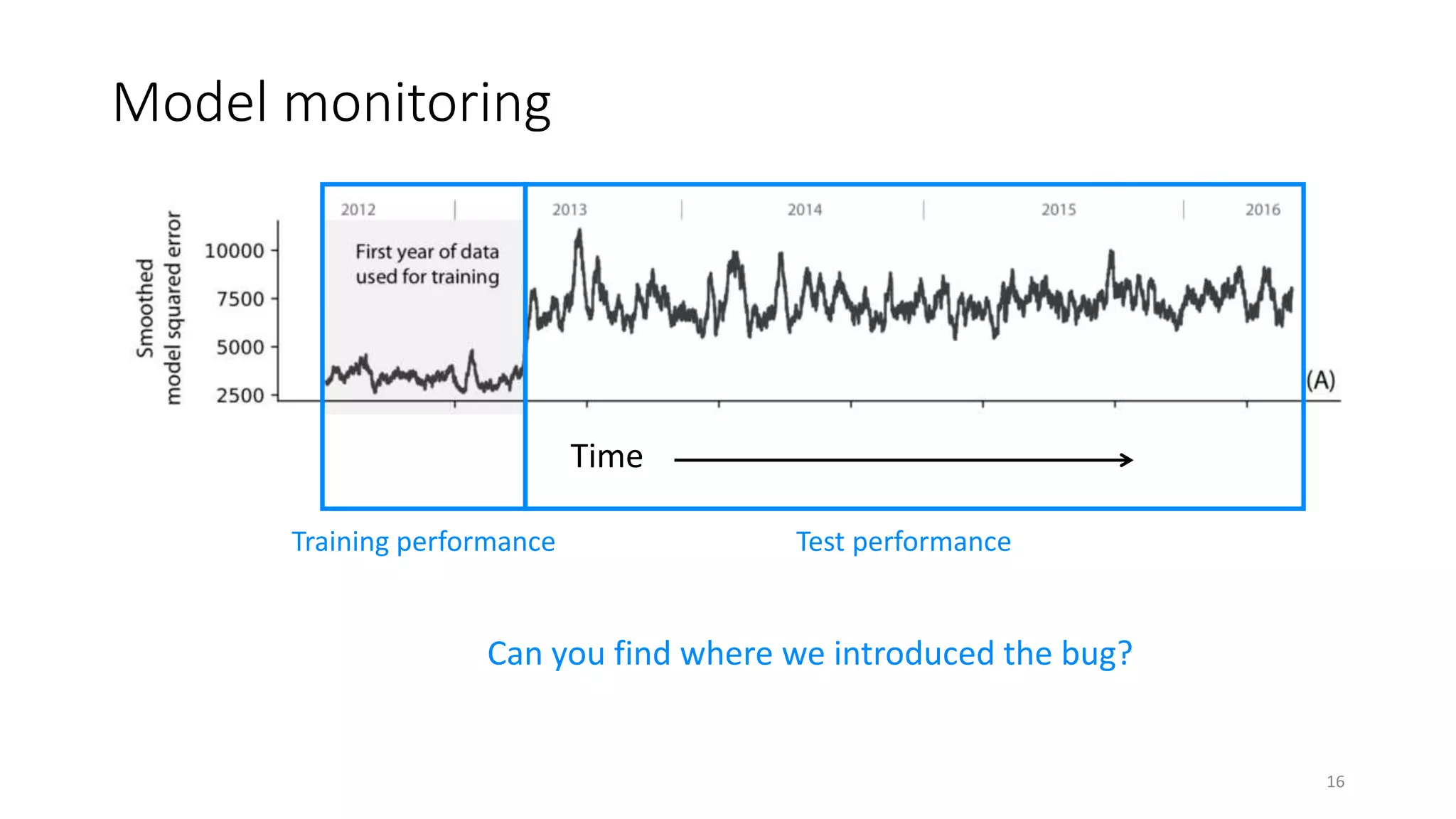

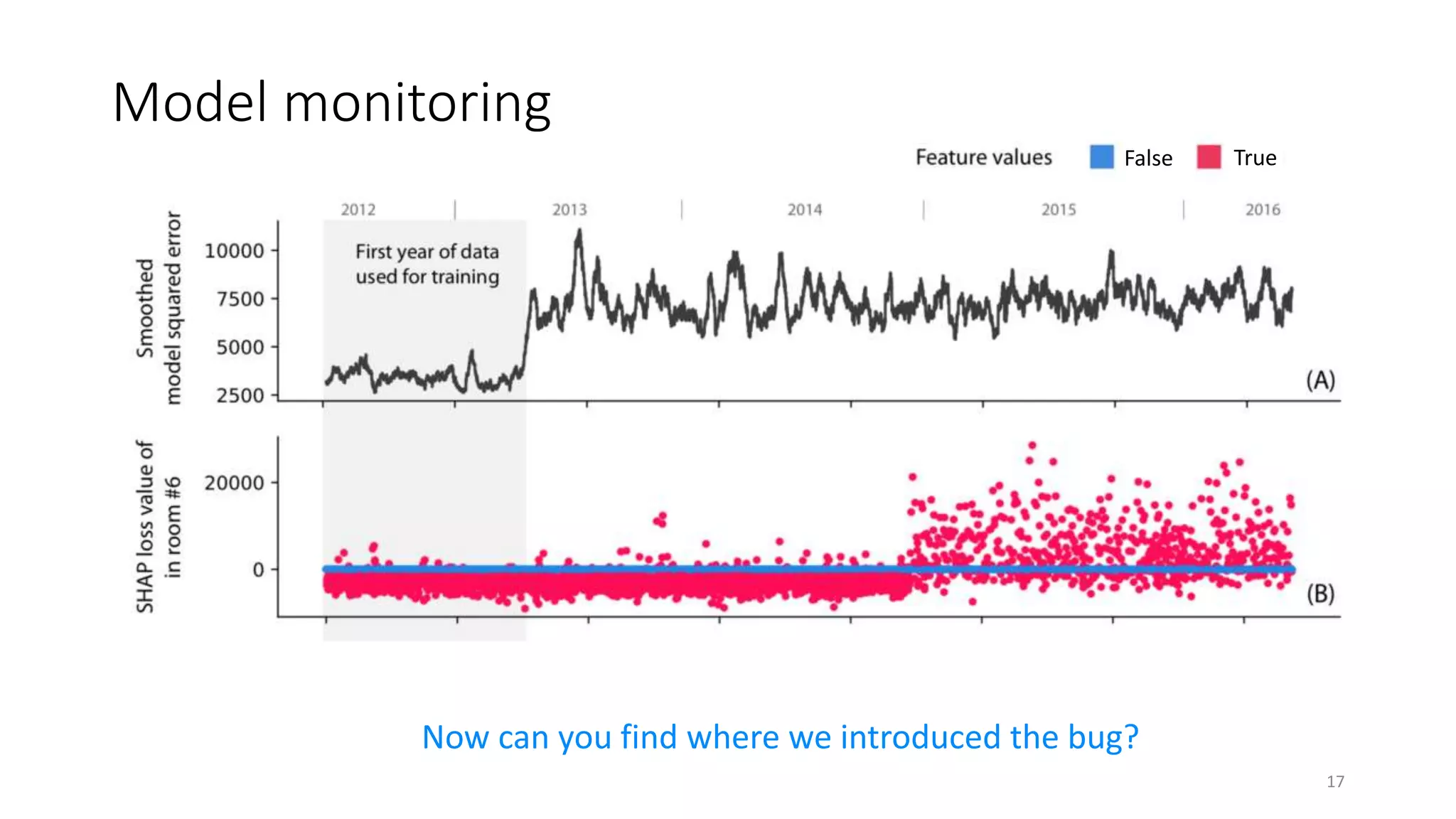

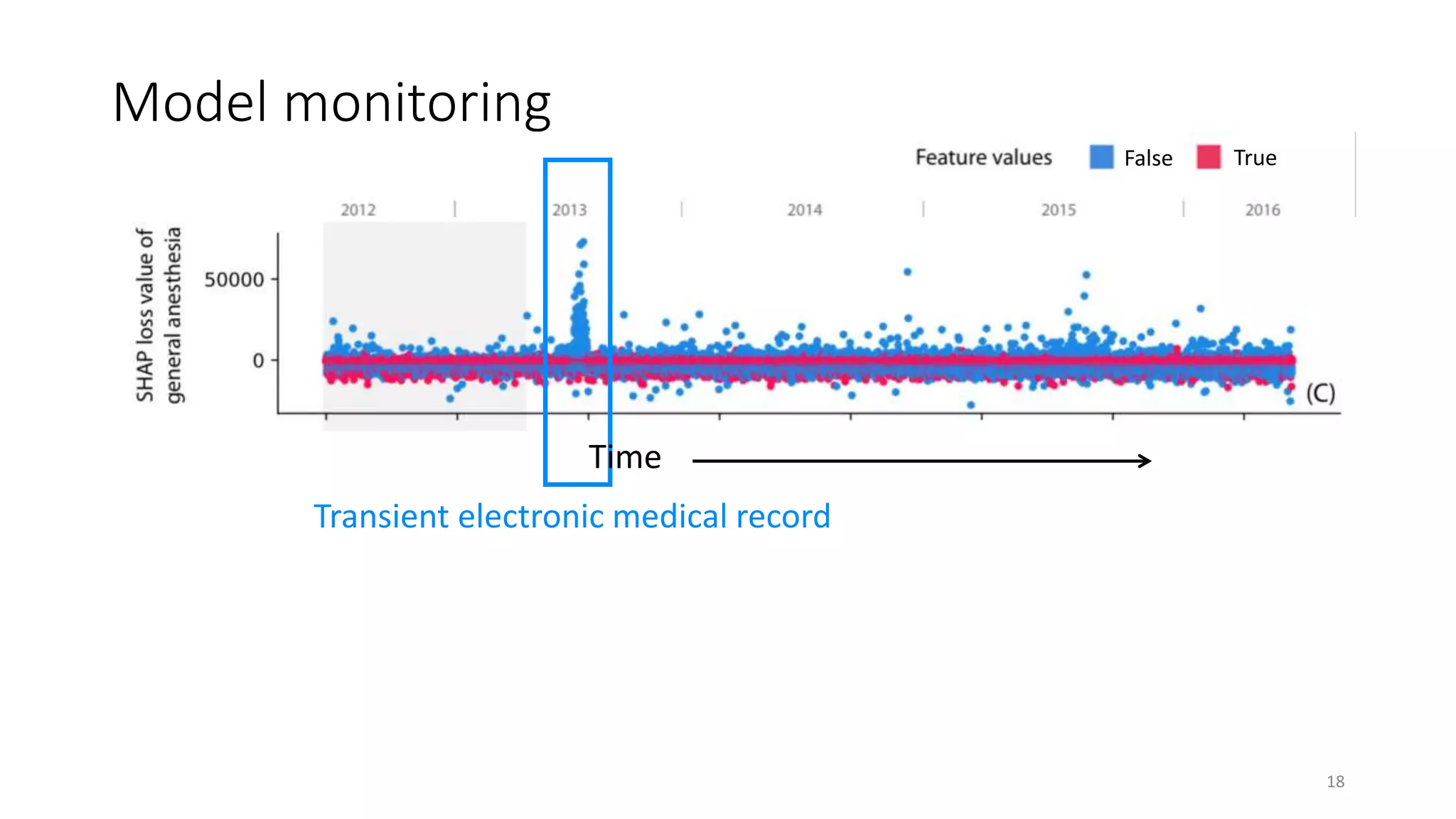

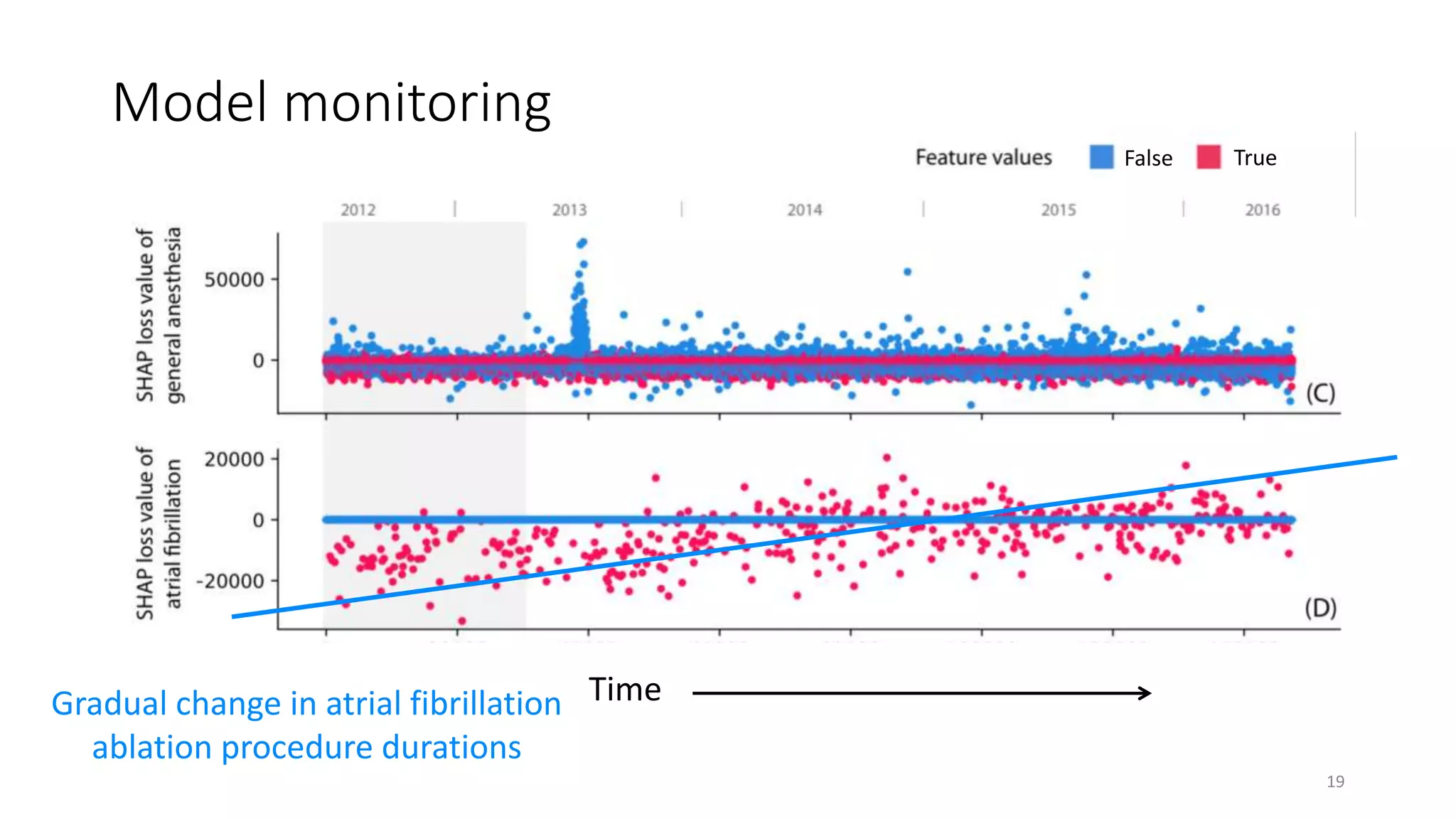

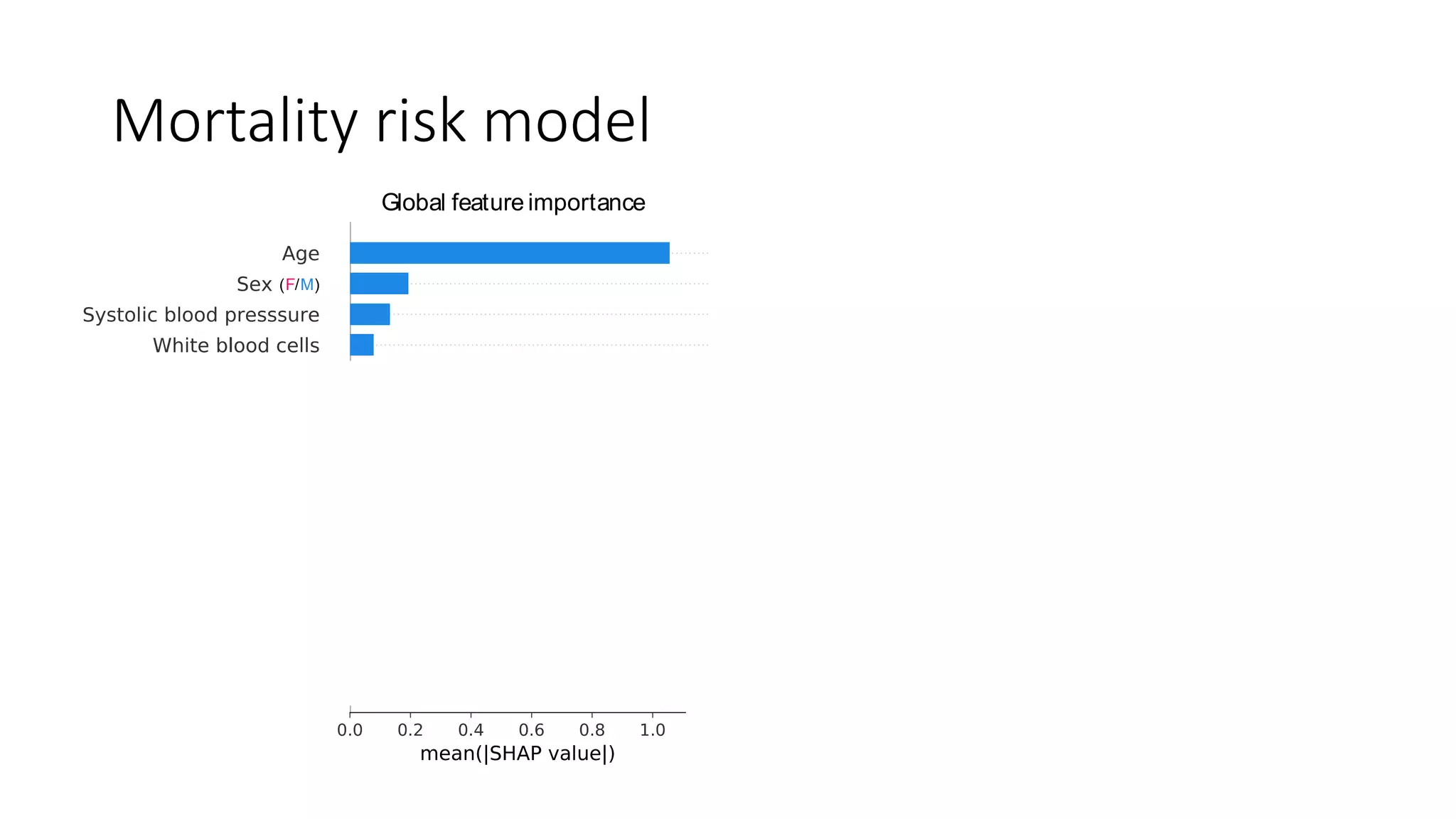

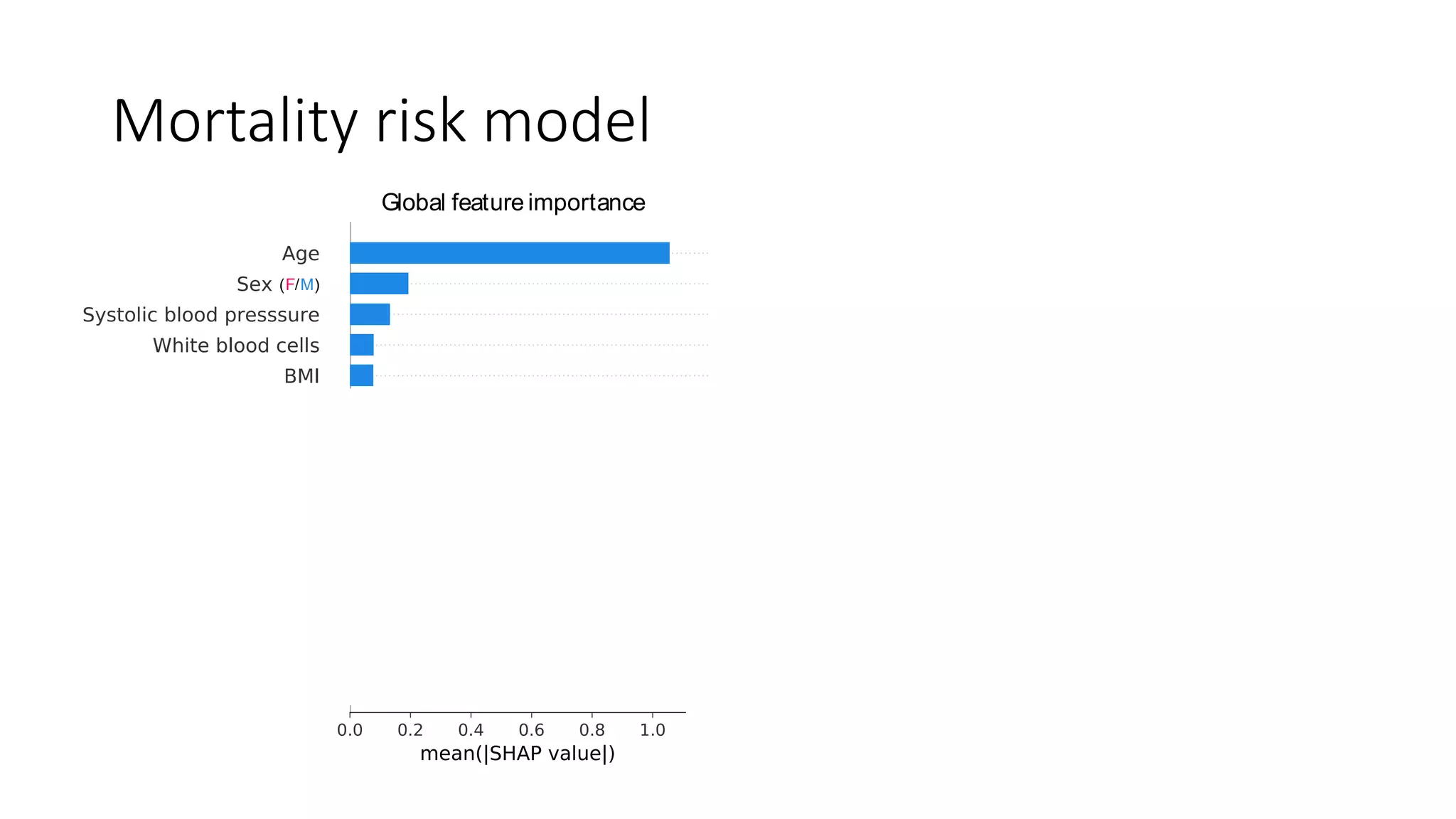

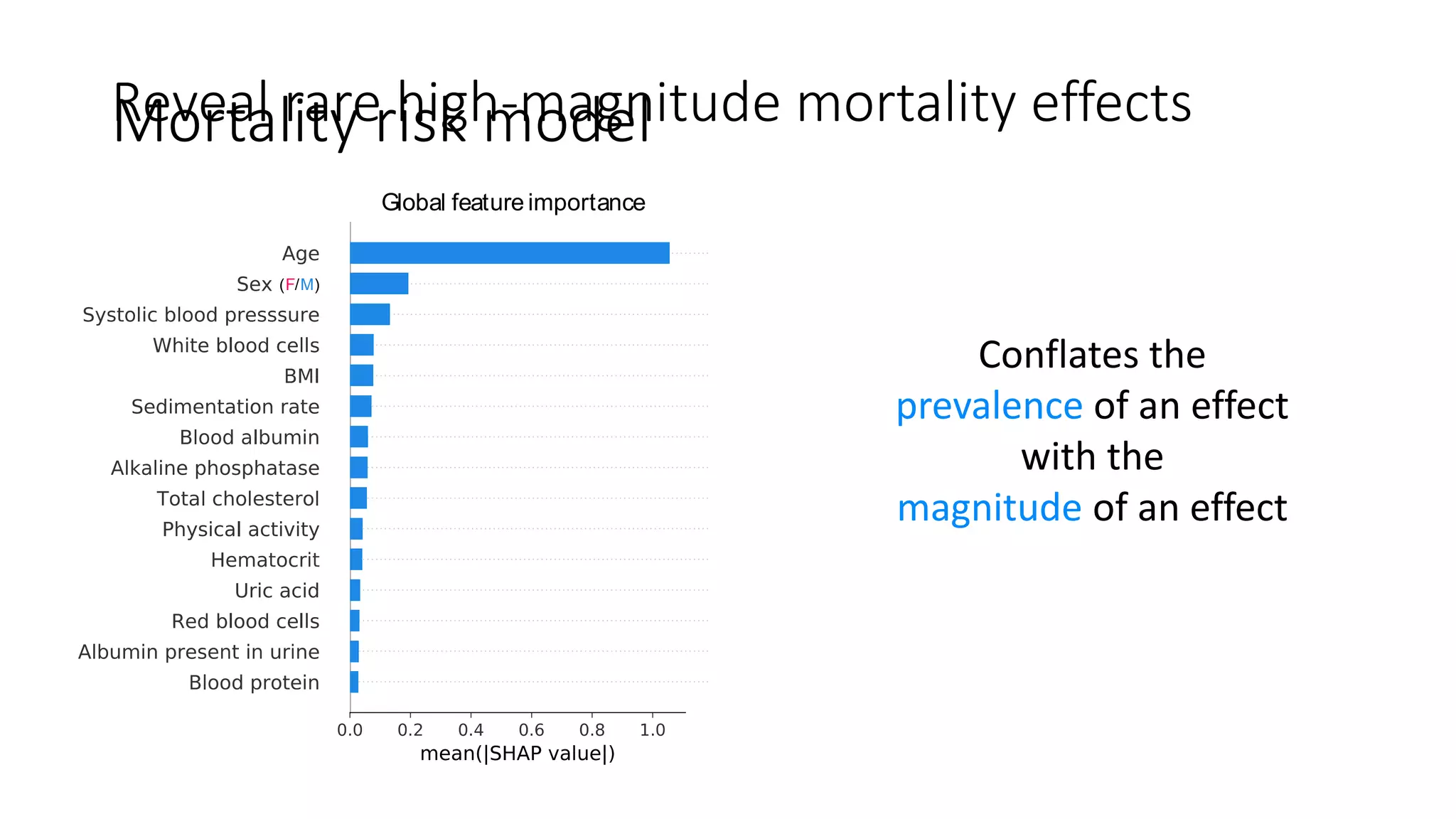

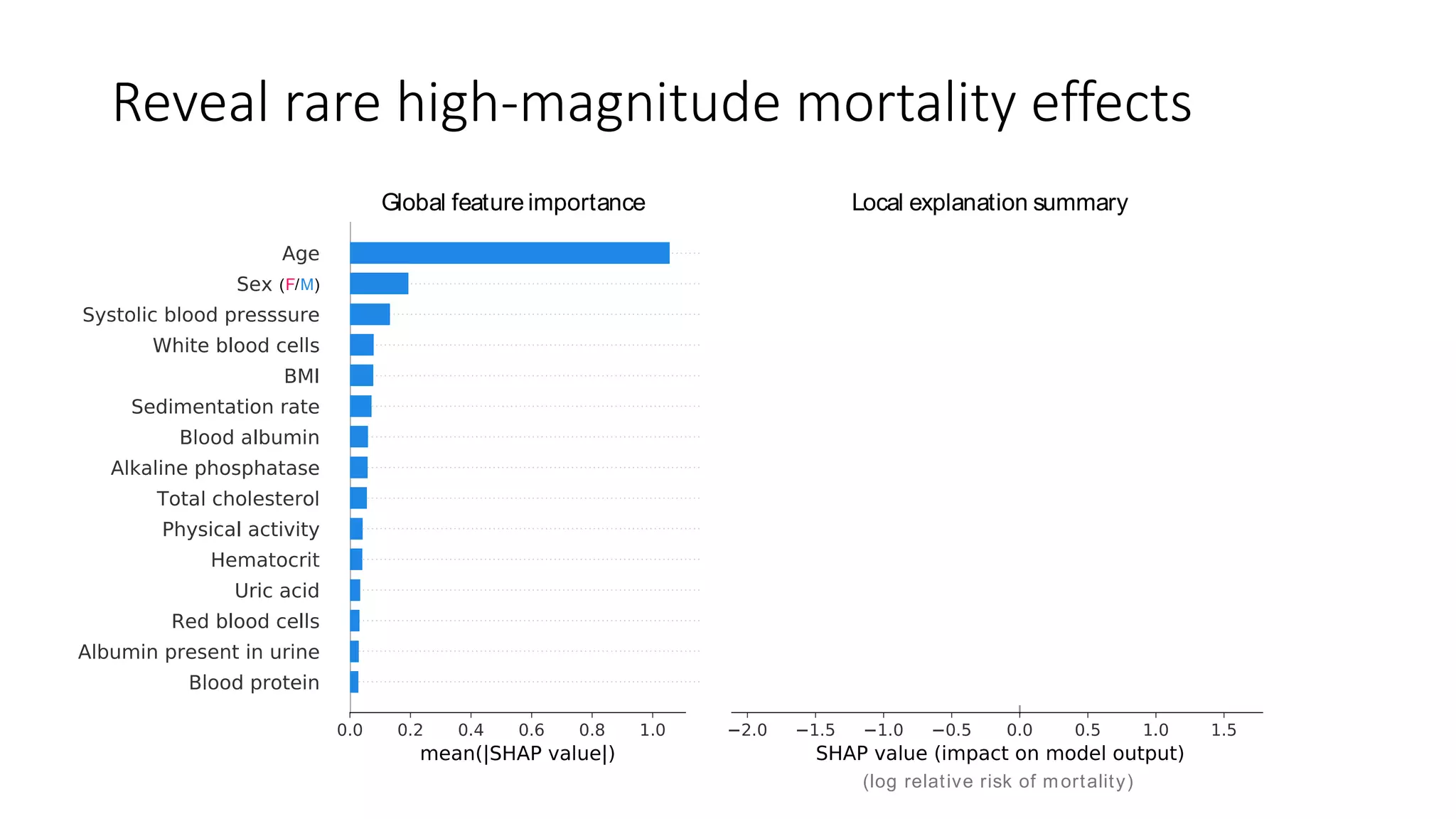

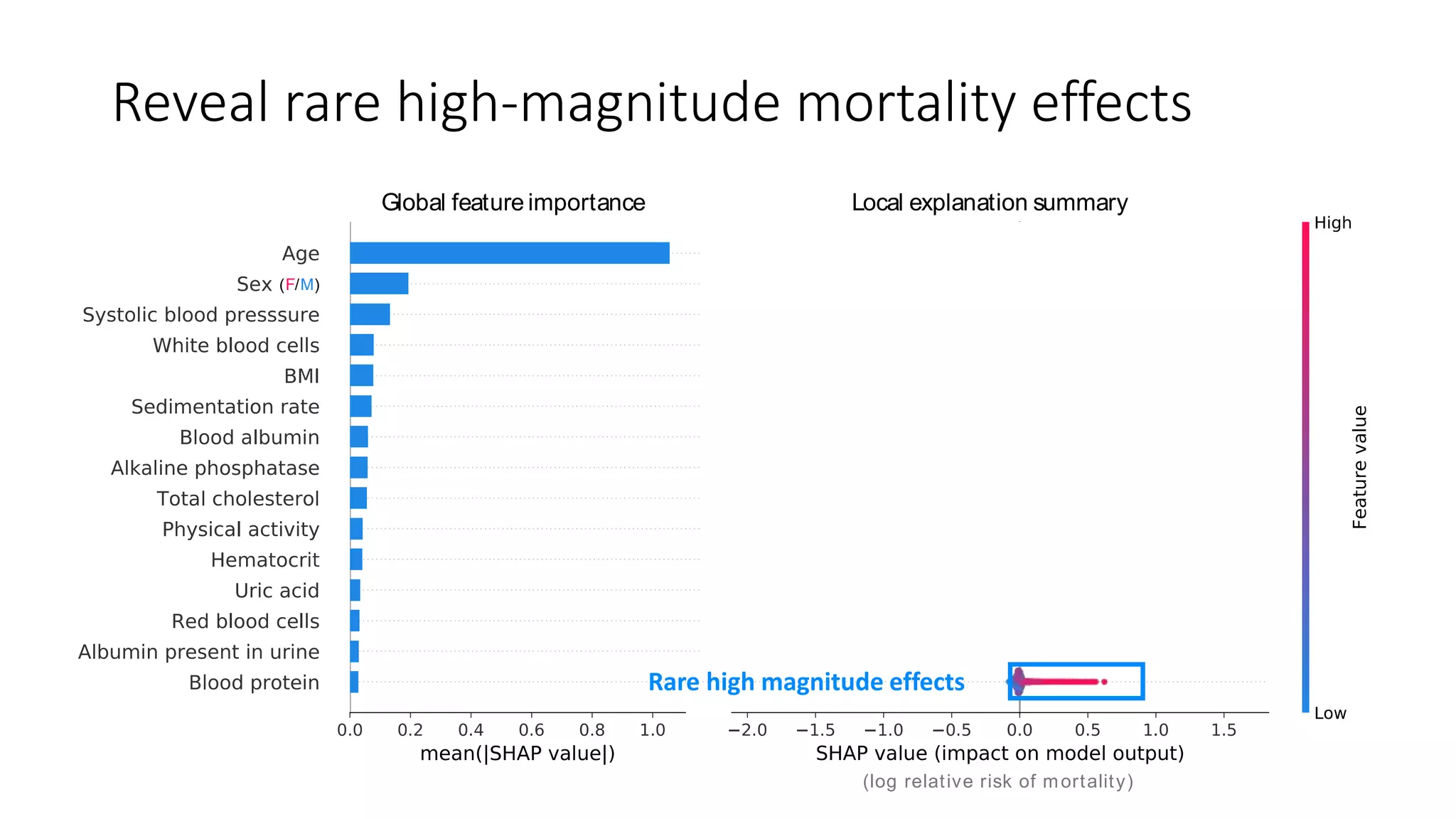

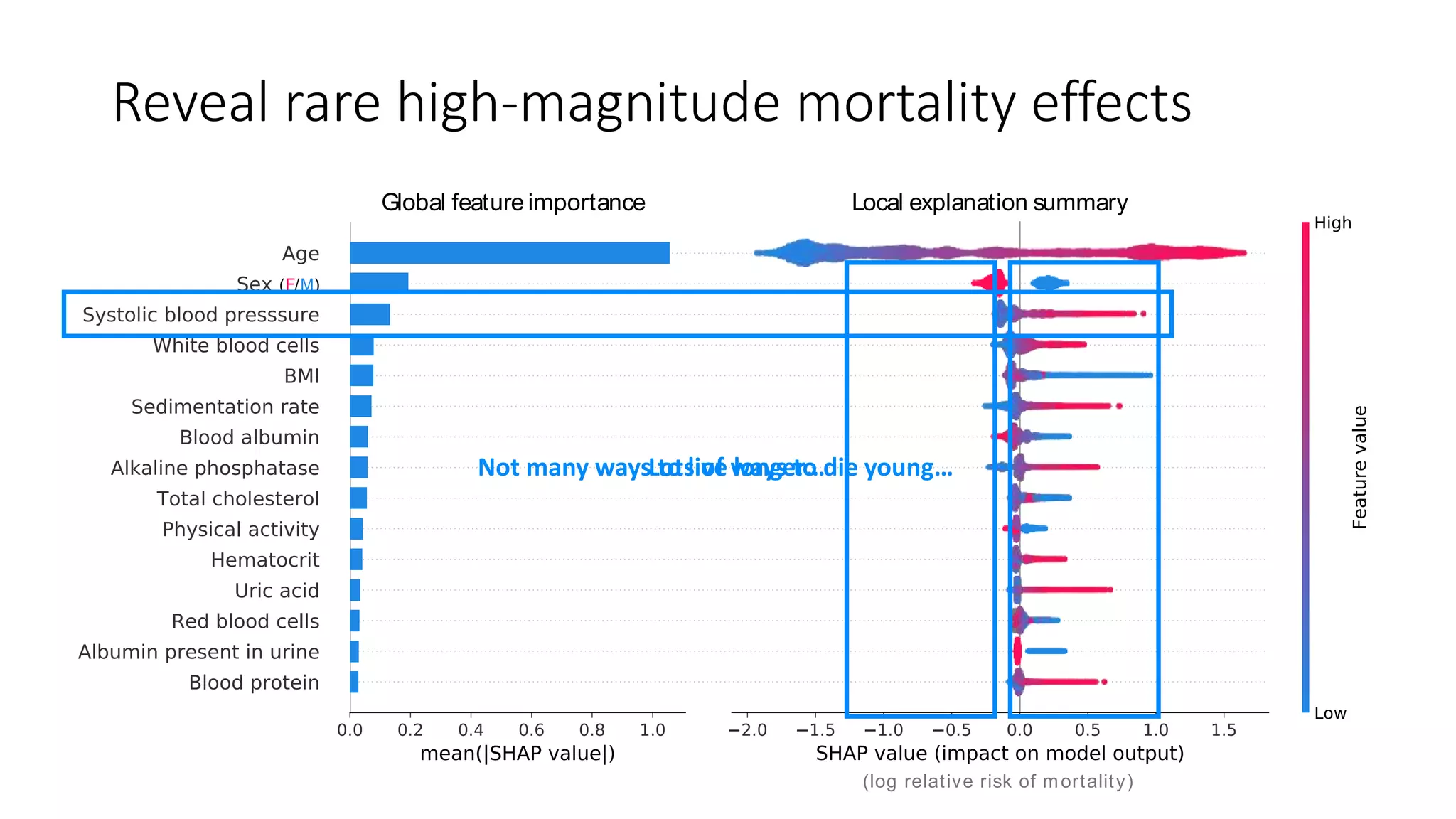

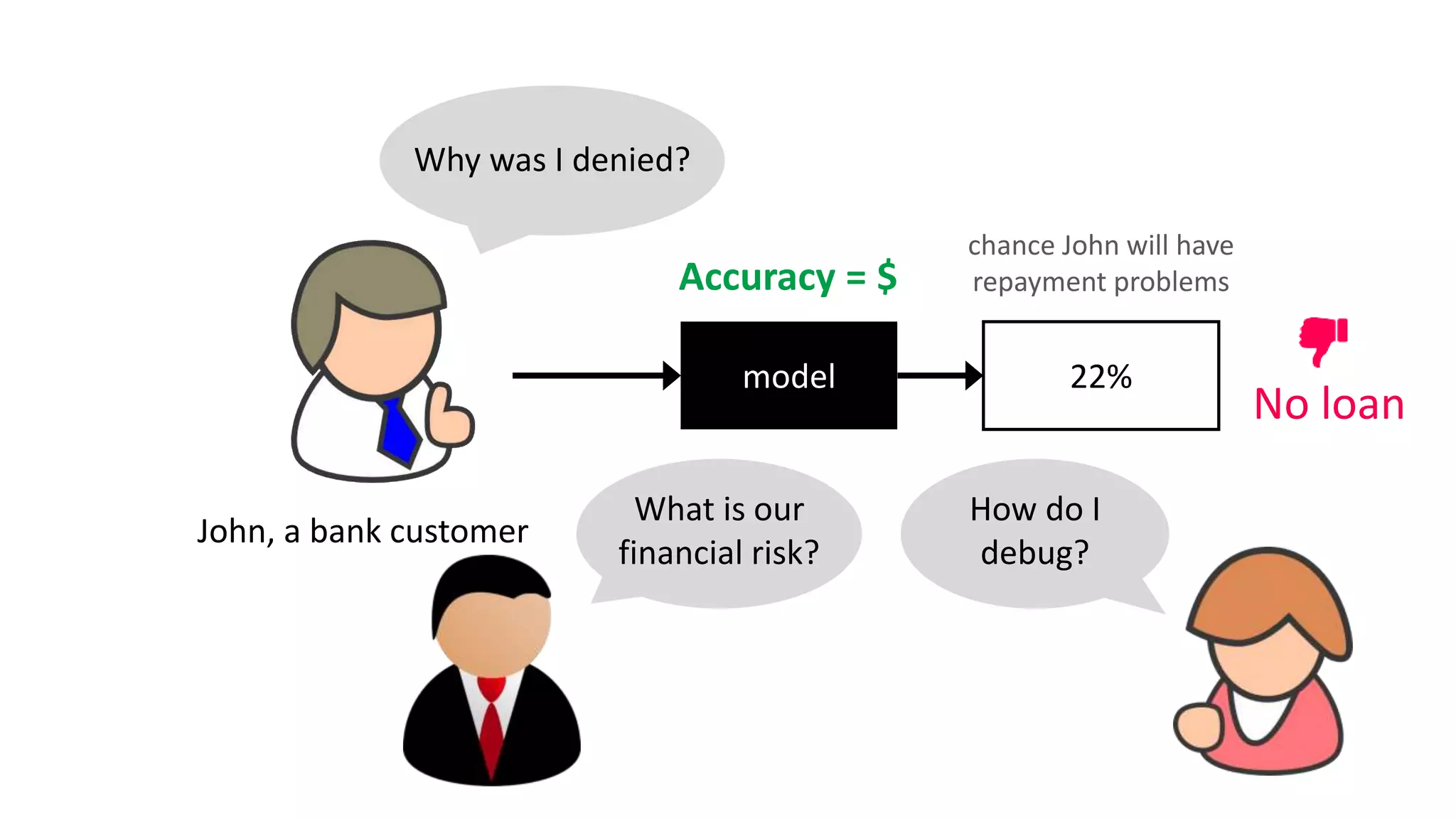

The document discusses the use of Shapley values in explainable machine learning, highlighting their importance for understanding and debugging complex models in financial risk assessment and healthcare. It emphasizes the balance between model accuracy and interpretability, the significance of feature attributions, and properties such as additivity and monotonicity. The examples illustrate how Shapley values can help explain predictions and identify potential issues in model performance, ensuring accountability and transparency in AI applications.

![6

How did we get here?

Base rate Prediction for John

22%

𝑓 𝑥0

16%

𝐸[𝑓 𝑋 ]](https://image.slidesharecdn.com/1140amgpscottlundbergfinalv2-191022184911/75/Scott-Lundberg-Microsoft-Research-Explainable-Machine-Learning-with-Shapley-Values-H2O-World-NYC-2019-6-2048.jpg)

![7

16% 22%

𝐸[𝑓 𝑋 ] 𝑓 𝑥0

Base rate

𝜙0

Income not verified

18.2%

𝐸 𝑓 𝑋 𝑑𝑜(𝑋1 = 𝑥1)]

𝜙1

No recent account openings

21%

𝐸 𝑓 𝑋 𝑑𝑜(𝑋1,2 = 𝑥1,2)]

22.5%

𝐸 𝑓 𝑋 𝑑𝑜(𝑋1,2,3 = 𝑥1,2,3)]

18.5%

𝐸 𝑓 𝑋 𝑑𝑜(𝑋1,2,3,4 = 𝑥1,2,3,4)]

𝜙2

𝜙3𝜙4

𝜙5

DTI = 30

Delinquent 10 months ago

46 years of credit history

The order matters!

*Janzing et al. 2019

*](https://image.slidesharecdn.com/1140amgpscottlundbergfinalv2-191022184911/75/Scott-Lundberg-Microsoft-Research-Explainable-Machine-Learning-with-Shapley-Values-H2O-World-NYC-2019-7-2048.jpg)

![8

𝐸[𝑓 𝑋 ] 𝑓 𝑥0

𝜙0

𝜙1

No recent account openings

𝜙2

𝜙3

𝜙4

𝜙5

46 years of credit history

The order matters!

Nobel Prize in 2012

Lloyd Shapley](https://image.slidesharecdn.com/1140amgpscottlundbergfinalv2-191022184911/75/Scott-Lundberg-Microsoft-Research-Explainable-Machine-Learning-with-Shapley-Values-H2O-World-NYC-2019-8-2048.jpg)

![9

𝐸[𝑓 𝑋 ] 𝑓 𝑥0

𝜙0

𝜙1

𝜙2

𝜙3

𝜙4

𝜙5

Shapley properties

Additivity (local accuracy) – The sum of the local

feature attributions equals the difference between

rate and the model output.

1](https://image.slidesharecdn.com/1140amgpscottlundbergfinalv2-191022184911/75/Scott-Lundberg-Microsoft-Research-Explainable-Machine-Learning-with-Shapley-Values-H2O-World-NYC-2019-9-2048.jpg)

![10

𝐸[𝑓 𝑋 ] 𝑓 𝑥0

𝜙0

𝜙1

𝜙2

𝜙3

𝜙4

𝜙5

Shapley properties

Monotonicity (consistency) – If you change the

original model such that a feature has a larger

possible ordering, then that input’s attribution

decrease.

2

Violating consistency means you can’t trust feature orderings

based on your attributions.

…even within the same model!](https://image.slidesharecdn.com/1140amgpscottlundbergfinalv2-191022184911/75/Scott-Lundberg-Microsoft-Research-Explainable-Machine-Learning-with-Shapley-Values-H2O-World-NYC-2019-10-2048.jpg)

![11

𝐸[𝑓 𝑋 ] 𝑓 𝑥0

𝜙0

𝜙1

𝜙2

𝜙3

𝜙4

𝜙5

Shapley values result from averaging over all N! possible orderings.

(NP-hard)](https://image.slidesharecdn.com/1140amgpscottlundbergfinalv2-191022184911/75/Scott-Lundberg-Microsoft-Research-Explainable-Machine-Learning-with-Shapley-Values-H2O-World-NYC-2019-11-2048.jpg)

![ex = shap.TreeExplainer(model, …)

shap_values = ex.shap_values(X)

shap.force_plot(ex.expected_value, shap_values[john_ind,:], X.iloc[john_ind,:])

Why does 46 years of credit history increase

the risk of payment problems?](https://image.slidesharecdn.com/1140amgpscottlundbergfinalv2-191022184911/75/Scott-Lundberg-Microsoft-Research-Explainable-Machine-Learning-with-Shapley-Values-H2O-World-NYC-2019-13-2048.jpg)