The document discusses several SBA loan programs to support small businesses. The main programs covered are:

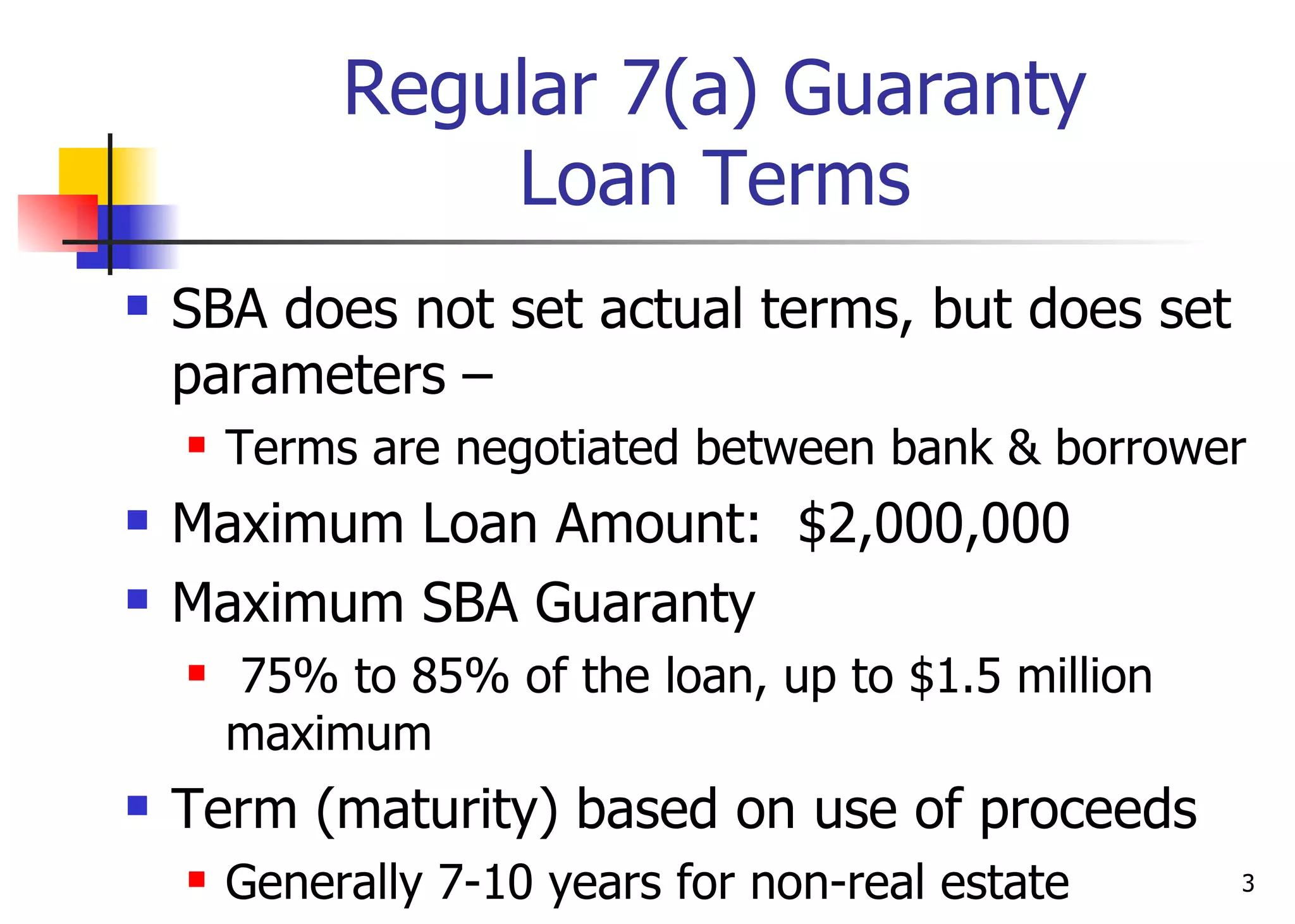

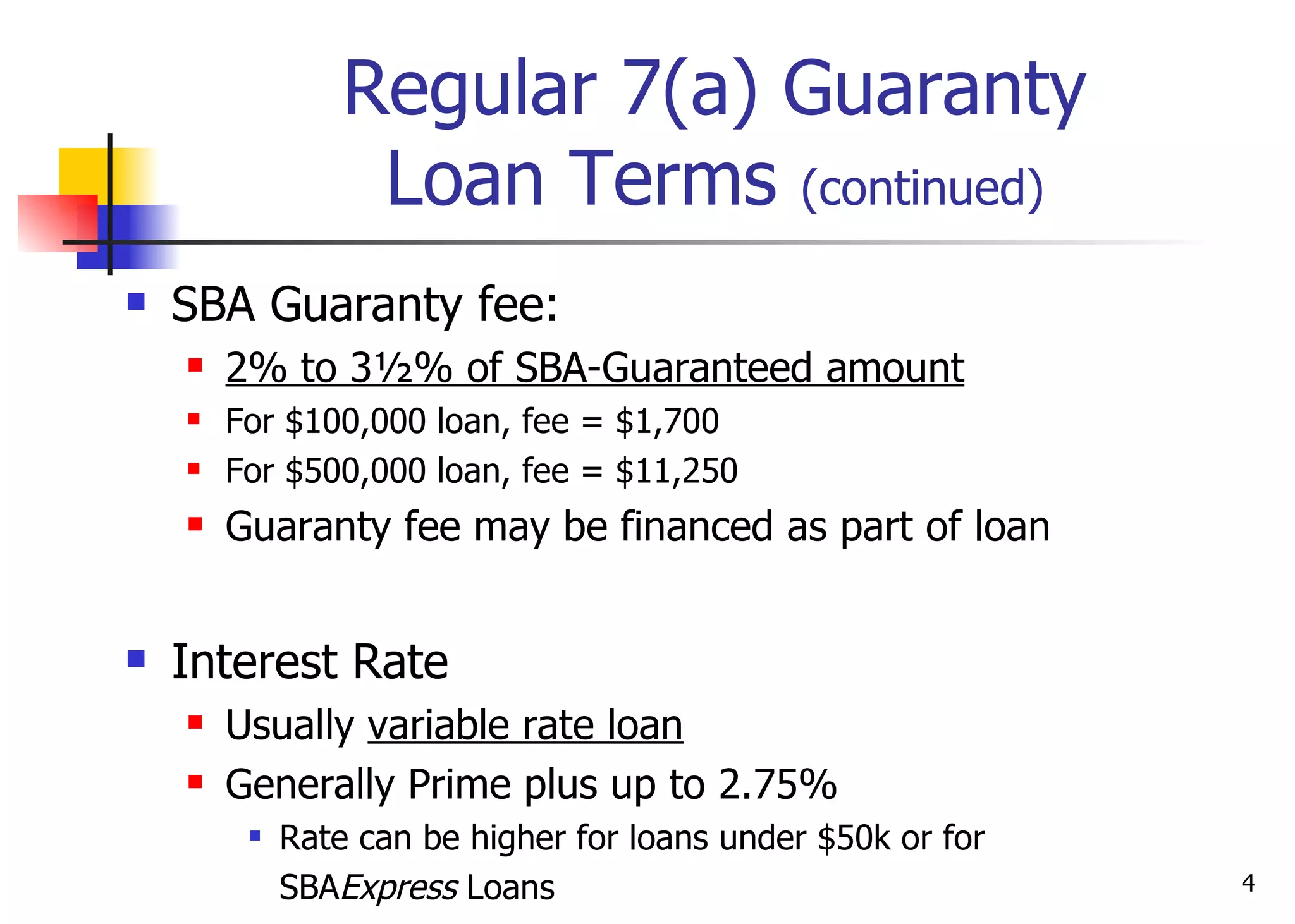

- Regular 7(a) Guaranty Loans which SBA guarantees up to 85% of loans from banks for working capital and other needs. Loan amounts can be up to $2 million with variable interest rates.

- SBA Express Loans which have lower paperwork and can be approved more quickly, with loan amounts up to $350,000 and variable interest rates up to 6.5% over prime.

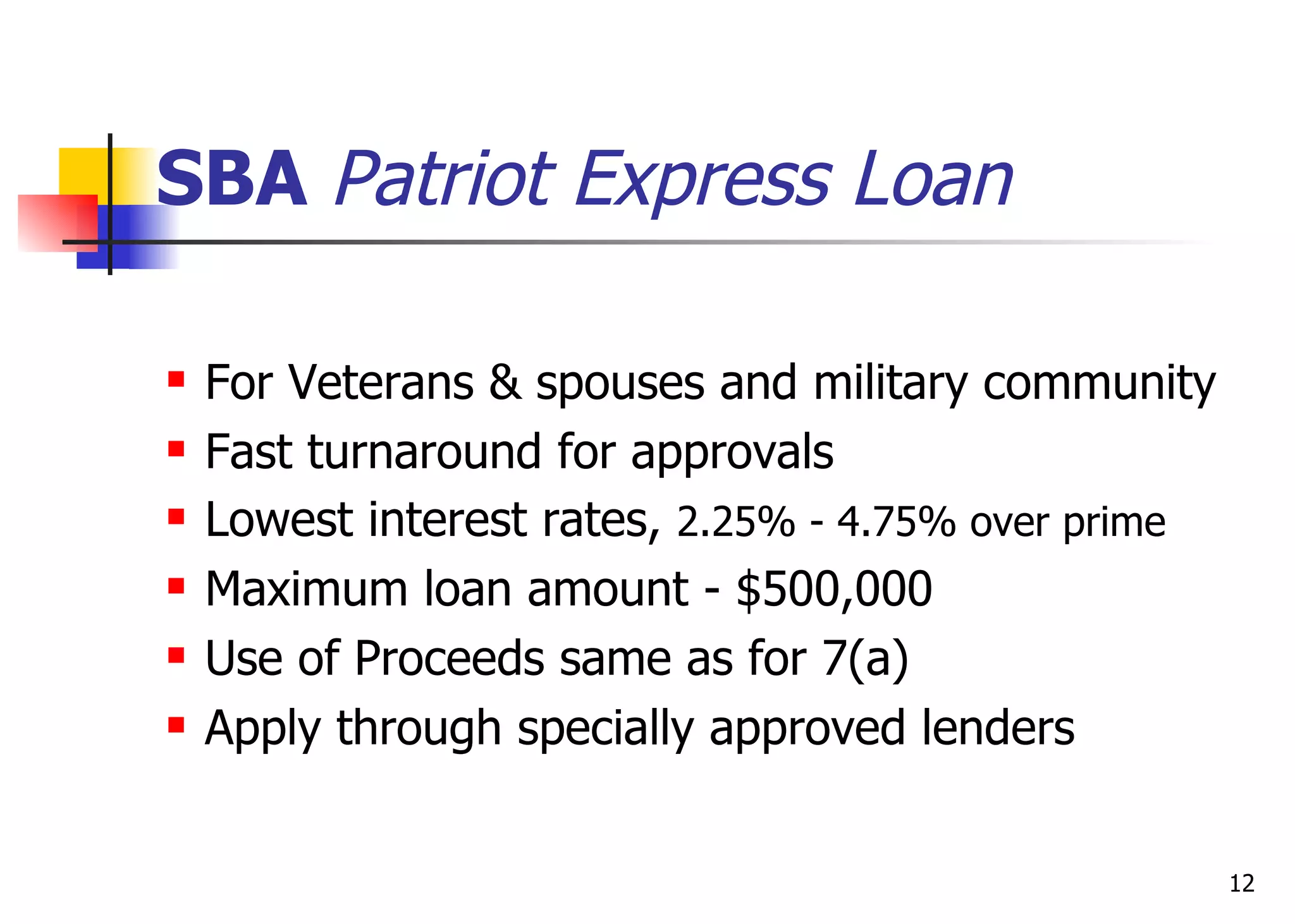

- SBA Patriot Express Loans which offer favorable terms for veterans and military community with loans up to $500,000 and fixed rates between 2.25-4.75% over prime.