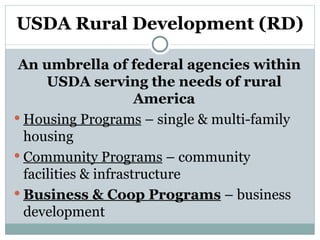

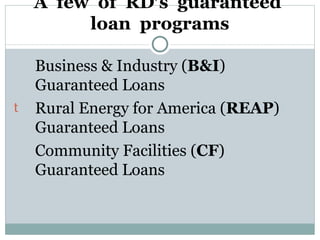

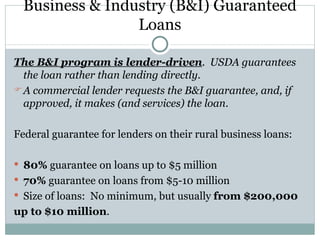

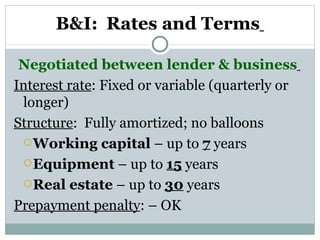

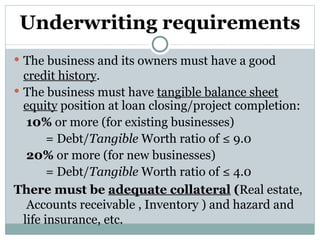

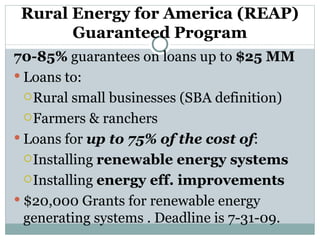

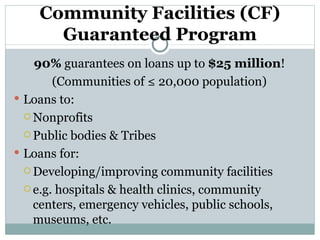

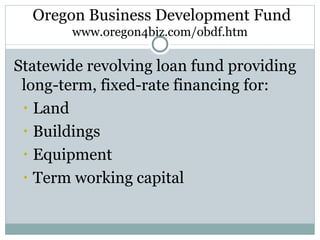

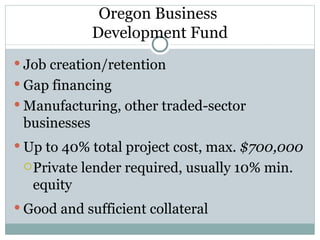

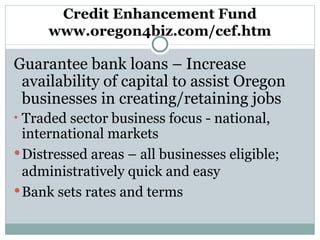

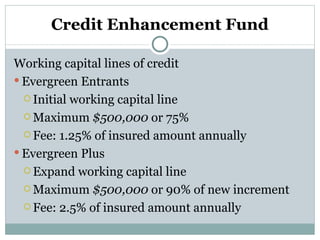

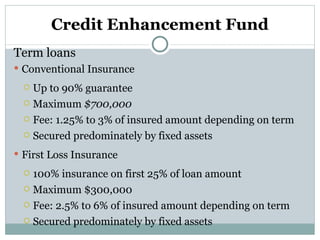

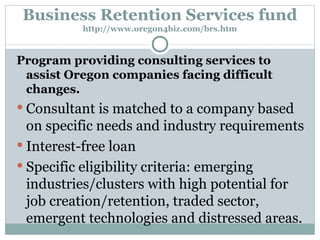

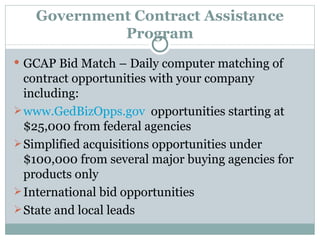

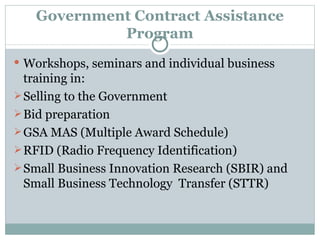

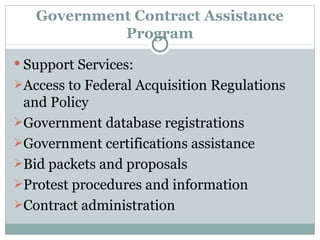

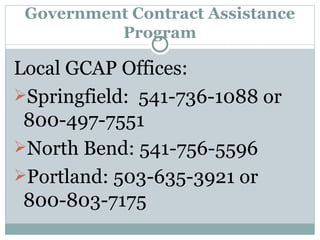

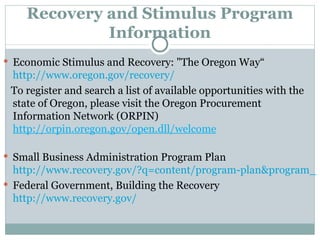

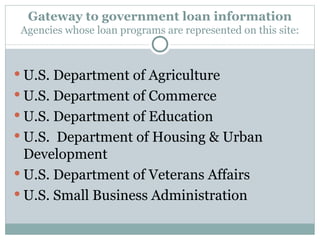

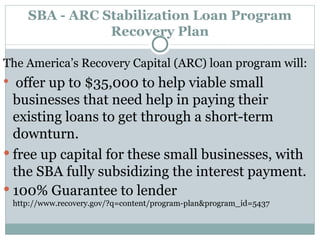

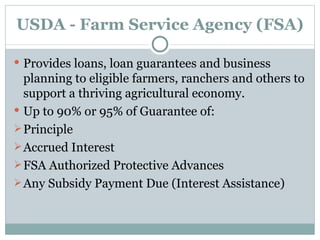

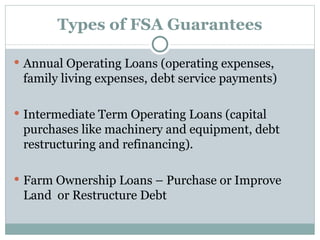

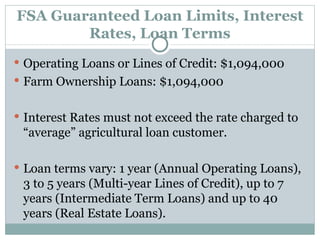

The Oregon Economic and Community Development Department aims to enhance Oregon's economy by working with various stakeholders to support sustainable growth and job creation. The document outlines various funding programs available for businesses, including long-term loans, credit enhancement funds, and resources for entrepreneurs, as well as comprehensive support services for government contracting and business retention. Additionally, it provides information on the USDA loan programs and rural development initiatives focused on supporting agriculture and rural communities.

![Oregon Economic and Community Development Department Our mission is to advance Oregon's economy . We look forward to paving the way for continued sustainable economic development in Oregon, and working with the Governor, private industry and other state agency partners to ensure opportunity for Oregonians today and beyond. Gabe Silva, Small Business Services Officer 503-986-0161 [email_address] http://www.oregon4biz.com/smbiz.htm](https://image.slidesharecdn.com/oecddcornerstonesstimulusfundspresentation-090604120702-phpapp02/85/OECDD-Cornerstones-Stimulus-Funds-Presentation-1-320.jpg)

![SBA Portland District Contacts Dennis Lloyd, Lead Lender Relations Specialist: 503-326-5205. Russ Hooker , Lender Relations Specialist: 503-326-5200. E-mail: [email_address]](https://image.slidesharecdn.com/oecddcornerstonesstimulusfundspresentation-090604120702-phpapp02/85/OECDD-Cornerstones-Stimulus-Funds-Presentation-27-320.jpg)

![Farm Service Agency Contacts Lynn Voigt, Farm Loan Chief, 503-692-1973 x256 [email_address] Bob Perry, Farm Loan Specialist, 503-692-1973 x257 [email_address] Peter Halvorson, Farm Loan Specialist, 503-692-1973 x 255. [email_address] FSA Website: www.usda.fsa.gov](https://image.slidesharecdn.com/oecddcornerstonesstimulusfundspresentation-090604120702-phpapp02/85/OECDD-Cornerstones-Stimulus-Funds-Presentation-31-320.jpg)