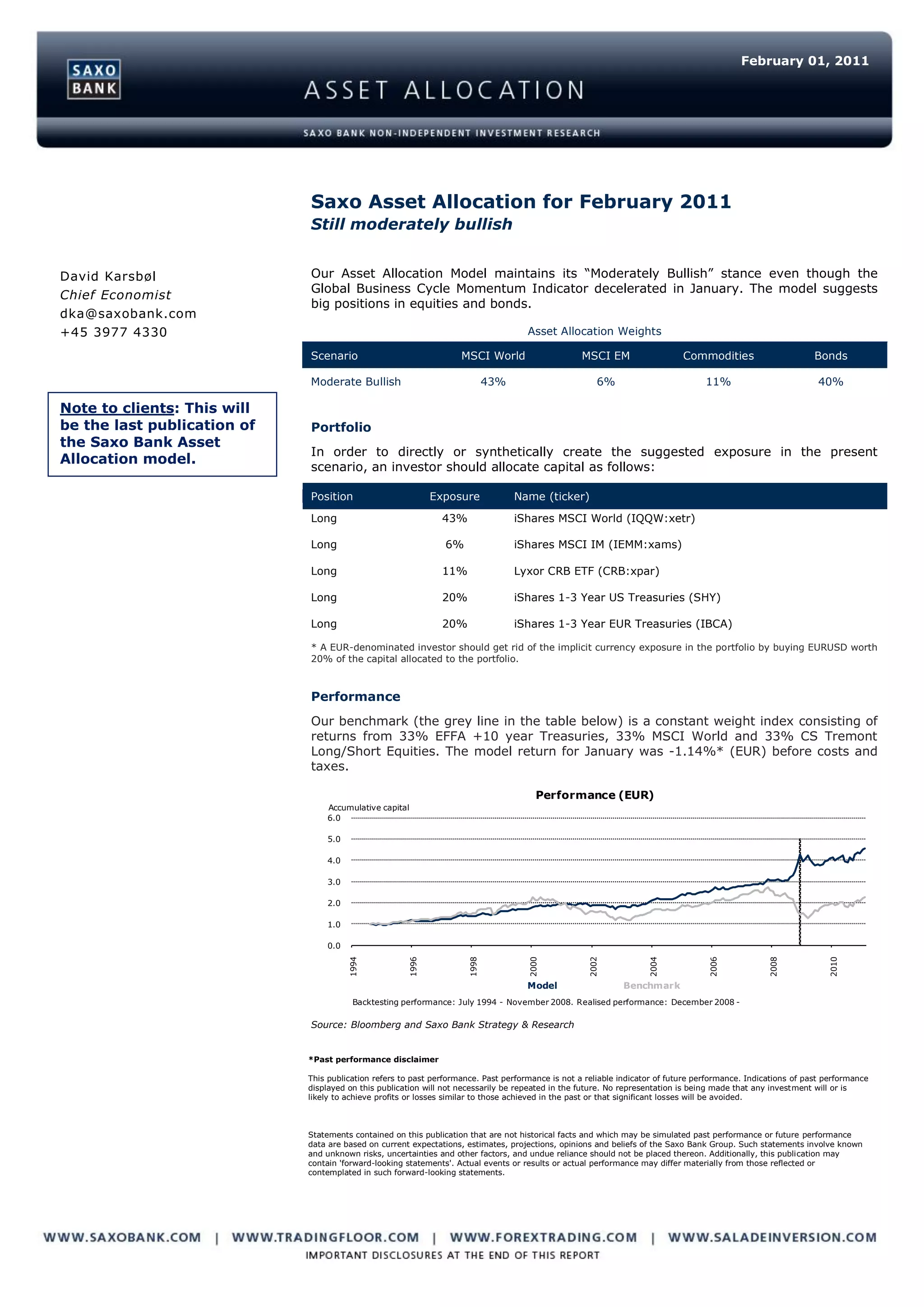

The Saxo Asset Allocation report for February 2011 maintains a 'moderately bullish' stance despite a deceleration in global business cycle momentum. The recommended asset allocation includes significant positions in equities, commodities, and bonds, with specific weights assigned to different asset classes. The document emphasizes that past performance is not a reliable indicator of future results and includes multiple disclaimers regarding investment risks.