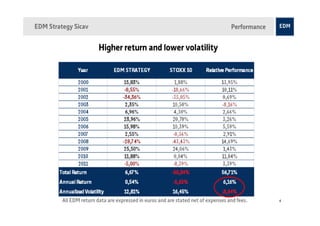

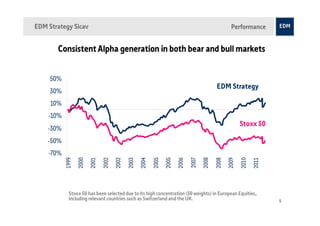

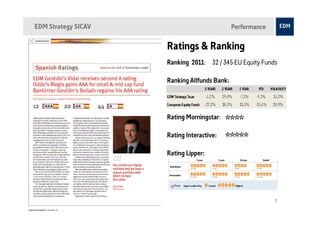

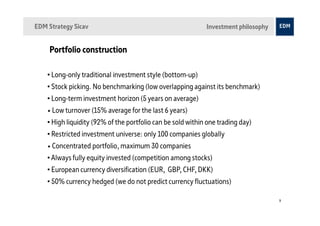

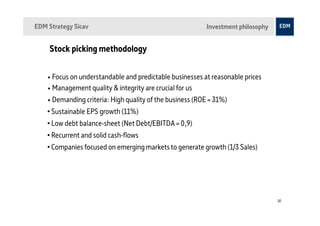

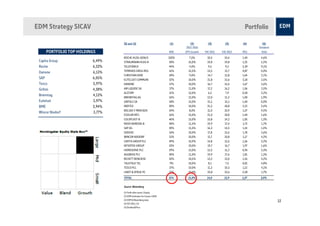

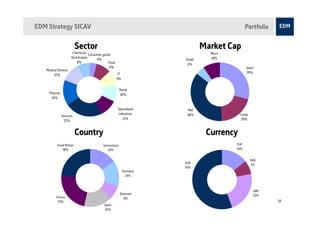

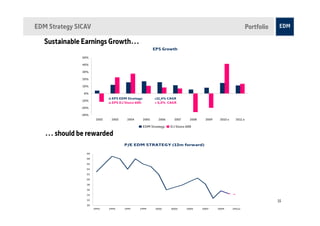

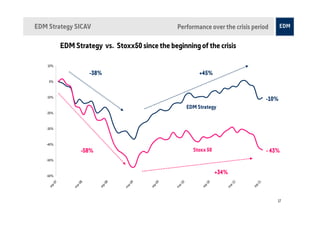

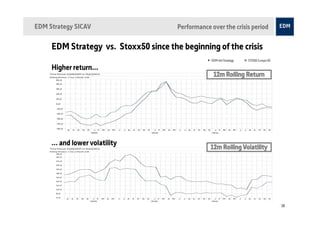

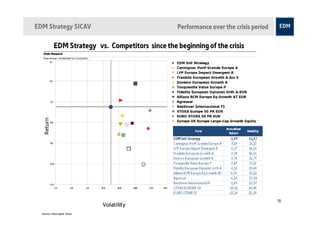

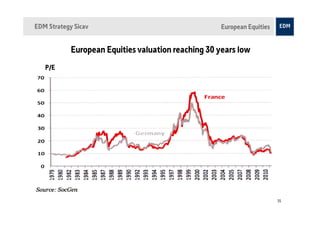

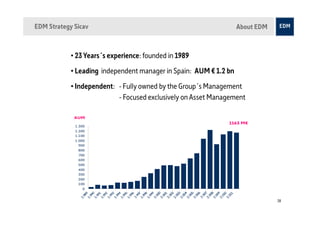

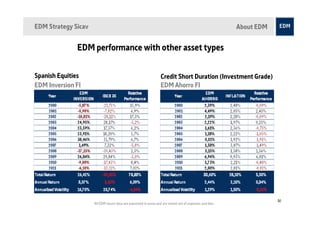

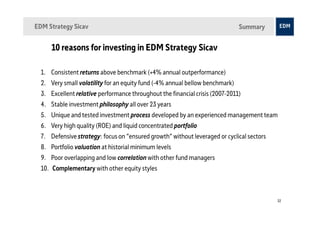

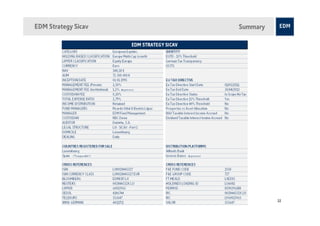

The EDM Strategy SICAV focuses on European equities, showcasing a consistent performance with higher returns and lower volatility compared to major indices through various market conditions. The investment philosophy emphasizes a long-term, bottom-up approach with concentrated stock picking, prioritizing quality, predictable businesses, and macro-trends. The fund is managed by a team of experienced professionals, and its strategy aims for outperformance while maintaining a defensive posture and high liquidity.