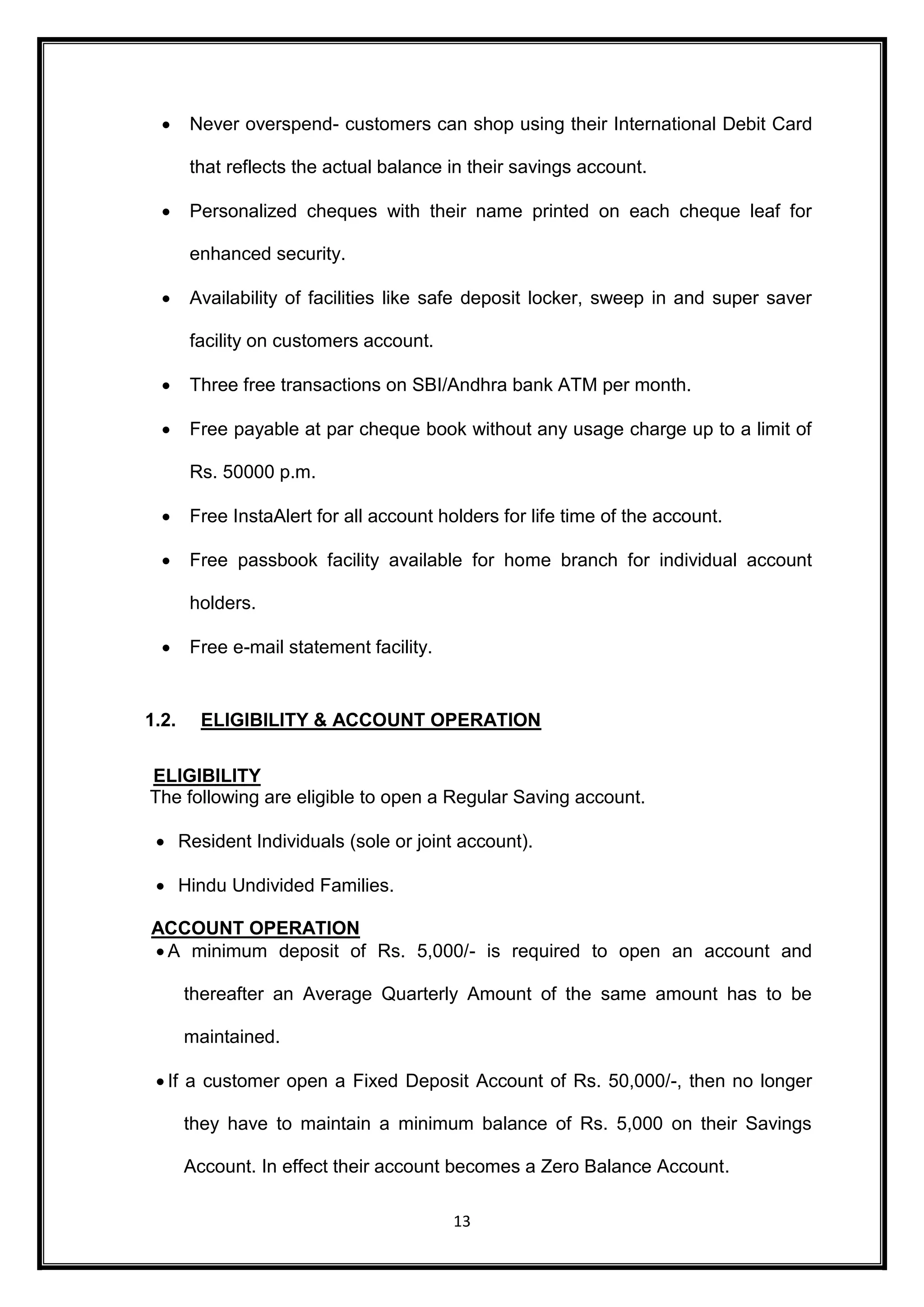

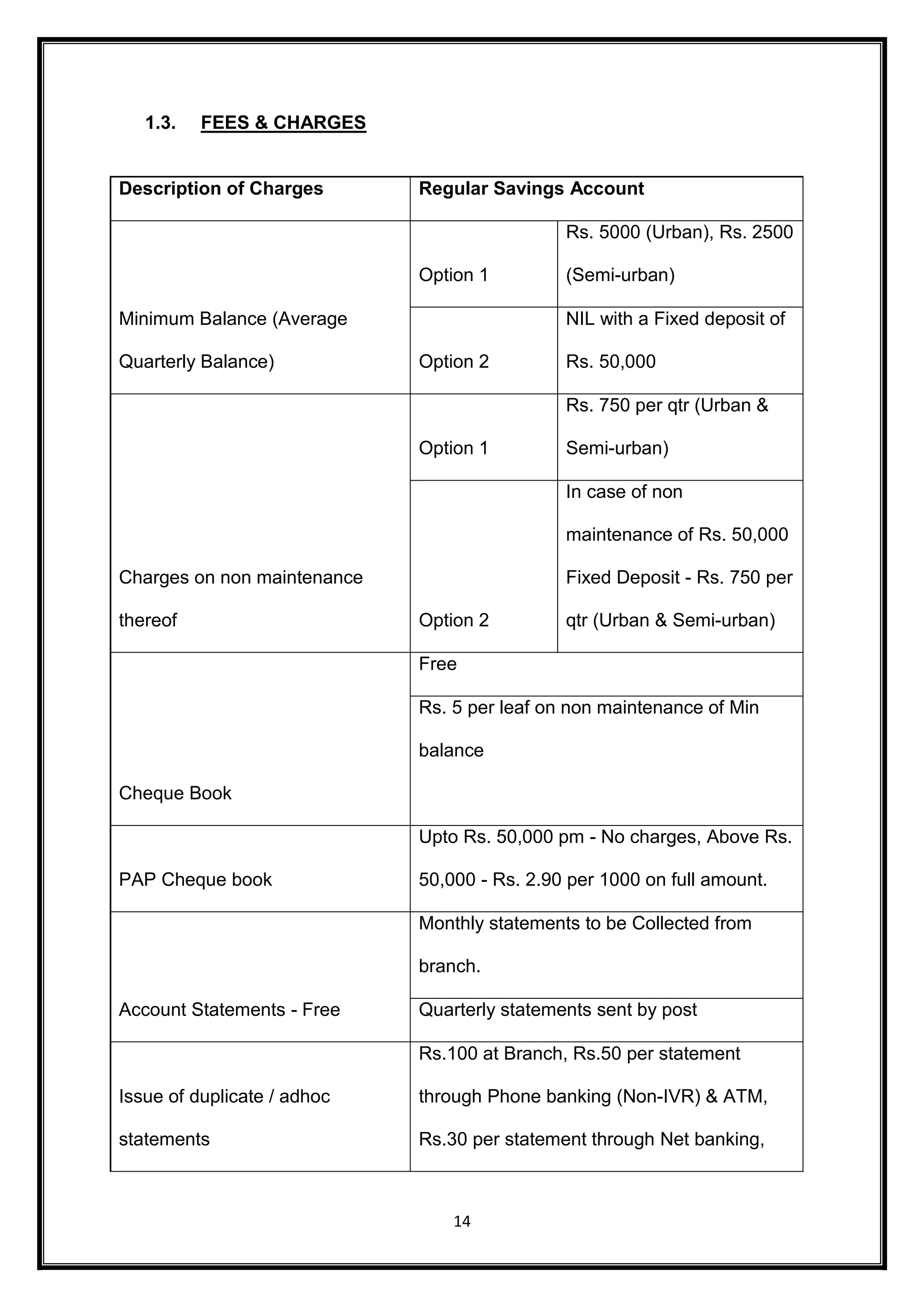

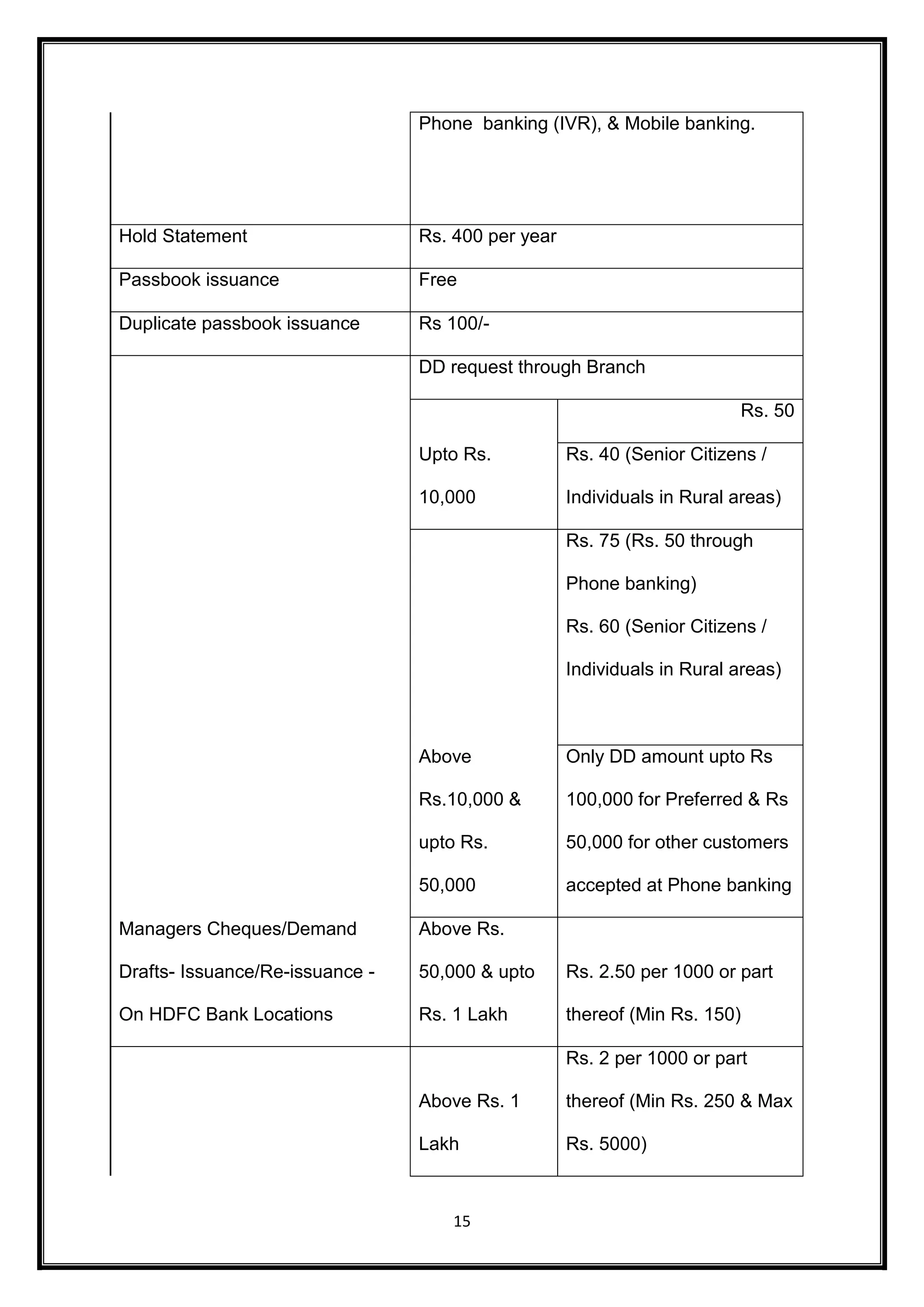

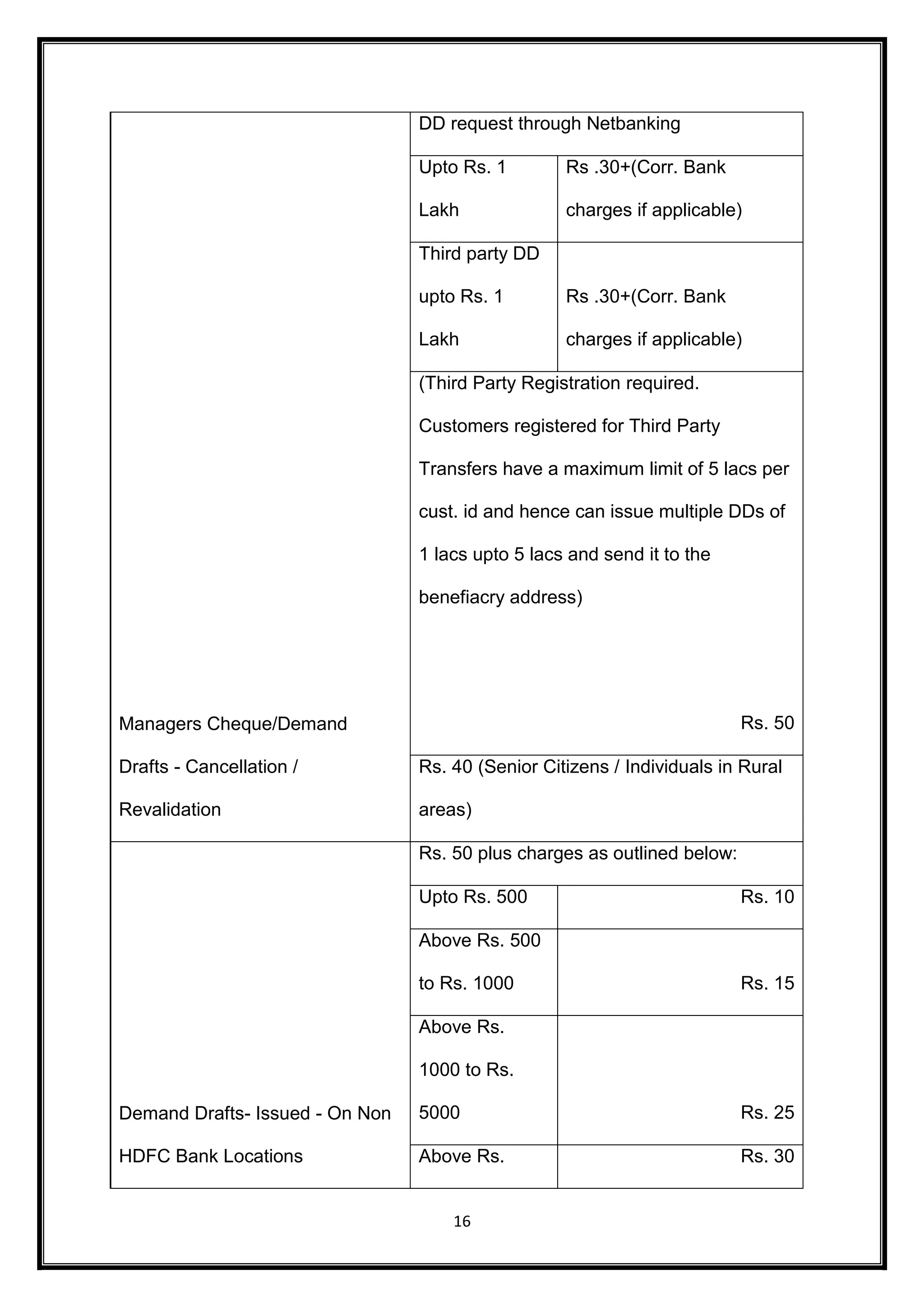

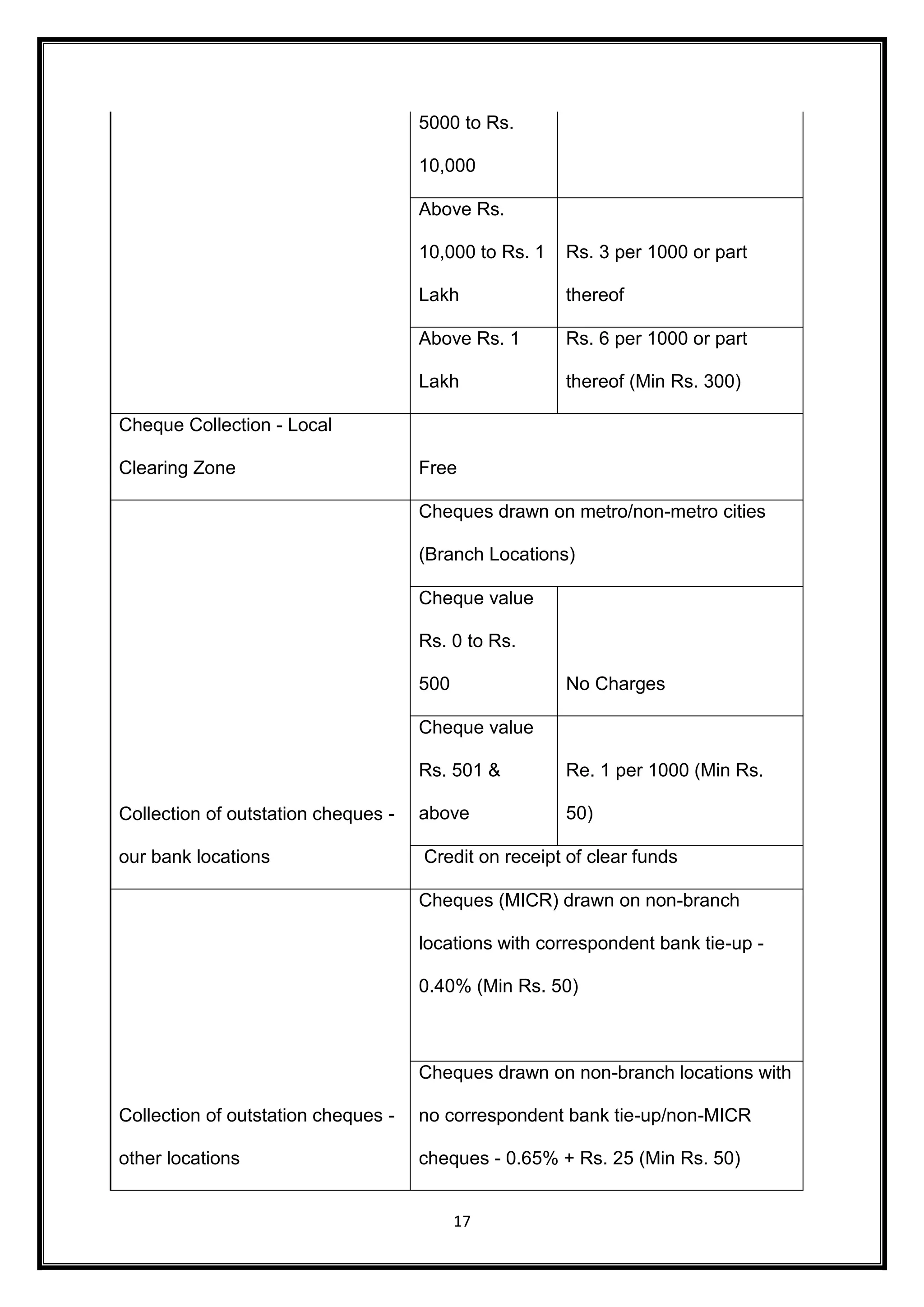

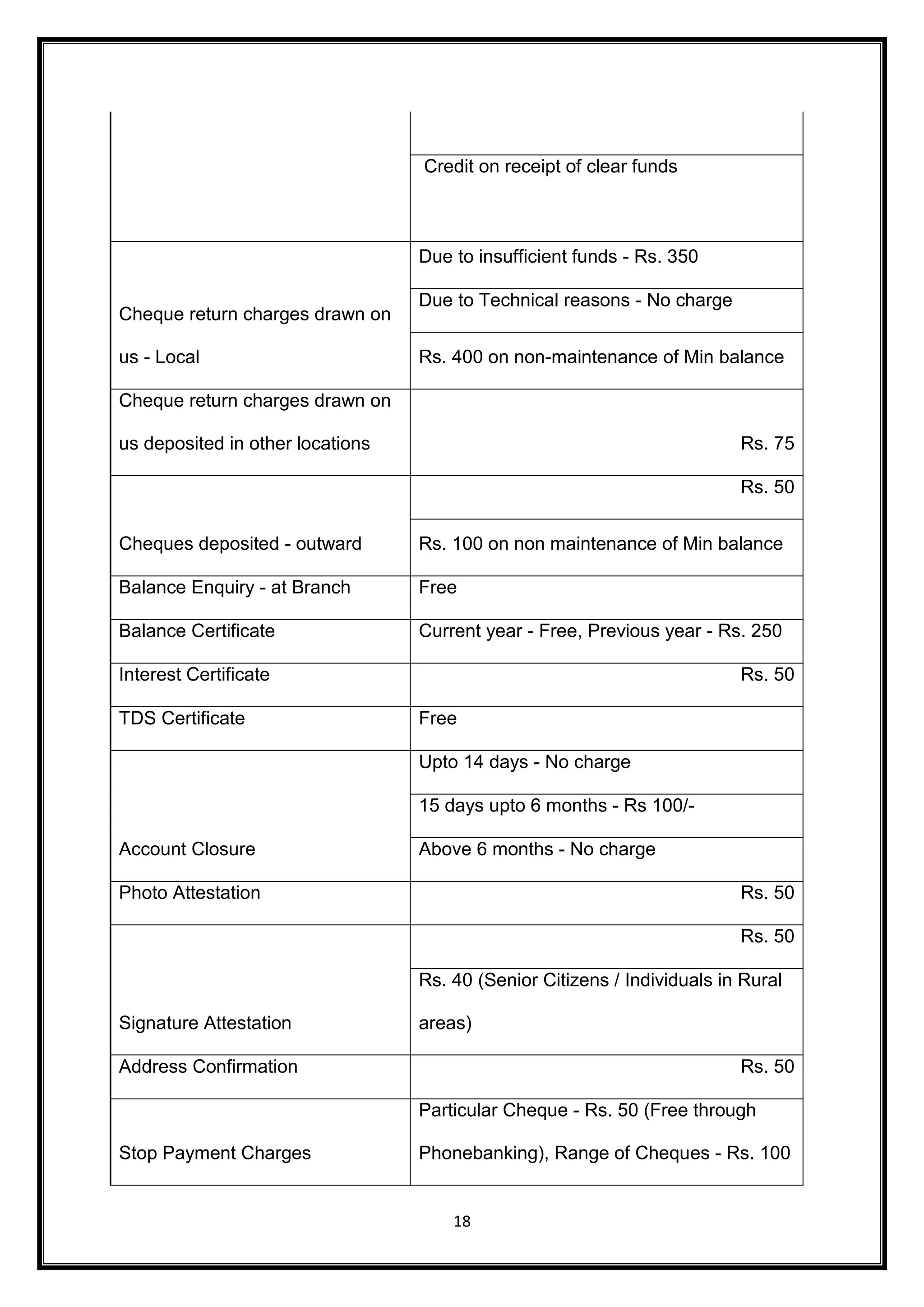

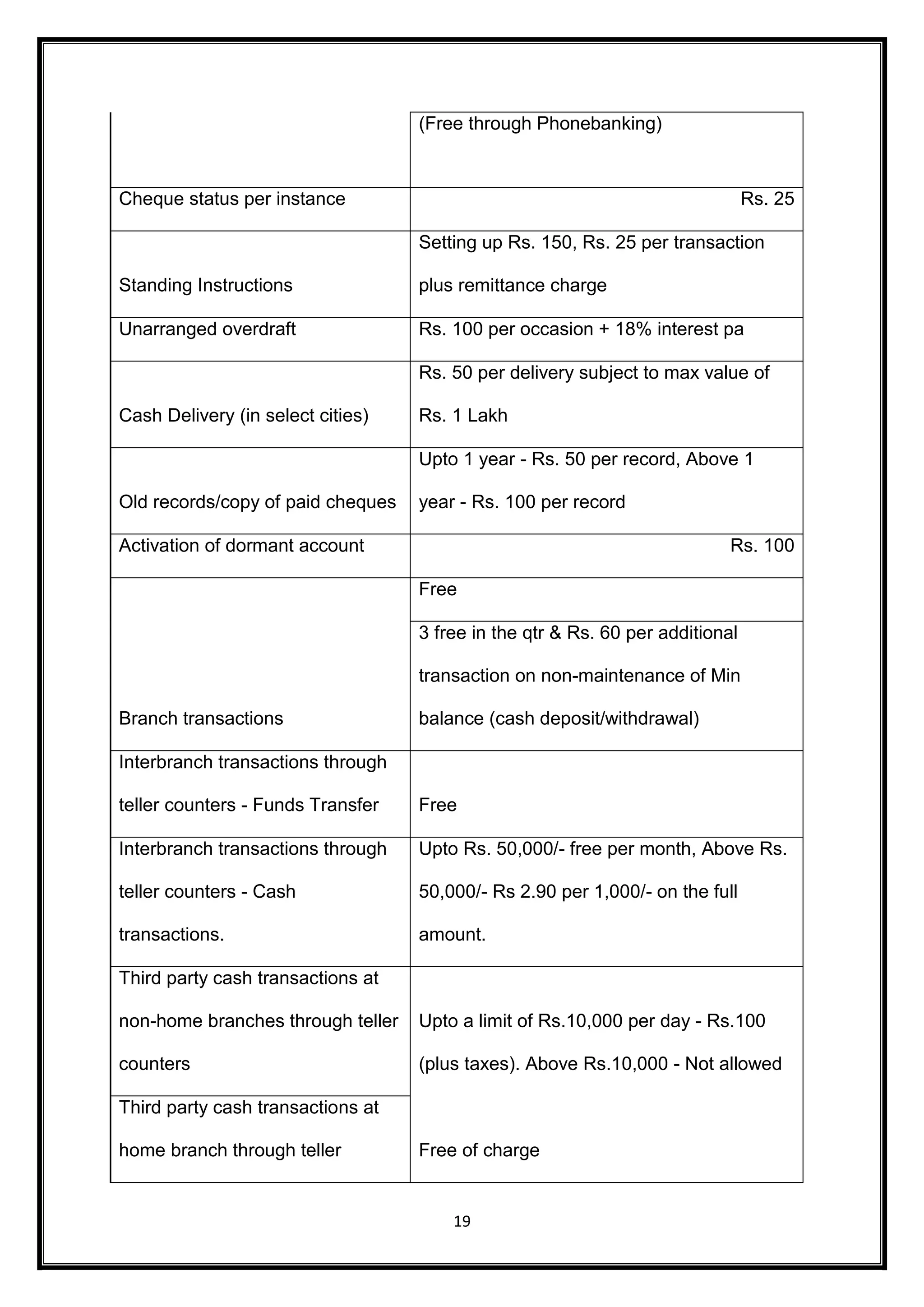

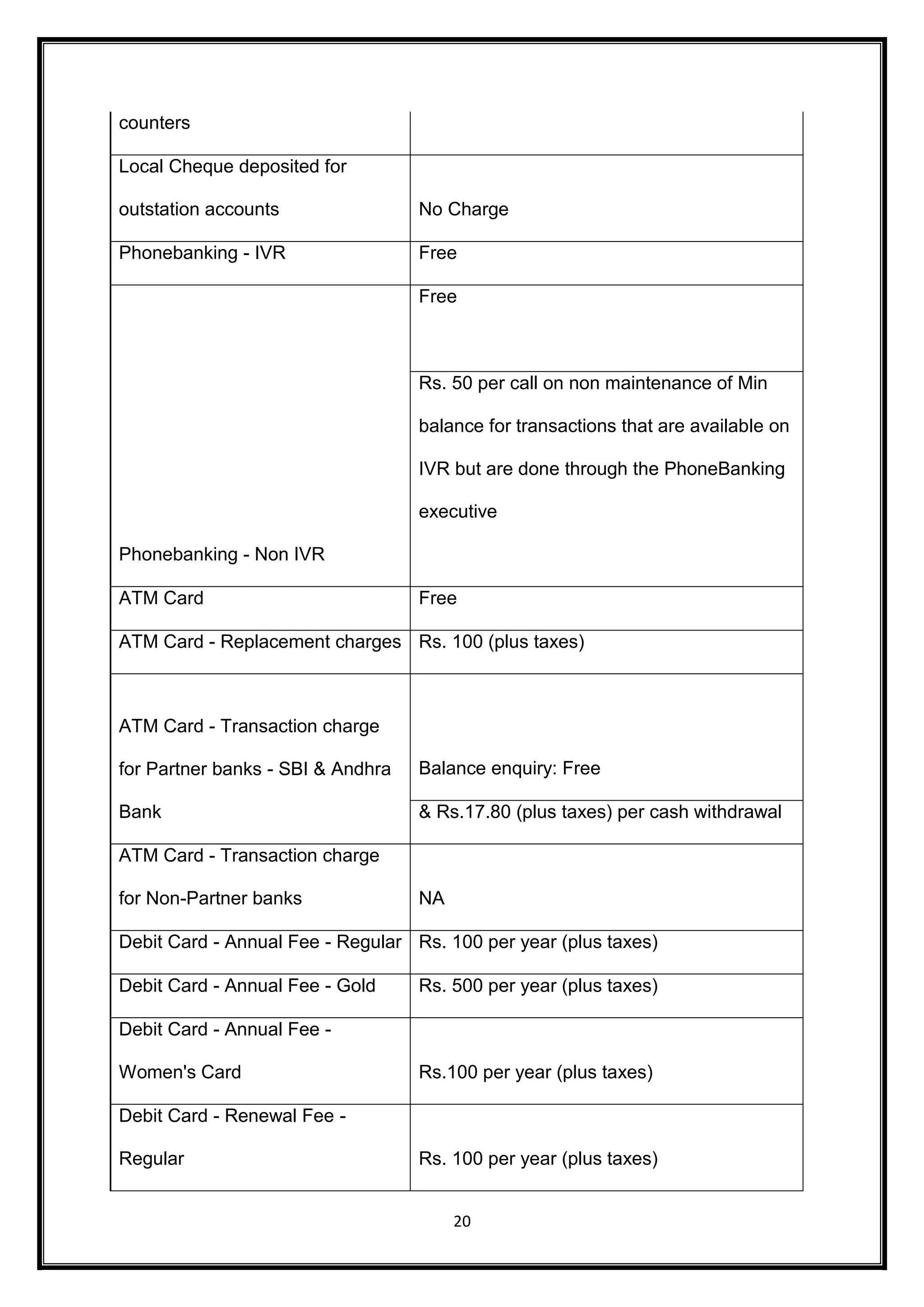

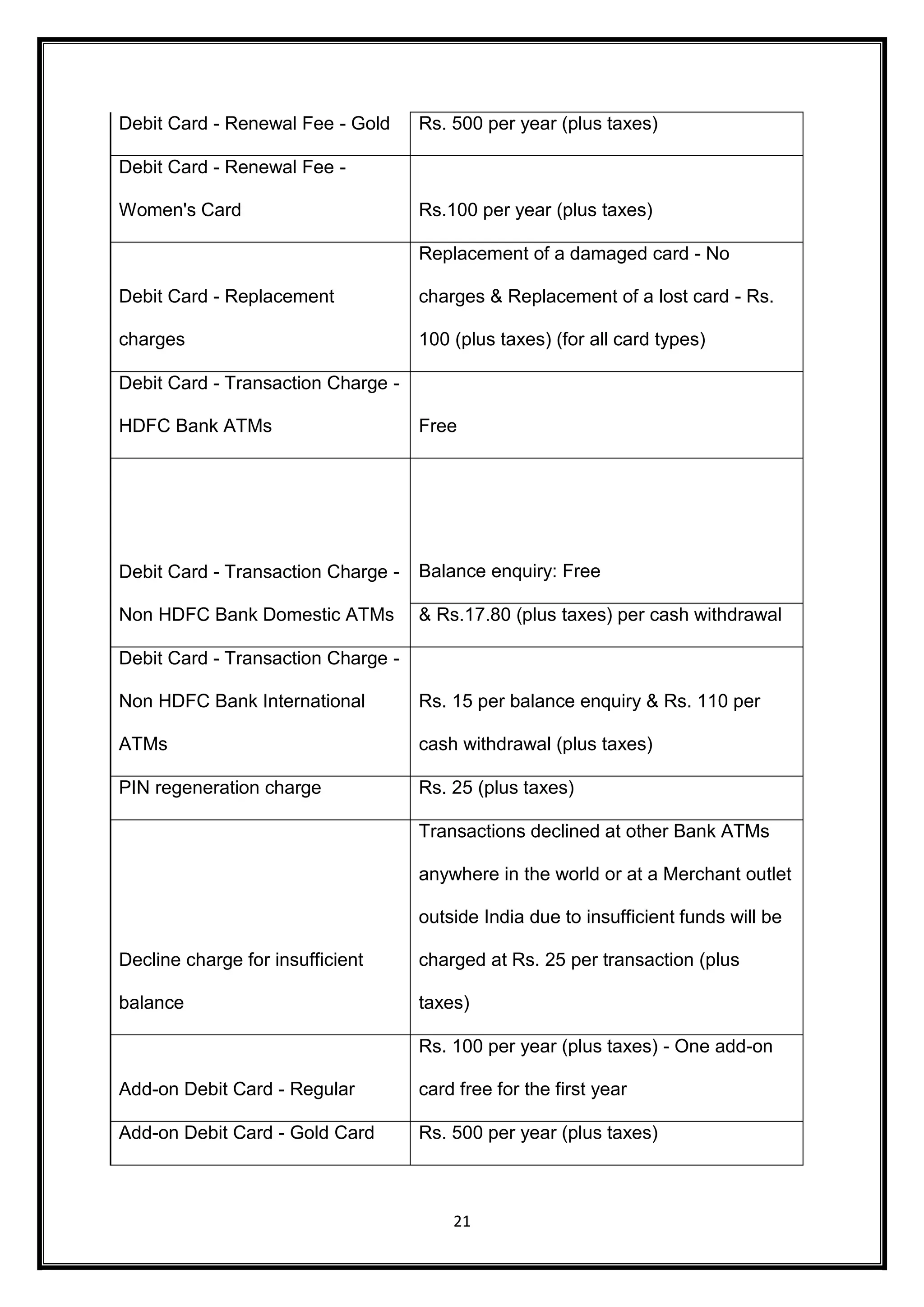

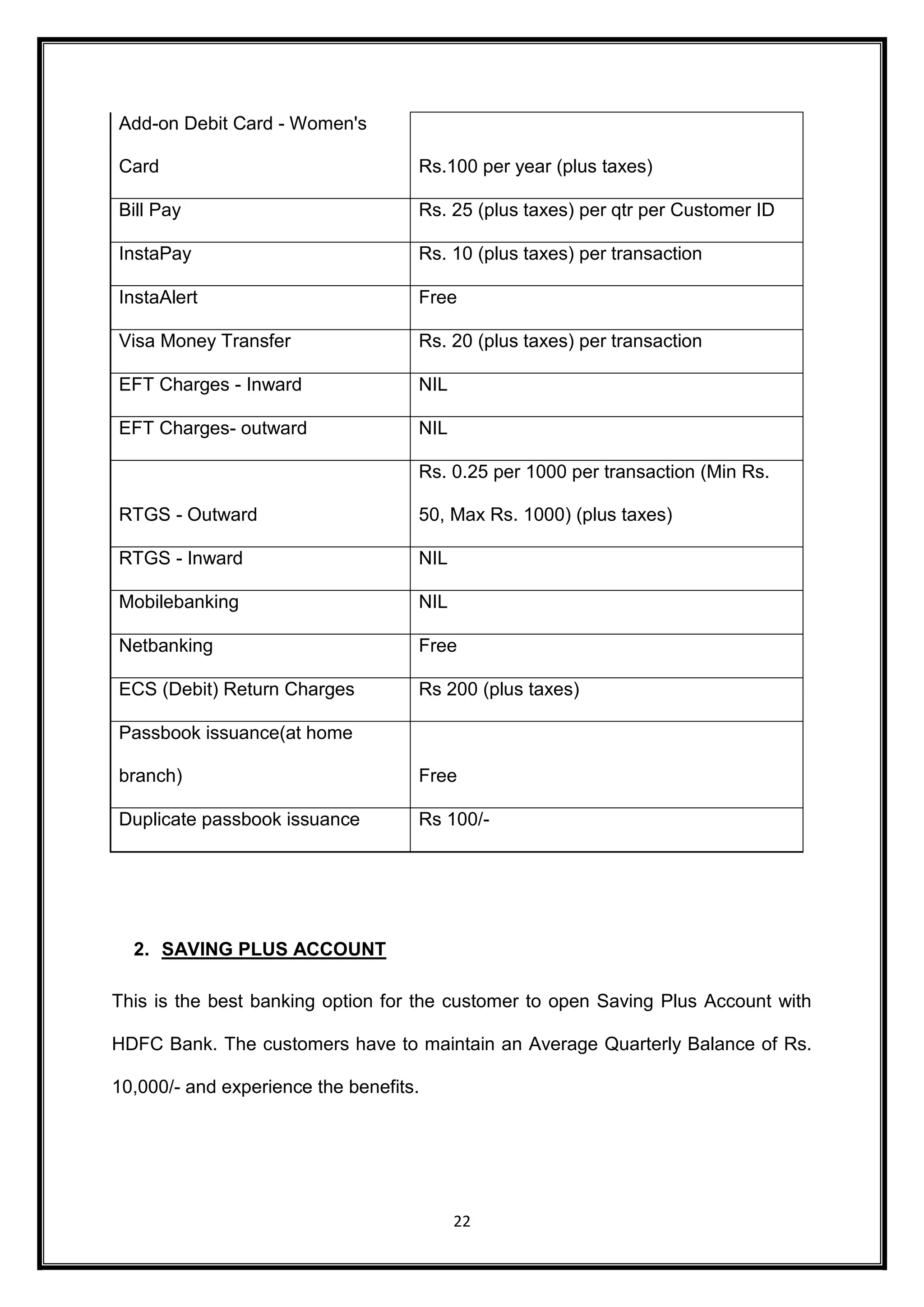

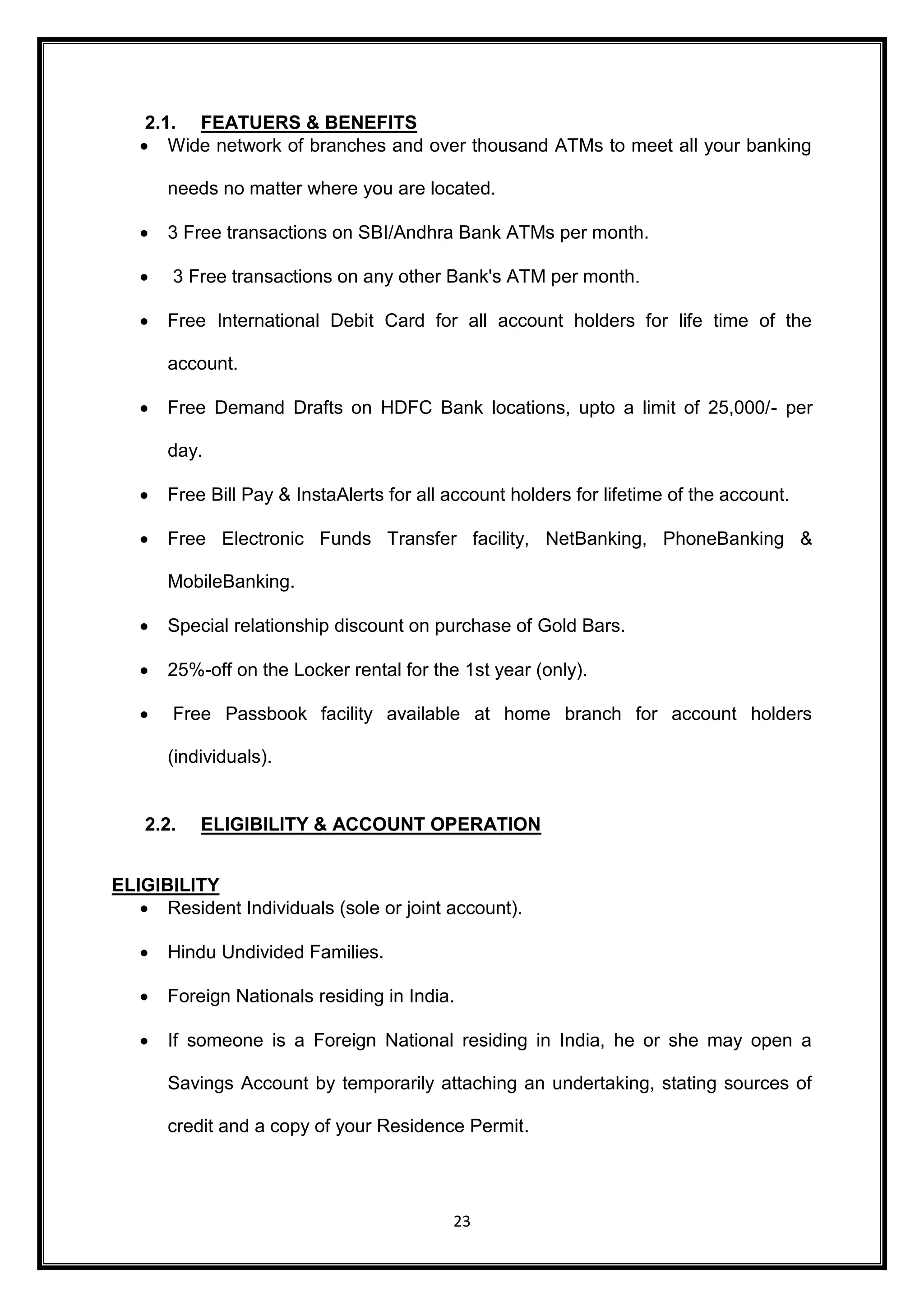

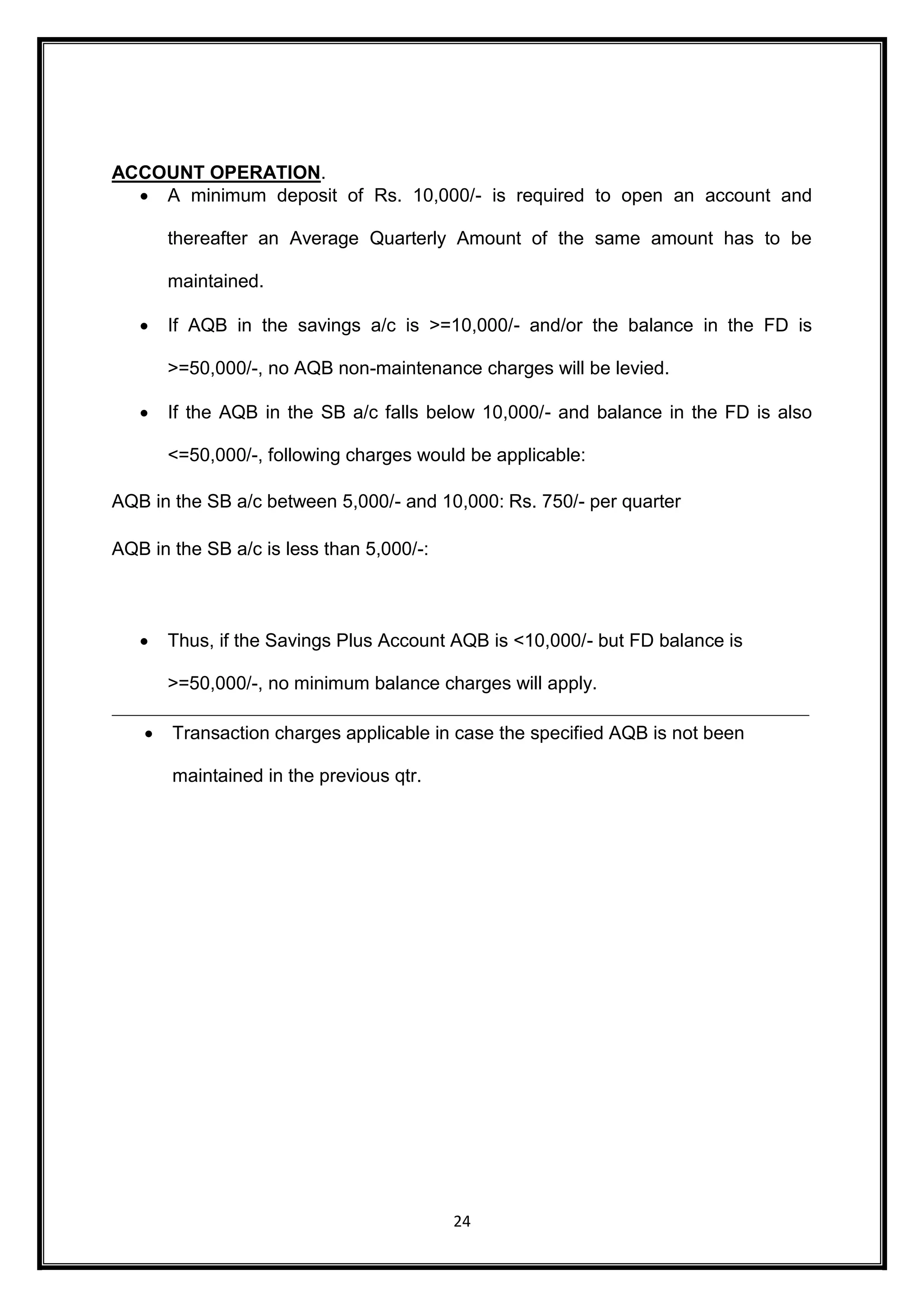

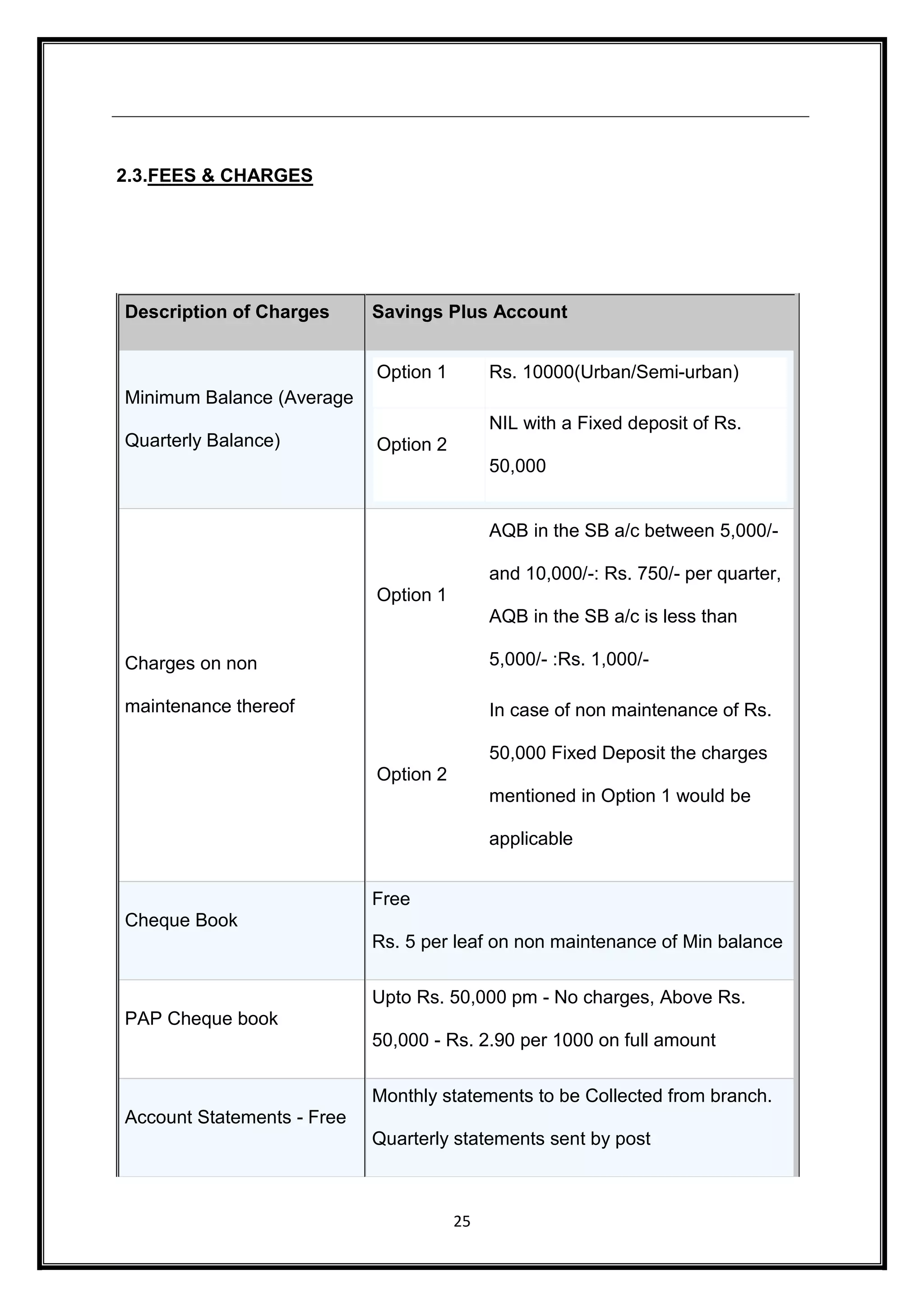

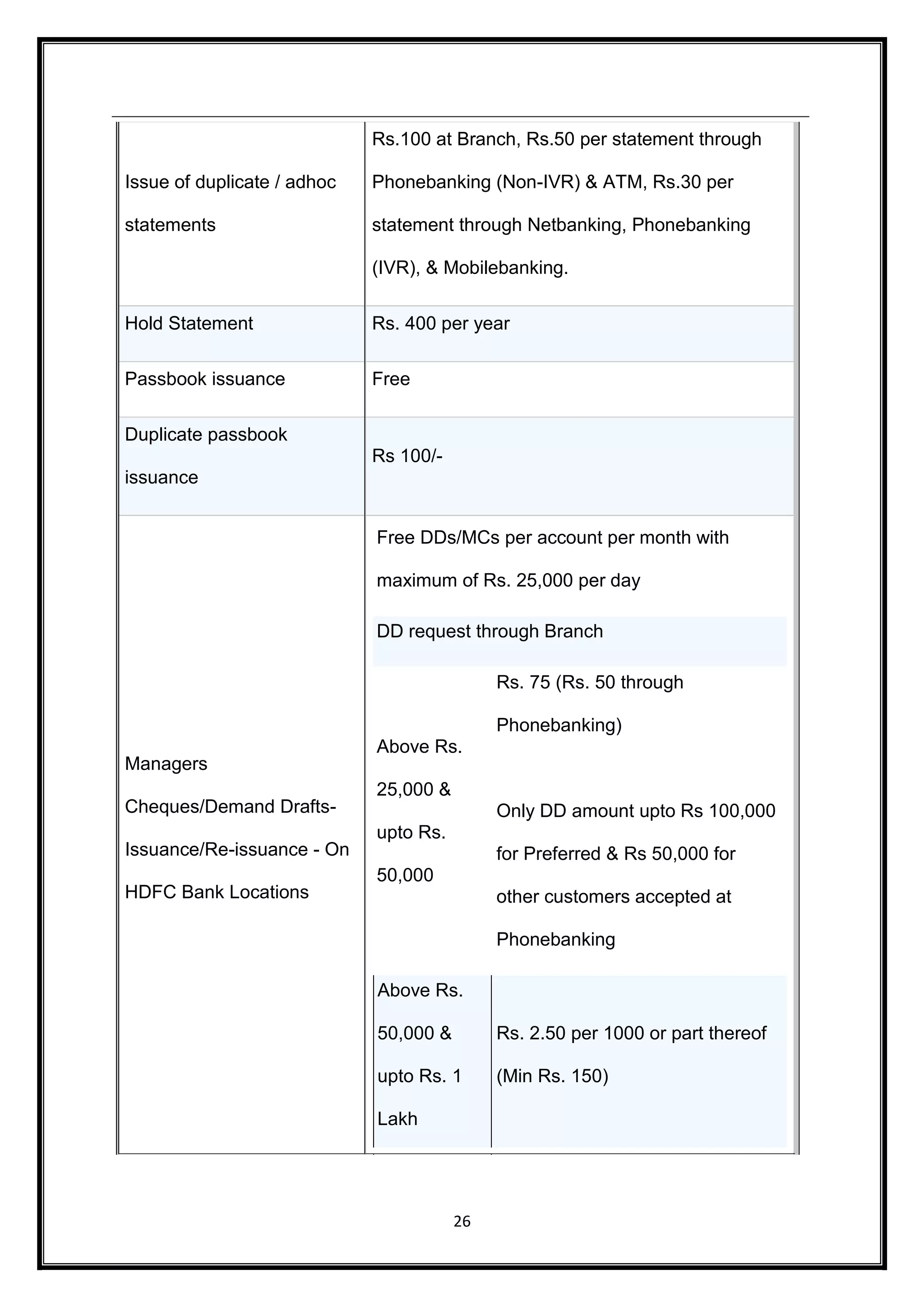

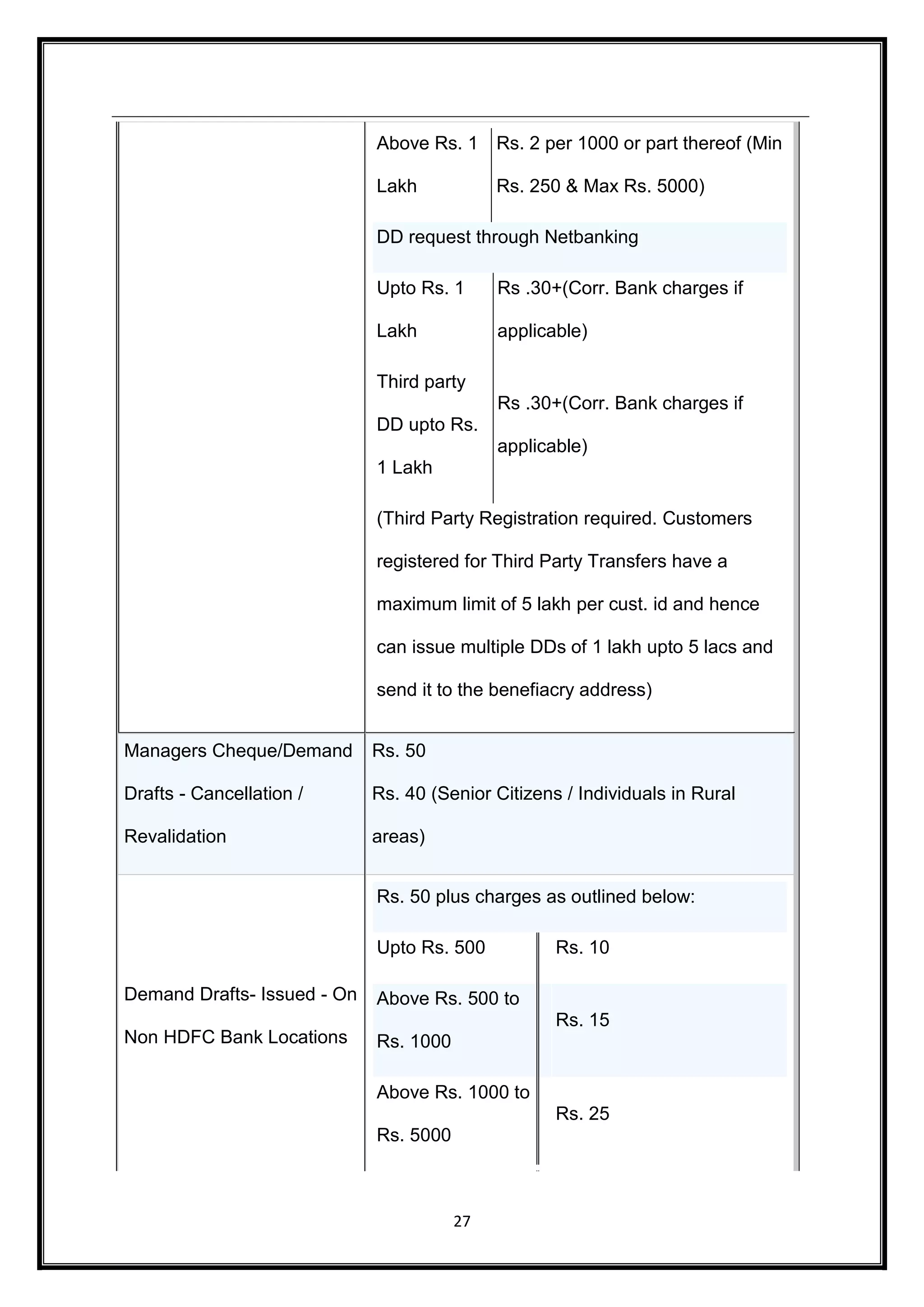

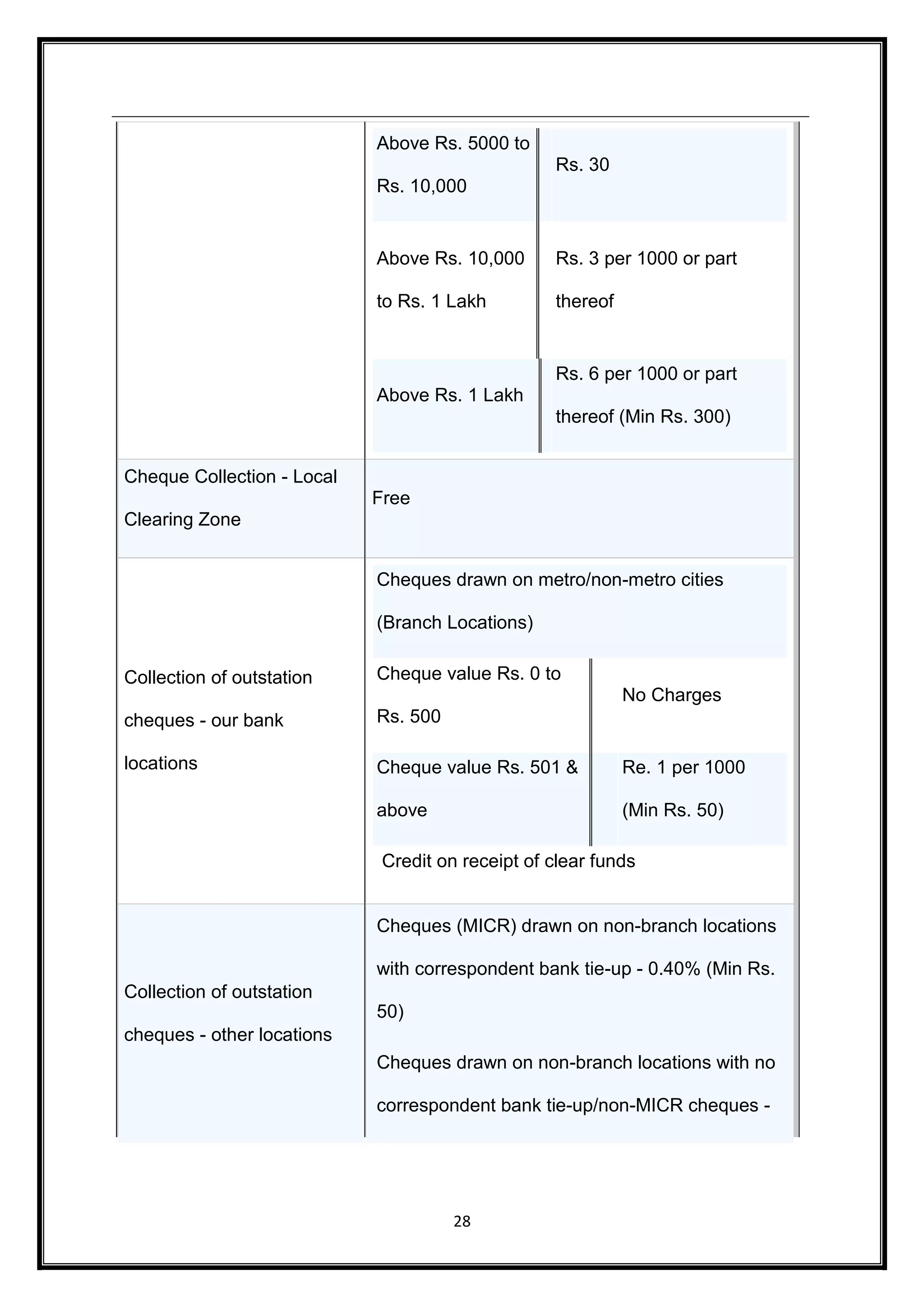

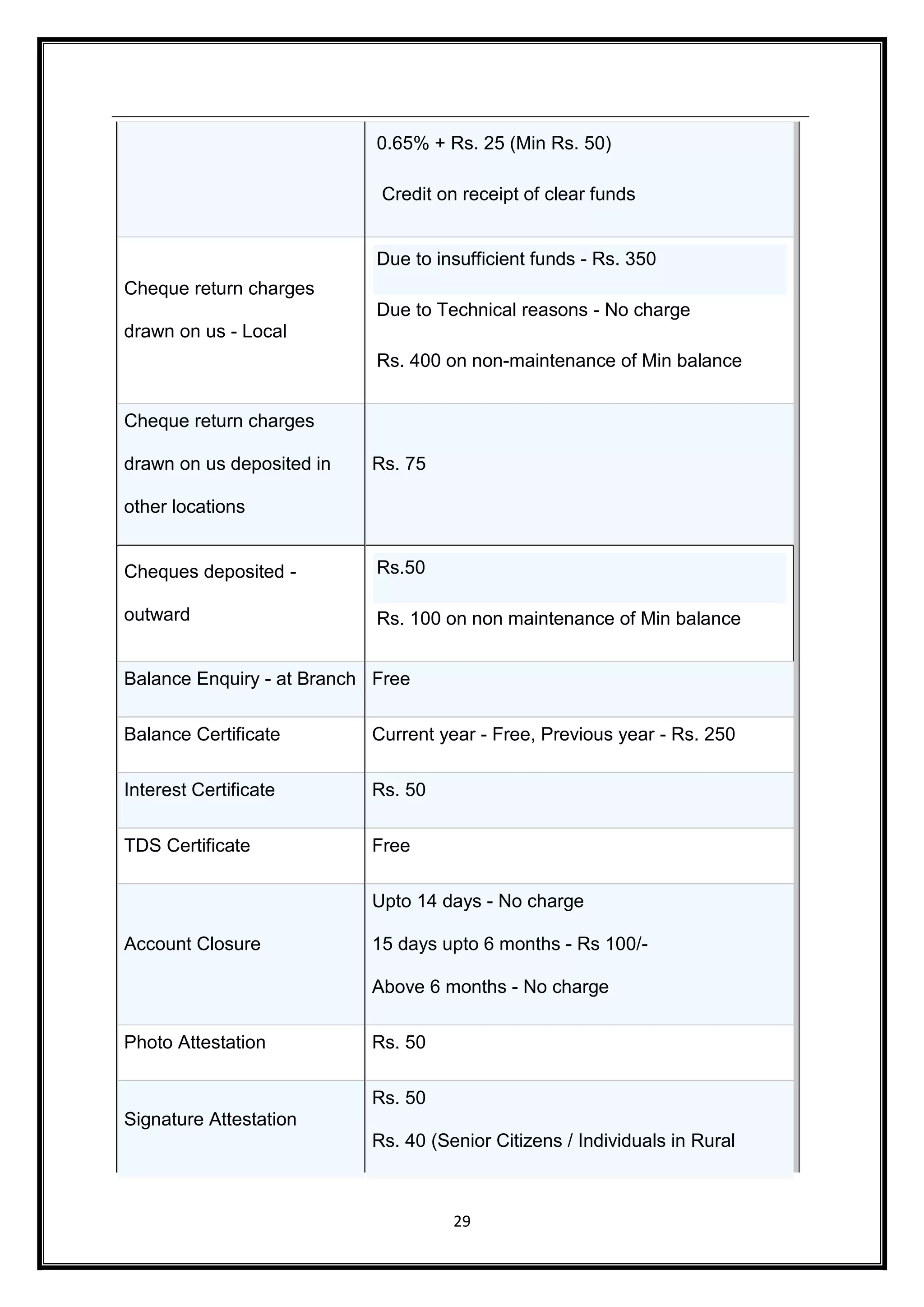

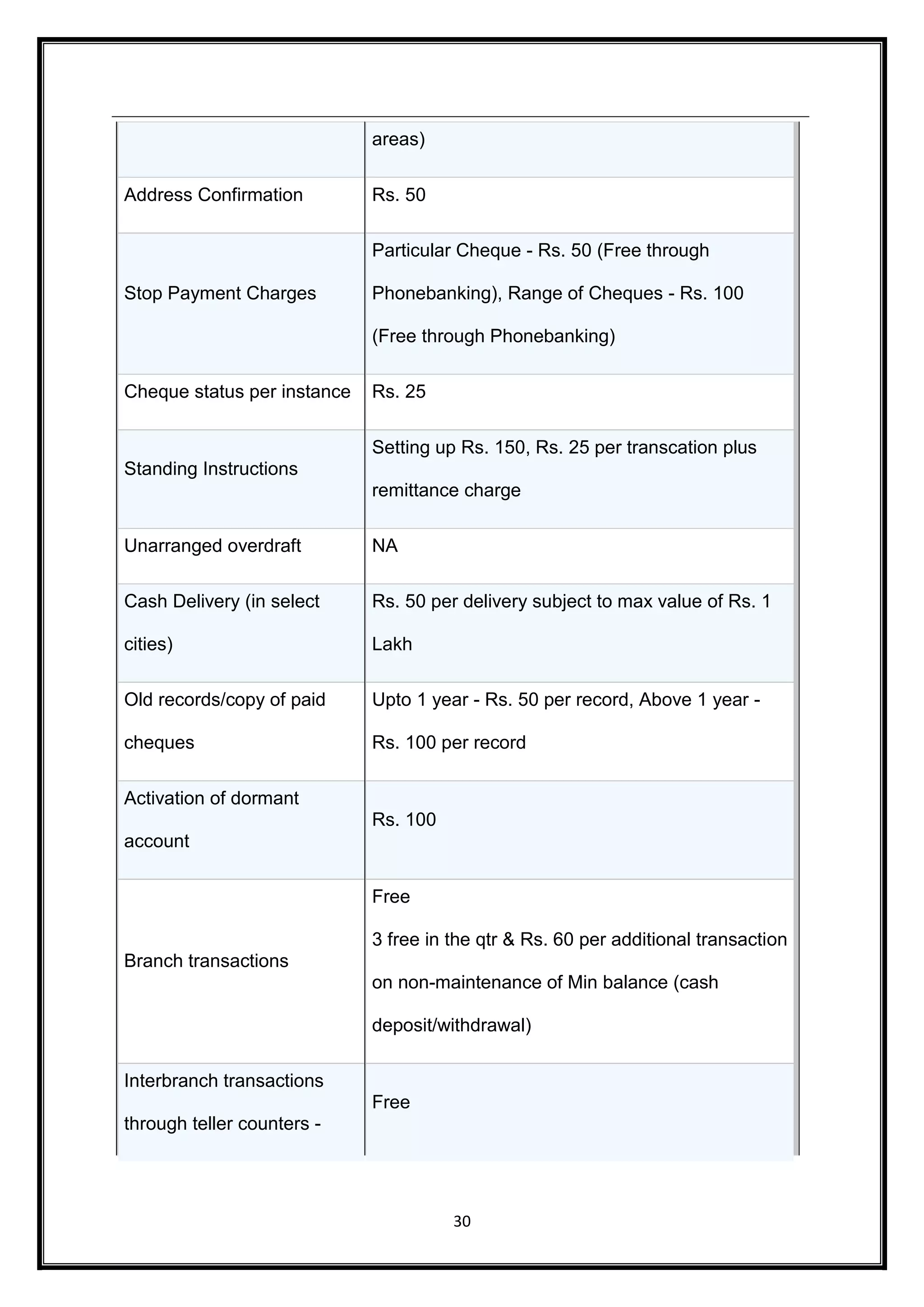

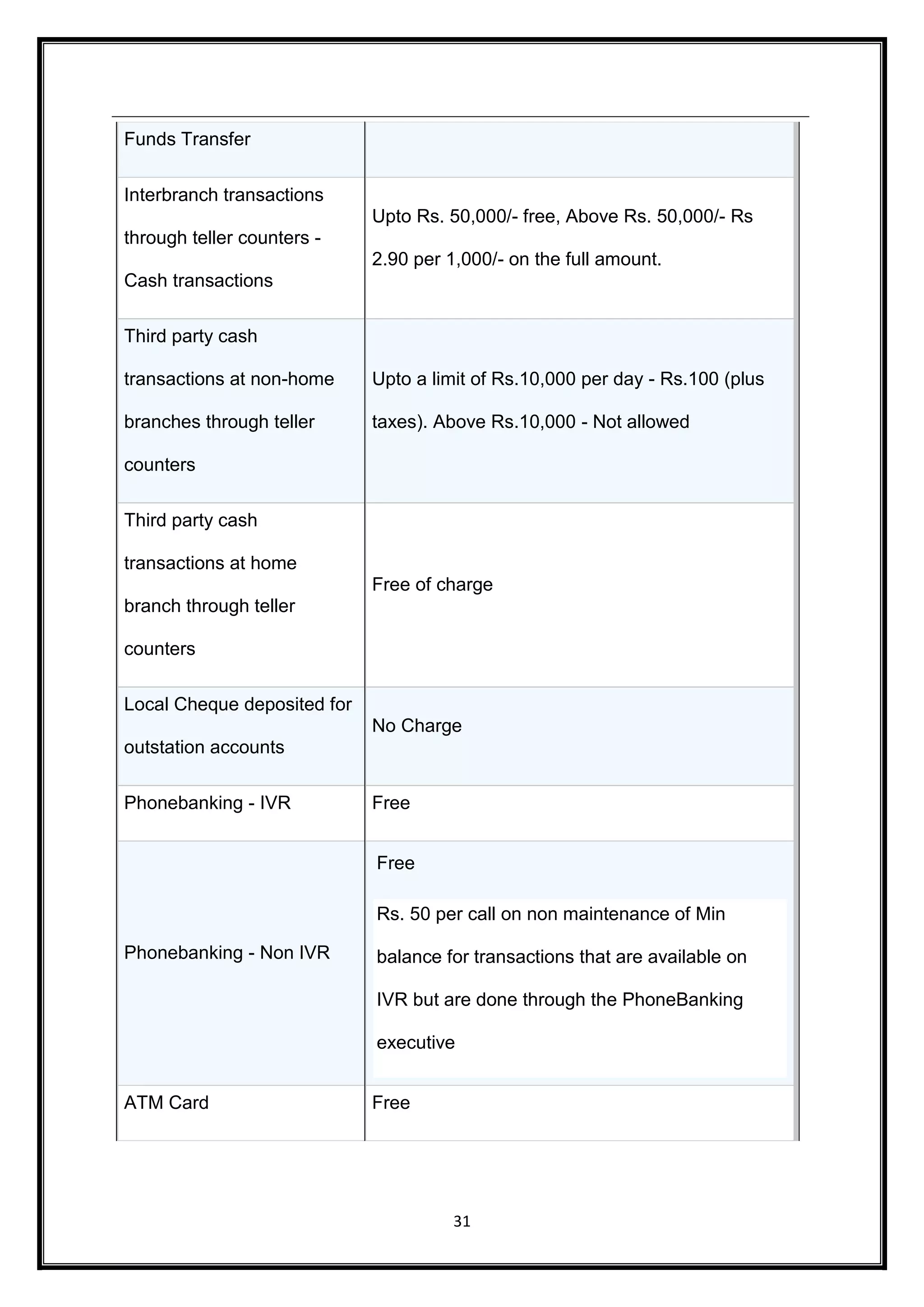

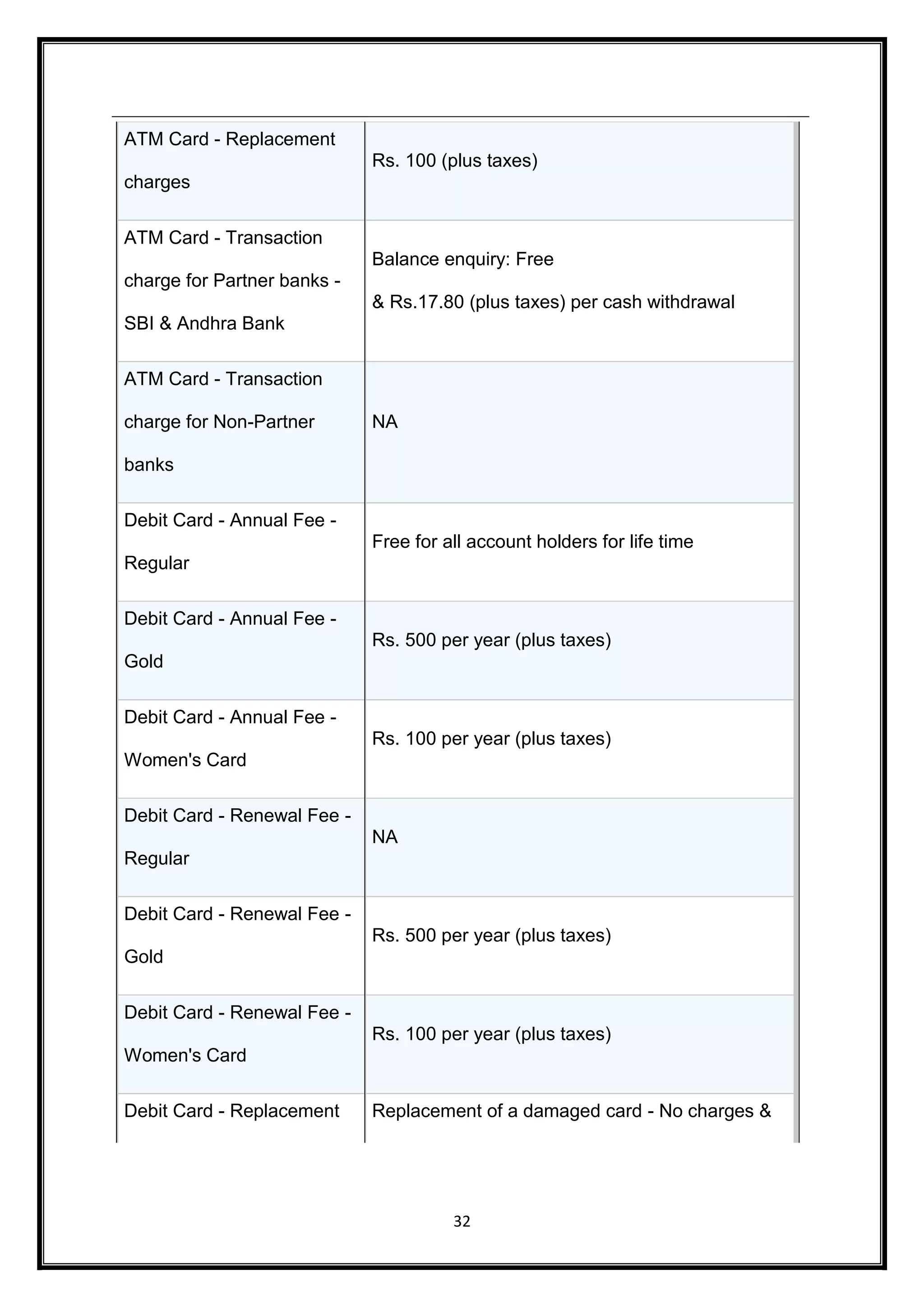

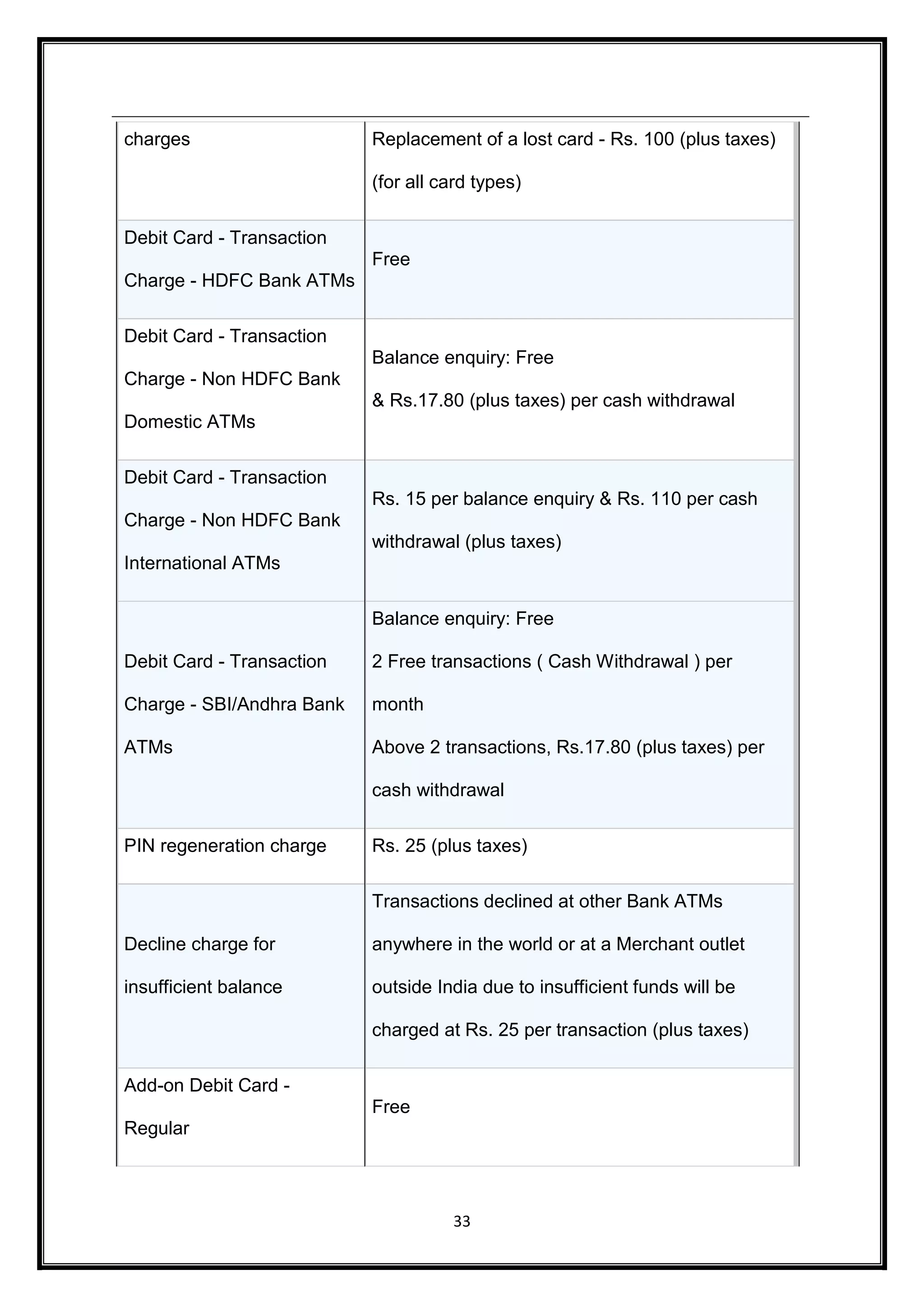

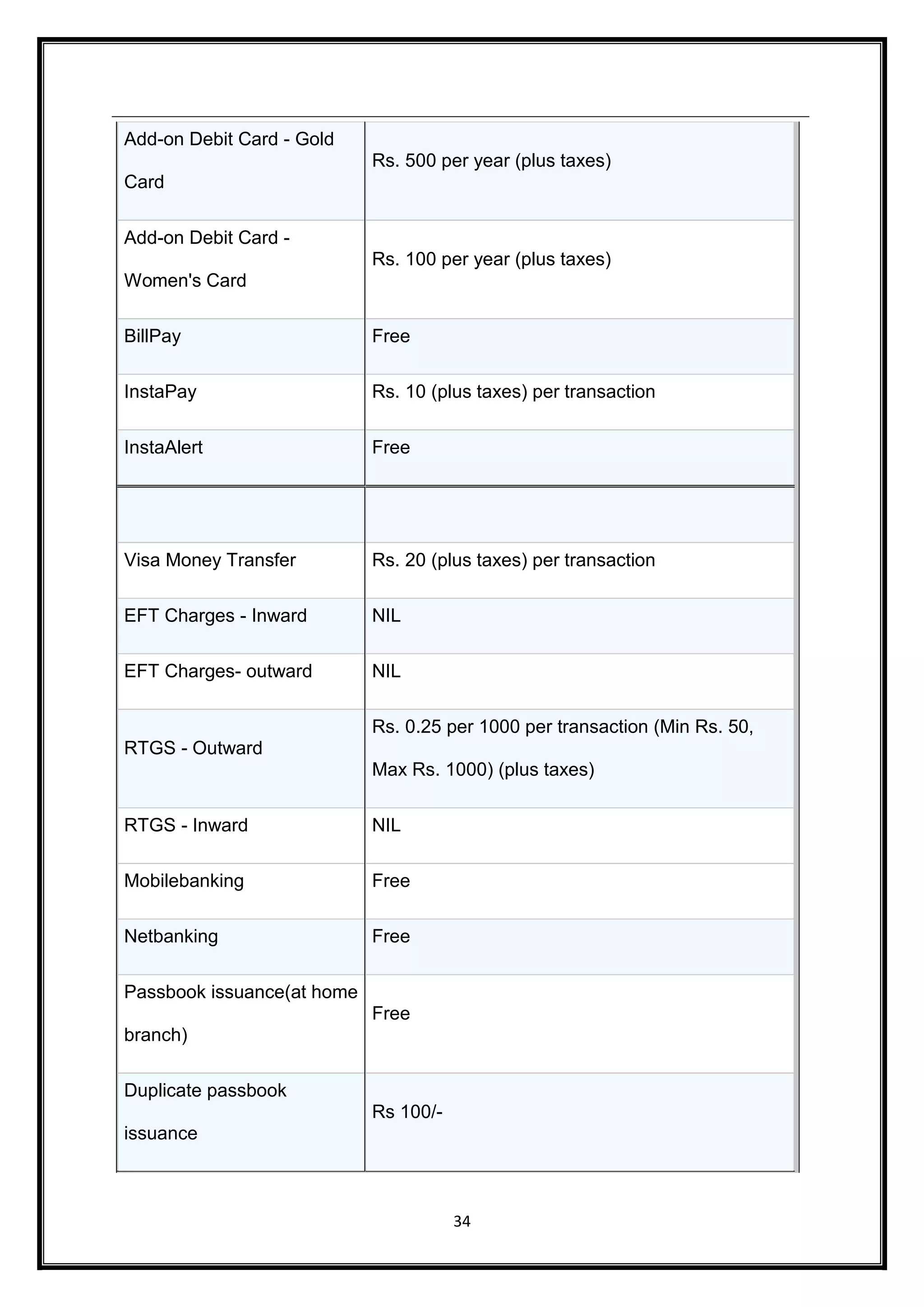

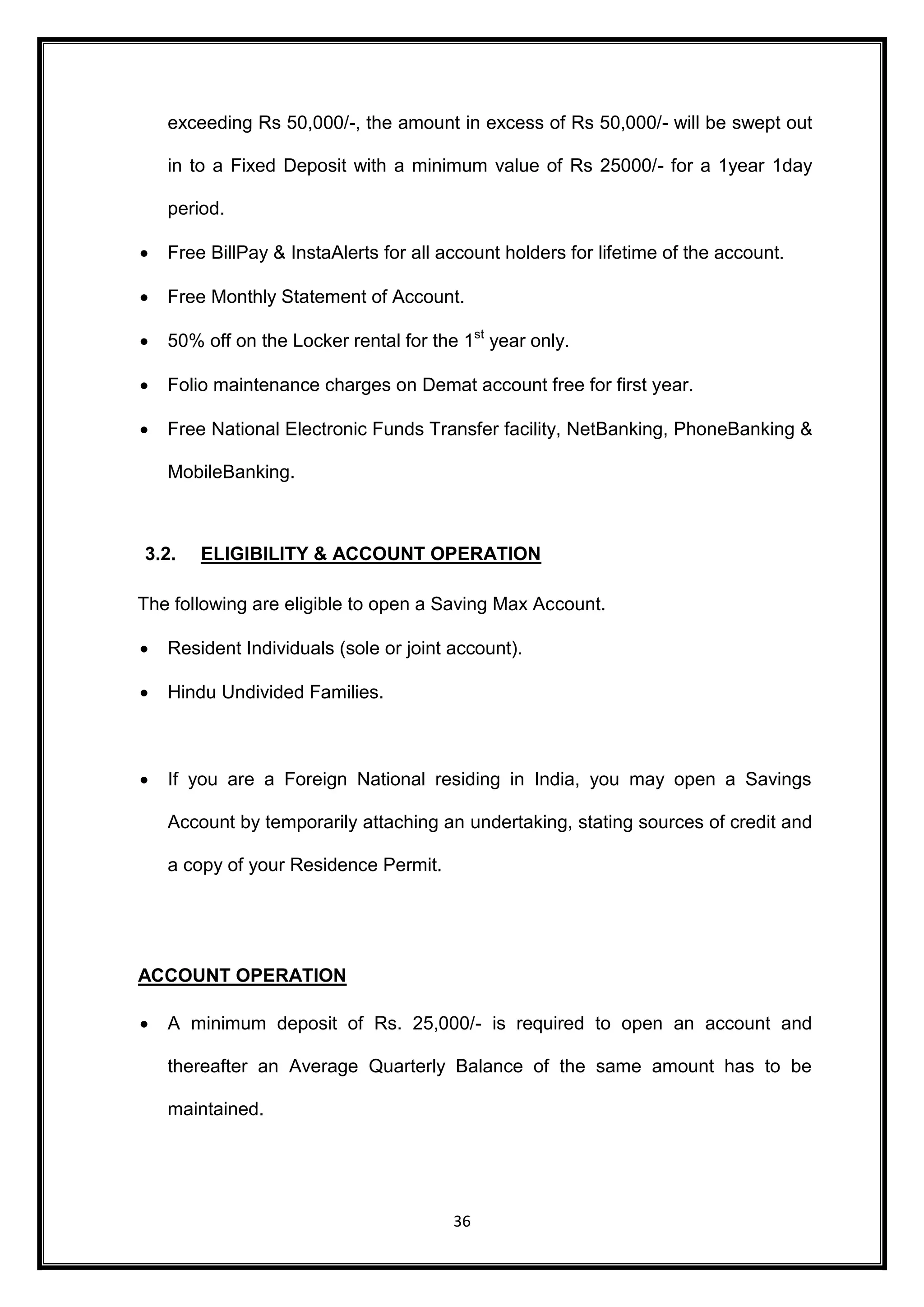

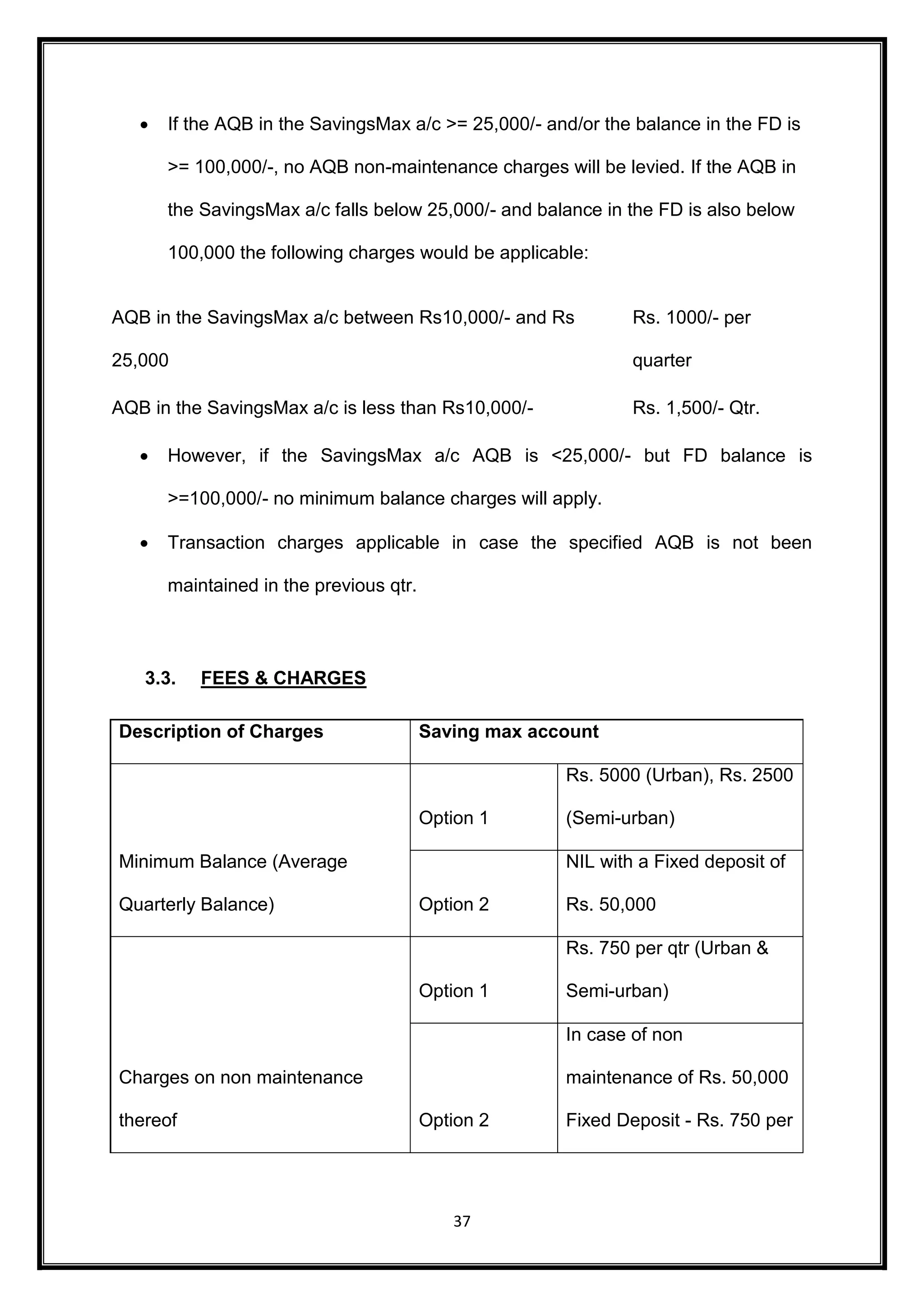

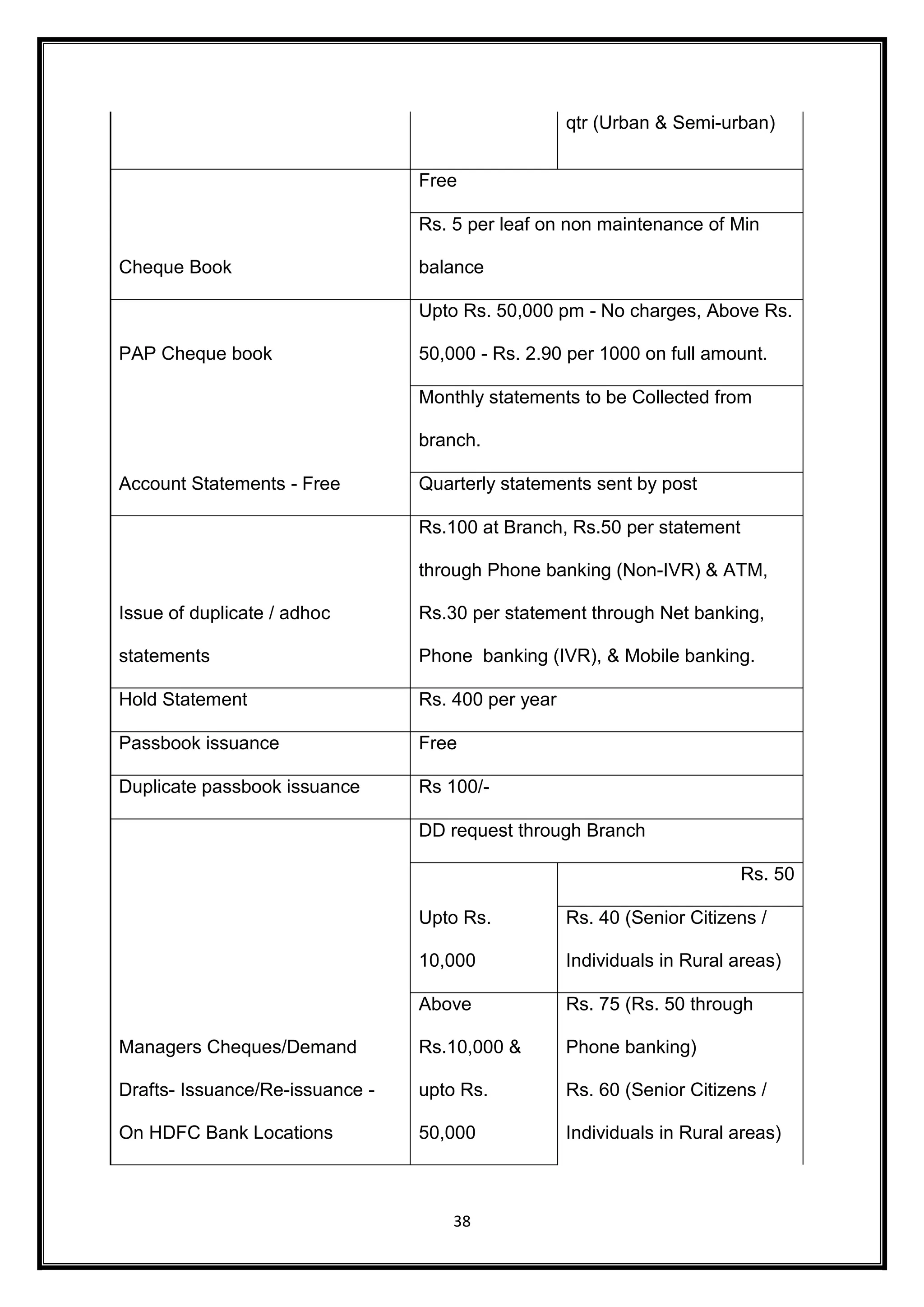

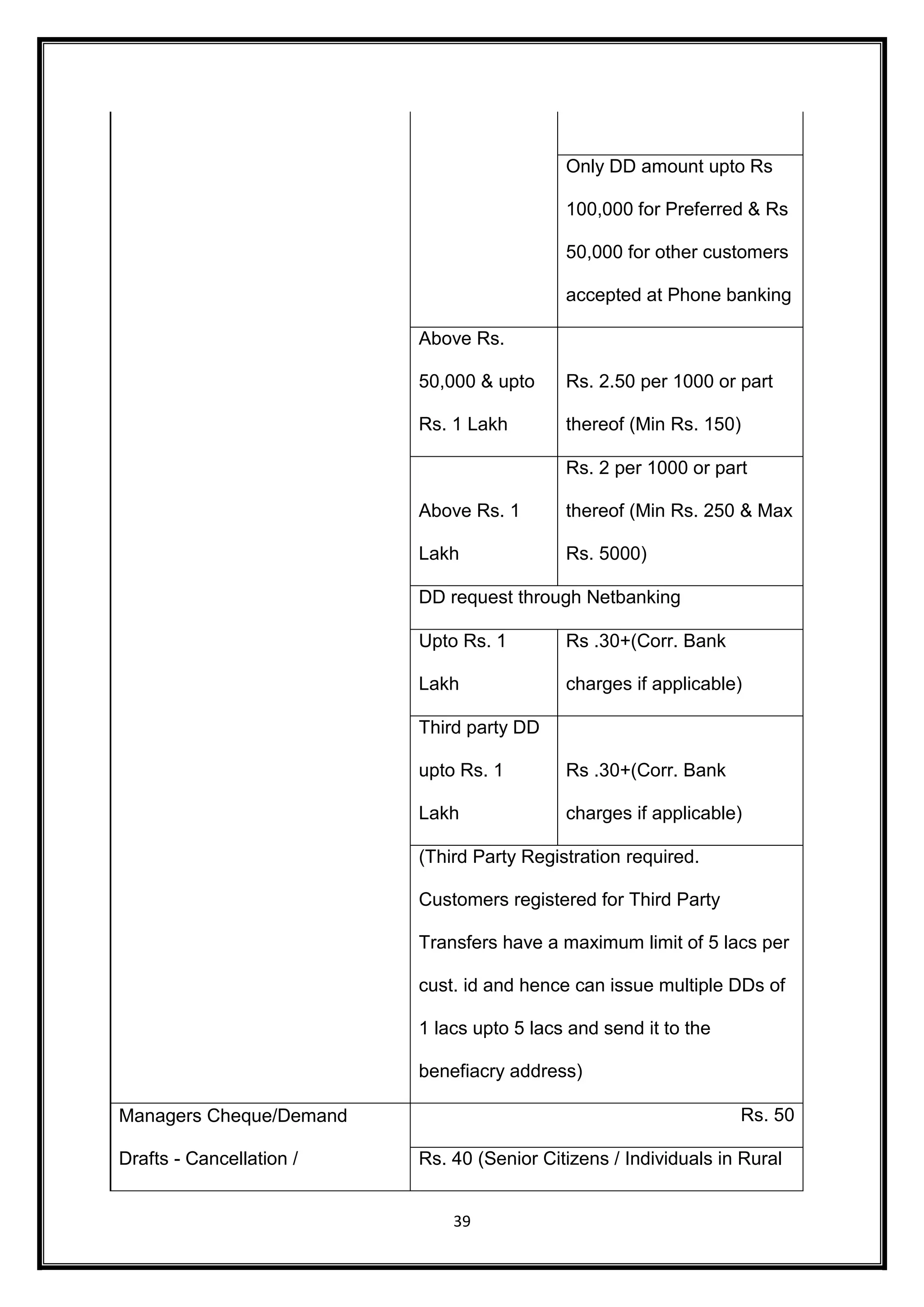

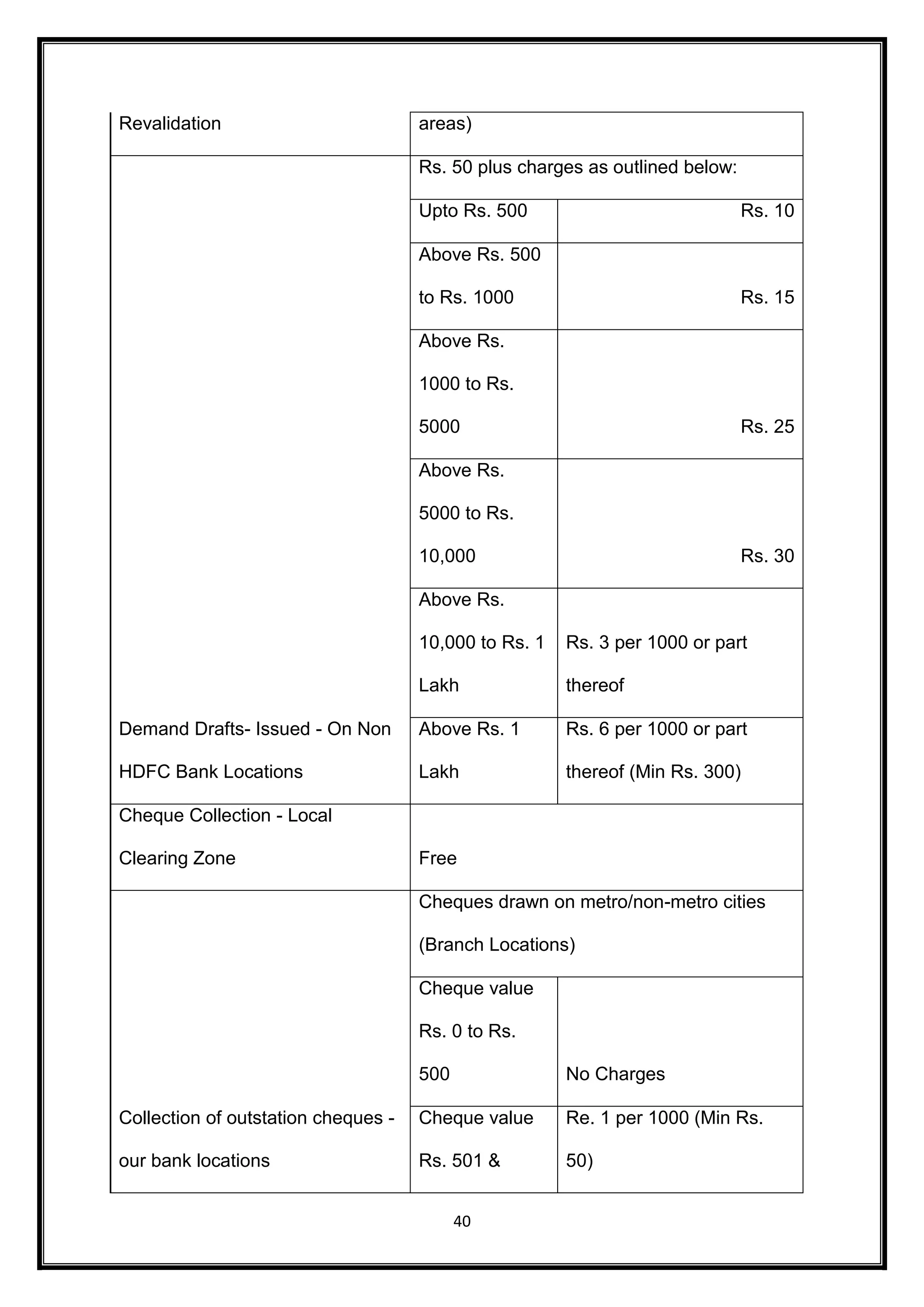

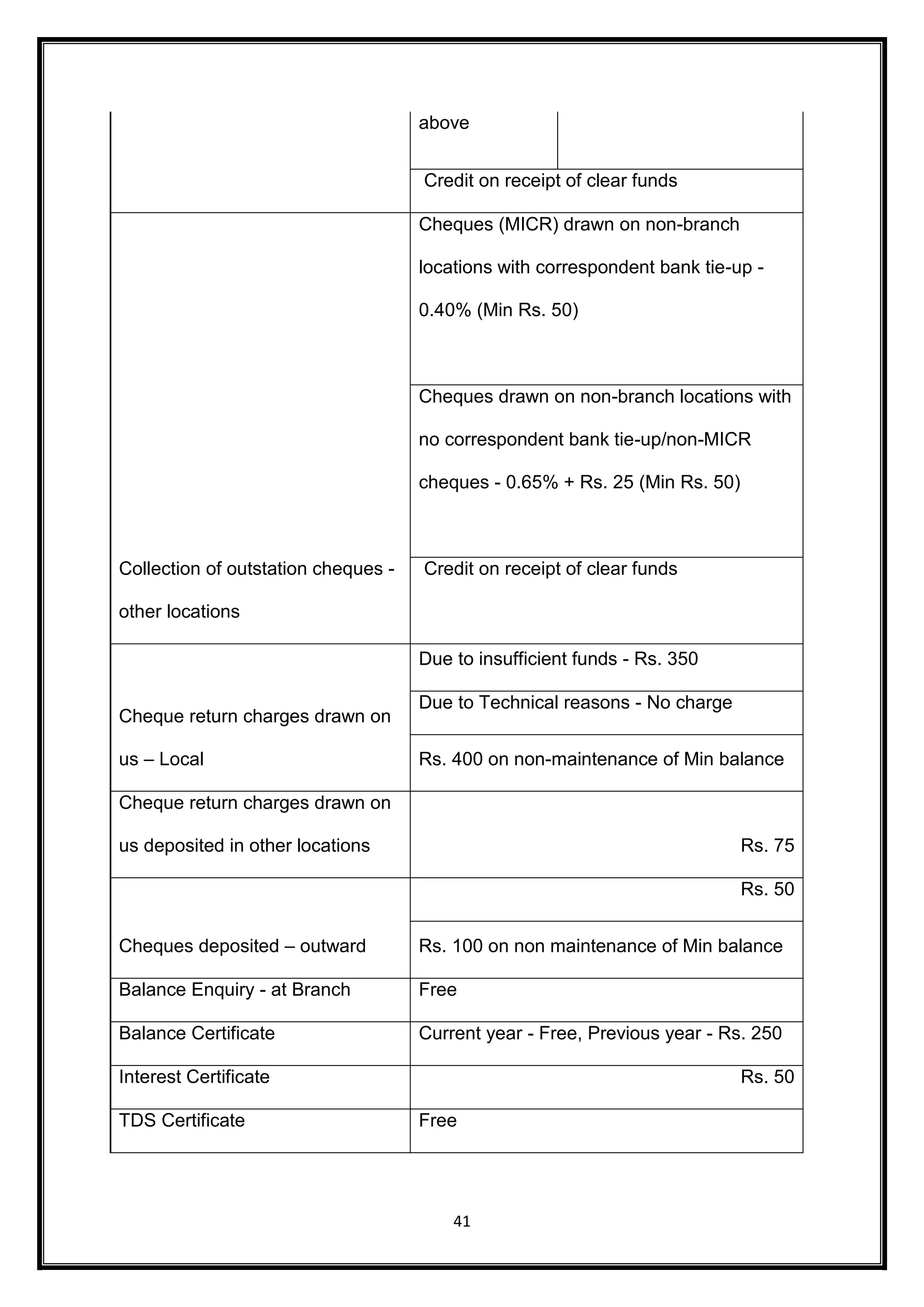

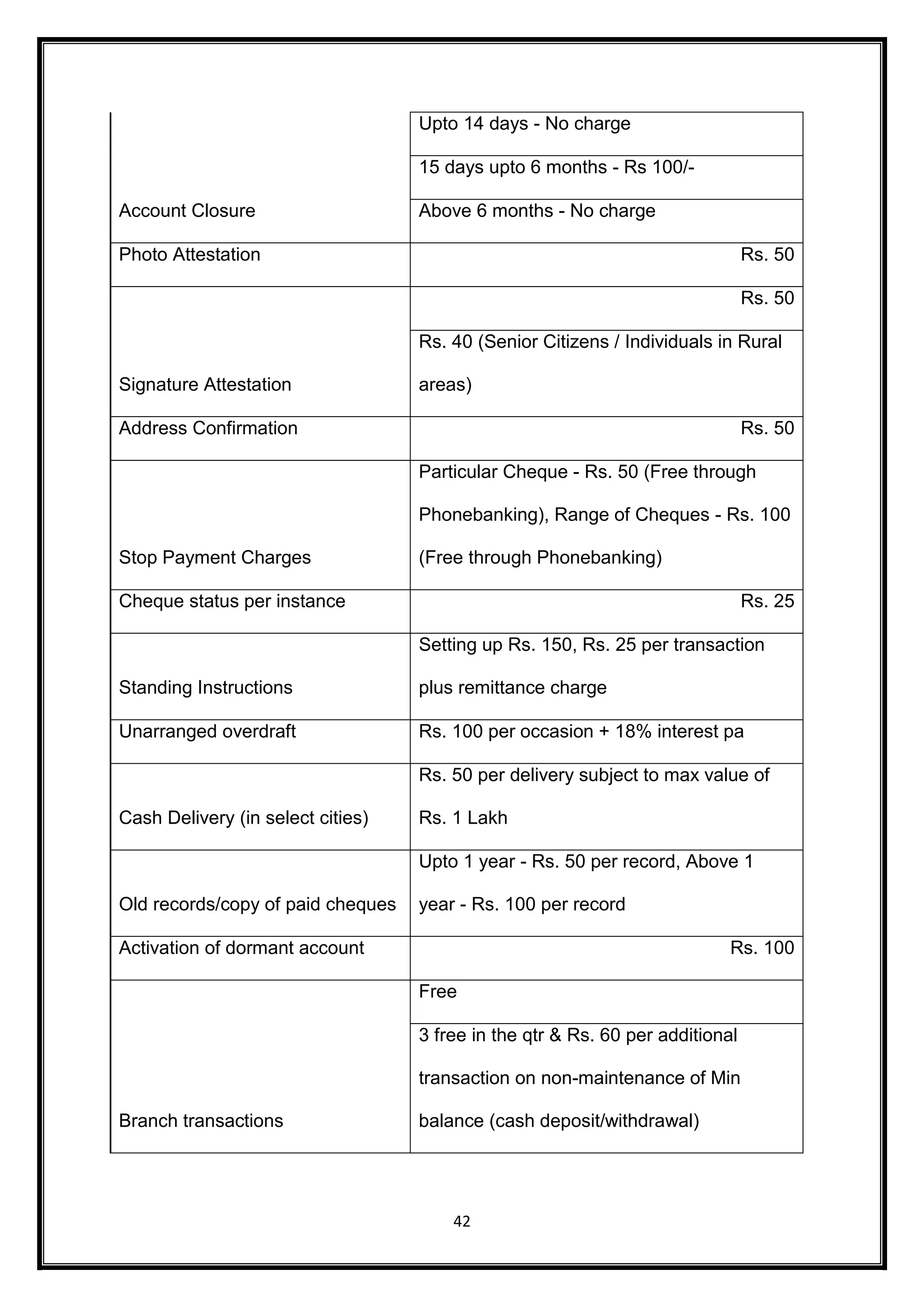

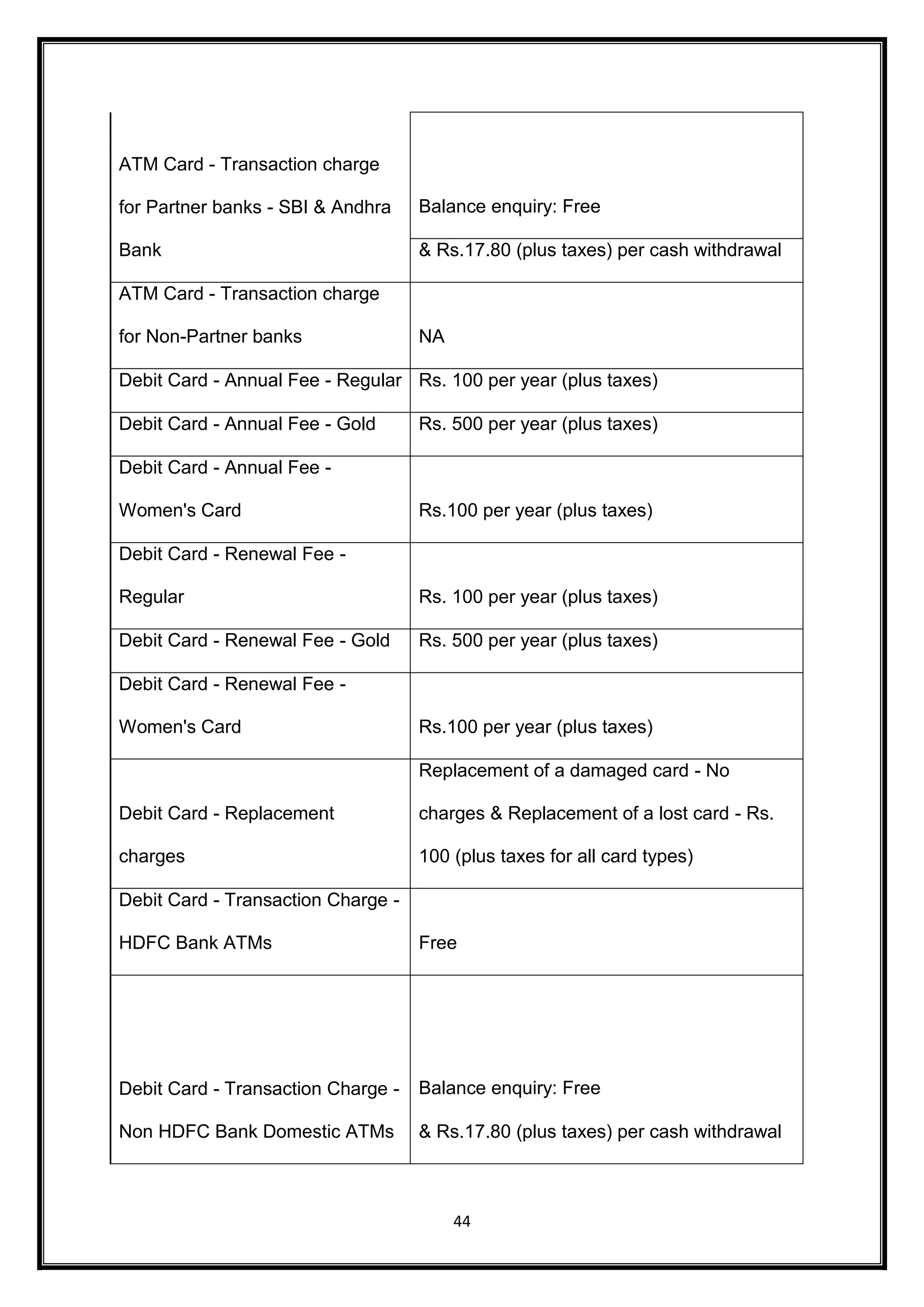

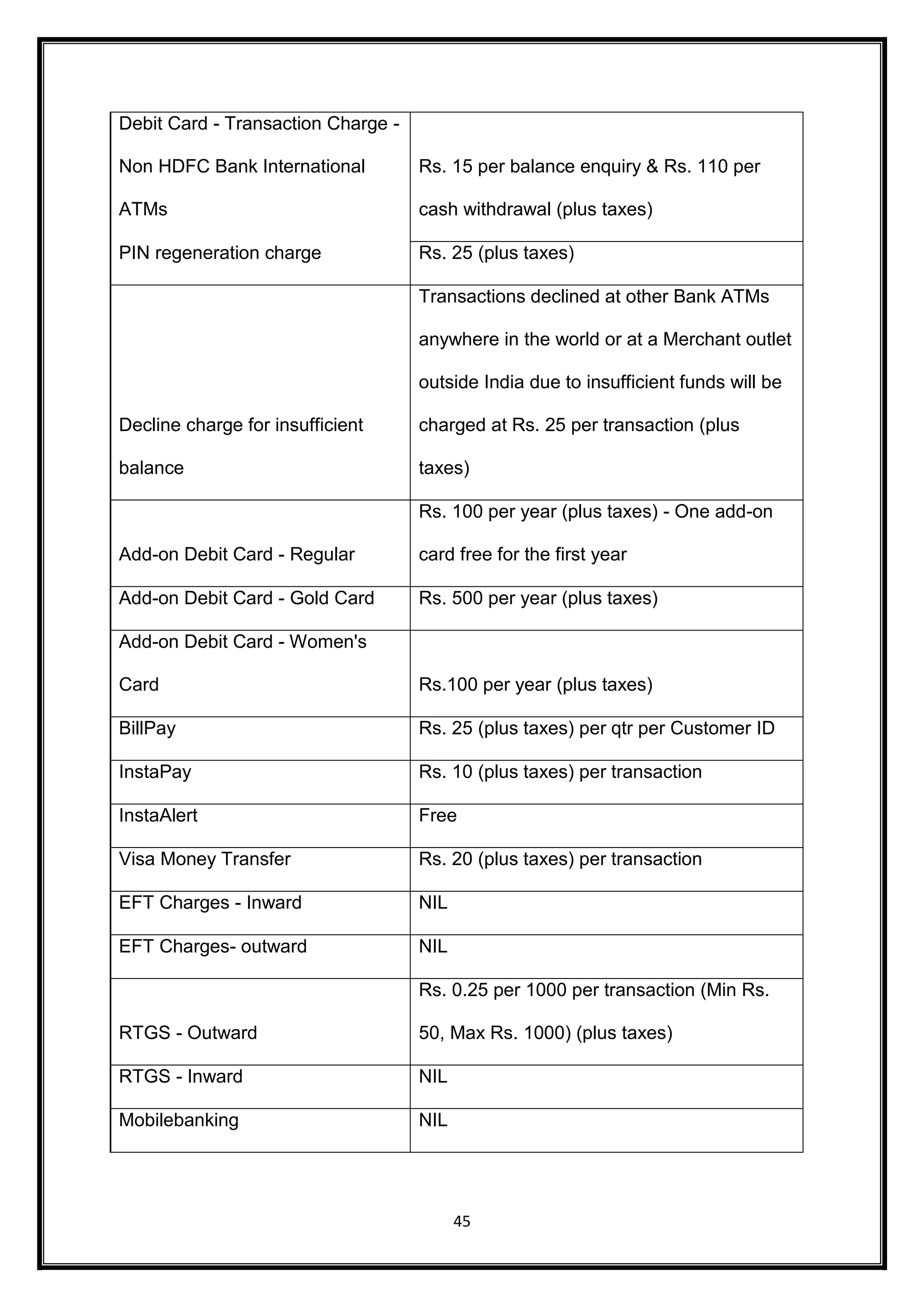

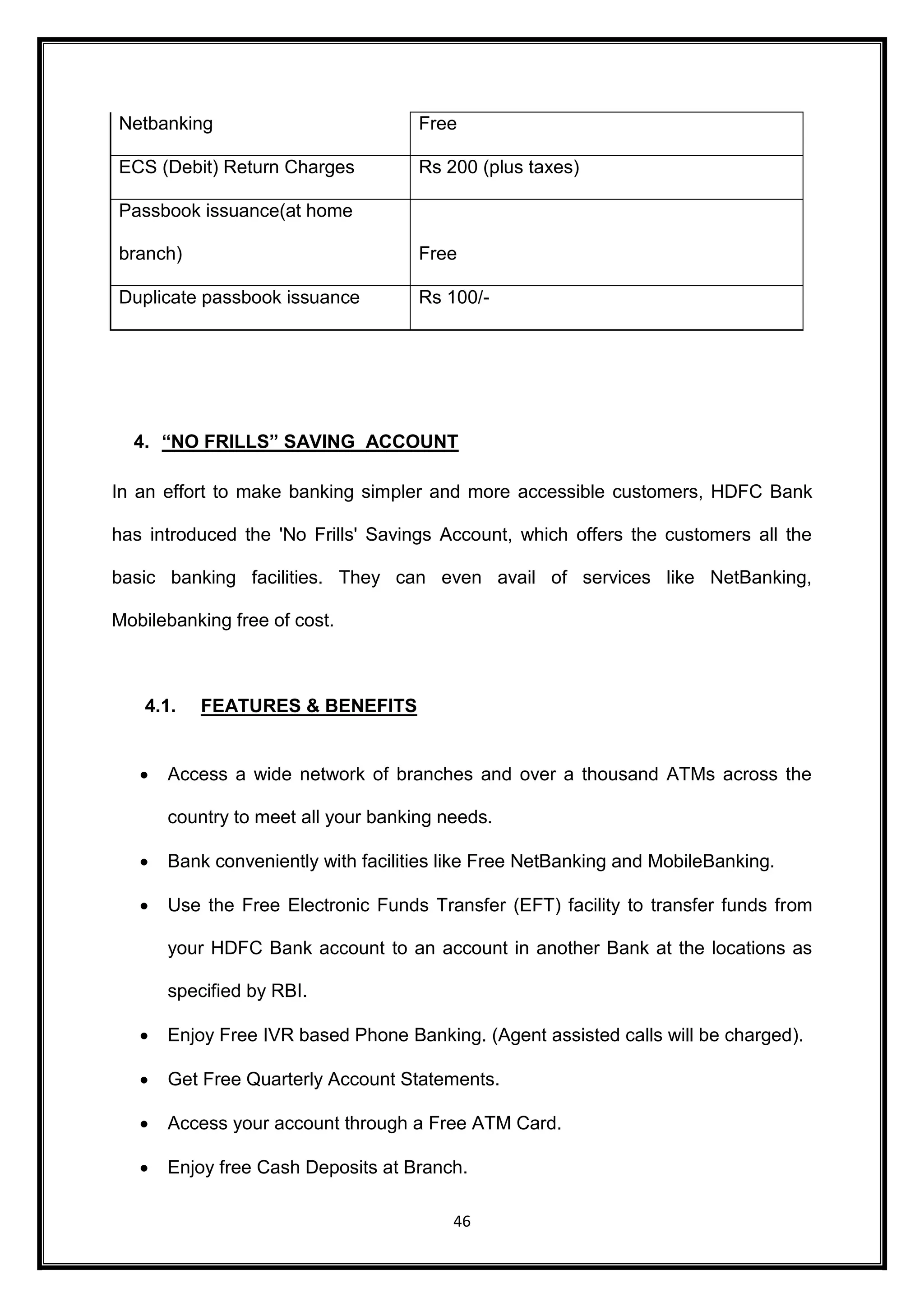

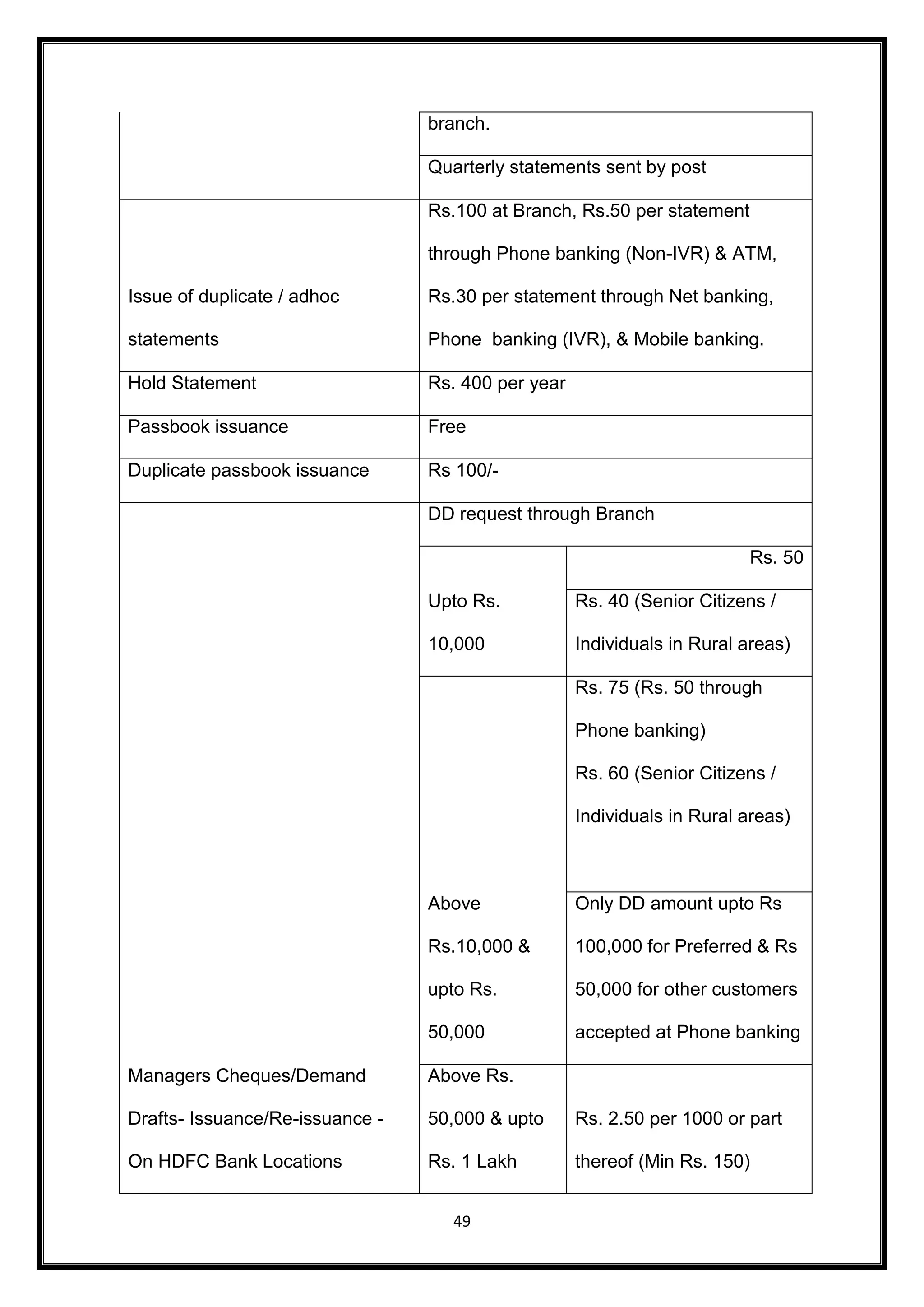

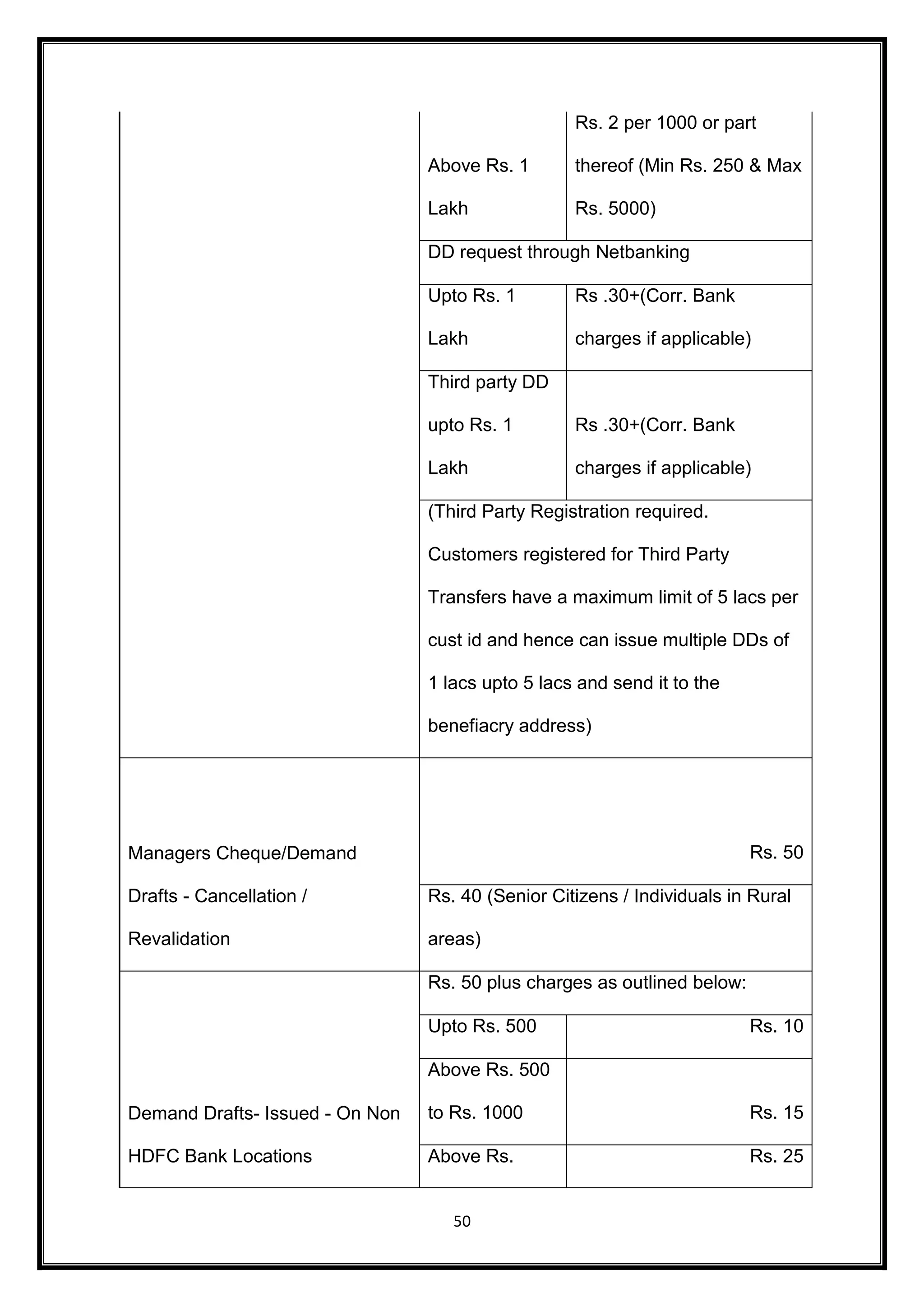

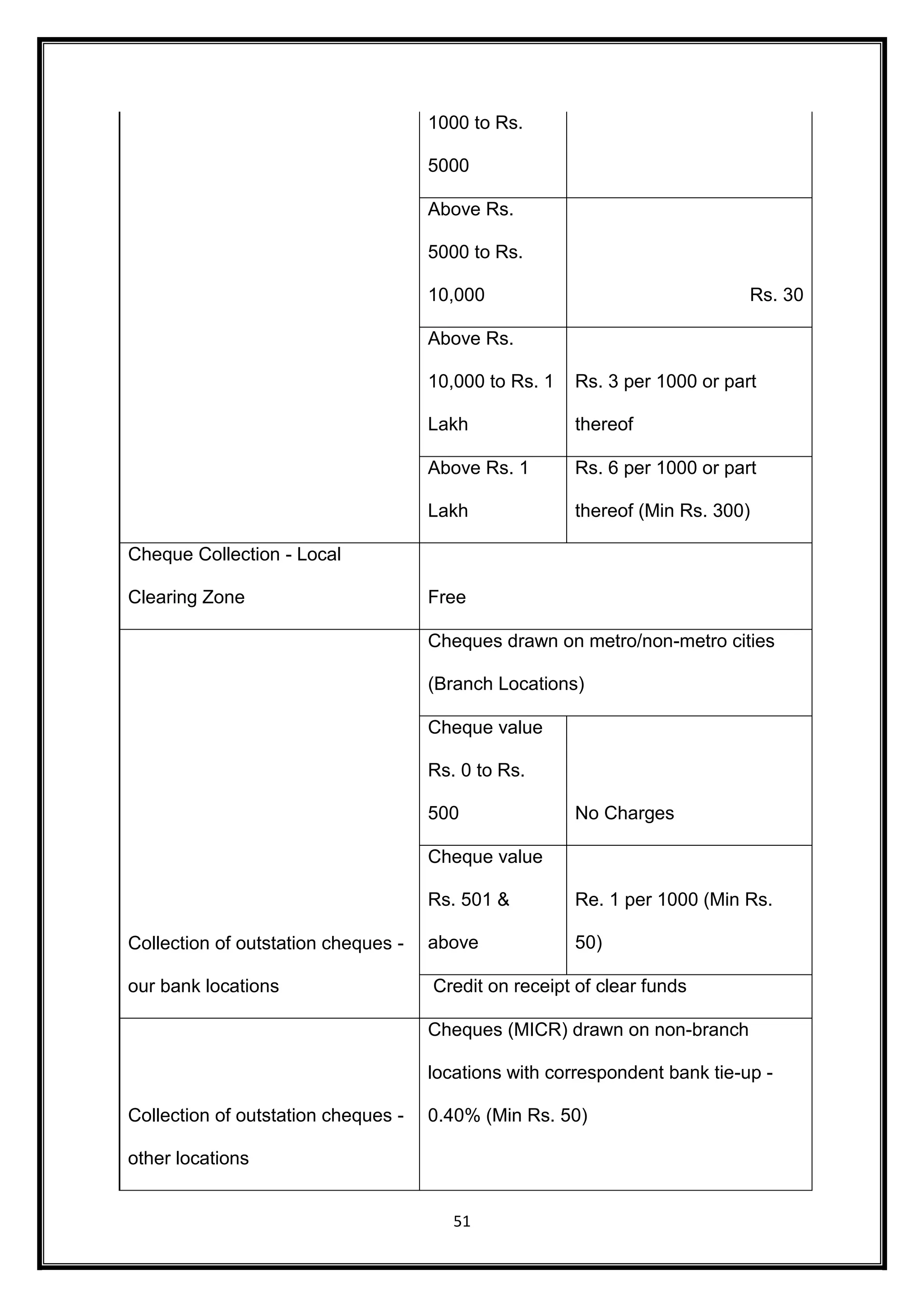

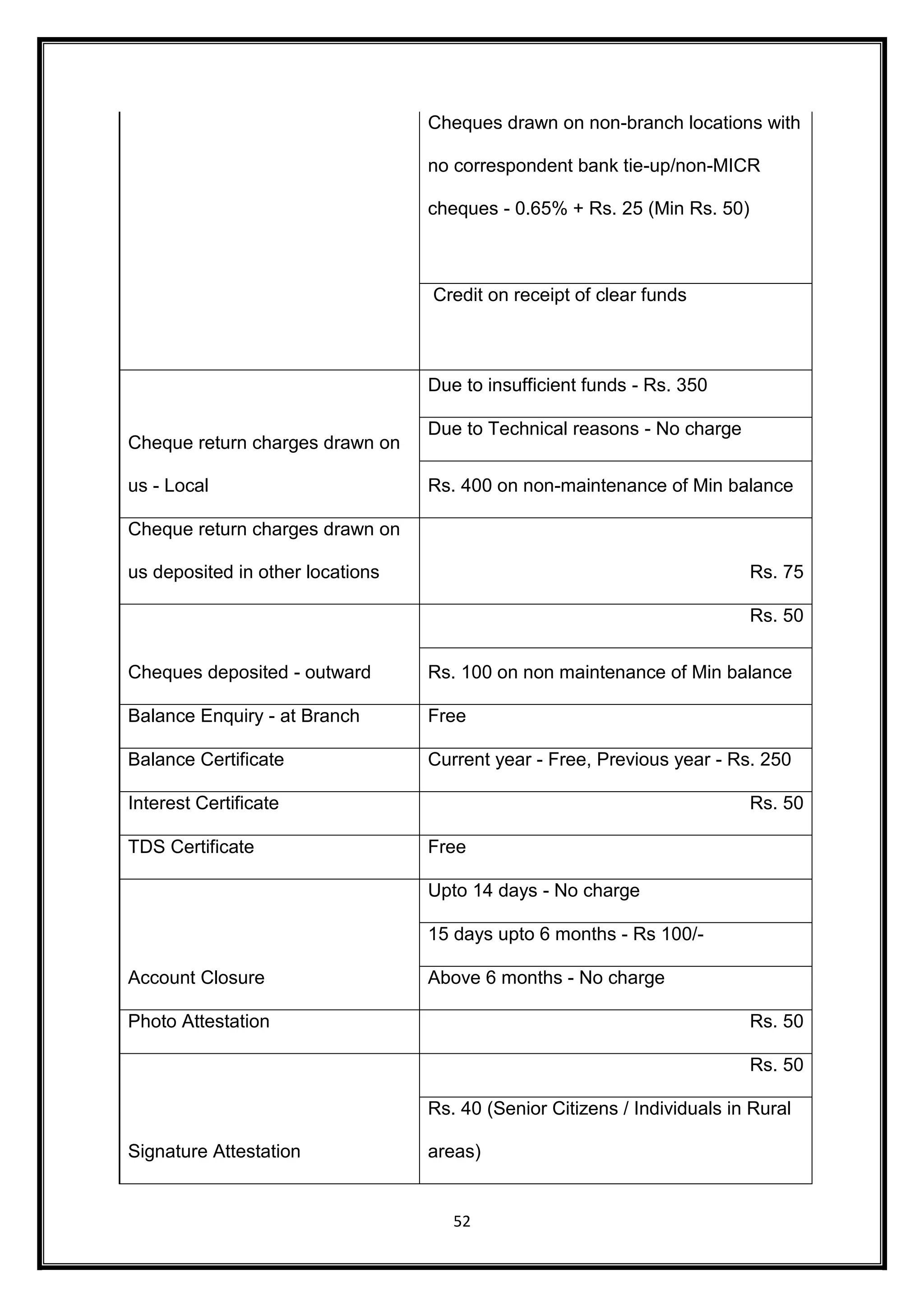

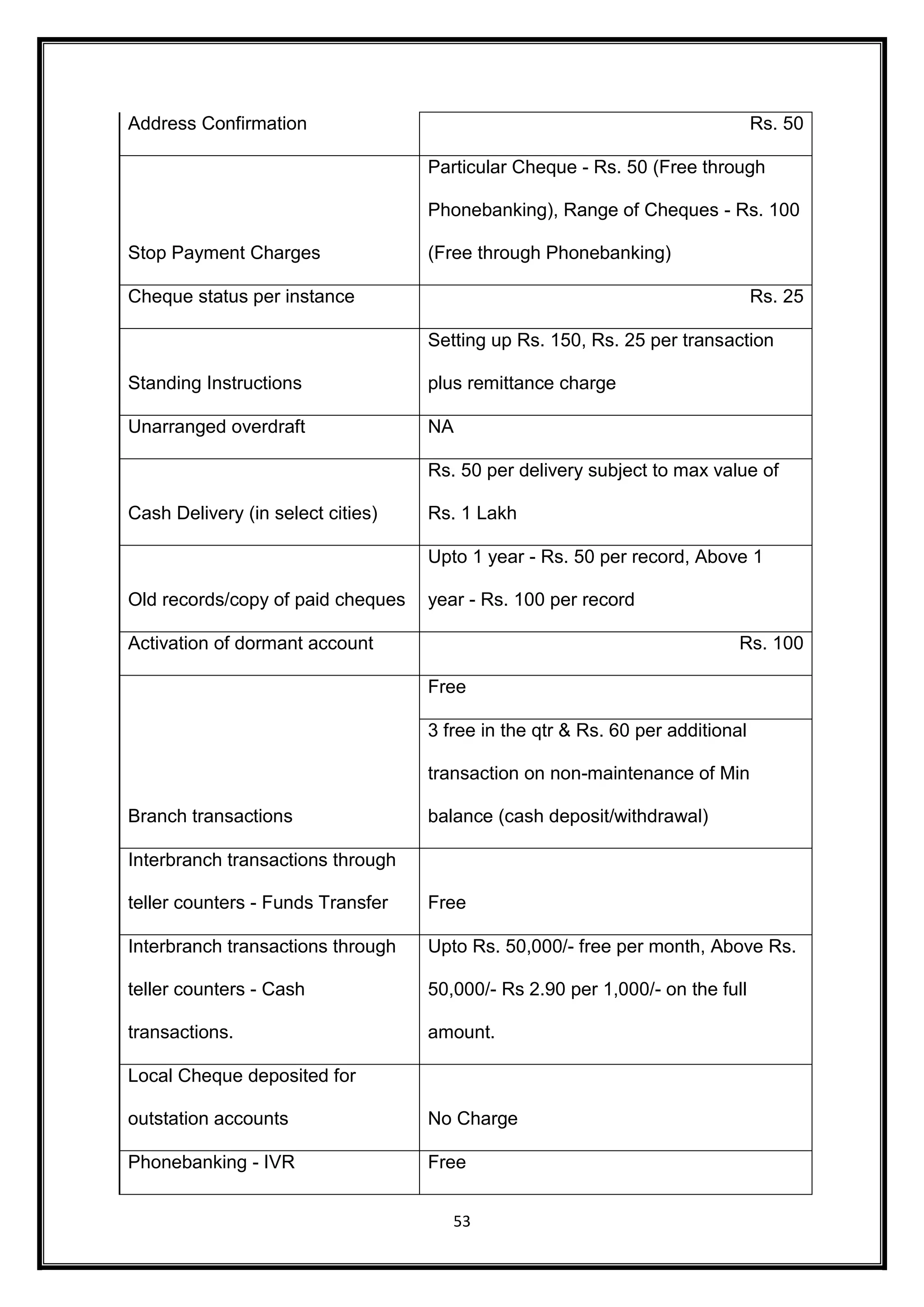

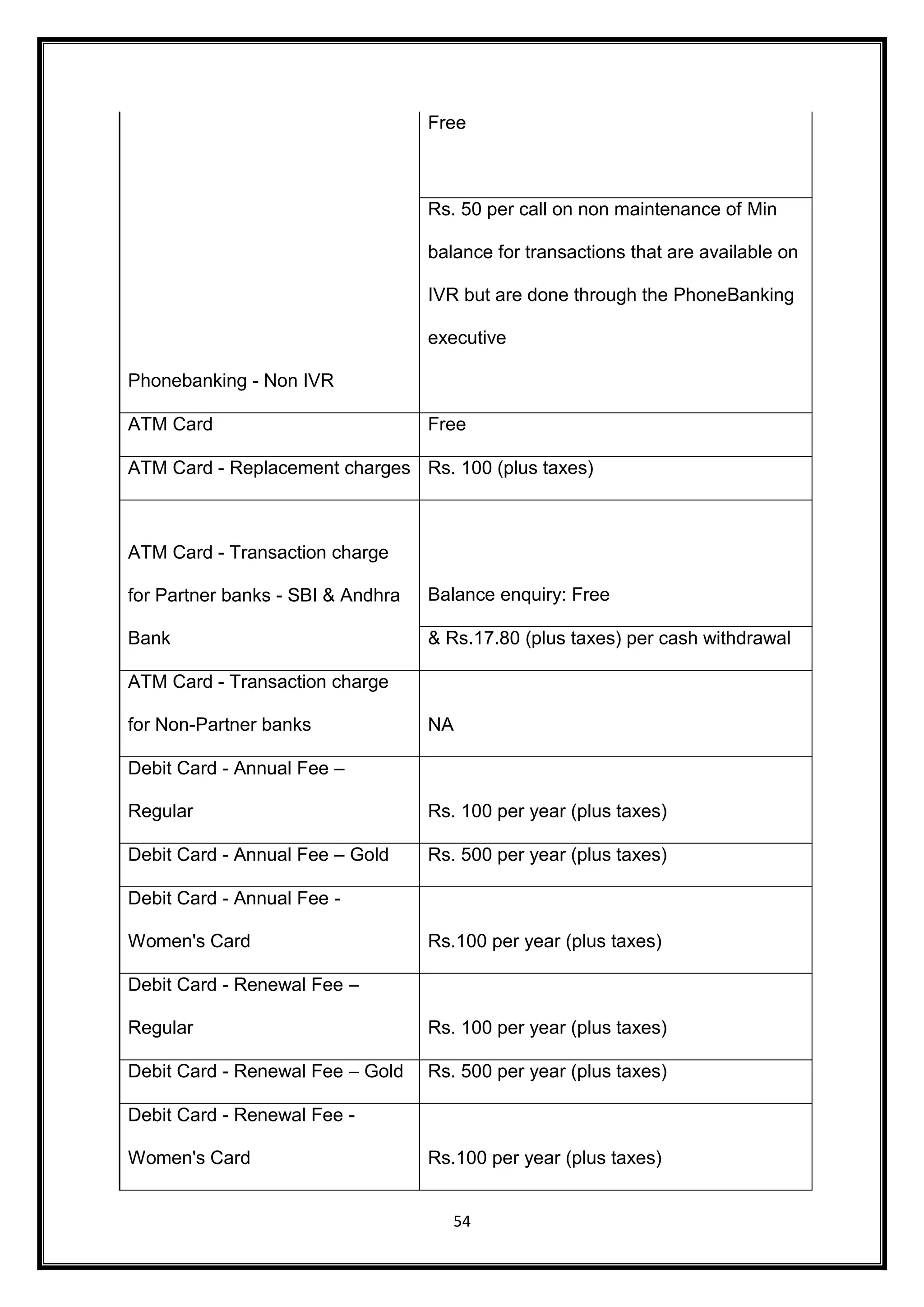

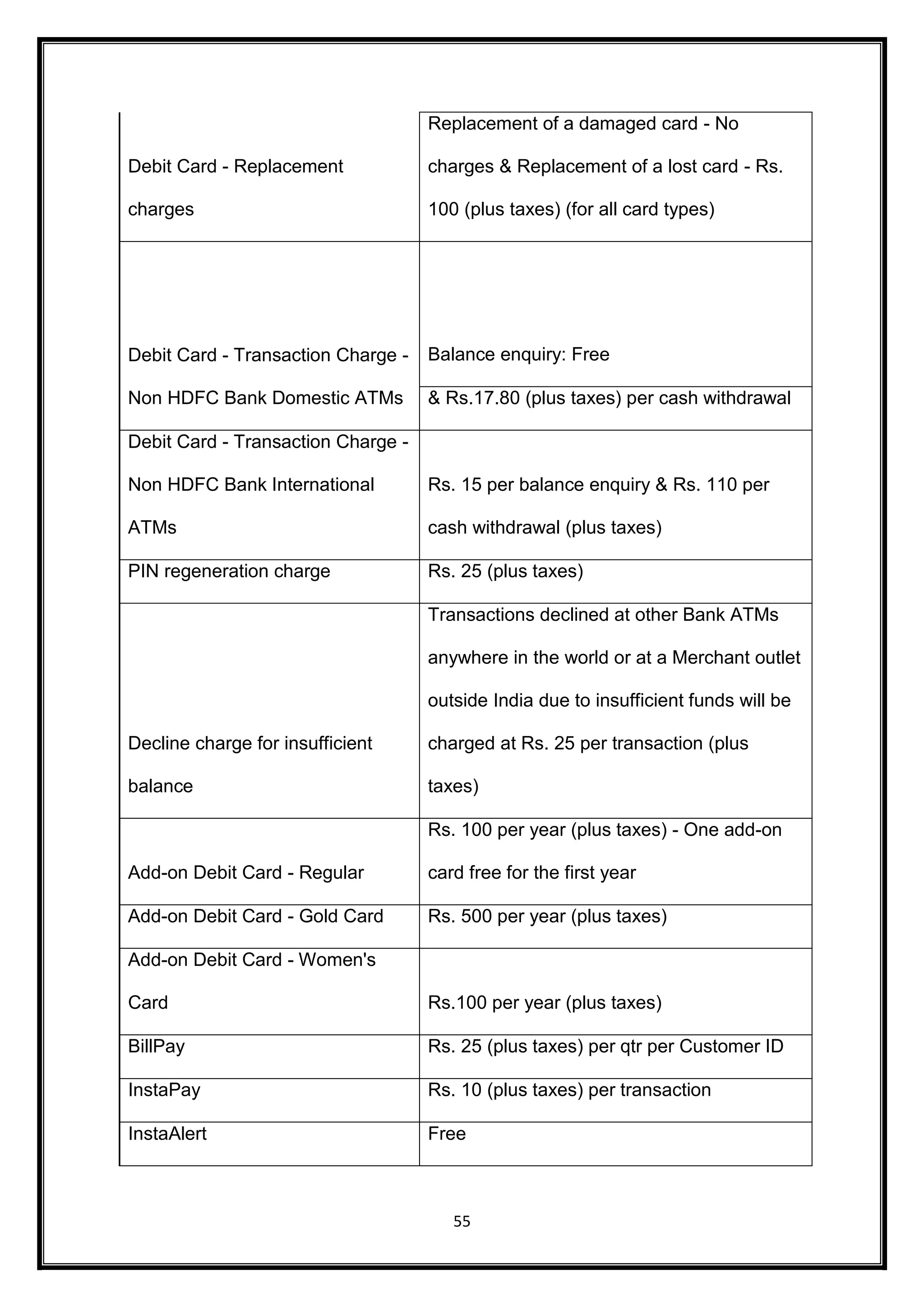

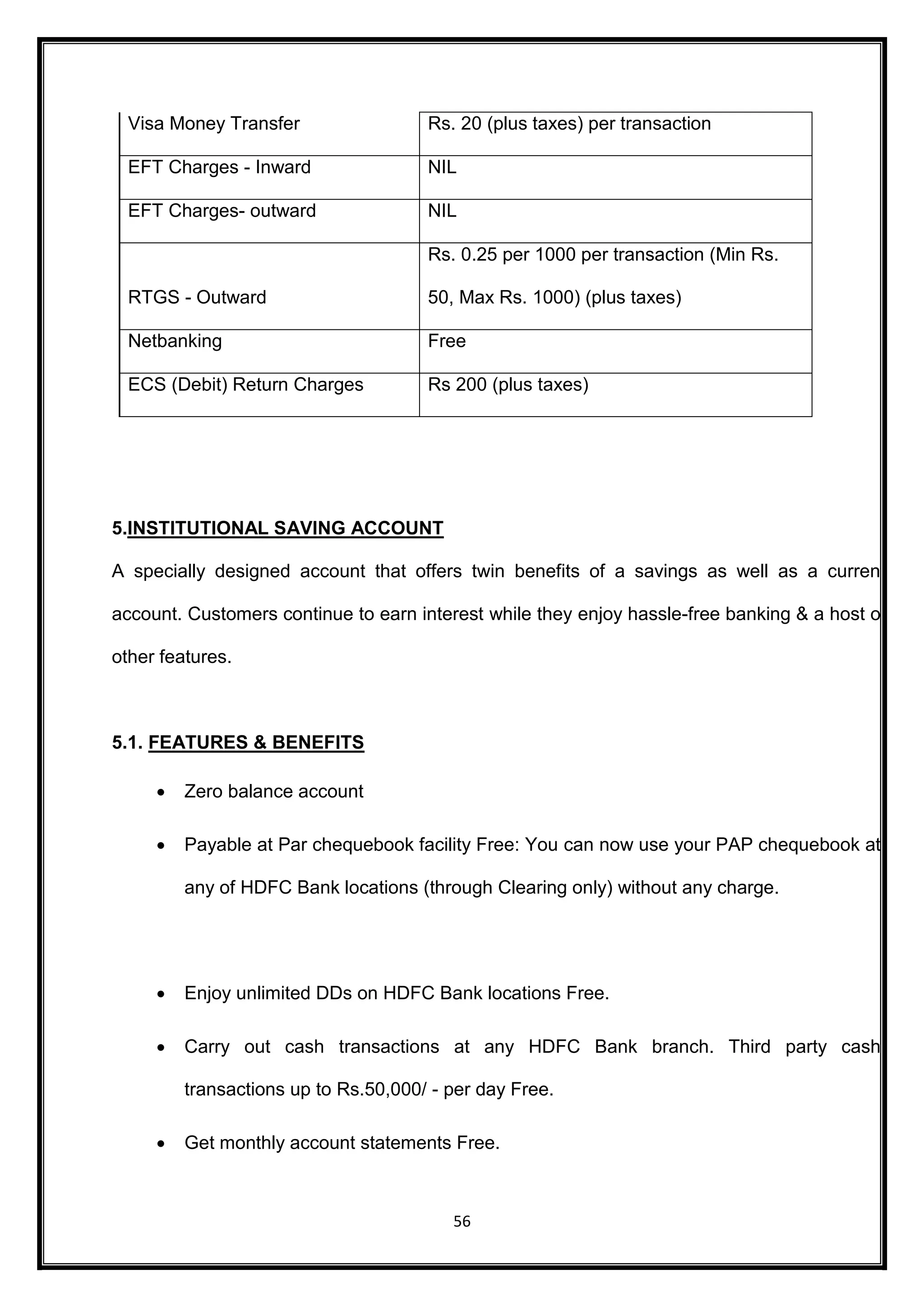

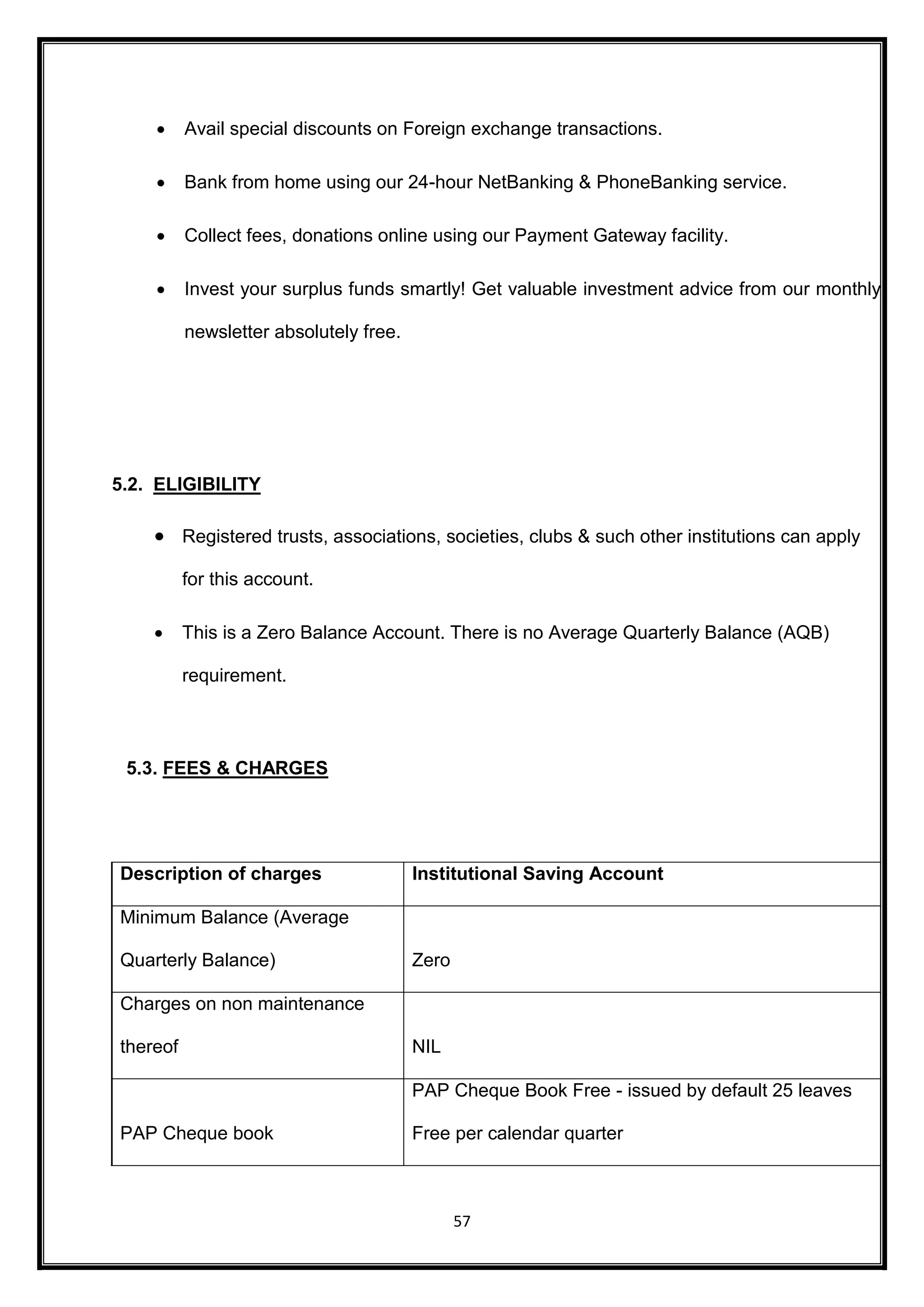

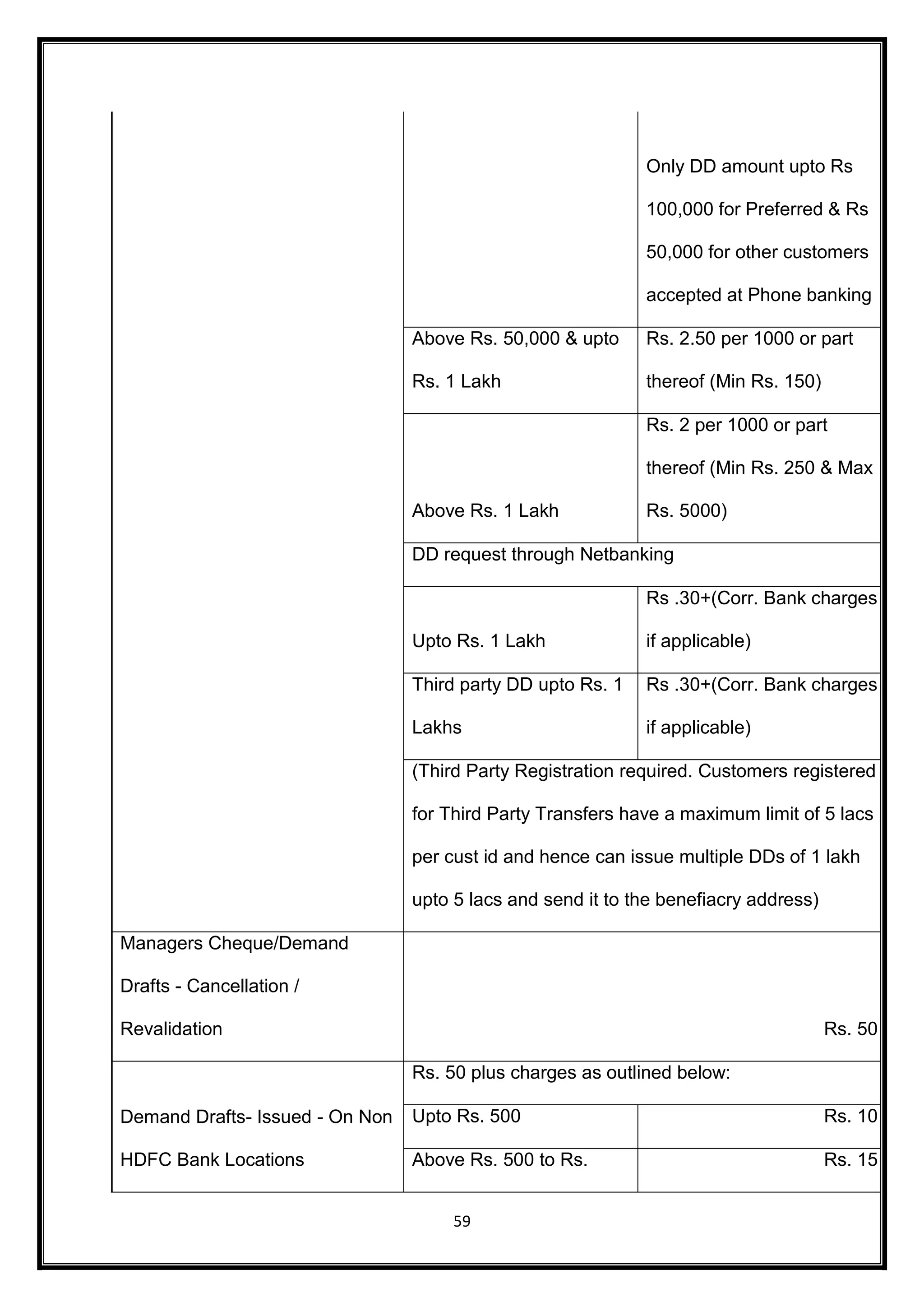

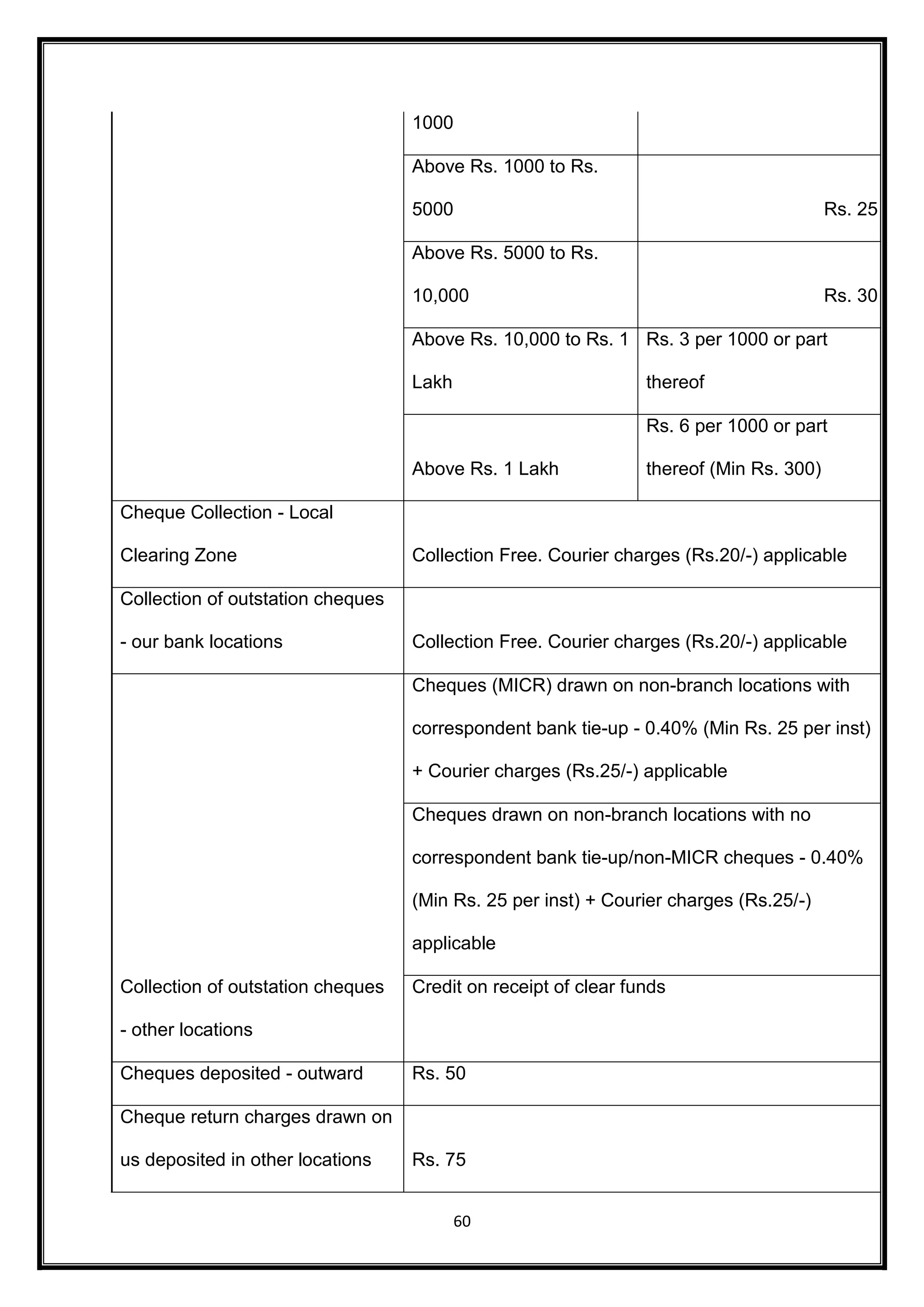

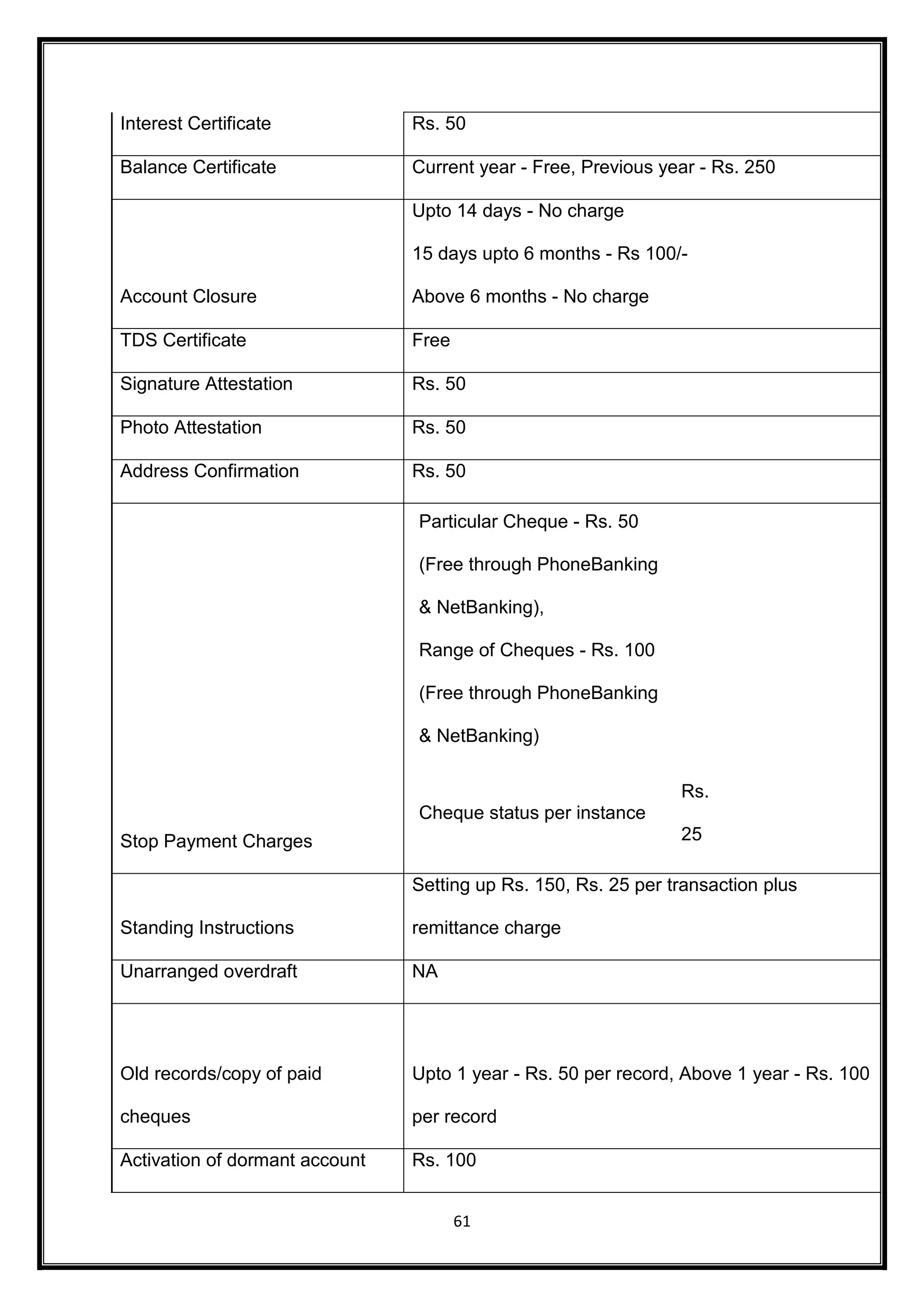

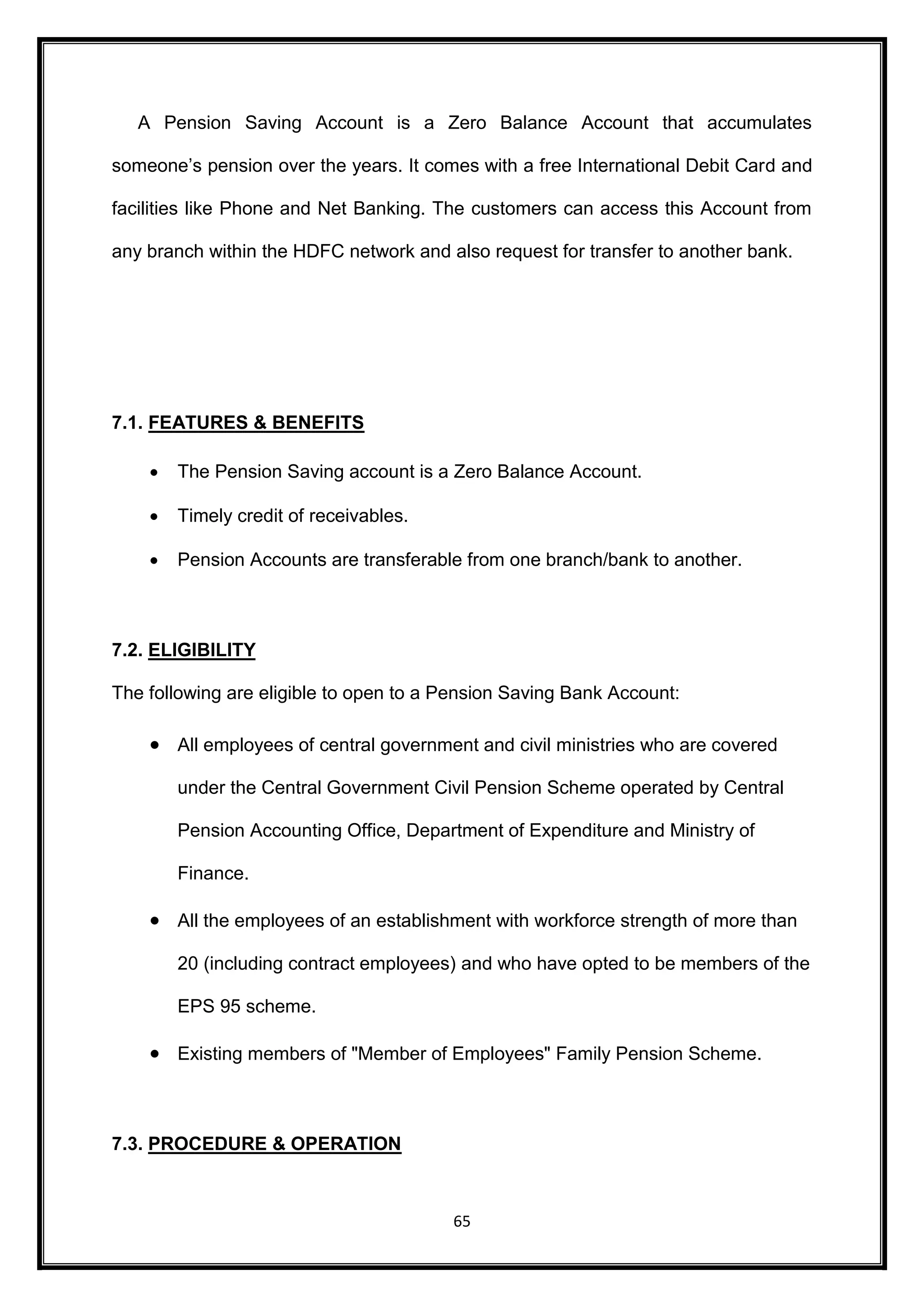

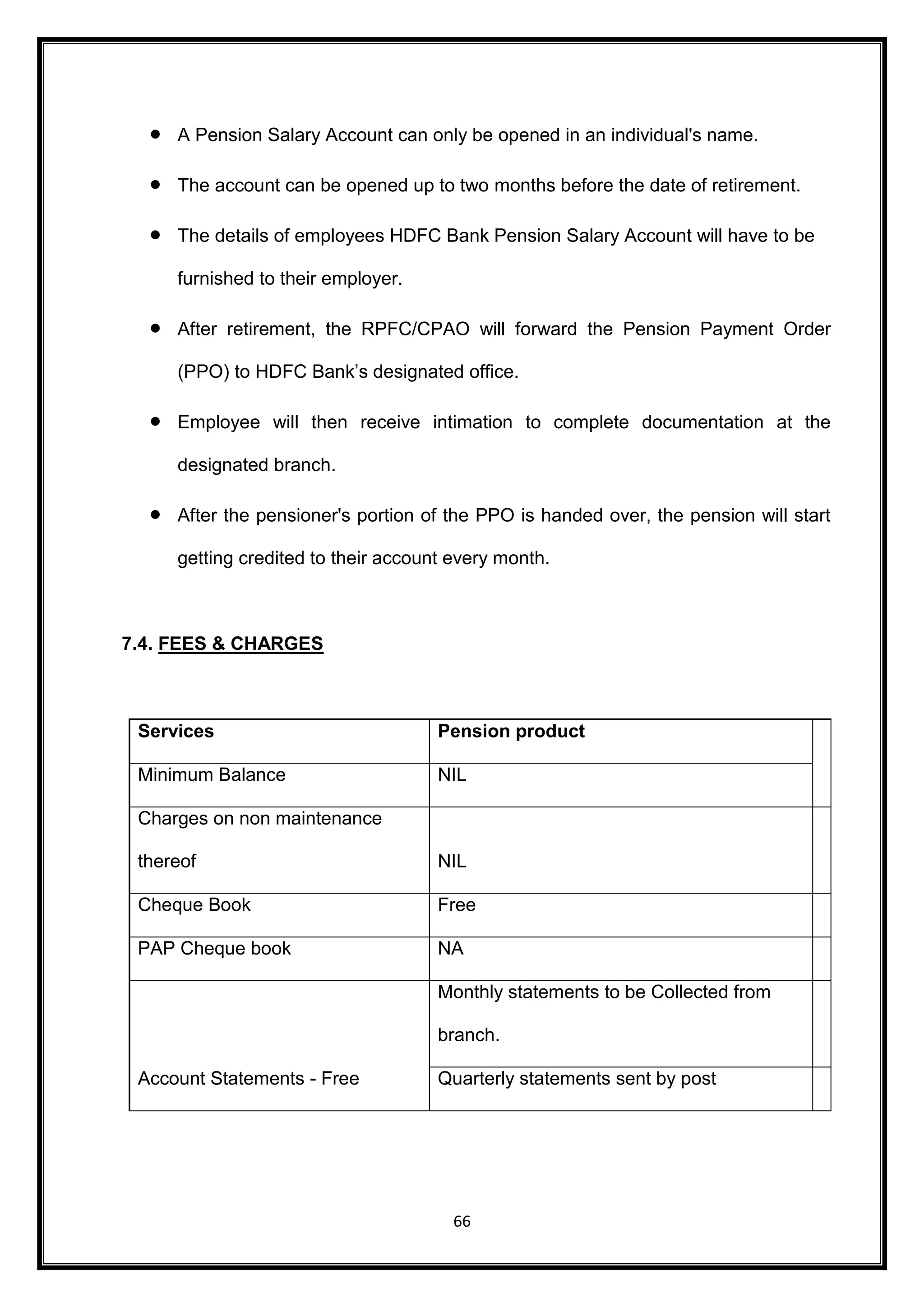

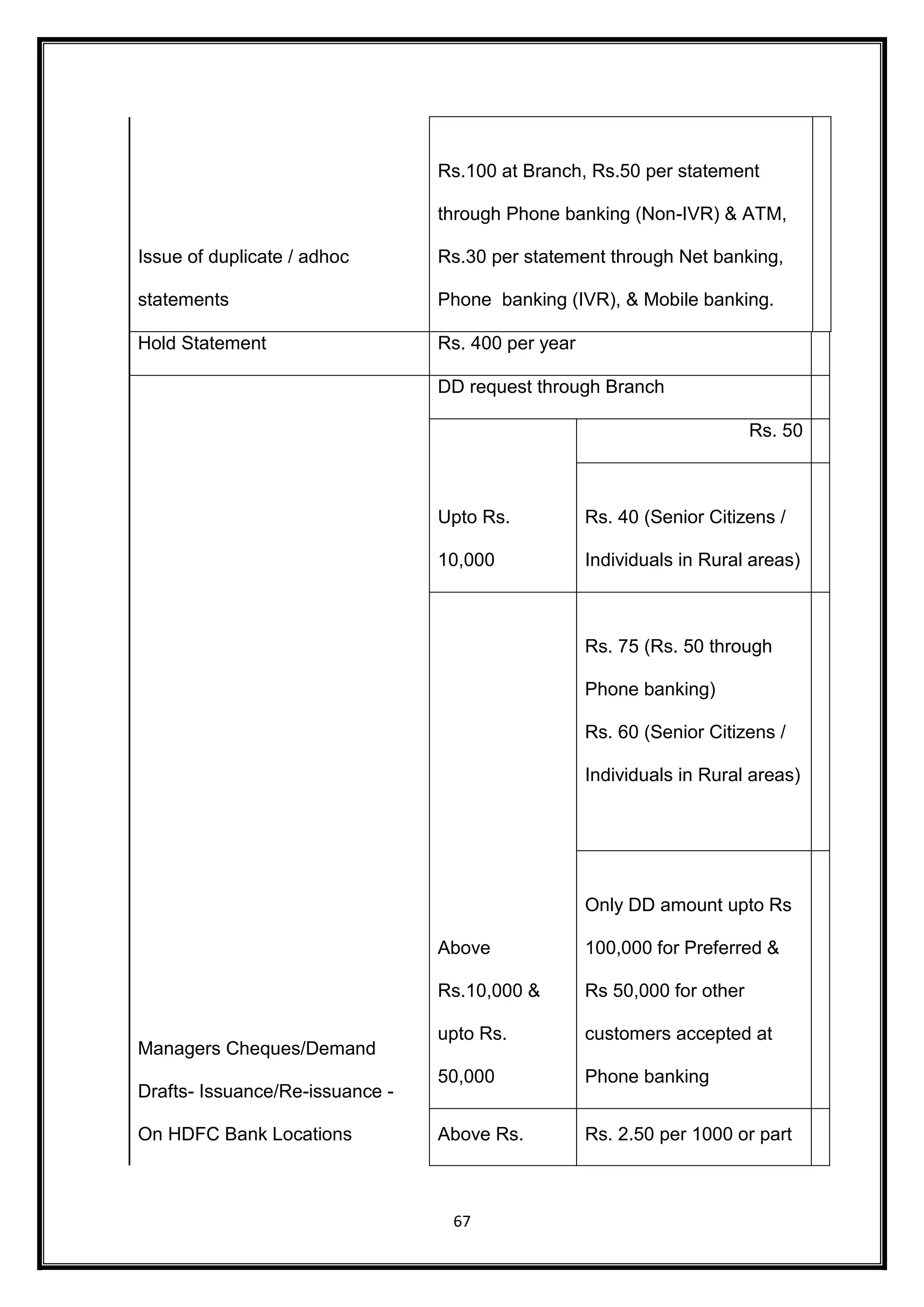

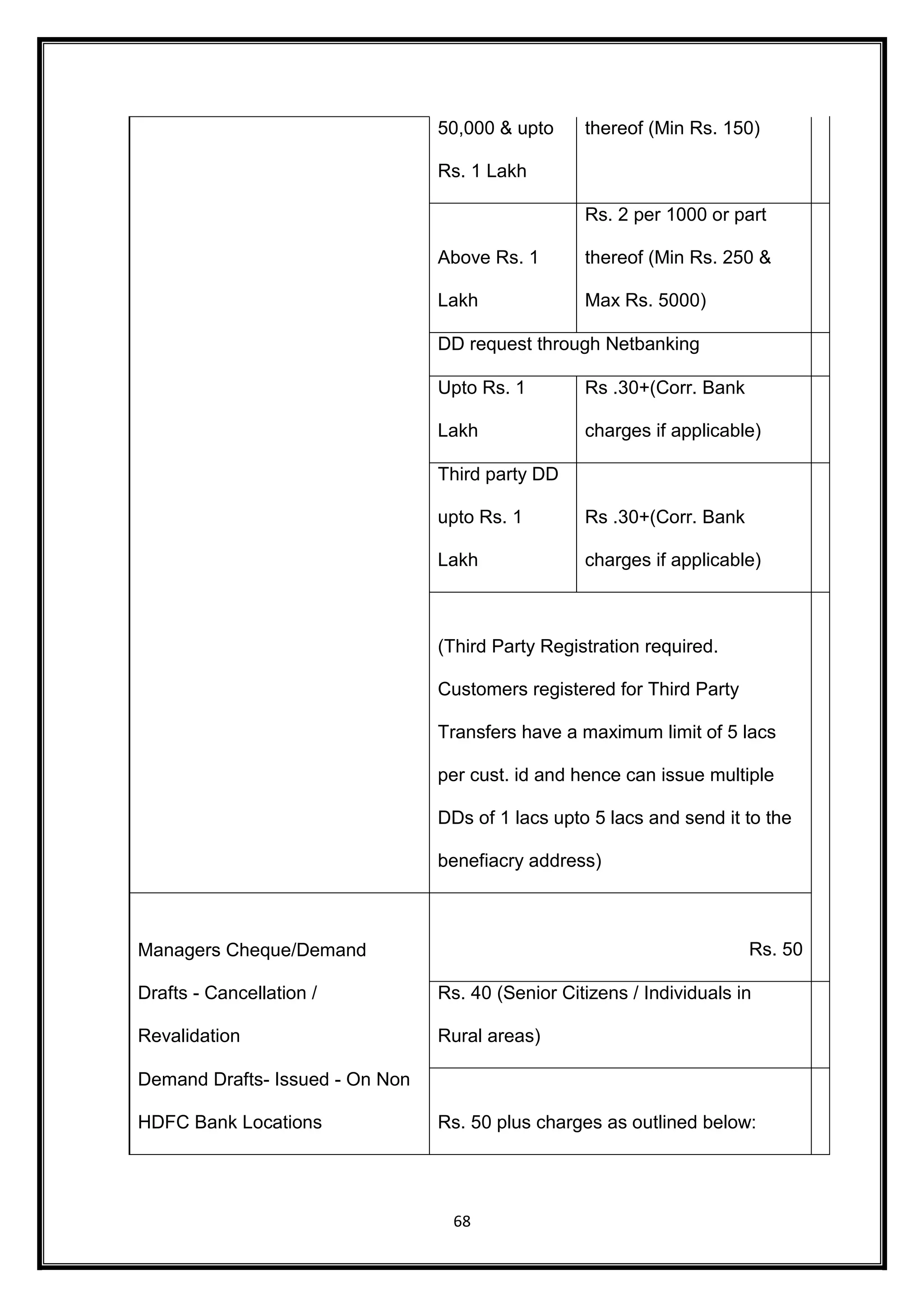

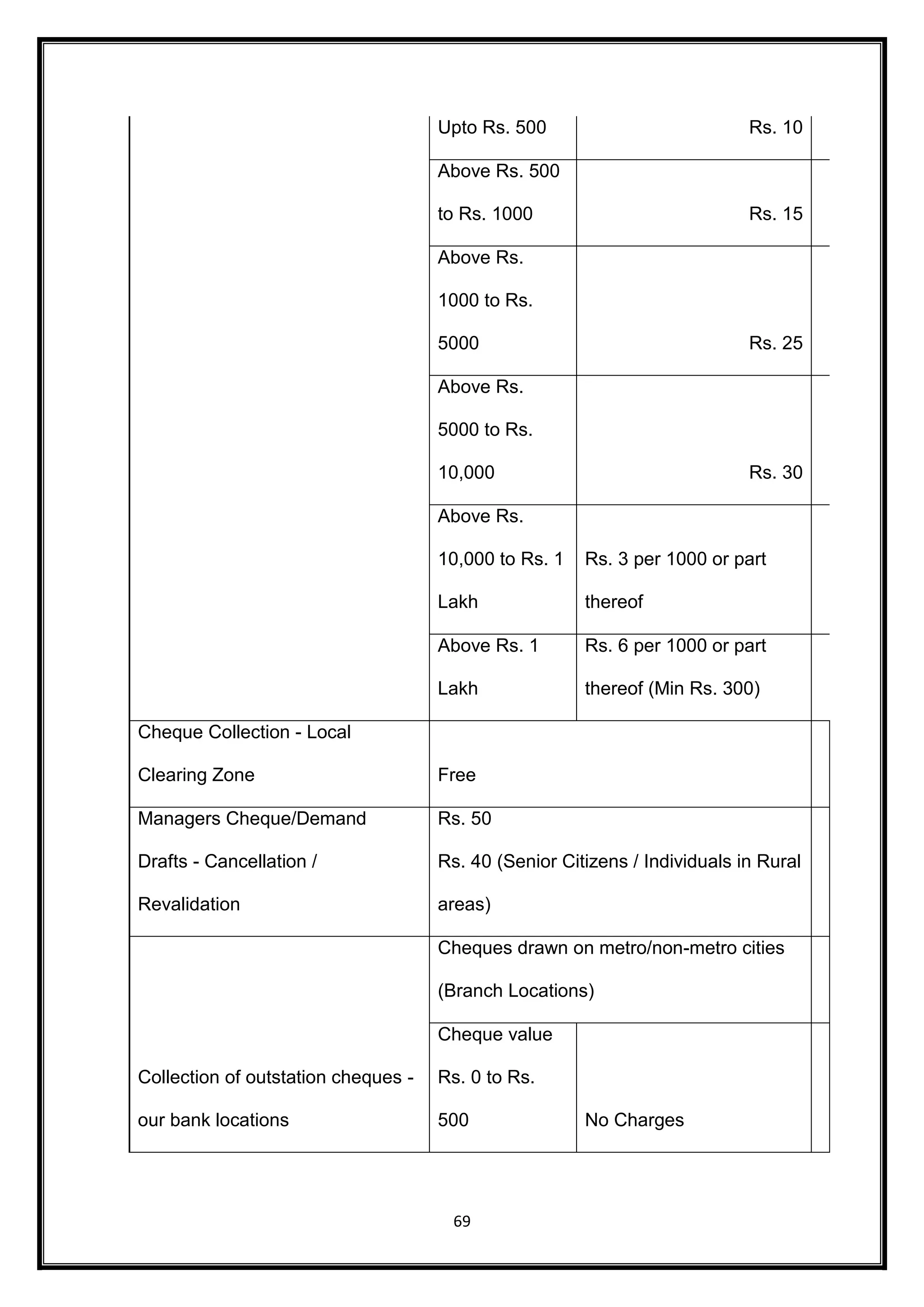

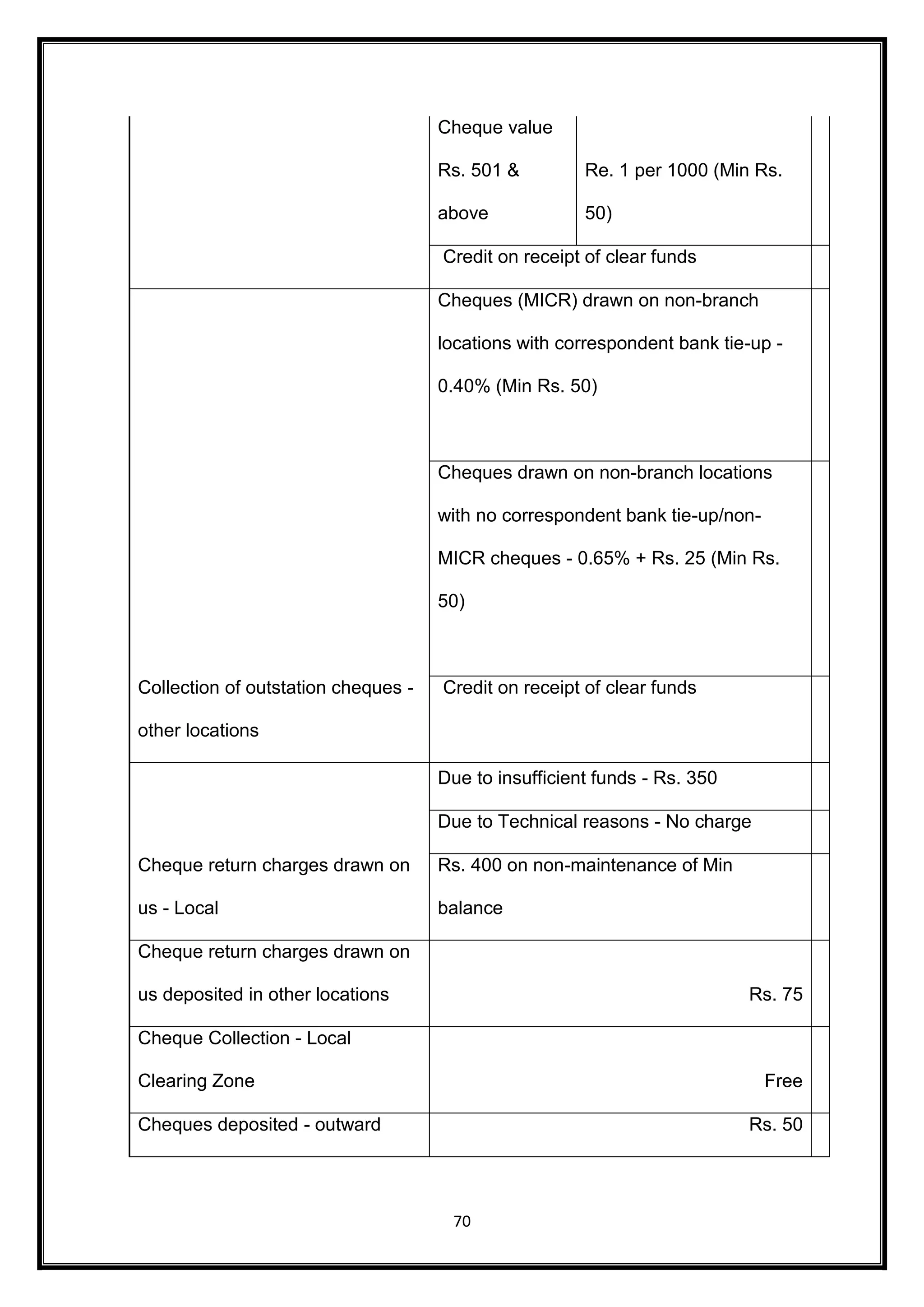

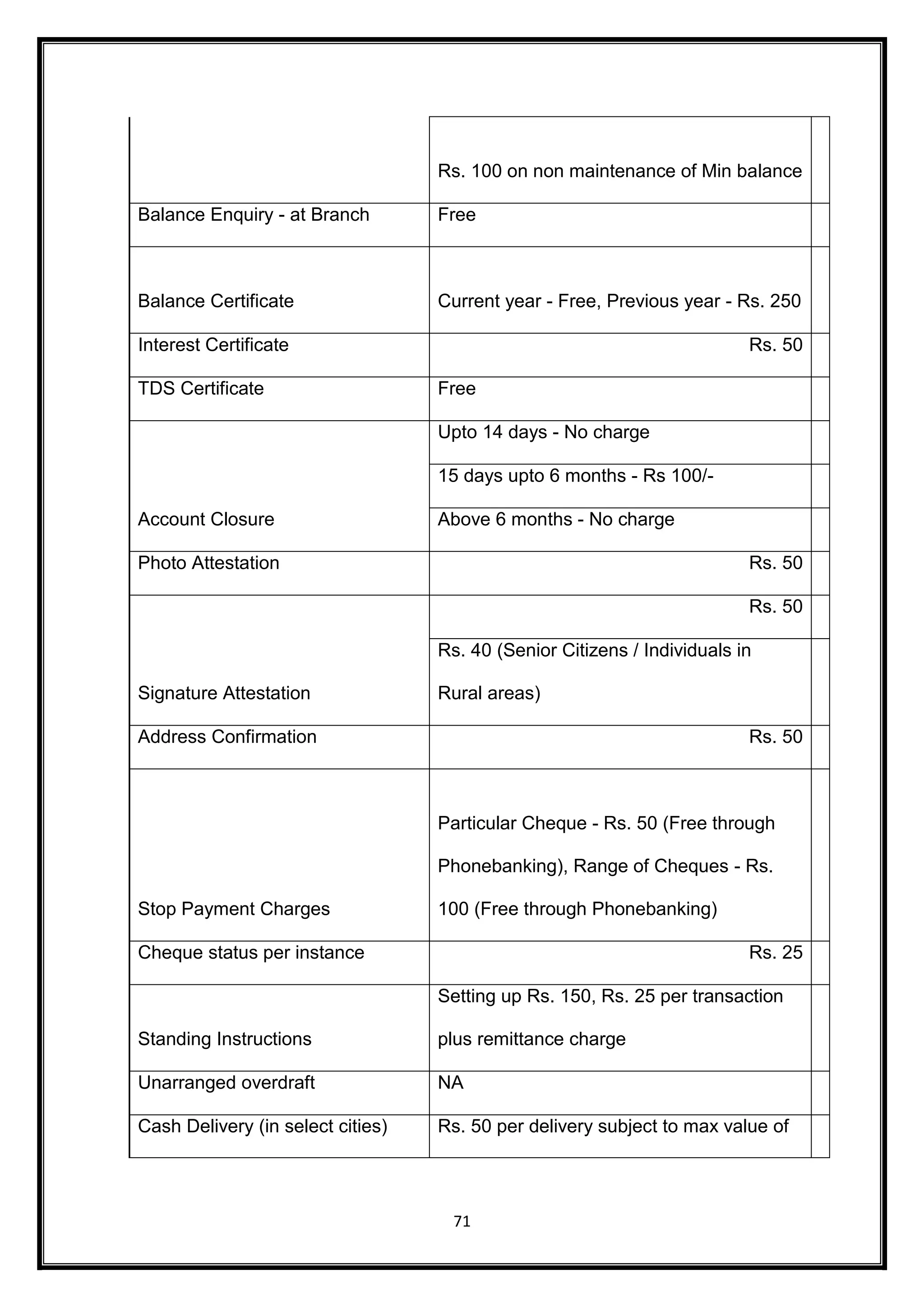

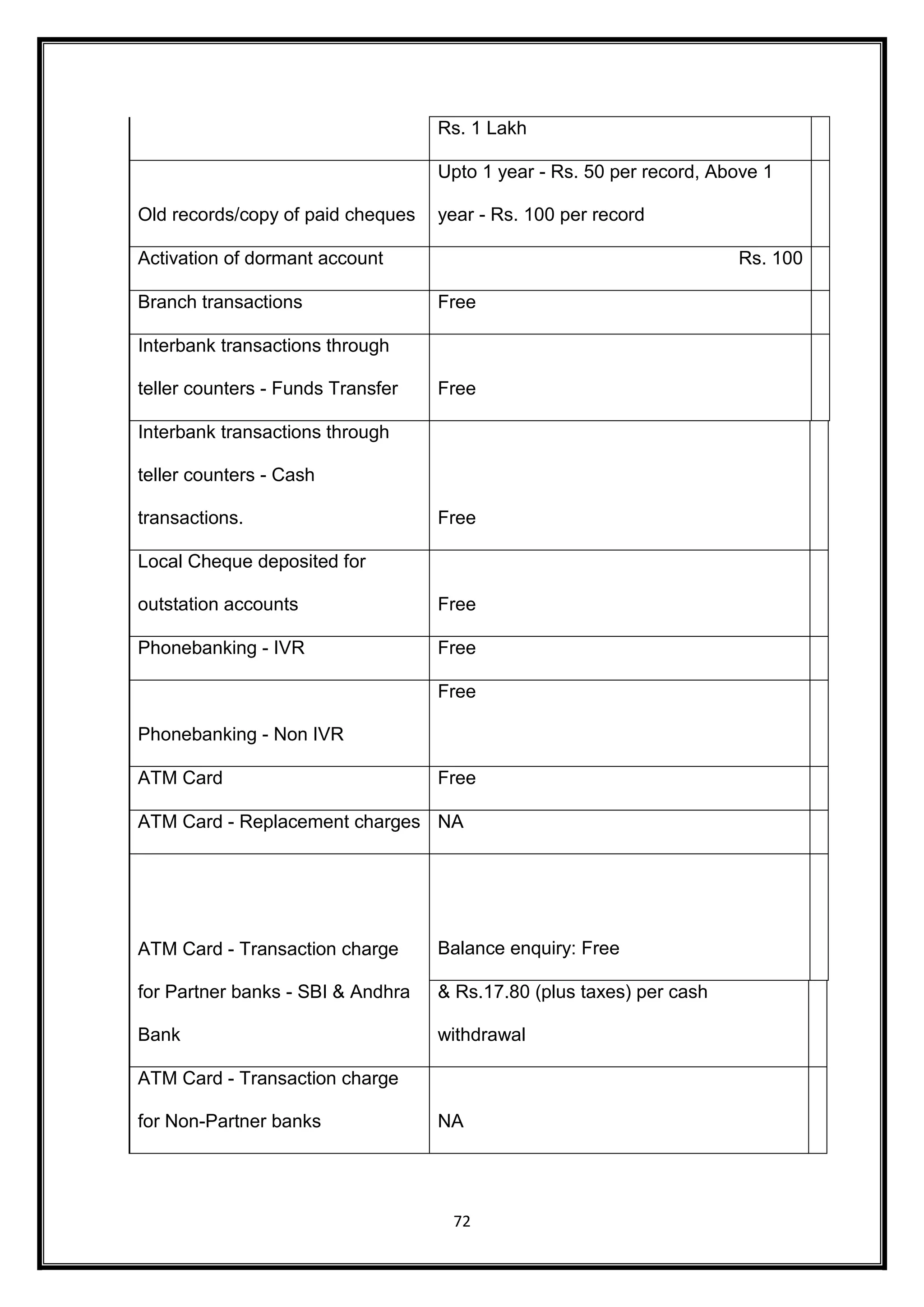

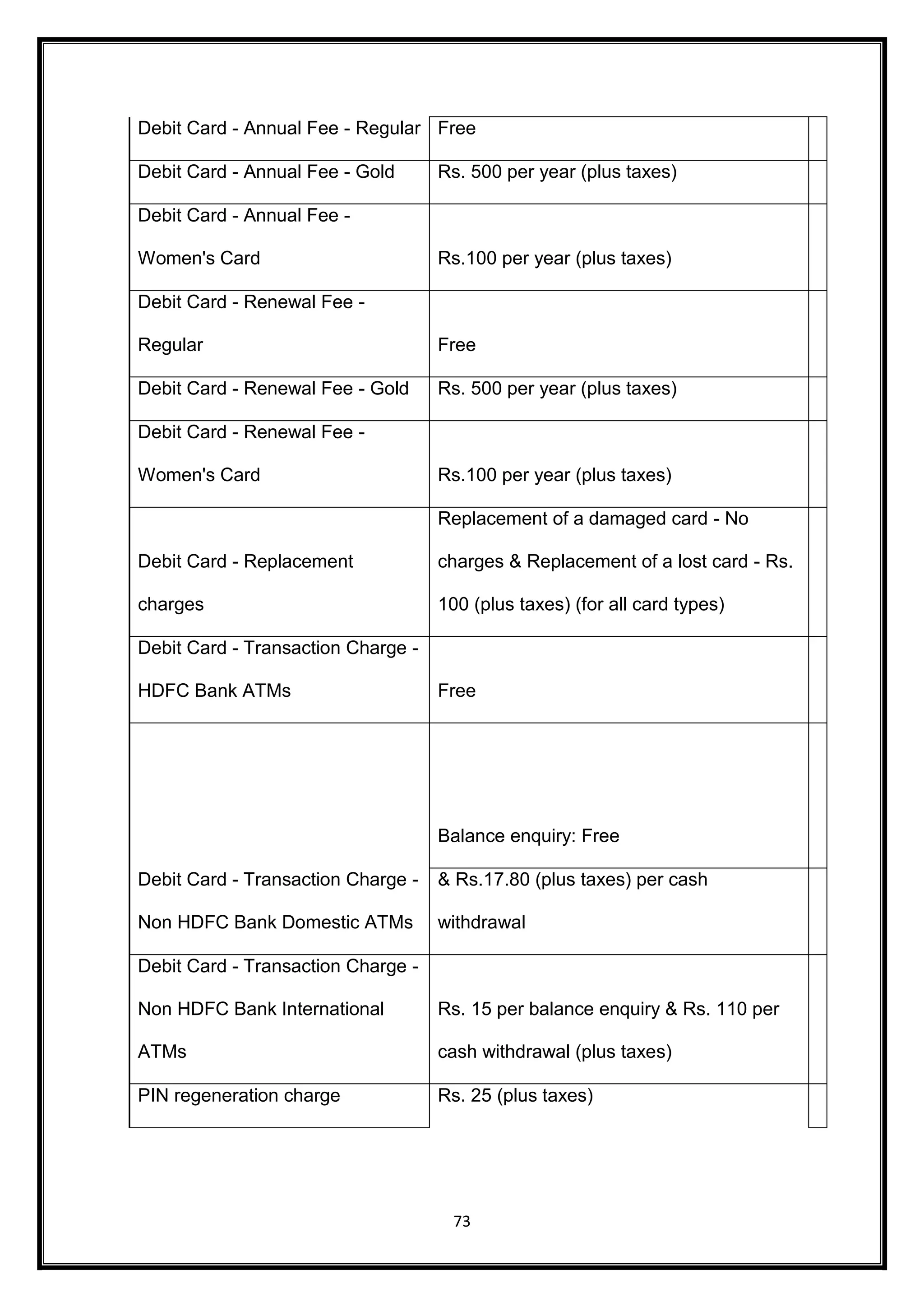

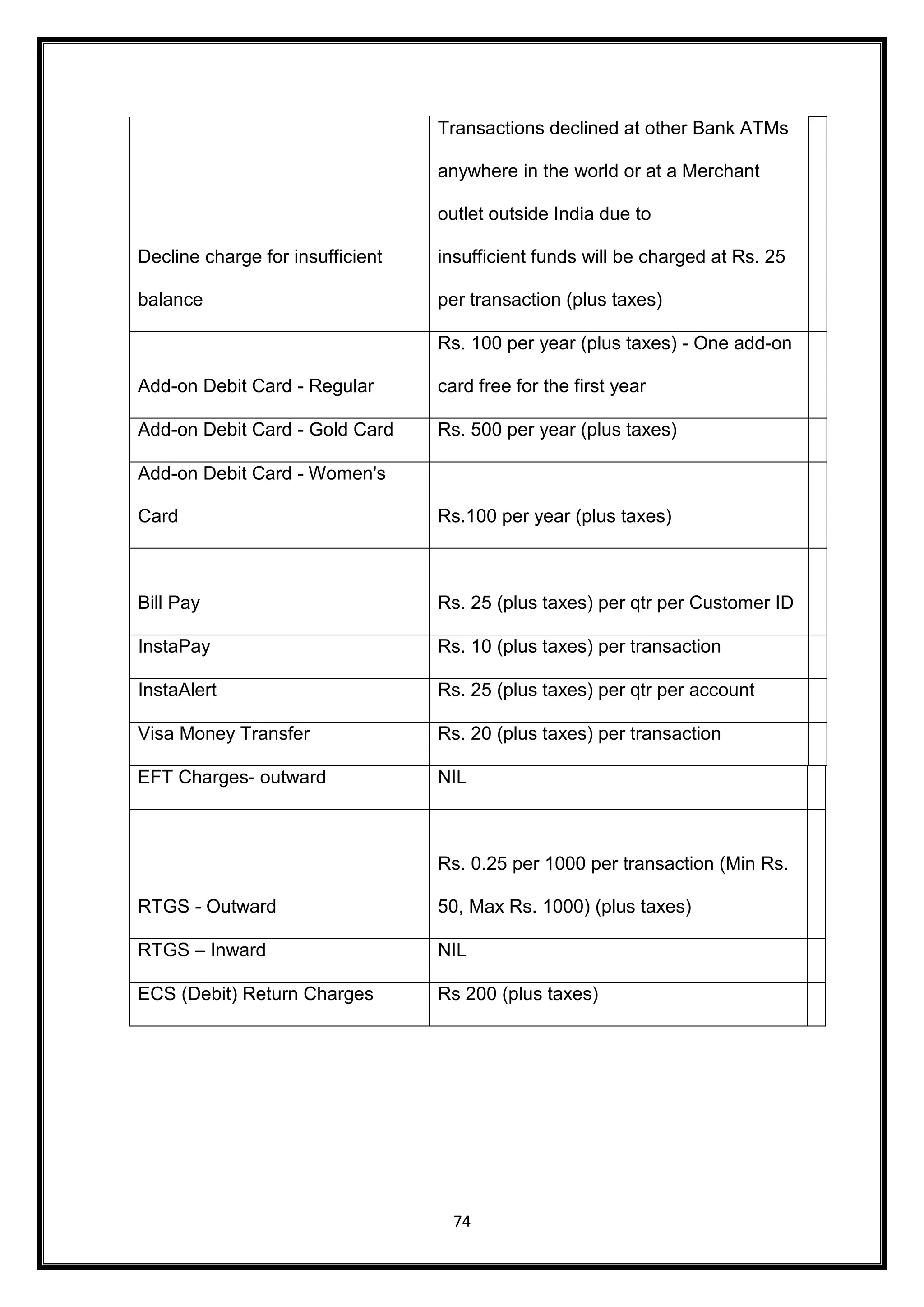

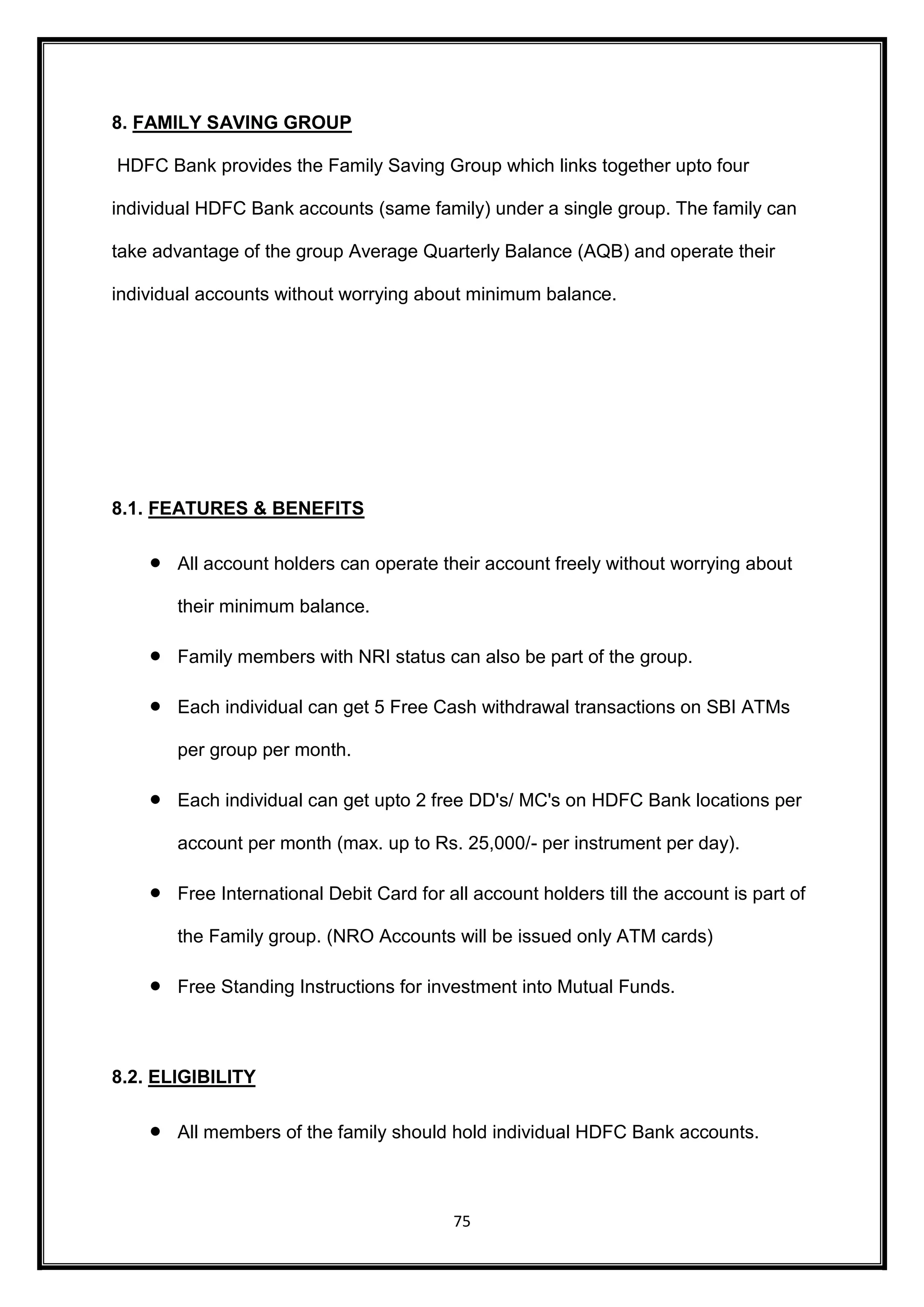

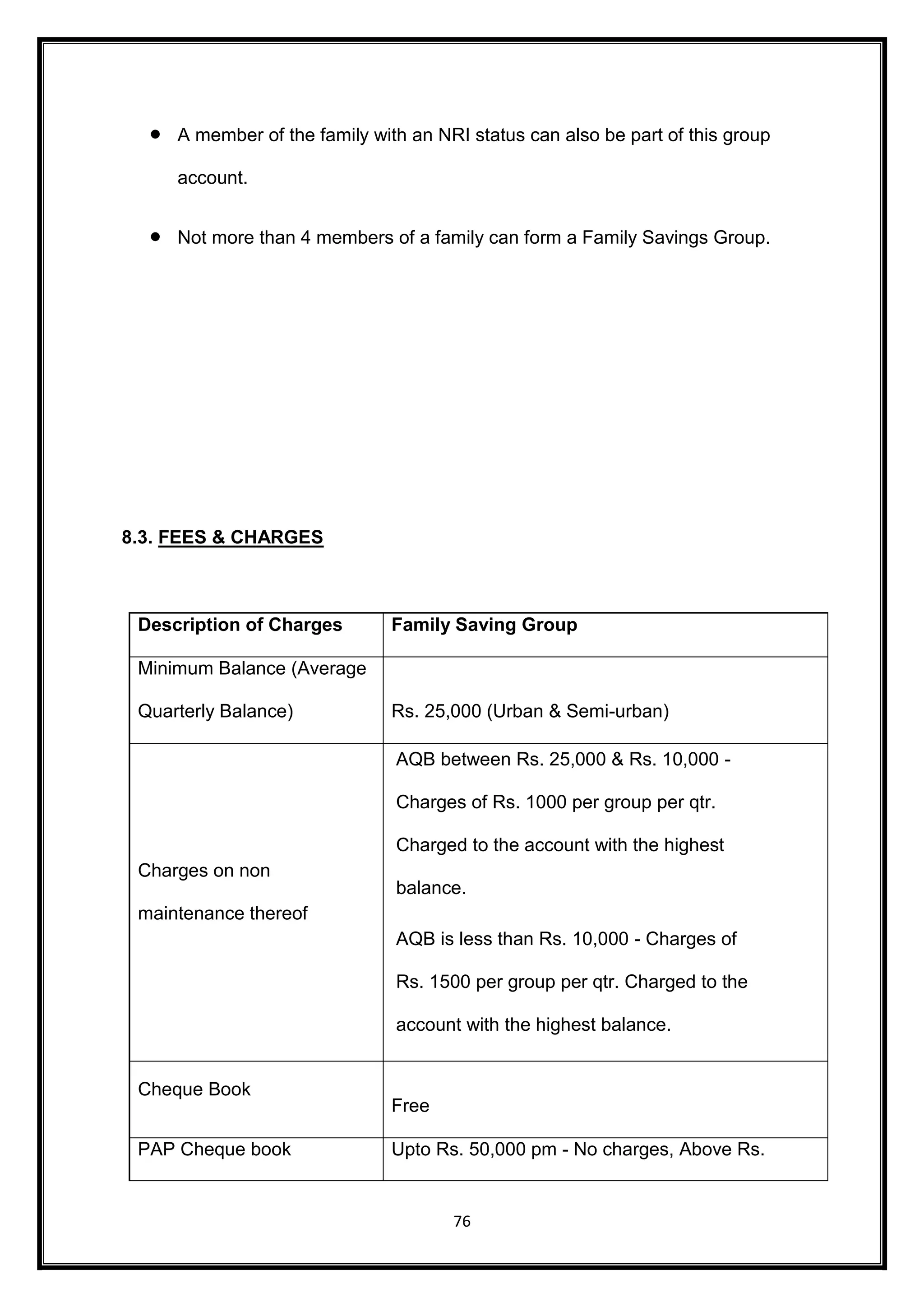

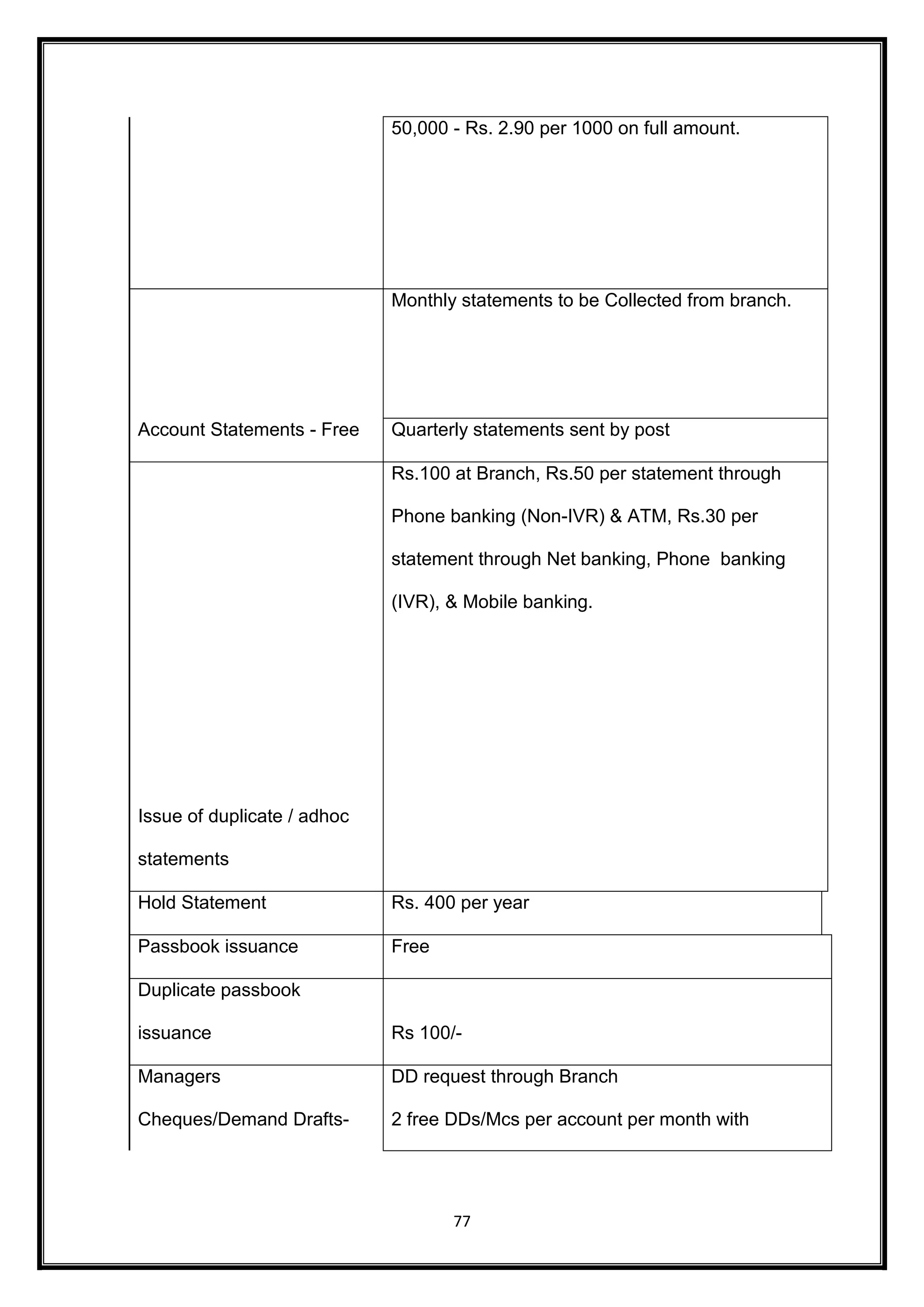

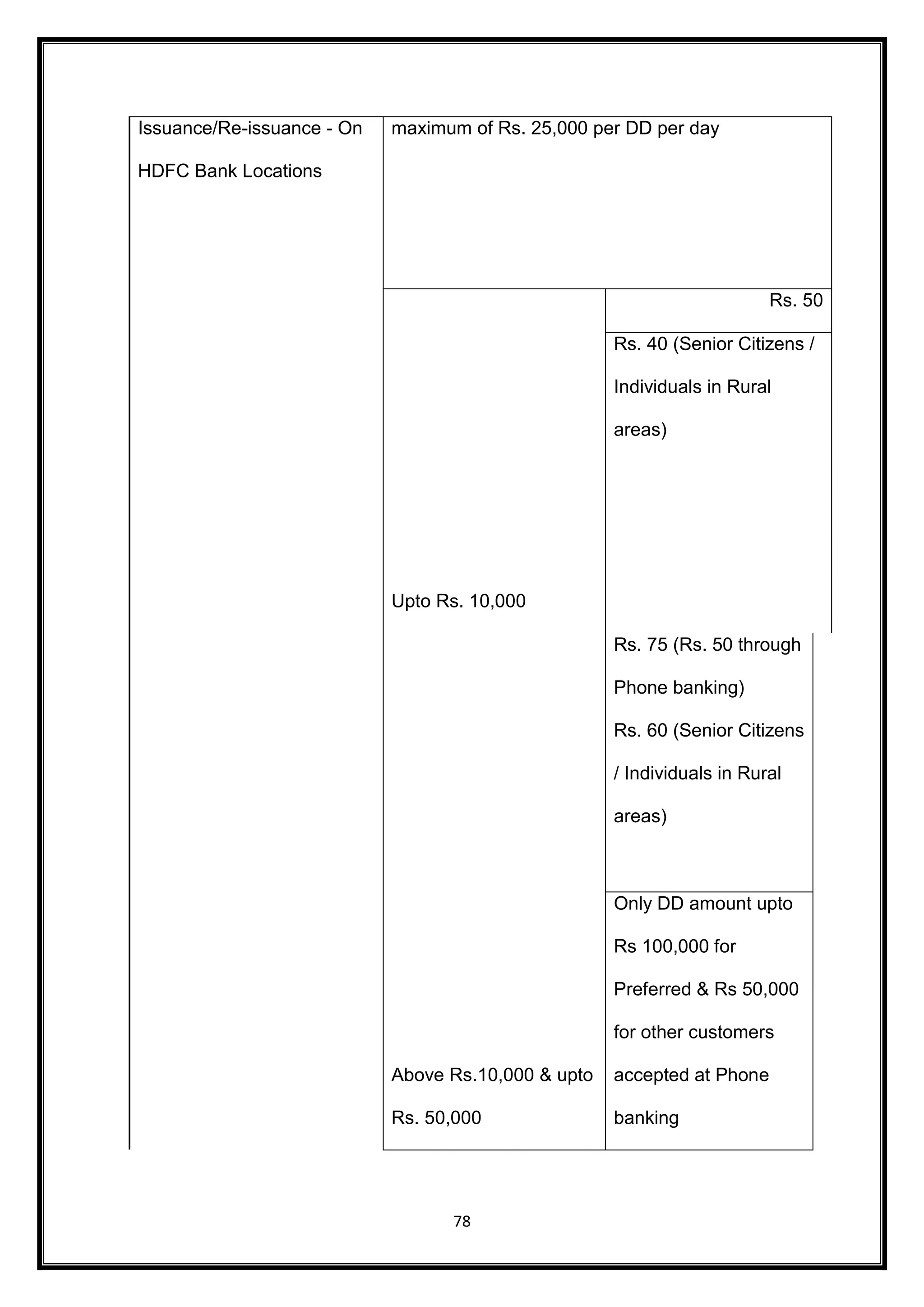

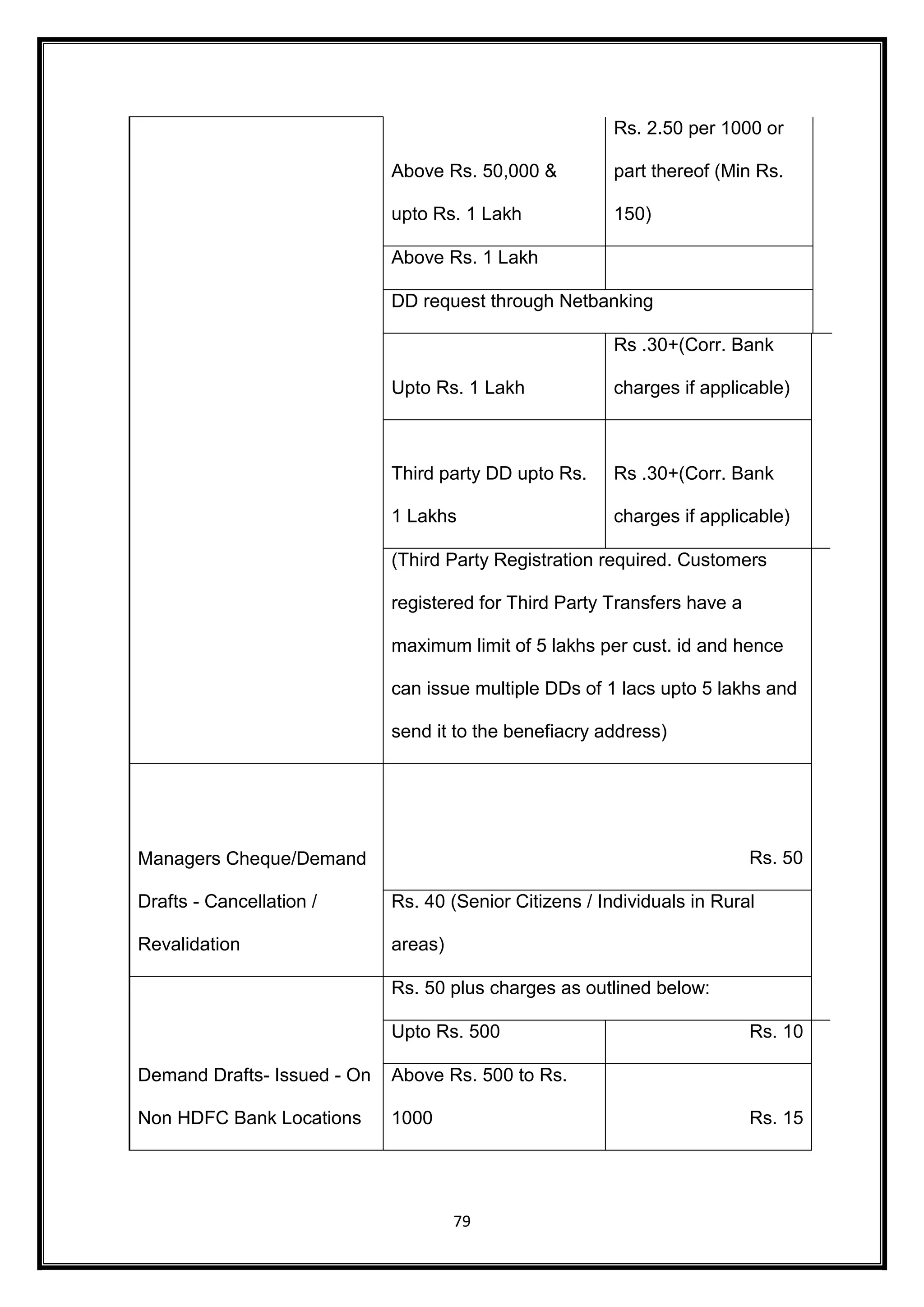

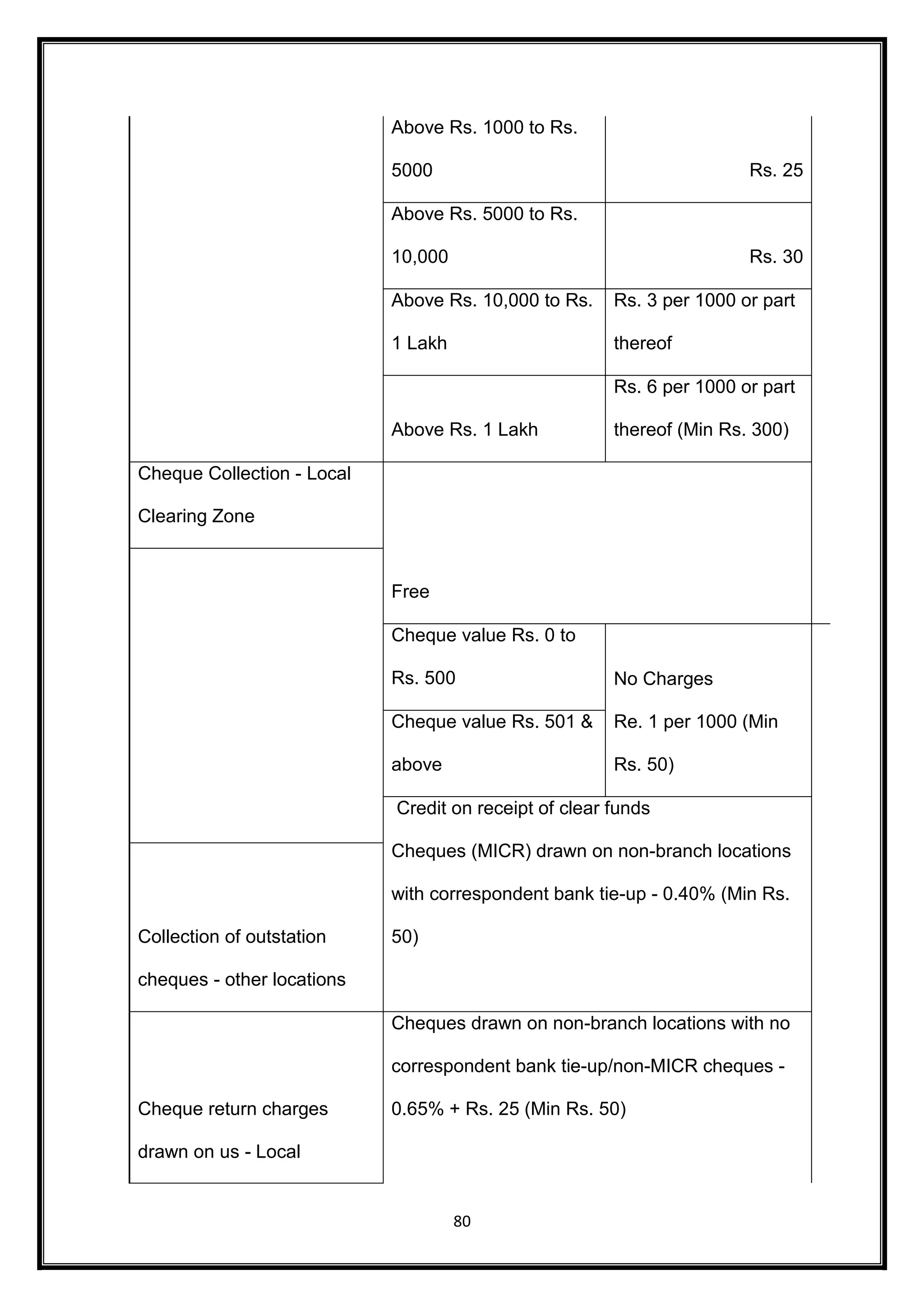

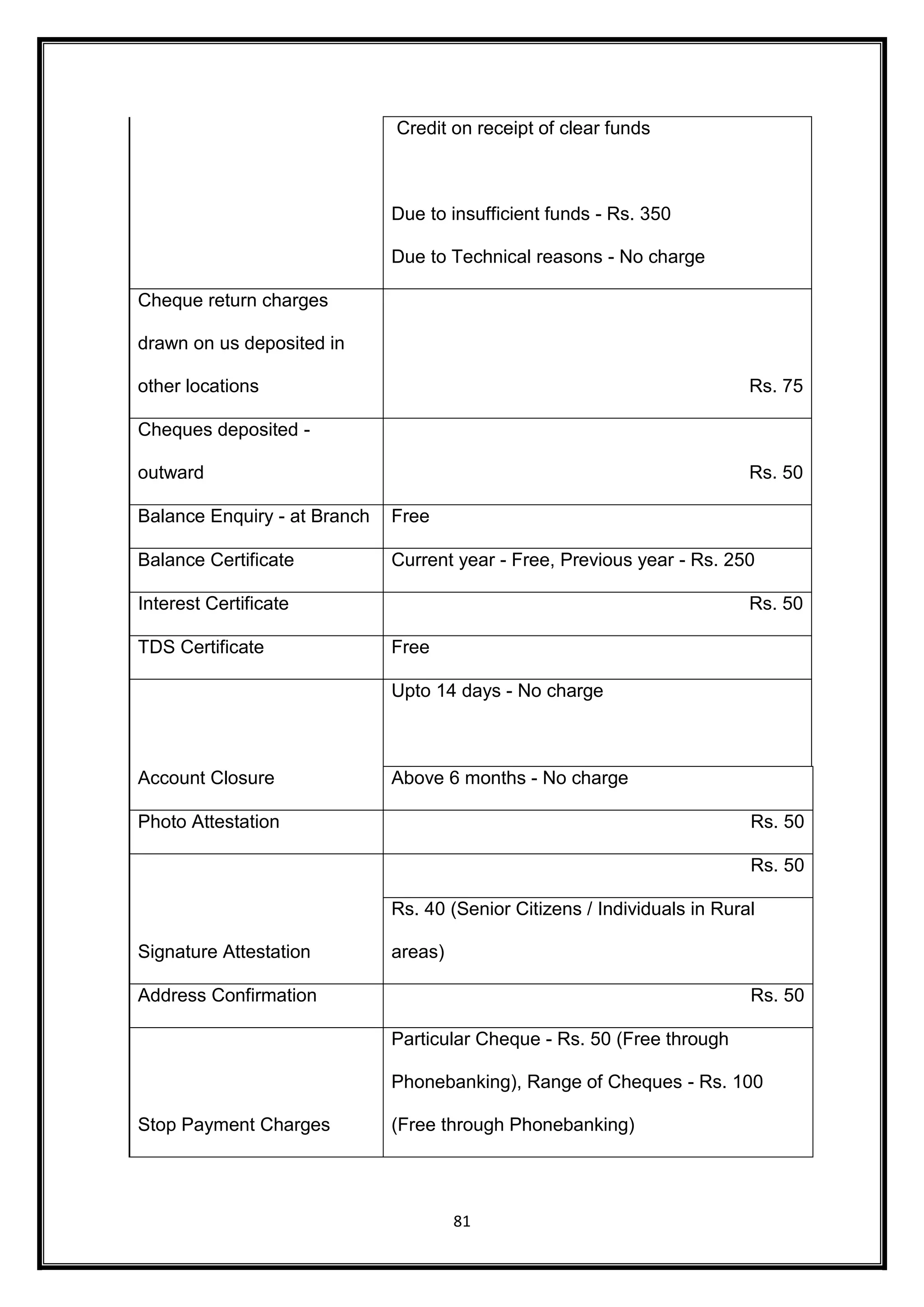

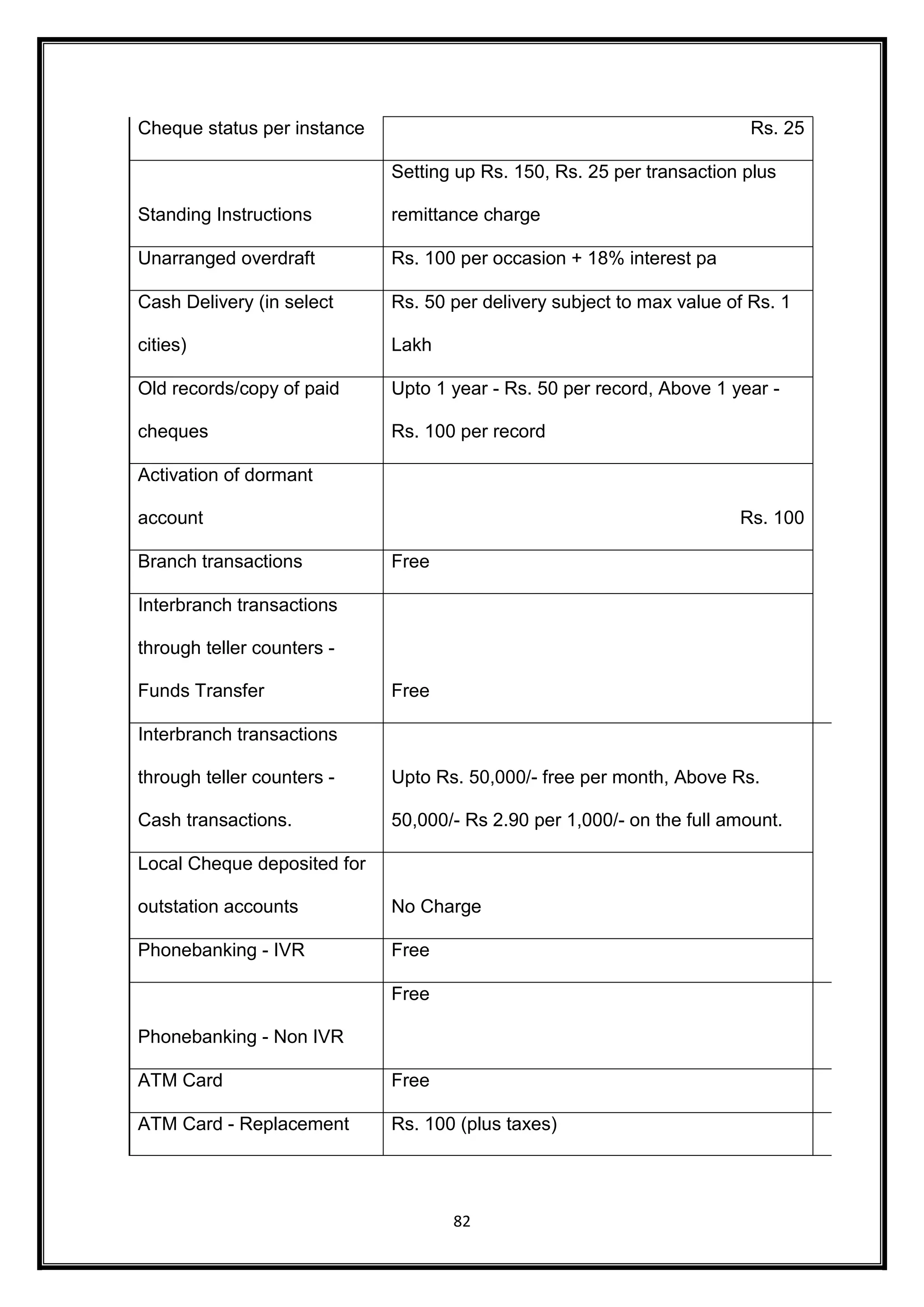

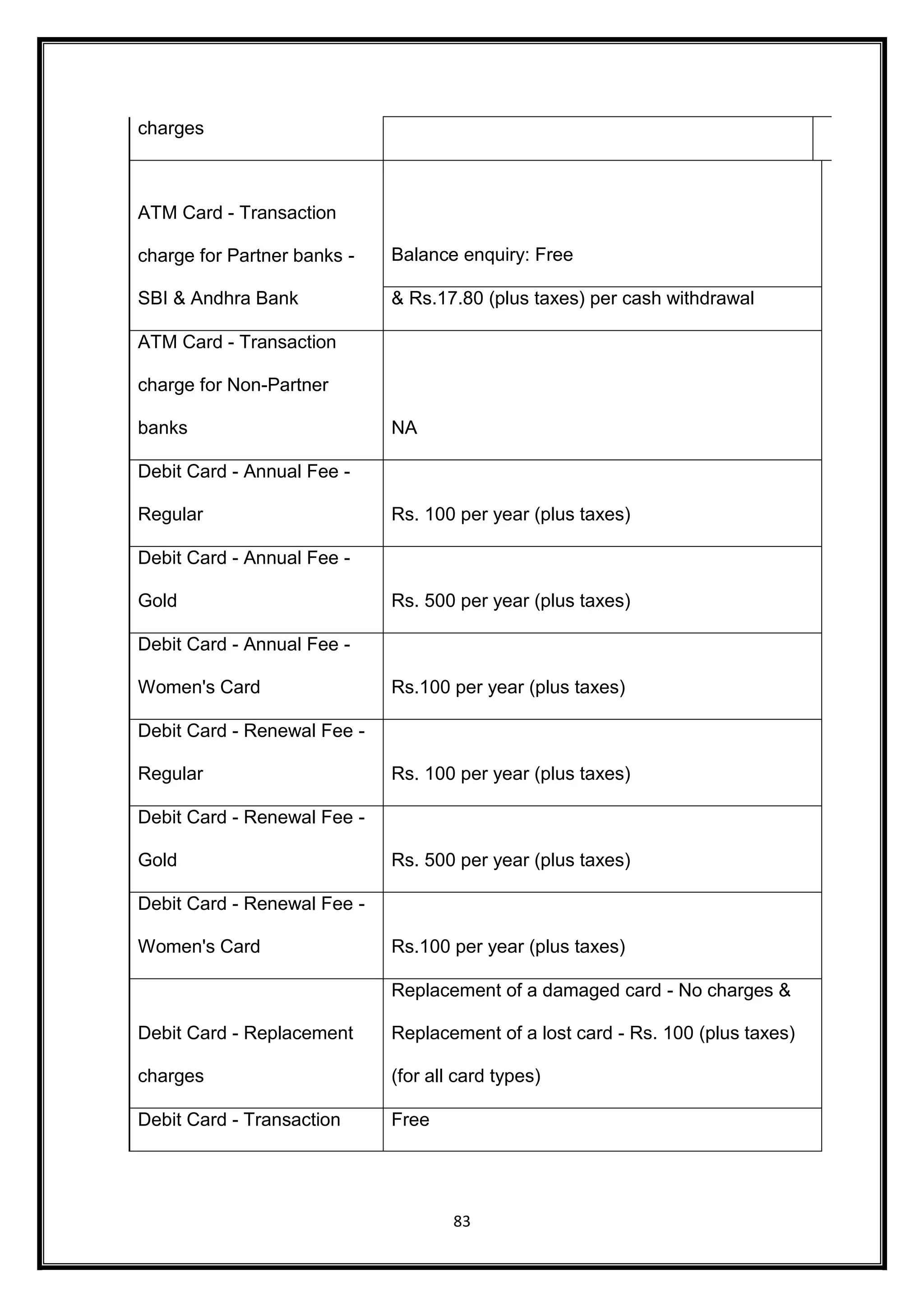

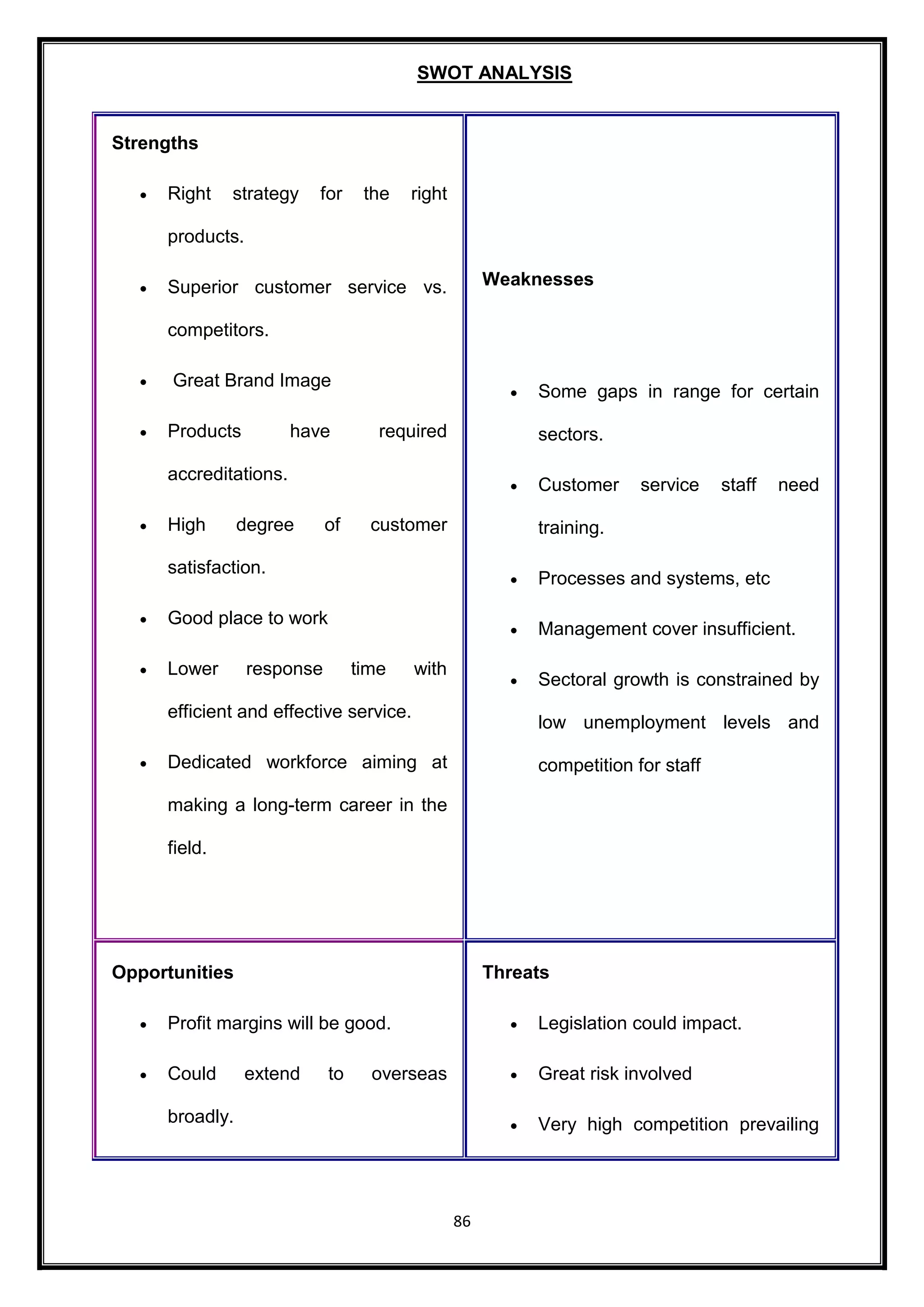

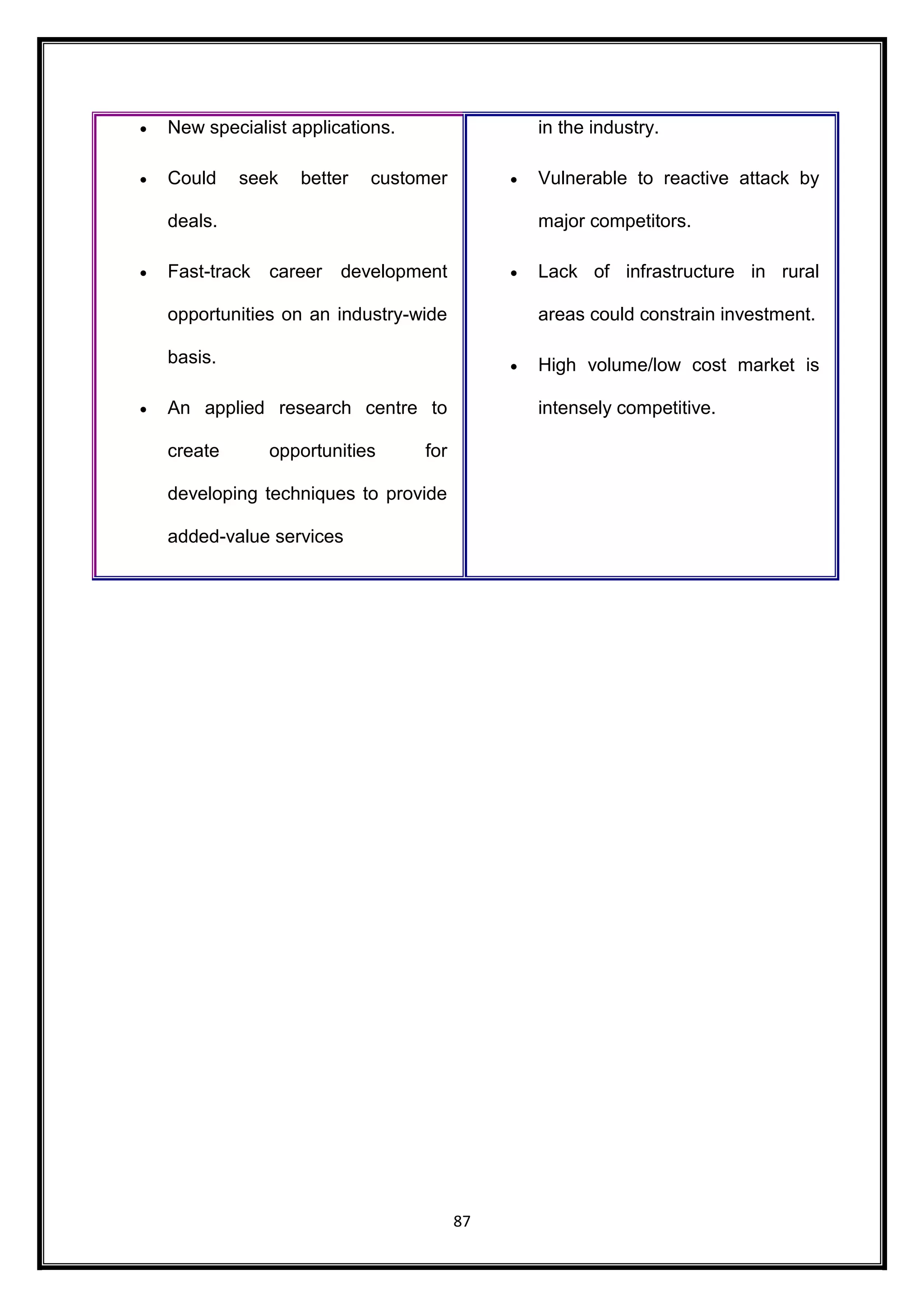

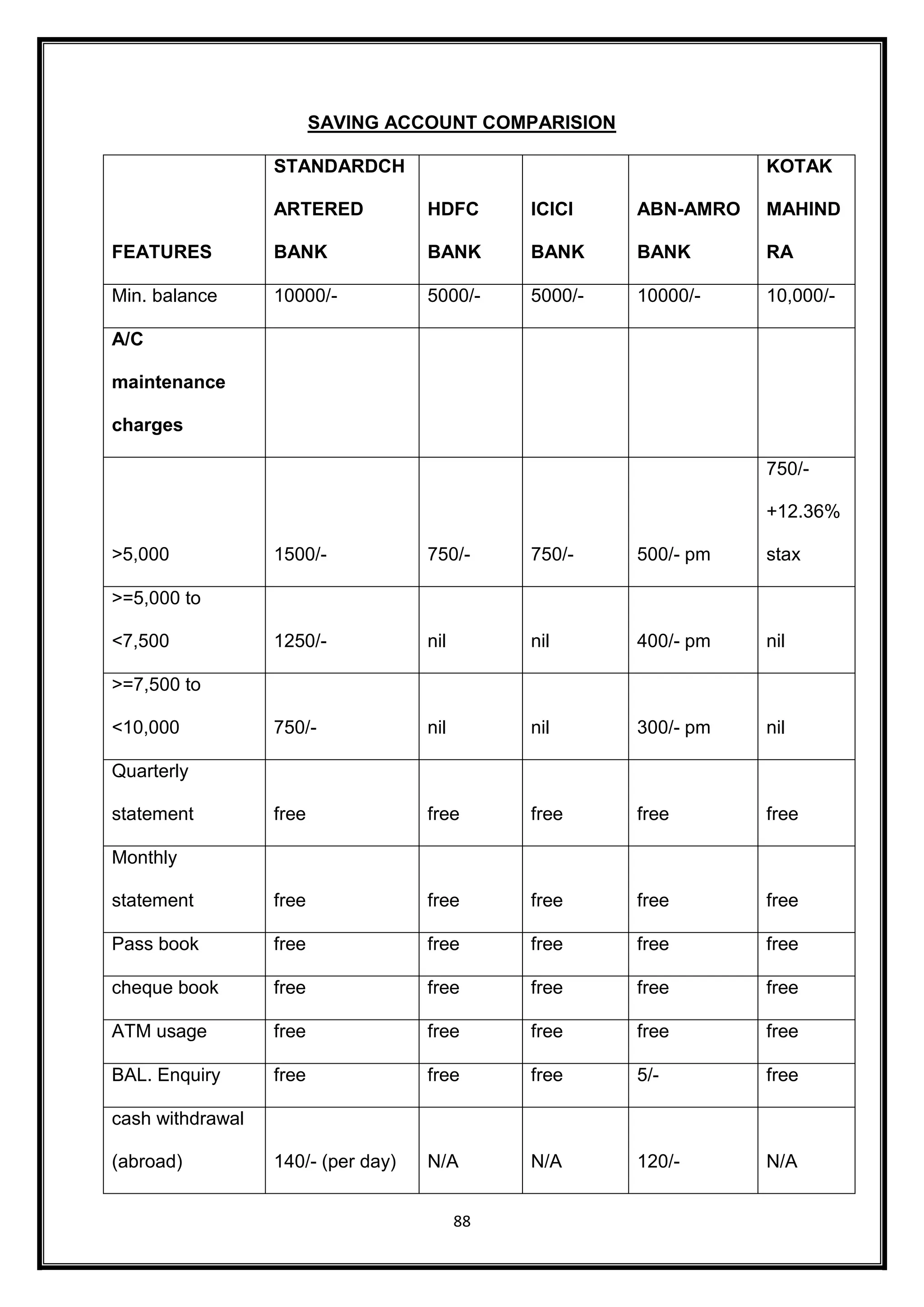

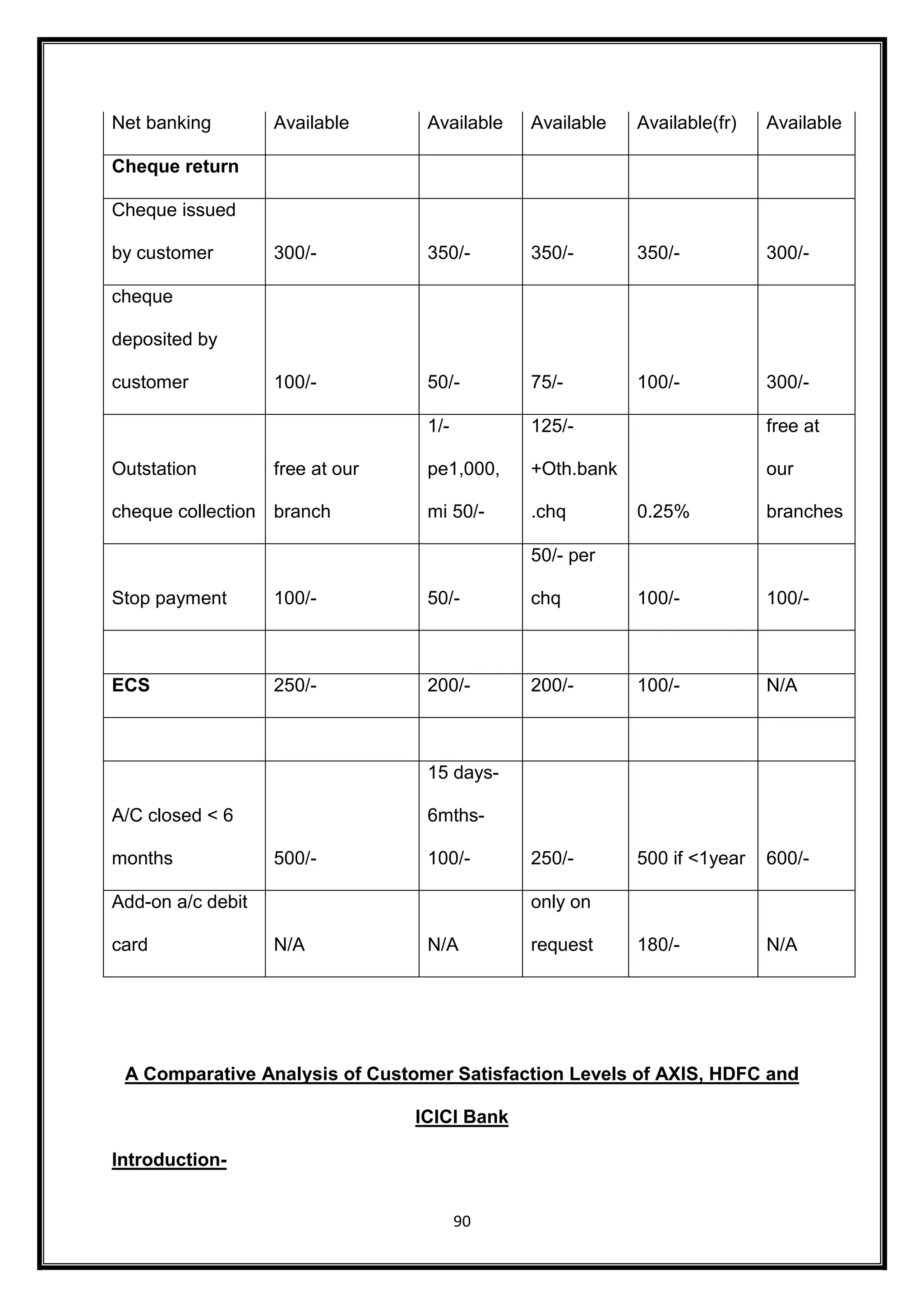

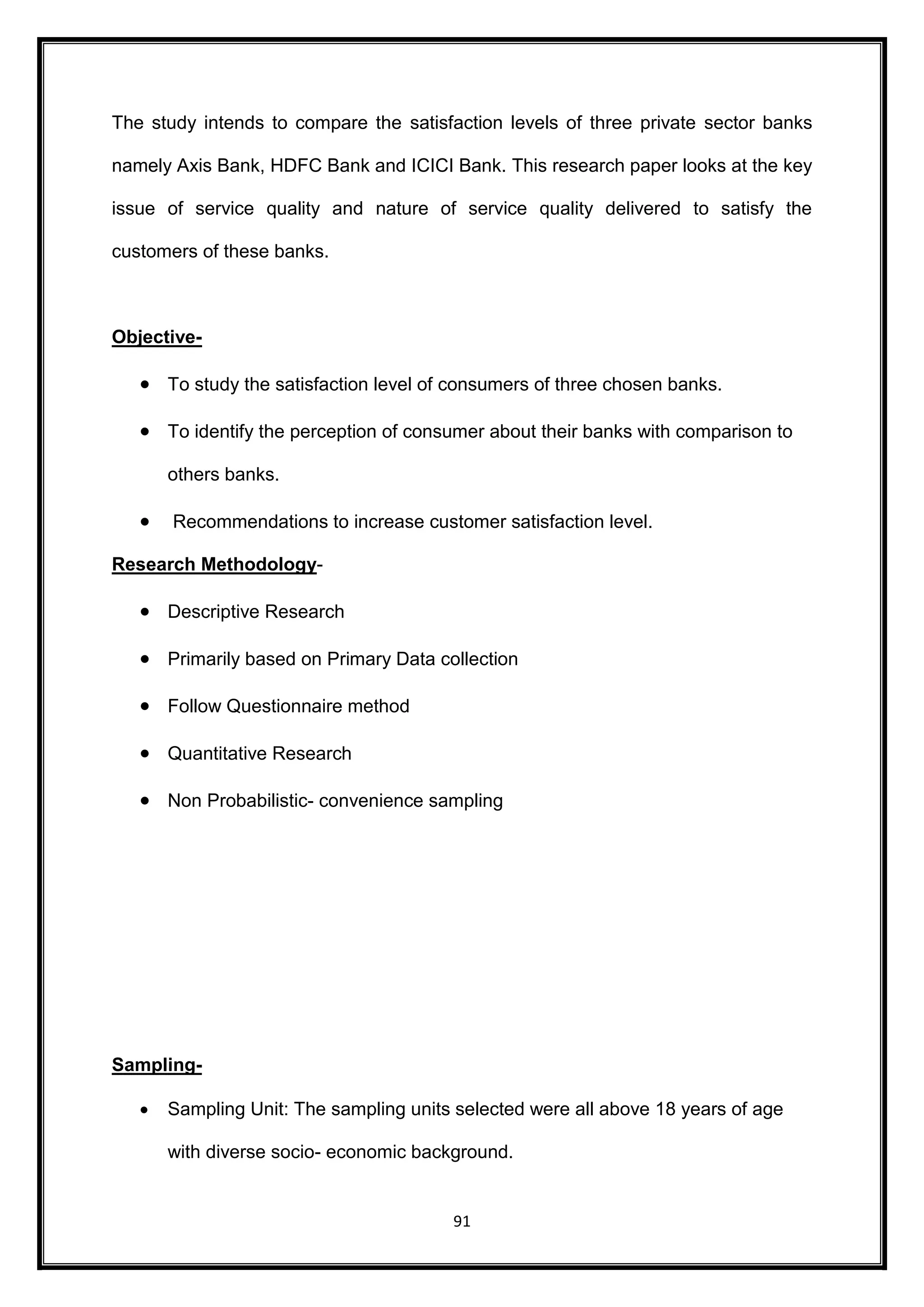

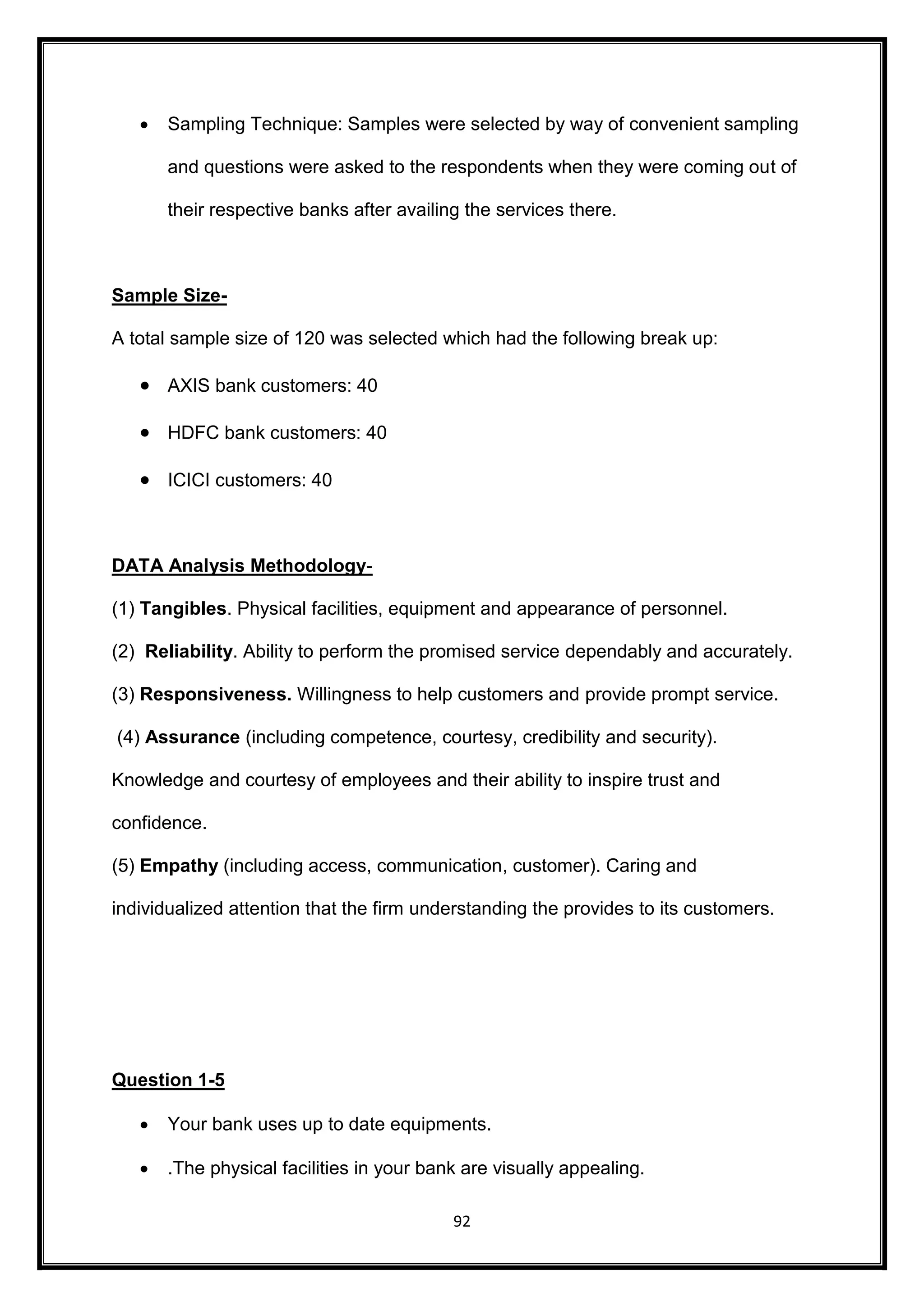

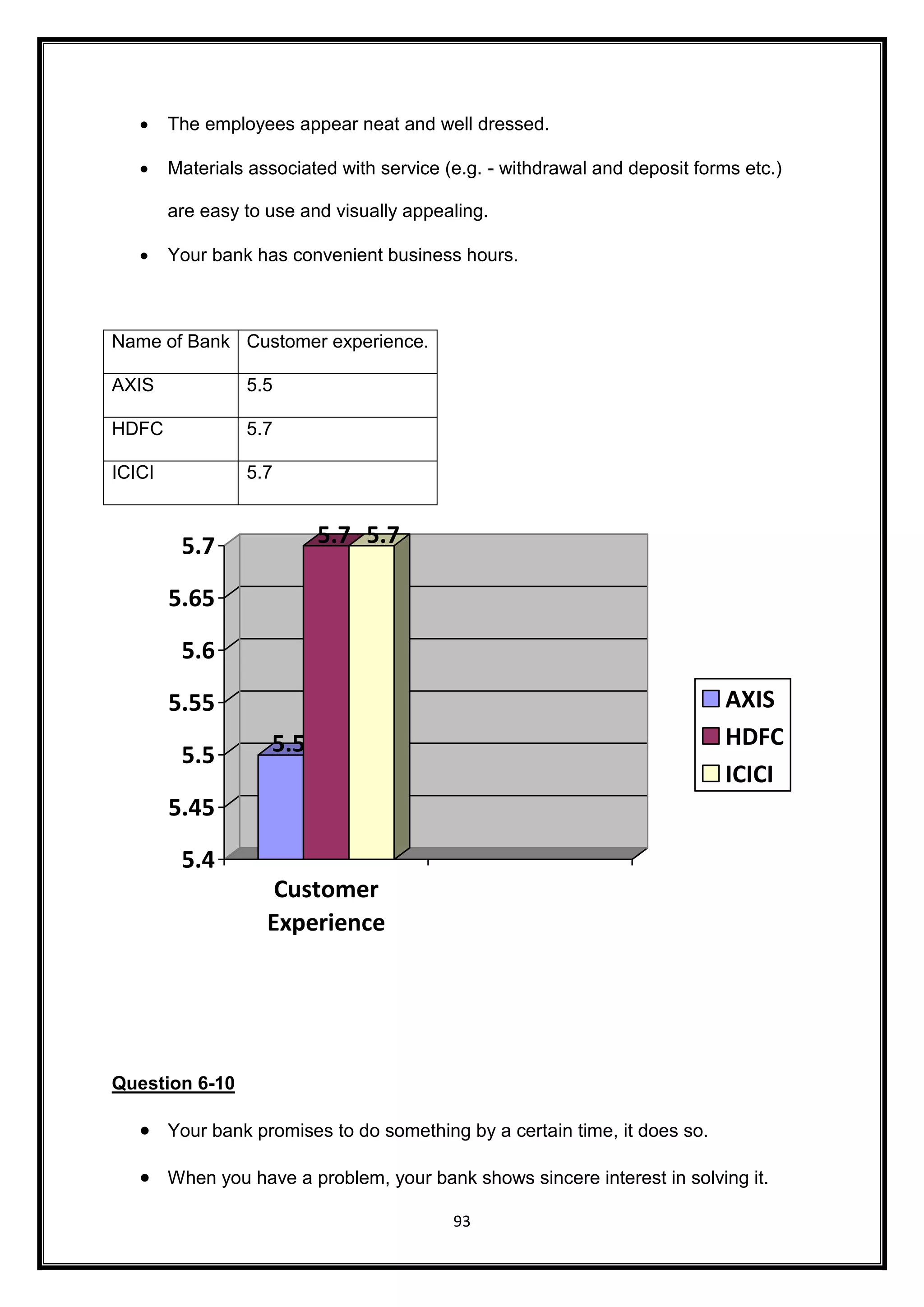

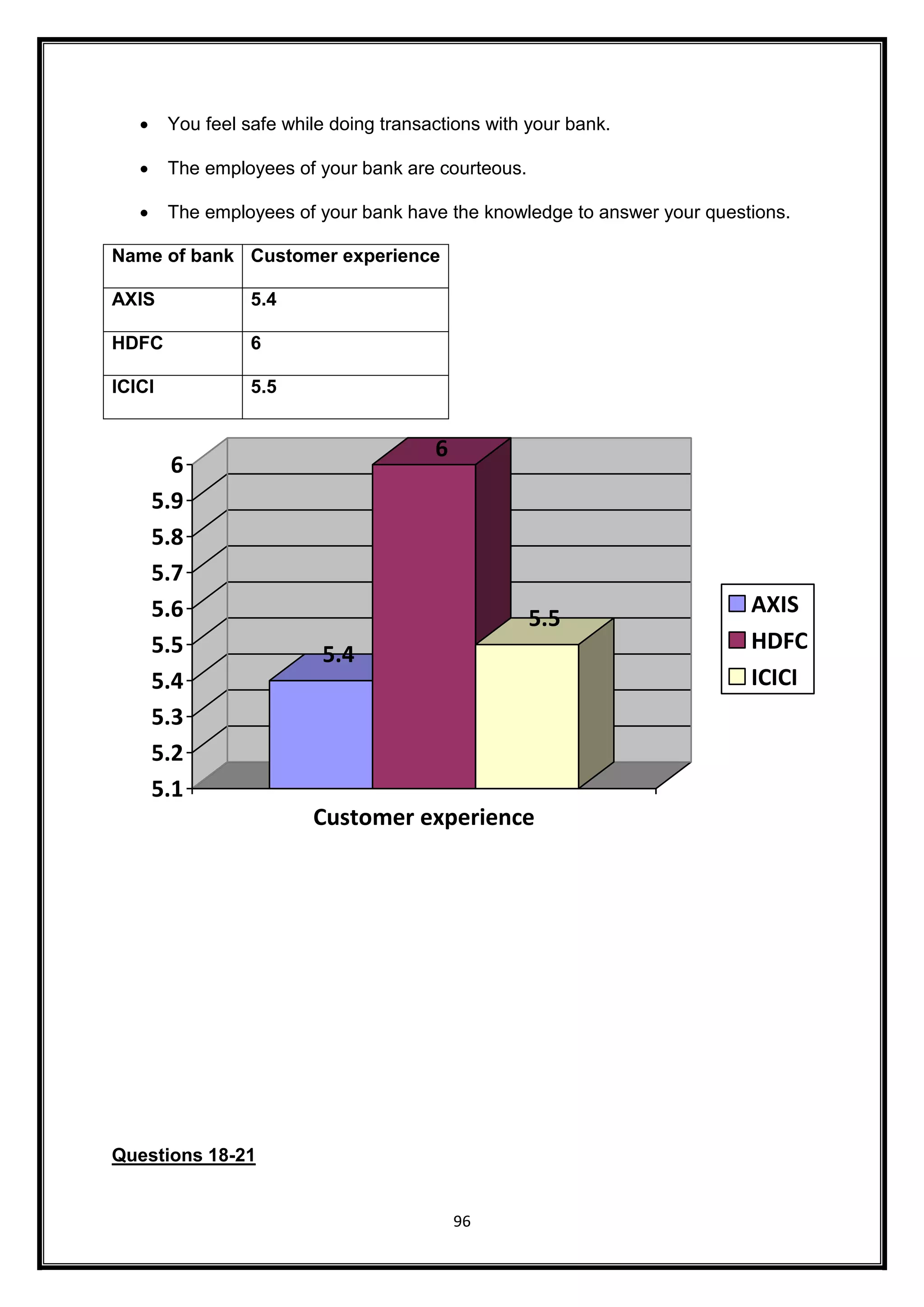

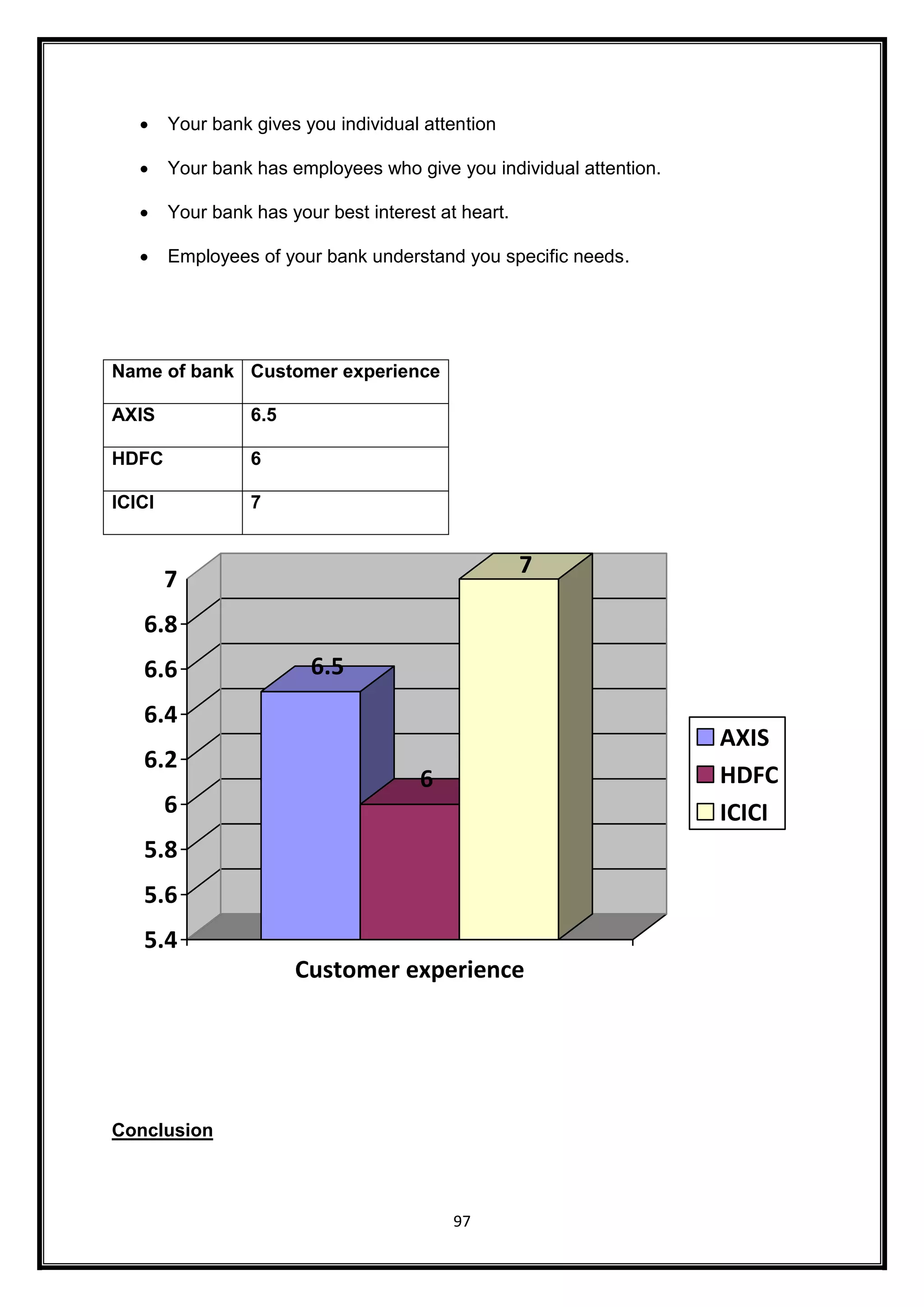

This document provides an overview and analysis of HDFC Bank's savings account offerings. It begins with an introduction to HDFC Bank, discusses its management and board of directors. It then examines the bank's various business segments including wholesale banking, retail banking, and treasury services. The document focuses on HDFC Bank's different savings account types, features, eligibility requirements, fees and charges. It provides a detailed table outlining the various fees and charges associated with transactions on regular savings accounts. In conclusion, the document performs a SWOT analysis and comparative analysis of customer satisfaction levels with HDFC Bank's savings accounts.