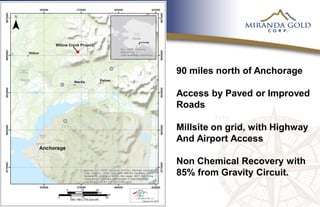

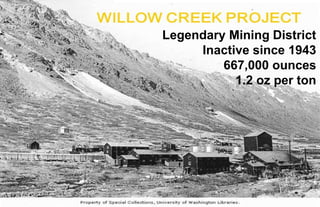

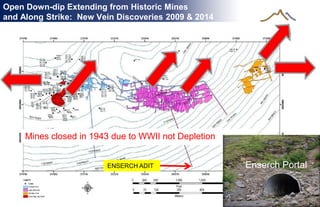

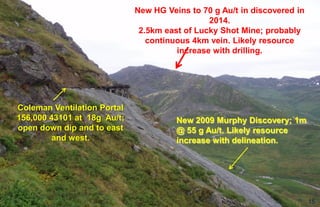

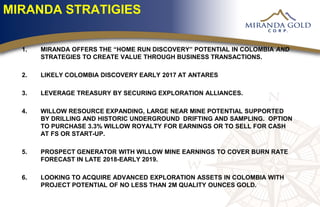

This presentation provides an overview of Miranda Gold Corp., a prospect generator company with projects in Colombia and Alaska. The company has 5 total projects, including 3 in Colombia where it is seeking joint venture partners for two projects. In Alaska, Miranda owns the Willow Creek project which has a historic gold resource and potential for expansion. The company's strategy is to make discoveries in Colombia, leverage its treasury through partnerships, expand the Willow resource, and acquire additional advanced exploration assets in Colombia with over 2 million ounces of gold potential.