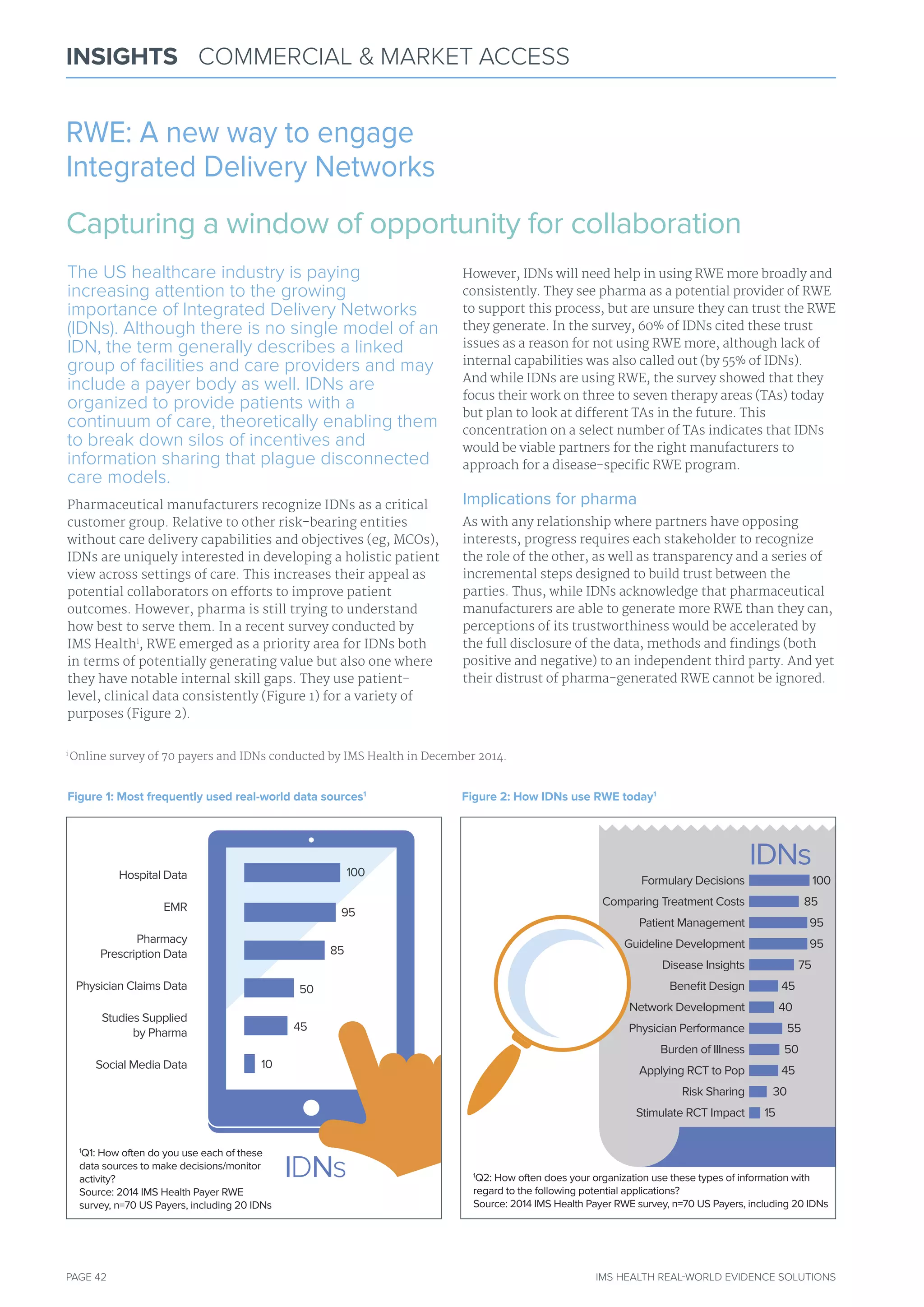

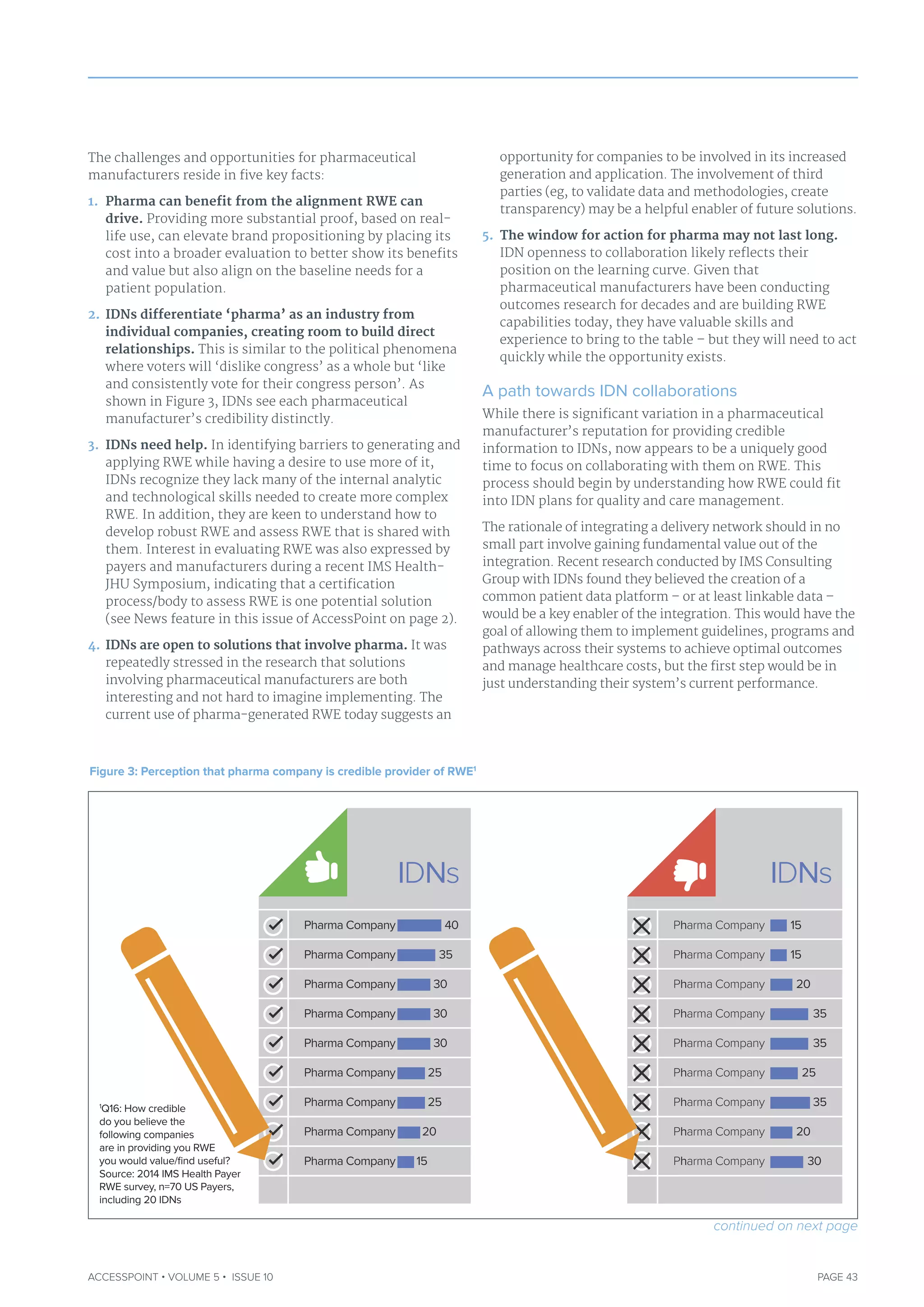

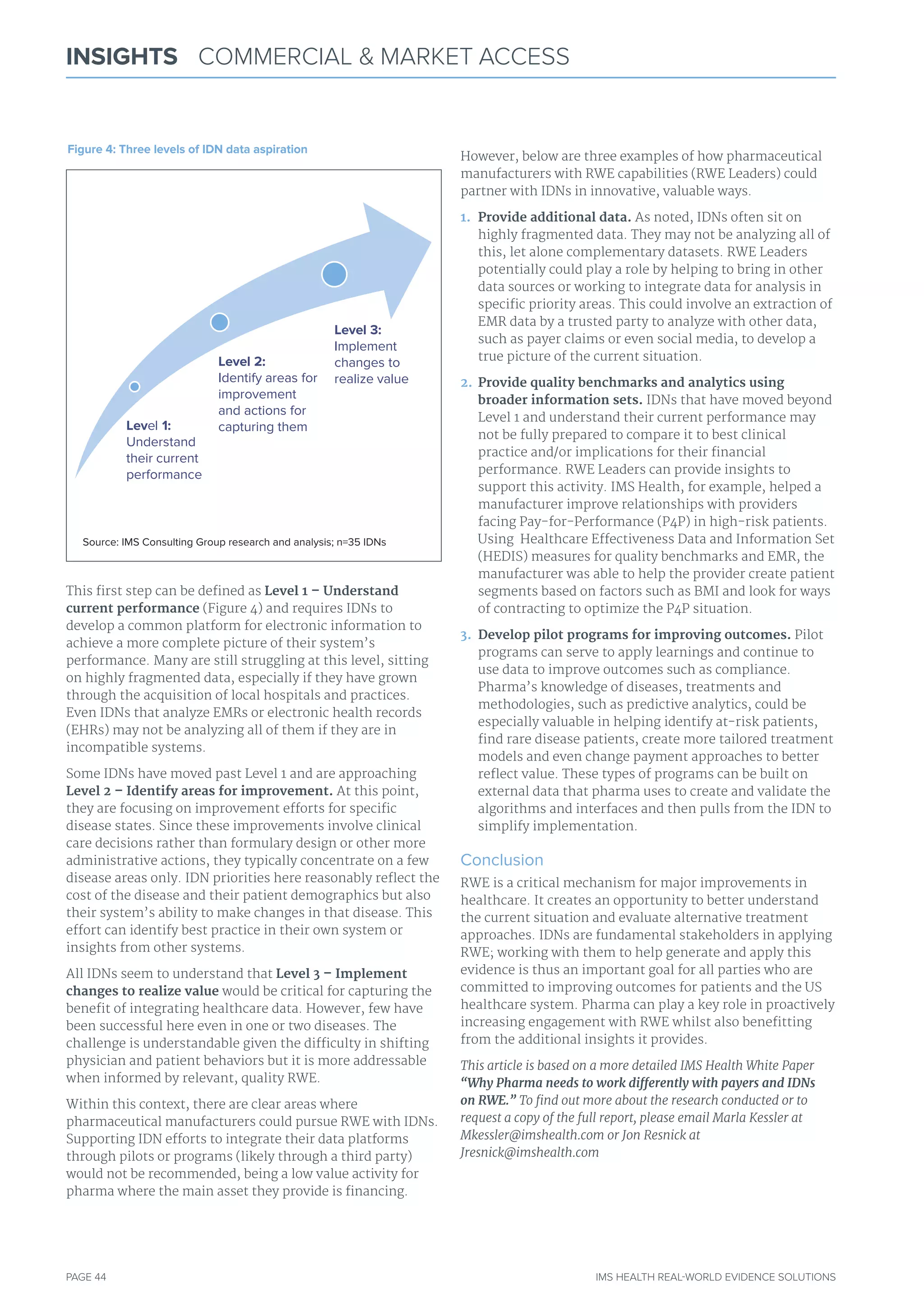

The document discusses the rising importance of real-world evidence (RWE) for pharmaceutical manufacturers seeking to engage with integrated delivery networks (IDNs) to improve patient outcomes. IDNs, which provide interconnected healthcare services, see RWE as a valuable tool but often lack the necessary capabilities to fully utilize it, leading to trust issues with pharma-generated RWE. The authors highlight that collaboration between pharma and IDNs is essential for advancing healthcare integration and improving outcomes, suggesting that pharma should act quickly to build these partnerships.