This document provides a summary and analysis of CVS Health Corporation. It analyzes CVS Health's financial performance, the pharmacy benefits industry, and CVS Health's competition. Key points include:

- CVS Health has experienced strong financial growth but relies heavily on high-priced specialty drugs for revenue. Mergers and acquisitions could help expand its services.

- The pharmacy benefits industry faces changes from healthcare reform like value-based care. Increased regulation also poses risks.

- CVS Health is a market leader but faces intense competition on pricing and convenience. It aims to improve public health through initiatives like tobacco cessation.

![Nguyen, Leah

MBA Capstone

4

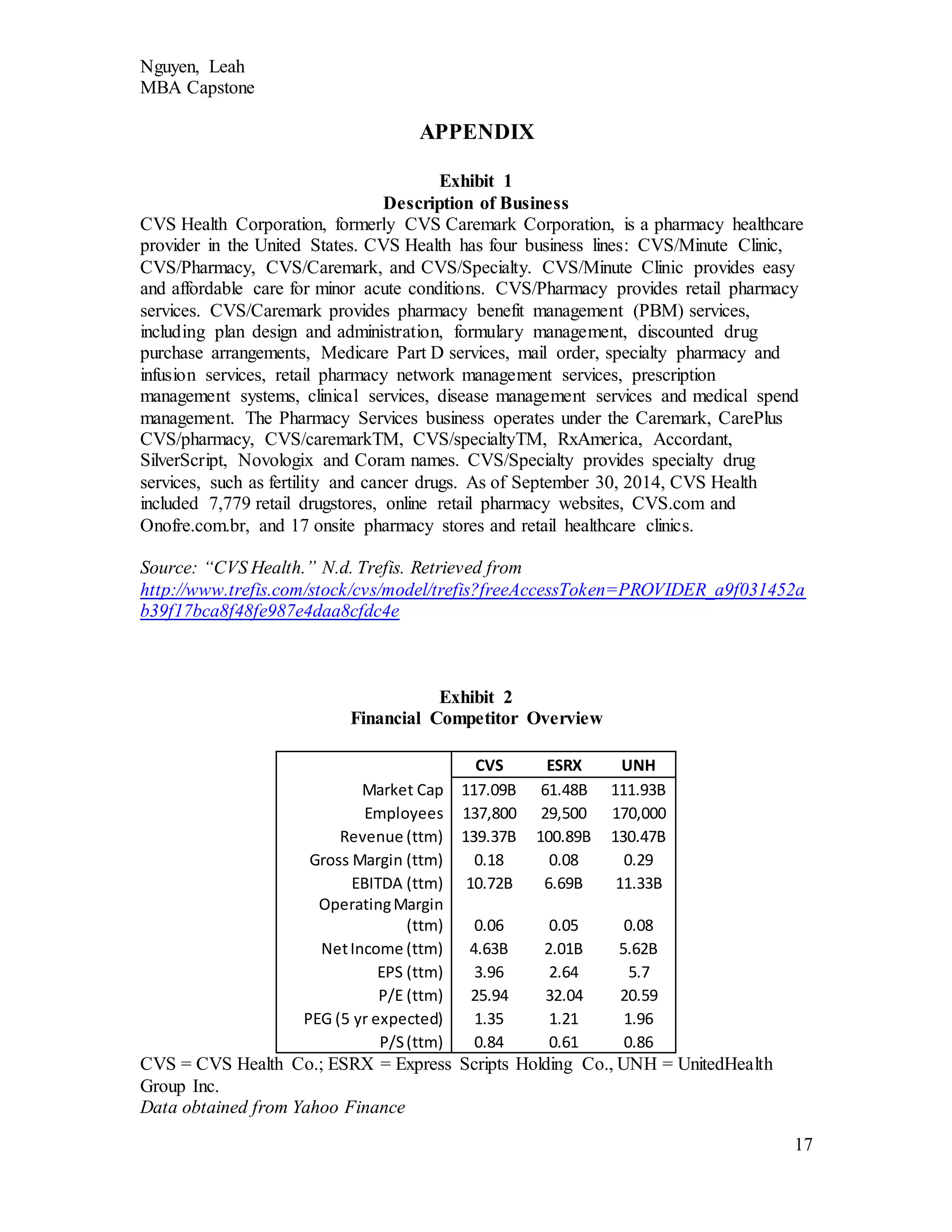

Scripts works with drug and equipment distribution, consulting, and case management. A

brief comparison of the three companies can be seen in Exhibit 2.

CVS Health has many financial strengths. They are a well-diversified company

with four different business lines: CVS/minute clinic, CVS/pharmacy, CVS/caremark,

and CVS/specialty. Each of these provides a separate function while working cohesively

to achieve improved patient and consumer well-being. For example, certain specialty

drugs are no longer being processed through the pharmacy store but instead through their

mail order capacity. While this lowered basis points for the pharmacy, it increased overall

revenues compared to prescription volumes due to the high price of specialty drugs

(“CVS Health Reports Strong Profits,” 2015). These high-priced specialty drugs are

growing in demand. In the last quarter, revenues for these drugs increased nearly 22

percent to $23.9 billion (Associated Press, 2015). CVS Health also benefitted from the

increase in patient access due to the ACA, as more patients were being treated and filling

prescriptions. UnitedHealth and Express Scripts also saw this increase, and this increase

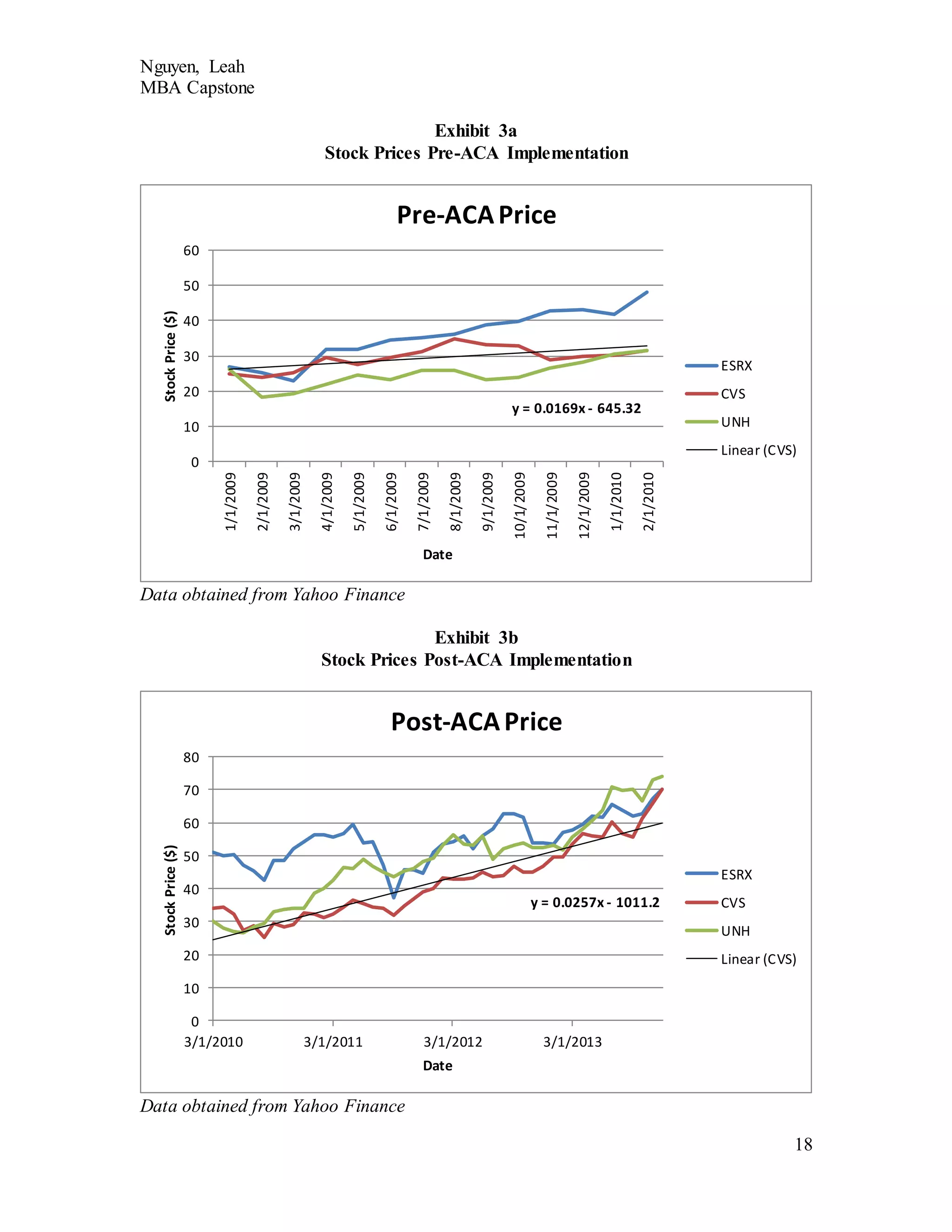

in value was translated into stock price. Exhibits 3a and 3b show the difference in rate of

stock price increase before and after the ACA of CVS Health, Express Scripts, and

UnitedHealth. As illustrated, the rate nearly doubles after implementation of the ACA.

In the last quarter, earnings rose 4 percent despite the “anticipated blow” from the

termination of sales from tobacco products (Associated Press, 2015). For the total year of

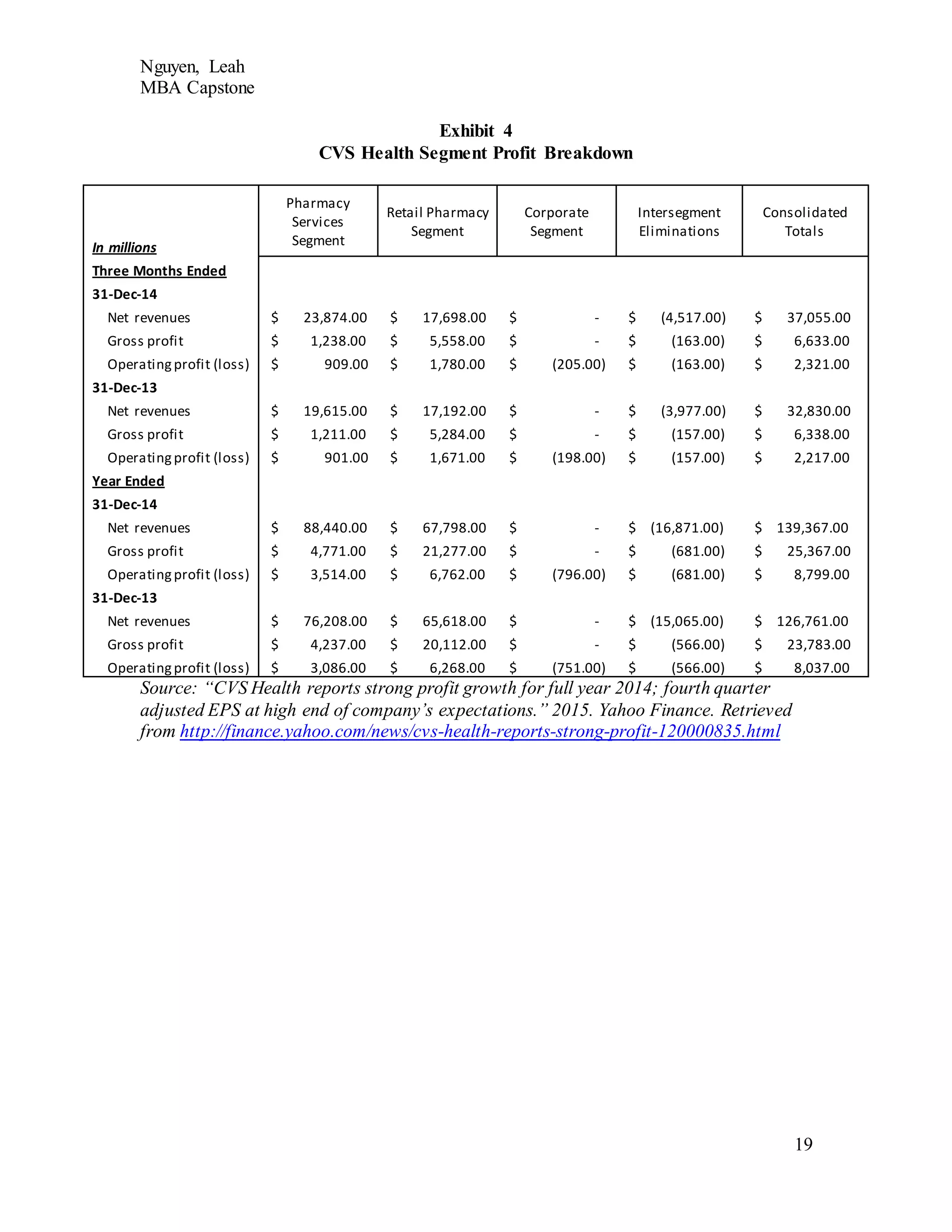

2014, net revenues increased 9.9 percent to a record $139.4 billion [Exhibit 4] and CVS

Health generated free cash flow of $6.5 billion and cash flow from operations of $8.1

billion (“CVS Health Reports Strong Profits,” 2015). This cash flow “exceeded” CVS](https://image.slidesharecdn.com/4c402d77-1ec5-4859-8f45-3962a3bbaa85-150702220338-lva1-app6892/75/Capstone-PaperFinal-5-2048.jpg)

![Nguyen, Leah

MBA Capstone

6

There are several opportunities for CVS Health to take advantage. As has

happened throughout the industry, mergers and acquisitions of other PBMs and pharmacy

services companies is common. When UnitedHealth acquired Catamaran Corporation, it

became the third-largest pharmacy benefit manager with a market share of 20 percent

(“What the UnitedHealth-Catamaran Deal Means,” 2015). Before this, CVS Health and

Express Scripts controlled about 50 percent of the PBM market, with Express Scripts

filling over one billion prescriptions annually. The acquisition of Catamaran brings

UnitedHealth’s estimated fulfillment of prescriptions to mirror that of Express Scripts at a

billion. CVS Health has acquired several smaller companies in the past, such as Coram in

2013, a specialty infusion services unit, and Long Drug Stores in 2008 (Townsend,

2013). To maintain its market share, CVS Health should continue exploring these

opportunities to expand their expertise and services to provide lower-cost and more

accessible care.

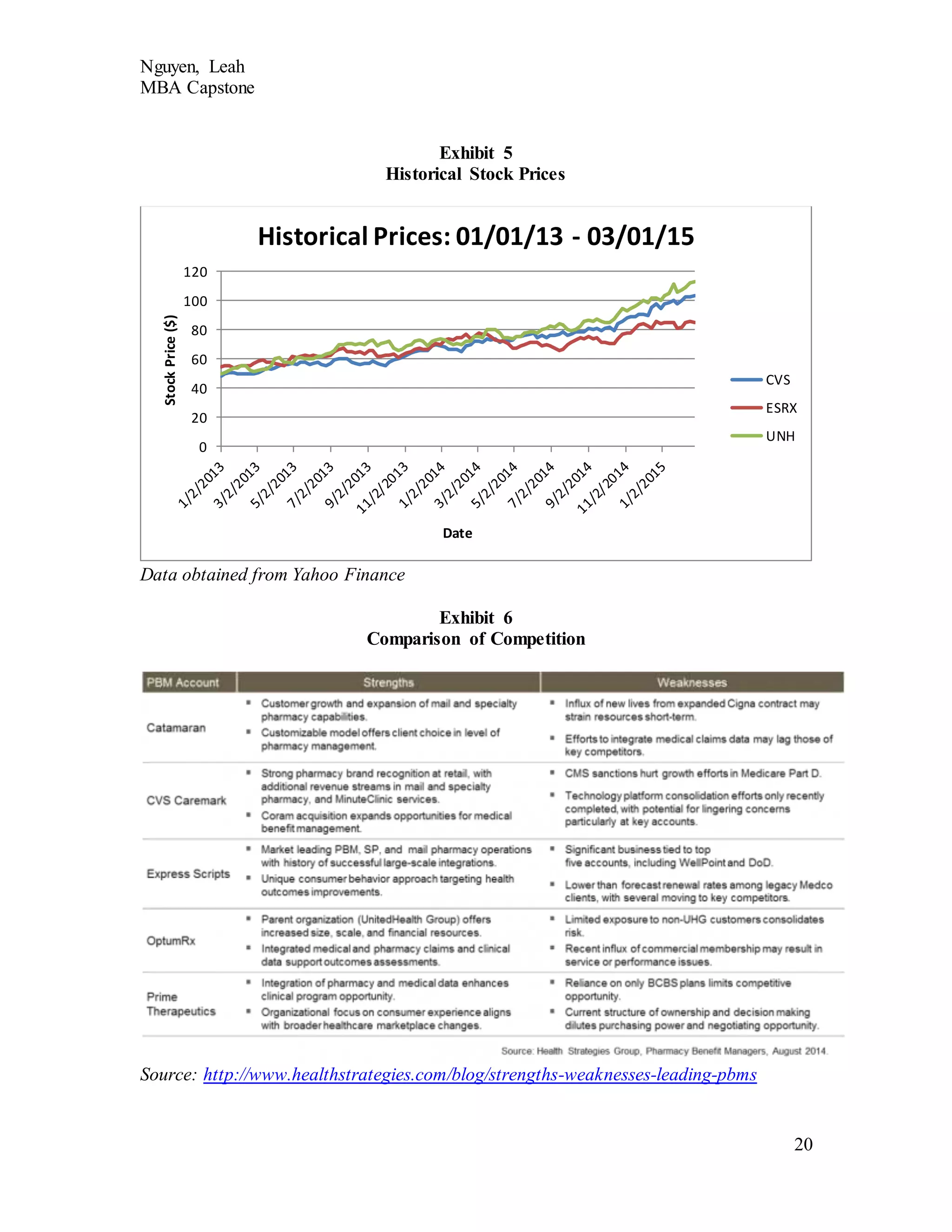

A final opportunity for CVS Health is to improve their stock price. Despite the

recent financial successes, CVS Health is not as strong as UnitedHealth. They are doing

much better than Express Scripts, but there is always opportunity for improvement

[Exhibit 5]. This could be achieved through increasing the value of the company to

increase demand for shares as well as buy back some of their shares to reduce the supply

of shares available.

Being a player in the healthcare system does not come without risks or threats.

CVS Health, UnitedHealth, and Express Scripts are threatened by litigation. As these

companies grow larger through acquisitions, the competition is effectively consolidated

into a few major players that have the potential for anti-trust law violations. Settlements](https://image.slidesharecdn.com/4c402d77-1ec5-4859-8f45-3962a3bbaa85-150702220338-lva1-app6892/75/Capstone-PaperFinal-7-2048.jpg)

![Nguyen, Leah

MBA Capstone

12

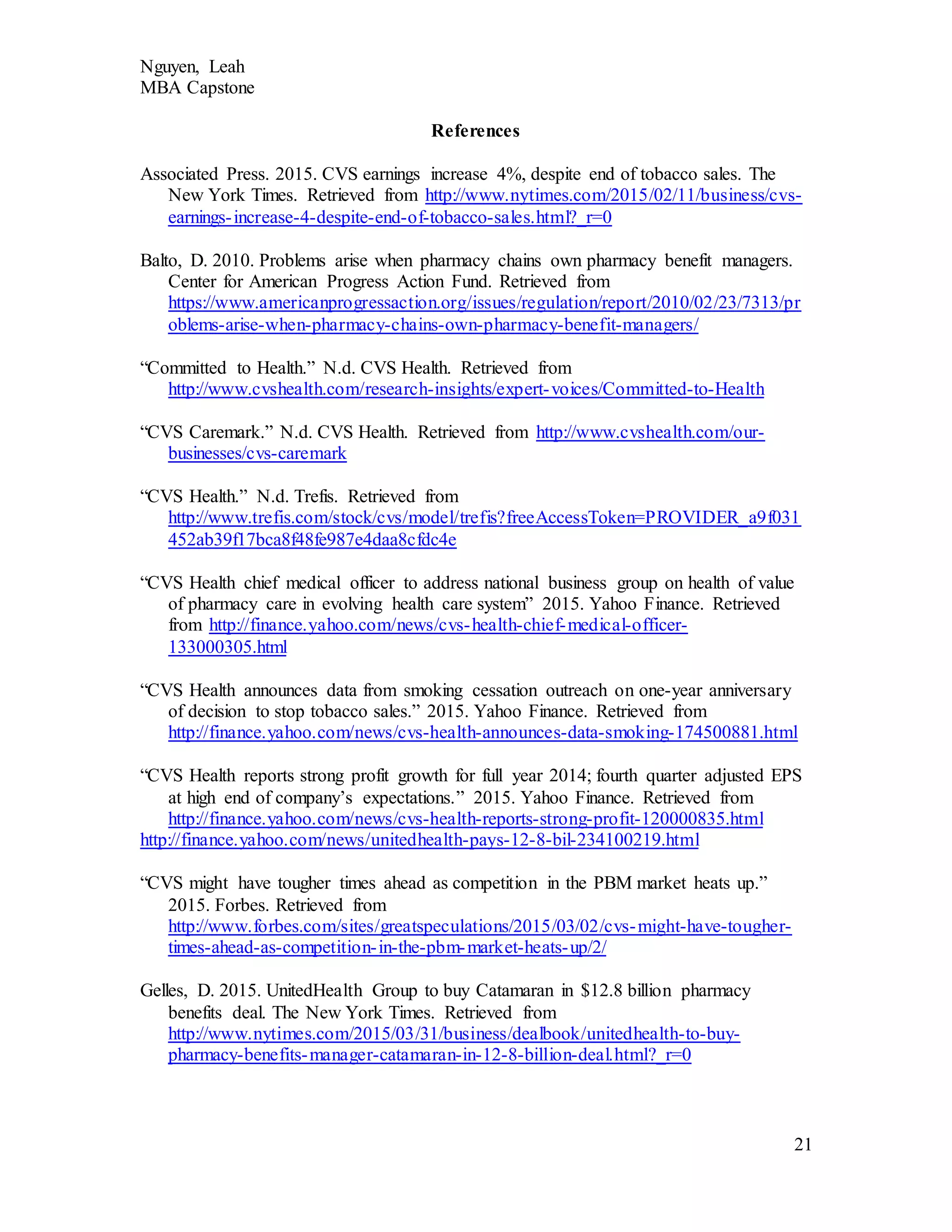

Exhibit 6 for an overall comparison – note that Catamaran and OptumRx are now part of

UnitedHealth].

In the face of these competitors, CVS Health has many strengths. By

eliminating tobacco products from their stores, they created a very strong marketing tool.

This well publicized action gave CVS Health a platform to further prove their

commitment to health and well-being. CVS Health’s Eileen Boone explained that

“cigarettes simply have no place in a setting where health care is delivered” and that

many conditions that pharmacies help manage are made worse by smoking (Kanani,

2014). In conjunction with this, they introduced a tobacco cessation program for their

customers that combined medication and coaching from the pharmacy staff. They also

rebranded from CVS Caremark to CVS Health in 2014 to emphasize their dedication to

health. CVS Health also has a separate Corporate Social Responsibility department that

operates several philanthropic efforts under the platform “Prescription for a Better

World.” These efforts prove to the public that CVS Health is committed to their mission

and may convince consumers to use their services instead.

Another strength of CVS Health’s is their proprietary technology. One use of

this technology is in the retail pharmacy. It is able to perform safety checks, interaction

screening, and substitutions for generic and brand drugs (“CVS Health,” n.d.). Their

technology also has the ability to deliver patient-specific information directly to EHRs to

the patients’ providers, integrating even more into the PCMH model. This improves

quality of care and safety for their patients.

The major weakness of CVS Health is the significant power that comes with

major acquisitions, like those of their competitors. As mentioned in the financial analysis,](https://image.slidesharecdn.com/4c402d77-1ec5-4859-8f45-3962a3bbaa85-150702220338-lva1-app6892/75/Capstone-PaperFinal-13-2048.jpg)