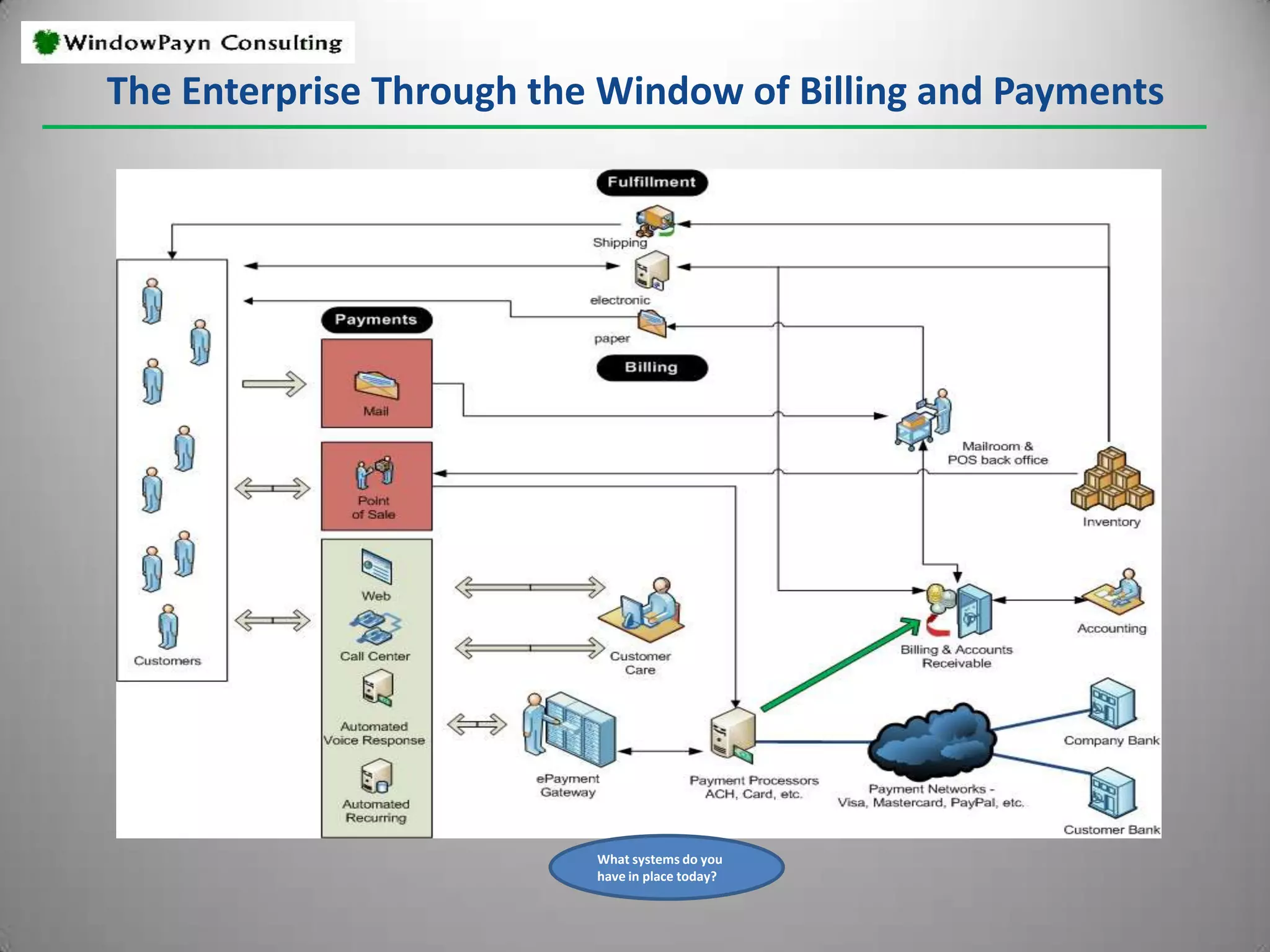

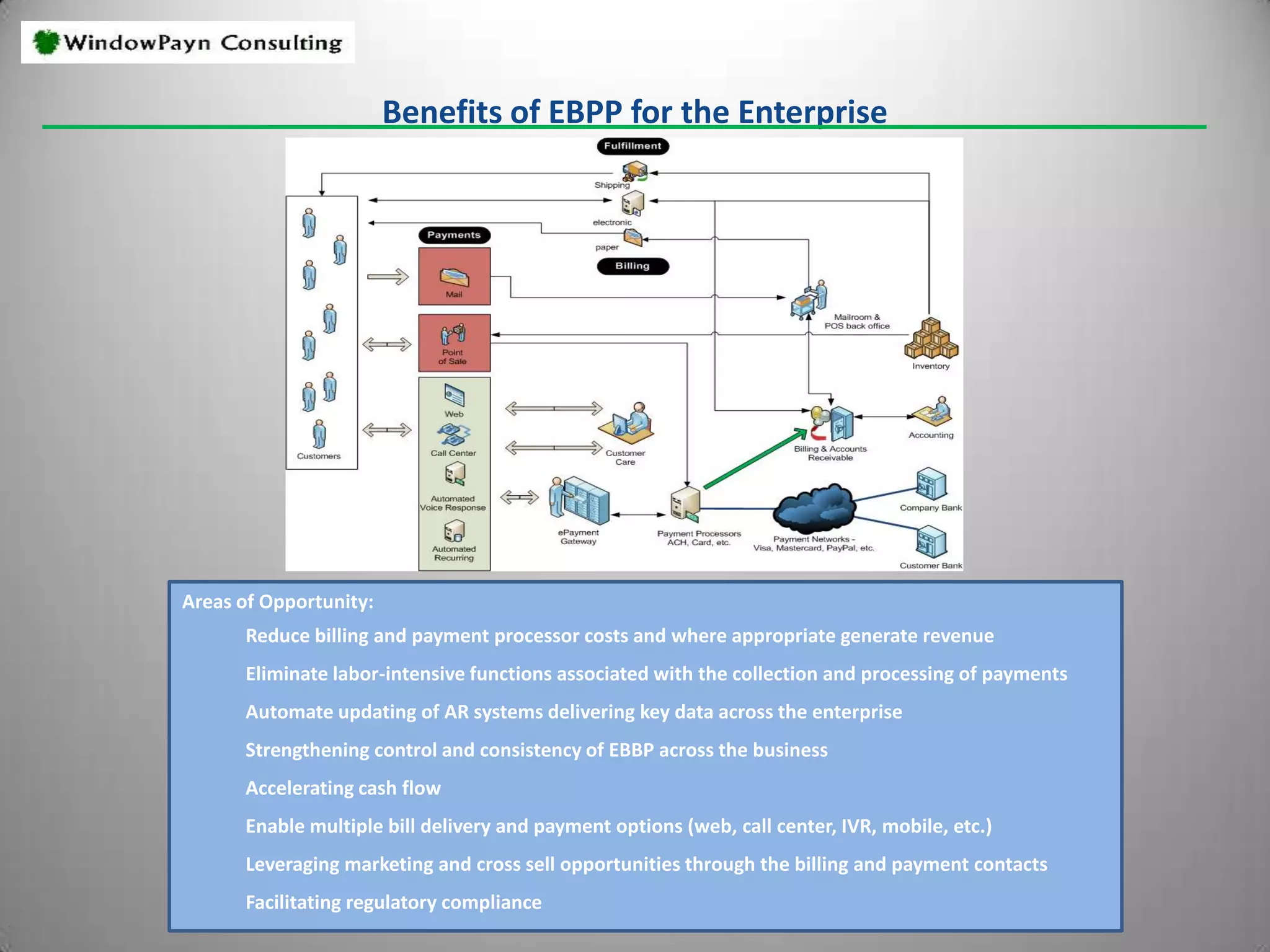

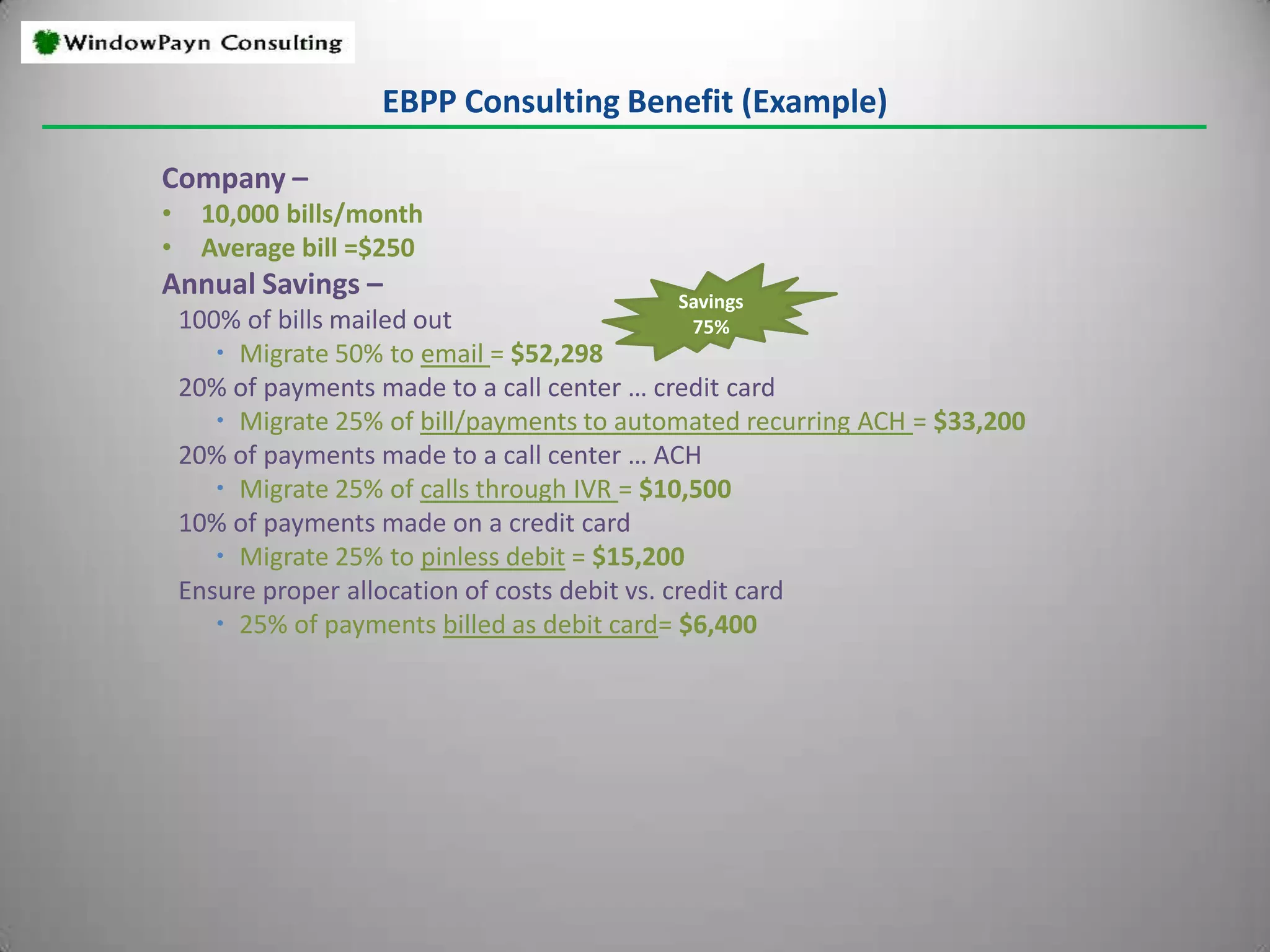

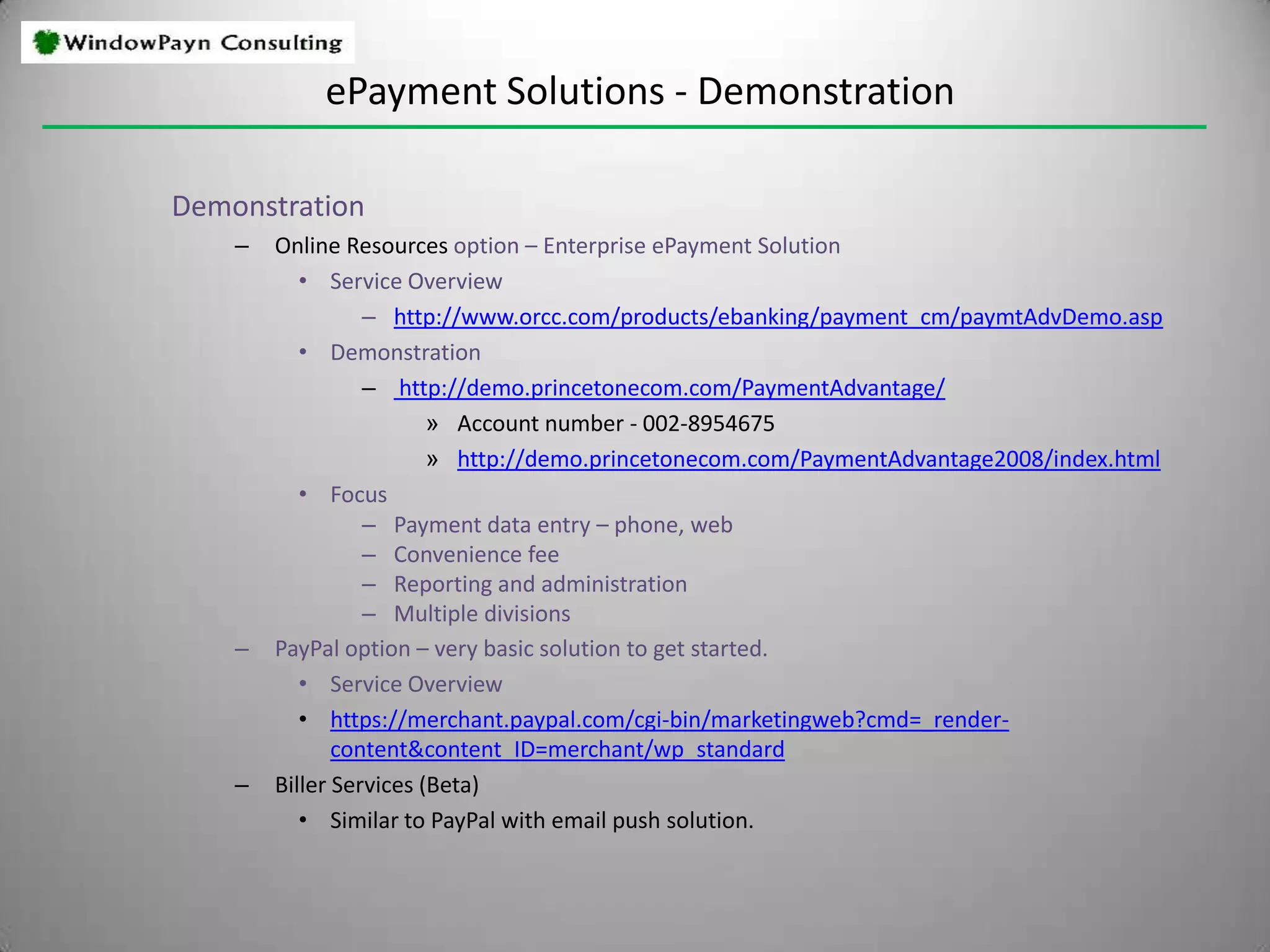

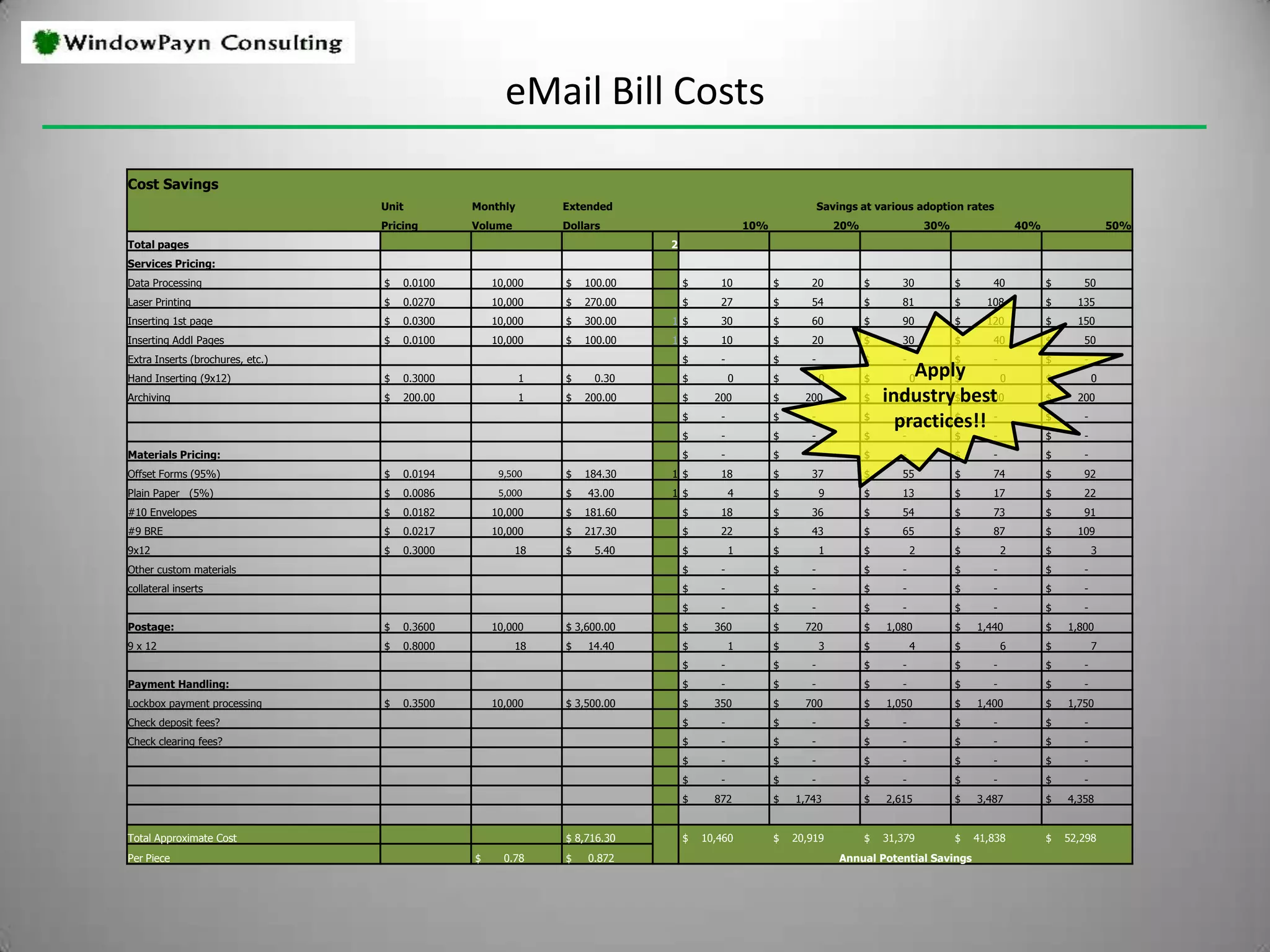

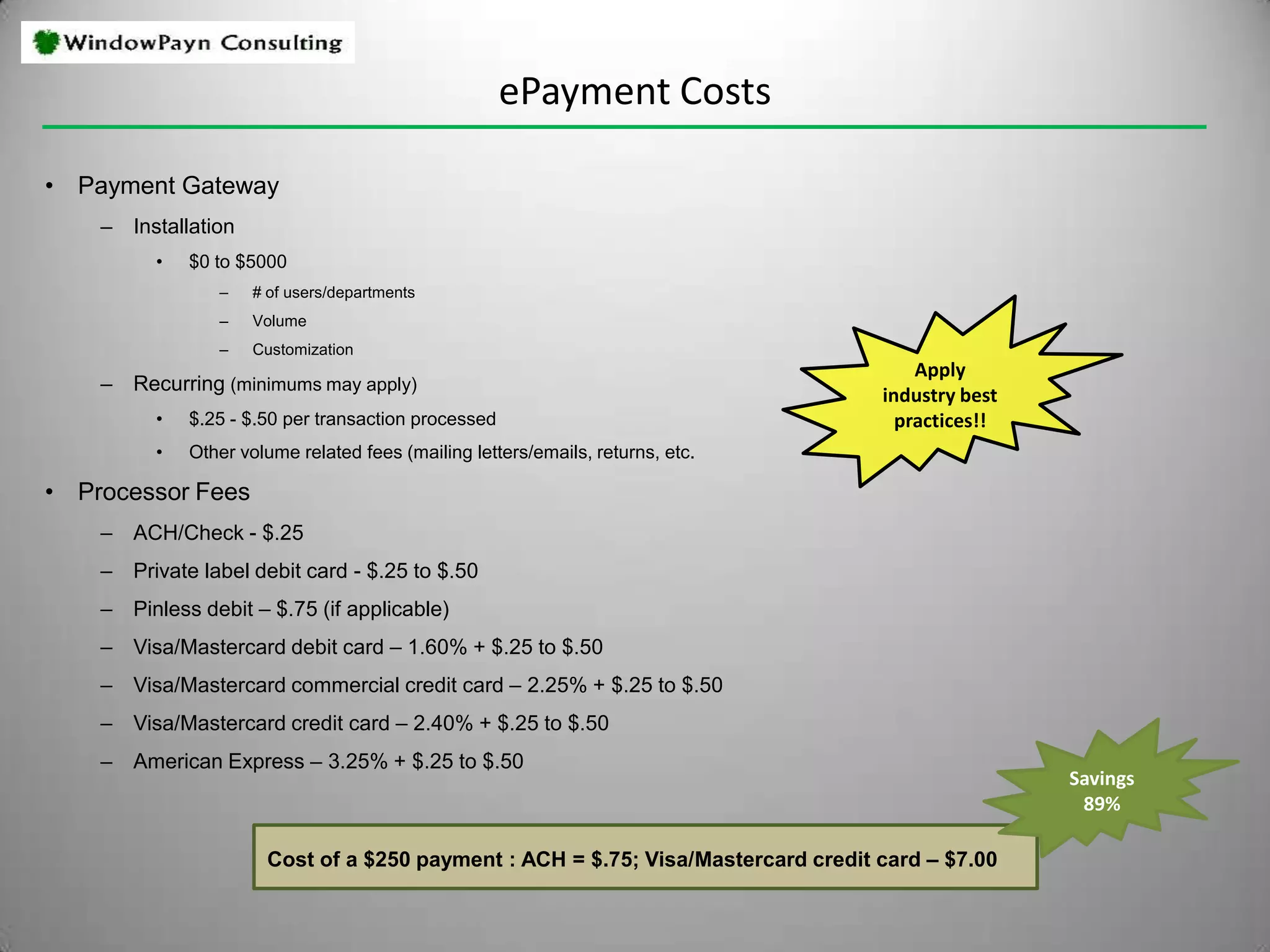

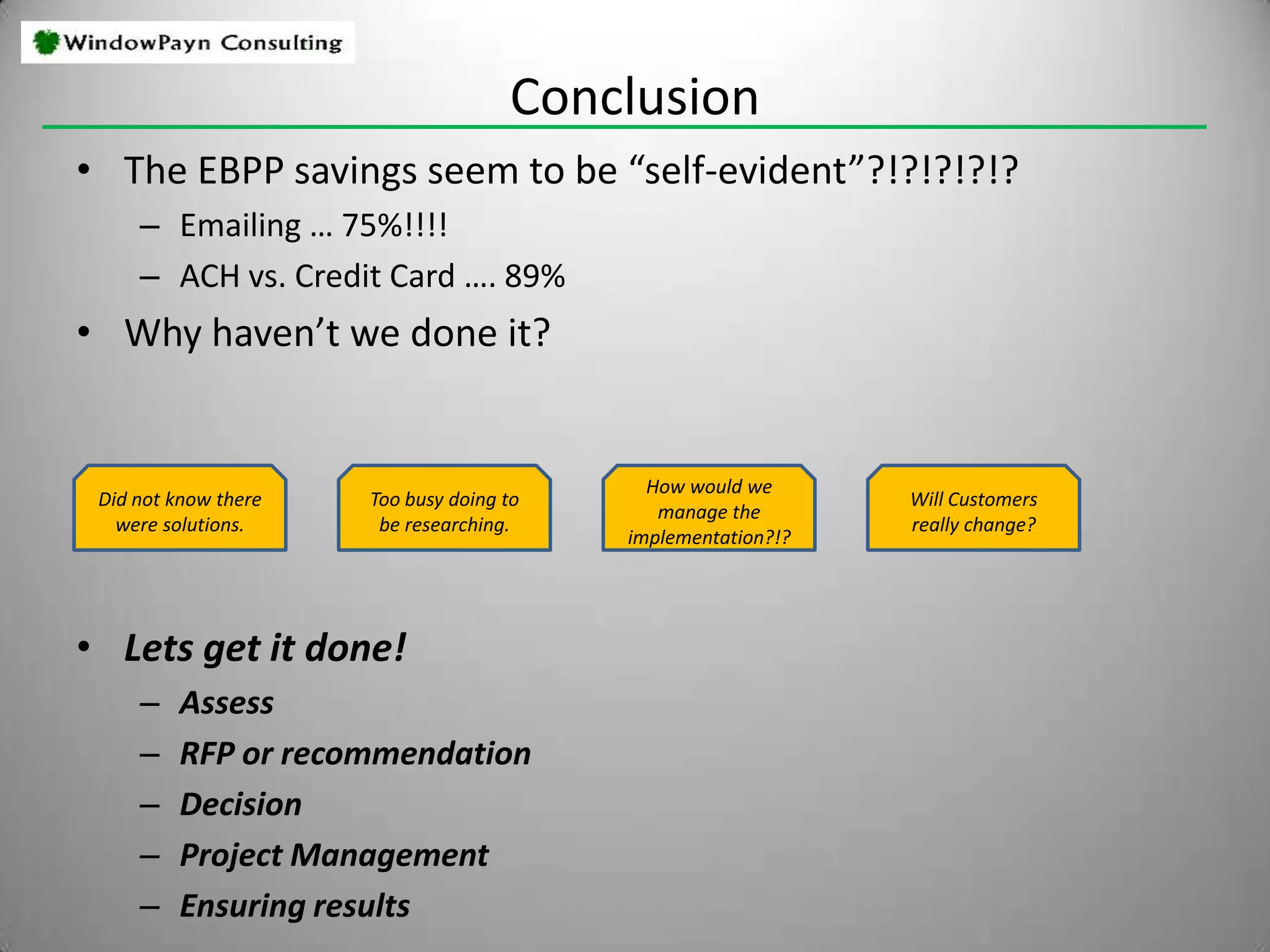

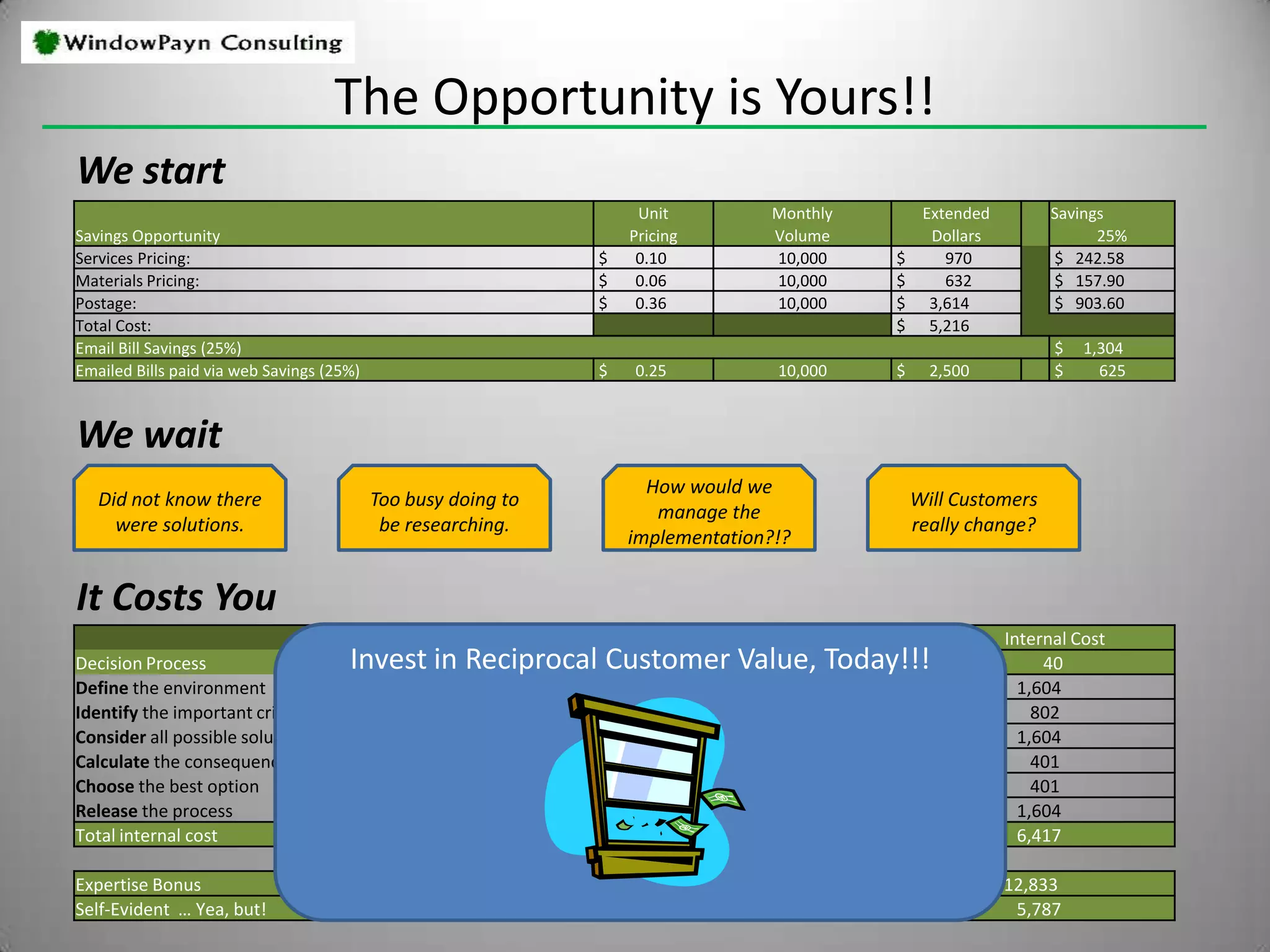

WindowPayn Consulting provides billing and payment process consulting to help clients reduce costs and strengthen customer relationships. They assess a client's current processes, identify opportunities for implementing electronic billing and payment to reduce processing fees and accelerate cash flow. WindowPayn demonstrates ePayment solutions and provides cost analyses showing clients can save 75% on mailing costs by emailing bills and 89% in payment processing fees by shifting from credit cards to ACH. The conclusion is that electronic billing and payment presents significant savings opportunities for clients.