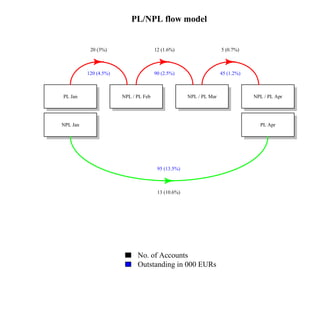

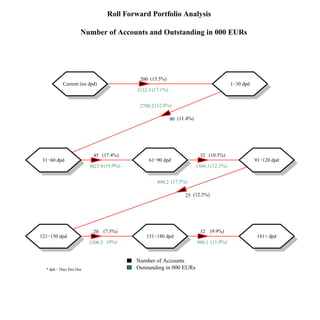

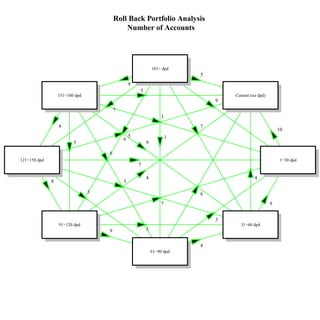

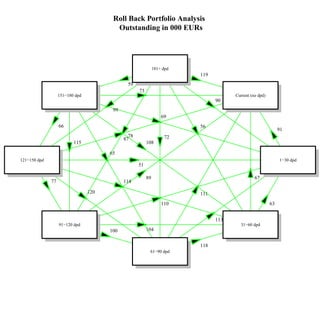

The document contains information about PL/NPL (performing loan/non-performing loan) accounts and balances over multiple months. It shows the number of accounts and outstanding balances in thousands of euros for different loan statuses (current, 1-30 days past due, etc.) and how those changed over time, from January through April. It also shows a "roll back" analysis, displaying the same information but with changes depicted as arrows moving between status categories from month to month.