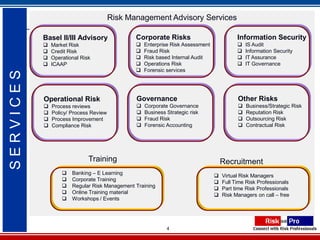

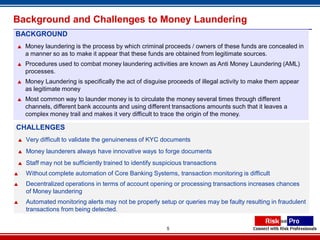

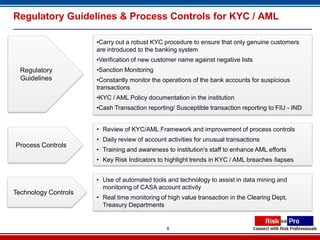

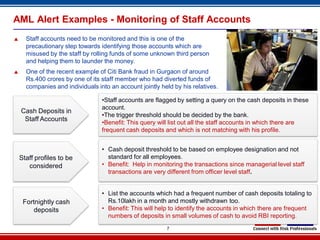

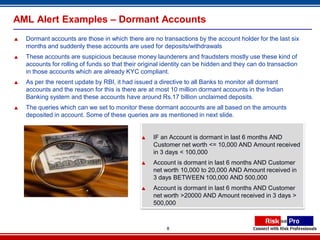

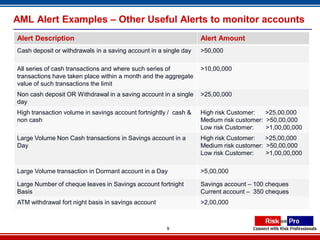

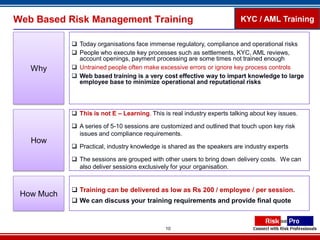

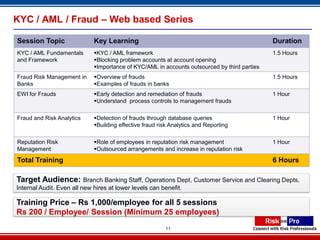

The document discusses anti-money laundering processes and controls. It provides background on money laundering and challenges to detecting it. It then outlines regulatory guidelines for know-your-customer (KYC) and anti-money laundering (AML) processes, as well as process controls, technology controls, and examples of AML alerts for monitoring staff accounts and dormant accounts. The goal is to establish controls and detection mechanisms to identify suspicious transactions and prevent money laundering.