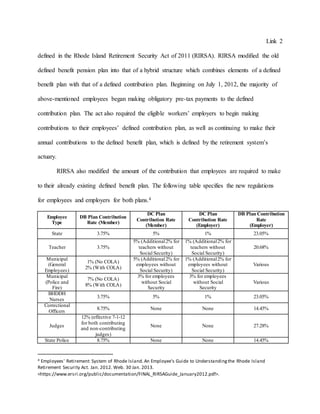

The document discusses Rhode Island's hybrid pension plan instituted through the Rhode Island Retirement Security Act of 2011. The hybrid plan combines elements of a defined benefit plan and defined contribution plan. It requires both employees and employers to contribute to both the defined benefit and defined contribution components. The reforms are aimed at reducing Rhode Island's $13.4 billion unfunded pension liability by an estimated $3 billion. Determining retirement eligibility became more complicated under the hybrid plan, as it depends on an employee's schedule based on their years of service prior to the reforms taking effect.