The document outlines the audit approach for revenue and accounts receivable, emphasizing key audit procedures and considerations under IFRS 15. It specifies steps for evaluating revenue contracts, determining transaction prices, allocating performance obligations, and recognizing revenue. The approach includes planning analytical procedures, assessing fraud risk, and ensuring data validation through various analytical methods and confirmations.

![Audit Approach & Audit procedures of

Revenue, Accounts Receivable & other issues

• Mohammad Gias Uddin ACA [enrolment number: 2100]

• E-mail: gias@icab.org.bd](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-1-2048.jpg)

![Key audit procedures…..

Significant Accounts

Based on the ICAB dummy Work Paper [link: : https://www.icab.org.bd/page/audit-program-and-

test-of-details-(tod)]](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-2-2048.jpg)

![Planning Analytics related to sales

ISA Reference Guidelines Works performed

[ISA 240.22]

We shall evaluate whether unusual or unexpected

relationships that have been identified in performing planning

analytical procedures, including those related to revenue

accounts, may indicate fraud risks.

We have performed inquiries with respective departments of the entity

to identify unusual or unexpected transactions. In addition, we have

provided special attention in relation to fraud risk and inquired about

it.

When performing planning analytical procedures we generally

use trend analysis, ratio analysis, or a combination thereof.

We may also use data analysis and predictive analysis, if

considered necessary.

We have used trend analysis and predictive analysis to perform

planning analytical procedures.](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-3-2048.jpg)

![Revenue process understanding & related

control test.

Revenue policy, process & contract evaluation [IFRS step-1]

Source documents related to control [3 way/ 5 way match]

Segregation of duties

Evaluation as per IFRS 15

Revenue segmenting & substantive analytical procedures

Sampling](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-5-2048.jpg)

![Revenue [IFRS 15 focused]](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-8-2048.jpg)

![Audit Focus area in step-1

• a. evaluate accounting policy, understand the revenue process [test]

• b. Obtain contract with customers

• c. Inspect contract to confirm legal bindings & effectiveness in audit

year

• d. For implied contracts, clarify contractual terms to establish R&O in

each case.

• e. If there is no apparent contract, evaluate the practices. Also consider

other issues](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-12-2048.jpg)

![A promised good or service is ‘distinct’ if both of

the following criteria are met: [example-purifier & technical service,

software installation & ASS]](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-14-2048.jpg)

![Audit Focus area in step-2

• a. Confirm the goods or services to be transferred, either individually or as

part of a series, by reference to the contracts in place;

• b. Identify distinct goods/ services based on saleability & distinct function;

[If goods/ services are not distinct, management must combine them with

other promised goods or services until a bundle of goods or services that is

distinct can be identified]

[keep in mind that, failure to identify the ‘distinct’ character of the contract

can lead to incorrect revenue recognition. Example: system installation &

support service]](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-15-2048.jpg)

![S3: Determine the transaction price (TP)

• Under IFRS 15, the “transaction price” is defined as the amount of

consideration an entity expects to be entitled to in exchange for the

goods or services promised under a contract, excluding any amounts

collected on behalf of third parties.

• An entity must consider the effects of all the following factors when

determining the transaction price:

variable consideration & any constraint on it

Time value of money

Non-cash consideration [FV]

The consideration payable to customers](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-16-2048.jpg)

![Variable consideration & its constraints

• The amount of consideration received under a contract might vary due to discounts, rebates, refunds,

credits, price concessions, incentives, performance bonuses, penalties and similar items. IFRS 15’s guidance

on variable consideration also applies if:

• The amount of consideration received under a contract is contingent on the occurrence or non-occurrence

of a future event (eg a fixed-price contract would be variable if the contract included a return right) & the

facts and circumstances at contract inception indicate that the entity intends to offer a price concession.

• To estimate TP with variable consideration an entity determines either: 1. the expected value (the sum of

probability-weighted amounts) or 2. the most likely amount of consideration to be received. [example:

Delivery terms modify in the sale of machine e.g., before or after a period, commission criteria]

• The expected value might be the appropriate amount in situations where an entity has a large number of

similar contracts. The most likely amount might be appropriate in situations where a contract has only two

possible outcomes (for example, a bonus for early delivery that either would be fully received or not at all).

• Example: customer with 30%-40% price concession issue (most likely), single alternative based delivery

(expected value)](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-17-2048.jpg)

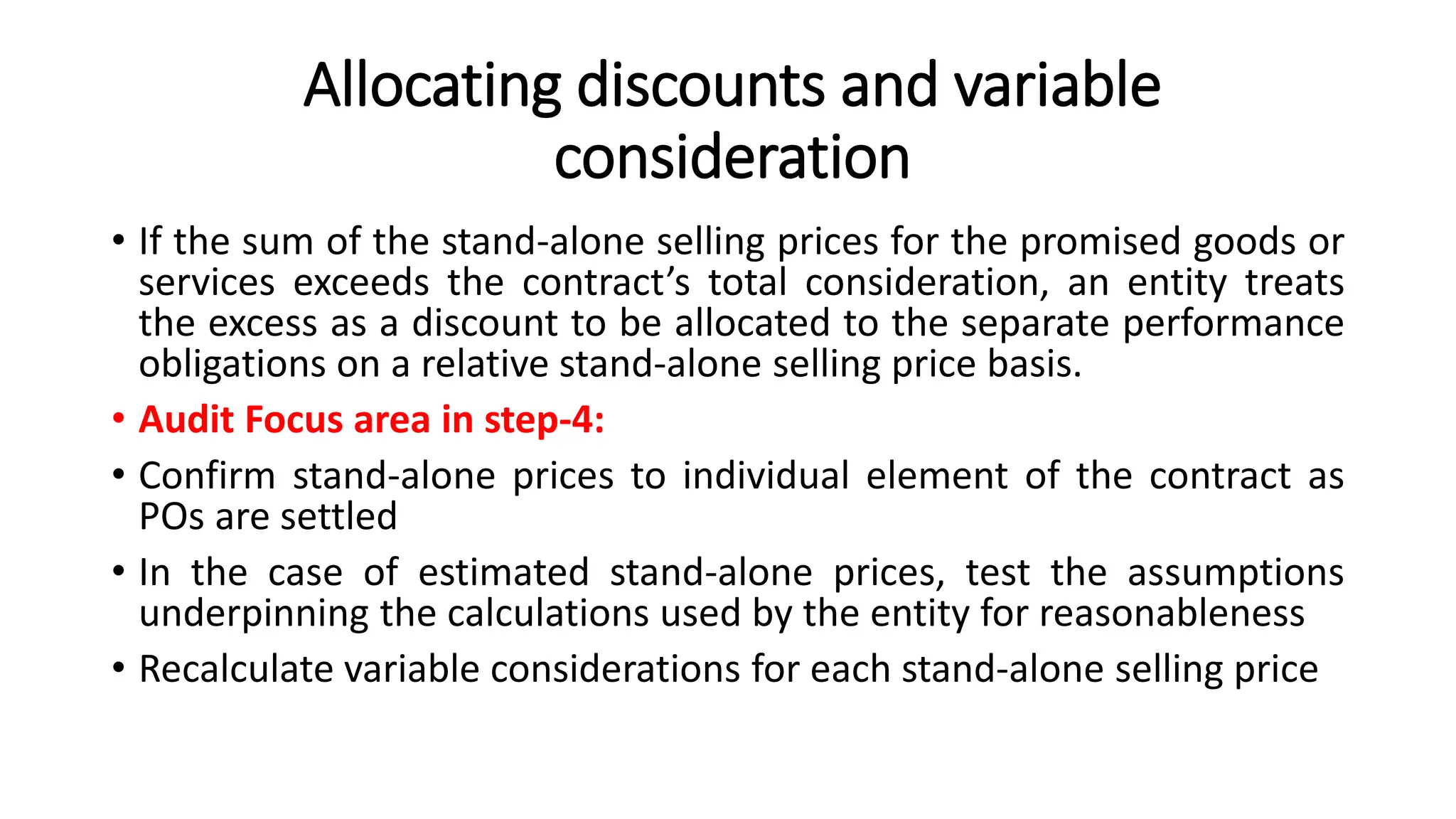

![S4: Allocate the TP to PO

• Under IFRS 15, an entity allocates a contract’s transaction price to each separate

performance obligation within that contract on a relative stand-alone selling price basis

at contract inception. IFRS 15 defines a stand-alone selling price as “the price at which an

entity would sell a promised good or service separately to a customer.” The best

evidence of the stand-alone selling price is the observable selling price charged by the

entity to similar customers and in similar circumstances, if available. If not, the stand-

alone selling price is estimated using all reasonably available information (including

market conditions, entity-specific factors, and information about the customer or class of

customer), maximizing the use of observable inputs.

• Example: selling machinery to Customer-A with maintenance service for 2 years

amounting to 12 lac [FV 11+3 lac]. Other customers get such service for 2.5 lac.

• Possible methods to estimate the stand-alone selling price:](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-21-2048.jpg)

![Audit Focus area in step-5

• For PO satisfied at a point in time, confirm the occurrence based on supporting docs; (vouching

of sales docs)

• For PO satisfied over time:

• a. Identify relevant method of measuring progress by inquiring management & inspecting related

documents: Output Method [measuring value to the customer of goods or services transferred to

date] or Input Method [measuring cost to the entity of goods or services transferred to date]

• b. confirm agreed contract price between customer & auditee

• c. determine conditional revenue/ cost (if any)

• d. confirm the progress to date of the work completed

• Input method: Confirm the total costs estimated for contracts to ensure no planned overspends

have been identified (budget docs, board minutes, mgt accounts can be inspected)

• Output method: Confirm the amounts of contract work certified as complete (Output) at the year

end by reference to relevant documentation (like surveyor’s report or client estimate)](https://image.slidesharecdn.com/revenueaccountingaudit-shared-240728040231-2575cfa2/75/Revenue-accounting-audit-Shared-pptx-26-2048.jpg)