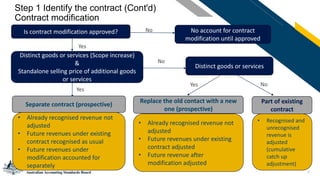

Contract modifications are subject to specific rules regarding revenue recognition. No accounting for contract modifications occurs until approval, ensuring changes are finalized before recognition.

When a modification involves distinct goods or services (i.e., a scope increase), the modification is treated as a separate contract. The standalone selling price of any additional goods or services is considered, and future revenues from the modification are accounted for separately. In this case, the old contract remains intact, and future revenues under the original contract continue as usual.

However, if the modification results in distinct goods or services and replaces the old contract with a new one, revenue is recognized prospectively—treating the new agreement as a separate contract. For modifications that are part of the existing contract, adjustments are made to both recognized and unrecognized revenue, with a cumulative catch-up adjustment applied to reflect the change.

These guidelines ensure clarity in revenue reporting when contract terms change, helping businesses maintain compliance with accounting standards.