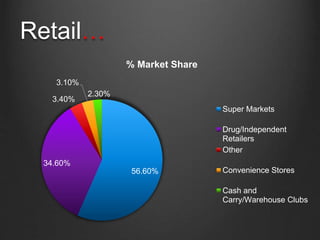

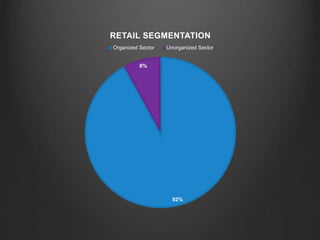

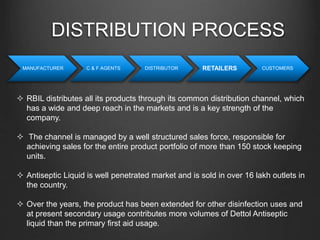

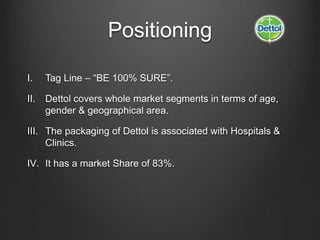

The document outlines the distribution channels in retailing, highlighting the role of various intermediaries such as retailers and wholesalers. It focuses on the success of Dettol antiseptic liquid, detailing its market penetration, strong distribution network, and key success factors like customer loyalty and continuous innovation. Additionally, it discusses the growth trajectory and future prospects of Dettol in the market.