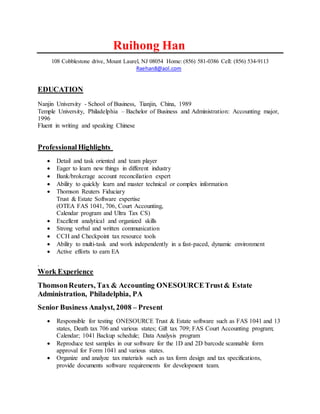

Ruihong Han has over 20 years of experience in accounting and financial analysis. She currently works as a Senior Business Analyst for Thomson Reuters, where she tests estate and trust accounting software and ensures it complies with tax regulations. Previously, she has held roles providing customer support, accounting, and tax preparation for estates, trusts, and financial institutions. She has strong skills in accounting, analysis, problem-solving, and working collaboratively.