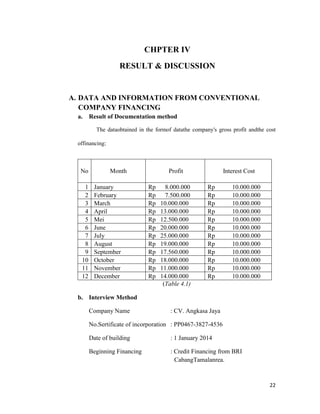

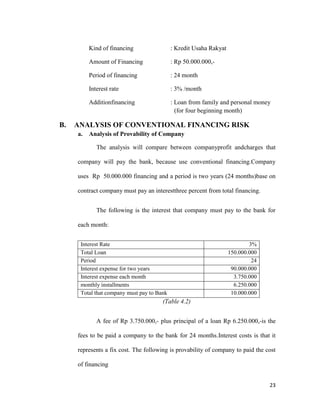

1. The document discusses the differences between conventional bank financing and Islamic bank financing. It outlines the key concepts of each type of financing.

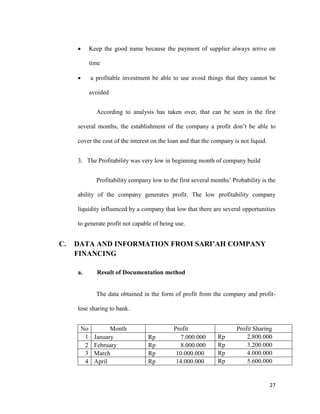

2. For conventional banks, financing involves providing loans and charging interest. For Islamic banks, financing is based on profit-sharing principles in accordance with Islamic law and does not charge interest.

3. The main Islamic financing products discussed are mudharabah (profit-sharing partnership) and musyarakah (joint partnership), which share profits between the bank and customer according to their capital contributions.