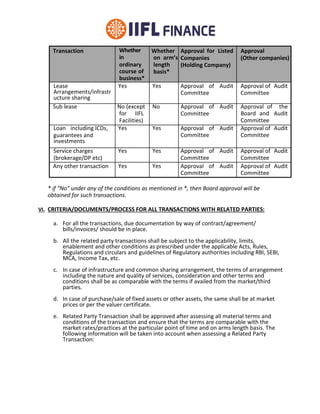

The document outlines the related party transaction policy for IIFL Finance Limited and its subsidiaries, ensuring compliance with applicable laws like the Companies Act and SEBI regulations. It defines key terms, specifies the processes for approvals from the audit committee and board, and sets materiality thresholds for transactions requiring shareholder approval. The policy emphasizes the need for transparency and fairness in related party transactions to avoid conflicts of interest.