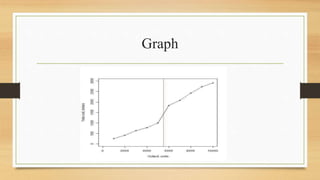

Piecewise linear regression models relationships that change at certain points by fitting separate linear models to different segments of data. It is useful when relationships exhibit non-linear or abrupt changes. The document provides an example of modeling sales commission data with two linear pieces that change slope at a threshold sales value. It also discusses applications in retail, economics, and environmental studies. Statistical methods for estimating piecewise linear regression coefficients using dummy variables are presented along with hypothesis testing of coefficients.

![Solution

Y X1 X1 – X* D X2 = (X1 – X*)*D

256 1000 -4500 0 0

414 2000 -3500 0 0

634 3000 -2500 0 0

778 4000 -1500 0 0

1003 5000 -500 0 0

1839 6000 500 1 500

2081 7000 1500 1 1500

2423 8000 2500 1 2500

2734 9000 3500 1 3500

2914 10000 4500 1 4500

Let Y represent total cost and X total output, we

obtain the following results:

n = 10 , k = 3

Yi = β0 + β1X1 + β2(X1 – X*)*D + μi

𝛽1 =

𝑐𝑜𝑣 𝑋1,𝑌 𝑣𝑎𝑟 𝑋2 −𝑐𝑜𝑣 𝑋2,𝑌 𝑐𝑜𝑣 (𝑋1 ,𝑋2)

𝑣𝑎𝑟 𝑋1 𝑣𝑎𝑟 𝑋2 −[𝑐𝑜𝑣 (𝑋1 ,𝑋2)]2

𝛽1 =

2692600 2562500 −(1393550)(4125000)

8249999.866 2562500 −[4125000]2

𝛽1 = 0.2791](https://image.slidesharecdn.com/regressionpresentation-240127163427-175fd6cd/85/Regression-Presentation-pptx-13-320.jpg)

![Continued…

𝛽2 =

𝑐𝑜𝑣 𝑋2,𝑌 𝑣𝑎𝑟 𝑋1 −𝑐𝑜𝑣 𝑋1,𝑌 𝑐𝑜𝑣 (𝑋1 ,𝑋2)

𝑣𝑎𝑟 𝑋1 𝑣𝑎𝑟 𝑋2 −[𝑐𝑜𝑣 (𝑋1 ,𝑋2)]2

𝛽2 =

1393550 8249999.866 −(2692600)(4125000)

8249999.866 2562500 − 41250002

𝛽2 = 0.0945

𝛽0 = 𝑌 − 𝛽1 𝑋1 − 𝛽2 𝑋2

𝛽0 = 1507.6 – (0.2791)(5500) – (0.0945)(1250)

𝛽0 = – 145.7167

Xi* = 5500

The estimated model is

𝑌i = – 145.7167 + 0.2791 Xi + 0.0945 (Xi – 5500) Di](https://image.slidesharecdn.com/regressionpresentation-240127163427-175fd6cd/85/Regression-Presentation-pptx-14-320.jpg)