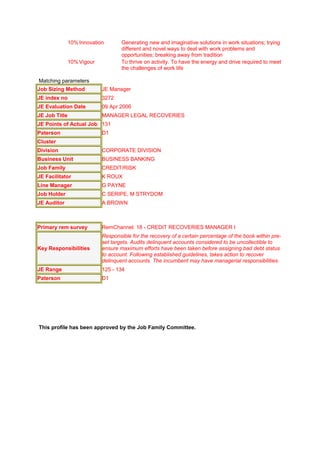

The role is responsible for maximizing recovery of non-performing loans through legal and risk management processes. Key responsibilities include managing regional legal collections according to policies and governance, ensuring all administrative and security issues are properly handled for legal matters, assessing matters and recommending appropriate strategies, and preparing reports. The role also manages staff and ensures expenses are within budget. Strong legal skills and a minimum of 5 years experience in collections are required for the role.