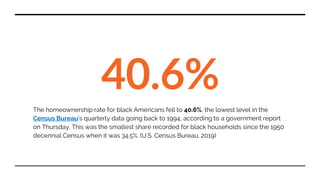

Redlining is an unethical practice that denies financial services to residents based on race or ethnicity, originating from discriminatory policies in the 1930s, such as those implemented by the Home Owners Loan Corporation (HOLC). The consequences of redlining, including significant disparities in homeownership for Black Americans and ongoing mortgage bias, persist today, despite the 1968 Fair Housing Act aimed at prohibiting racial discrimination in housing. The document discusses the historical background, impact, and current challenges related to redlining while posing questions about how to address its legacies.