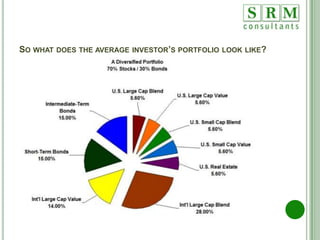

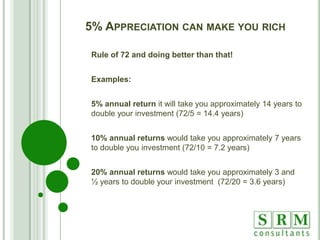

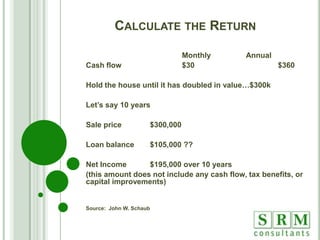

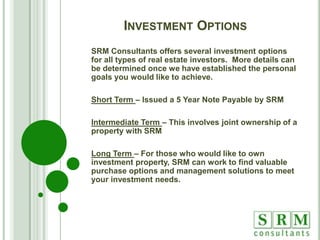

The document discusses the impact of the 2008-2009 financial crisis on the real estate market, highlighting the devaluation of the US dollar, rising gold prices, and a notable increase in foreclosures. It advocates for real estate investment as a strategic opportunity due to historically low interest rates and potential for appreciation despite projected declines in housing prices. The text also outlines investment strategies and emphasizes the advantages of leveraging equity in residential properties amid economic uncertainty.