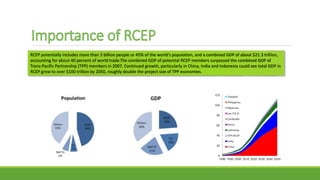

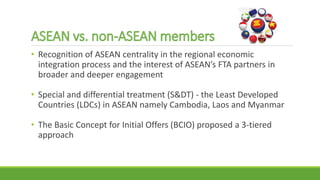

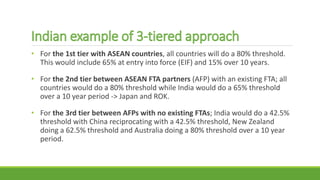

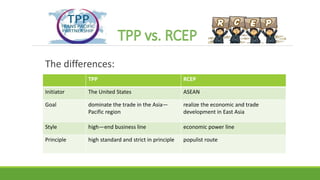

RCEP is a proposed free trade agreement between the 10 ASEAN member states and 6 Asia-Pacific countries - China, Japan, South Korea, India, Australia and New Zealand. Negotiations began in 2012 with the goal of liberalizing trade and investment. If concluded, RCEP would be one of the largest free trade areas in the world, covering nearly half the global population and trade. After 15 rounds of negotiations, members aim to finalize an agreement in 2017 to boost regional economic integration and confidence. However, several issues around intellectual property and market access remain unresolved.