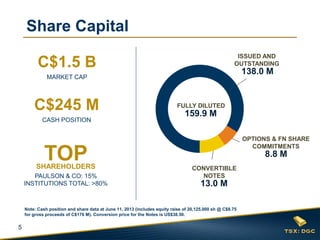

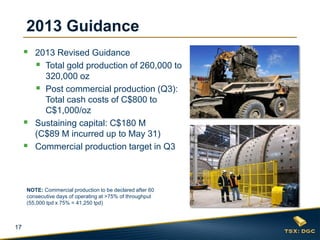

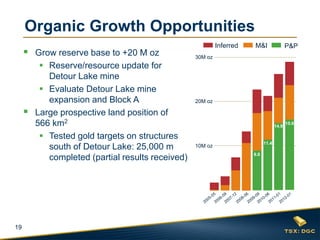

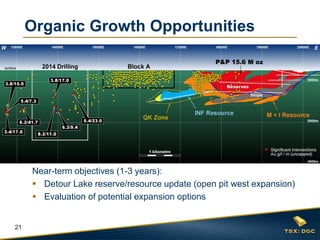

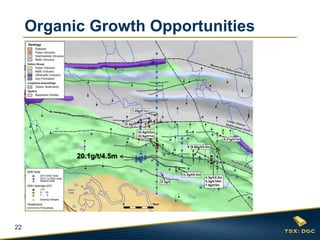

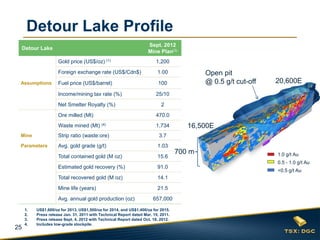

Detour Gold is Canada's next intermediate gold producer focused on its core Detour Lake mine in Ontario. The document provides an overview of Detour Gold's operations including: commercial production starting in 2013 with 260,000-320,000 ounces of gold expected for the year; 15.6 million ounces of gold reserves at Detour Lake mine with a mine life of 21.5 years; and opportunities for organic growth through exploration and expanding reserves beyond 20 million ounces. Detour Gold aims to become a leading intermediate gold producer through safe and disciplined operations, reserve growth, and value creation for shareholders.

![26

800

700

600

500

400

300

200

100

0

Gold Production (‘000 oz)

900

850

800

750

700

650

600

550

500

Total Cash Costs (C$/oz)

Gold Production/Cost/Grade Profile

Note: Excludes stripping adjustments.

Avg. C$749/oz

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0

Grade (g/t Au)

Avg. 657,000 oz/yr

2013 Guidance]](https://image.slidesharecdn.com/rbc-global-mining-and-materials-conference4301-130618130128-phpapp02/85/RBC-Global-Mining-and-Materials-Conference-26-320.jpg)