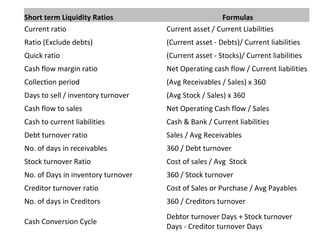

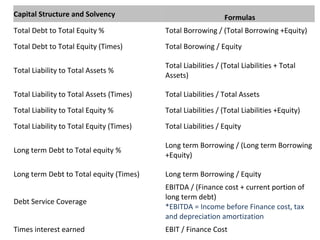

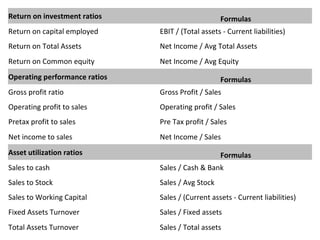

This document lists formulas for various financial ratios used to analyze a company's liquidity, capital structure, solvency, return on investment, operating performance, and asset utilization. Ratios included are the current ratio, quick ratio, cash flow margin ratio, collection period, inventory turnover, debt-to-equity ratio, times interest earned, return on capital employed, gross profit ratio, and total assets turnover among others. Formulas provided calculate metrics like current assets to current liabilities, EBITDA to debt payments, net income to average assets, and sales relative to working capital.