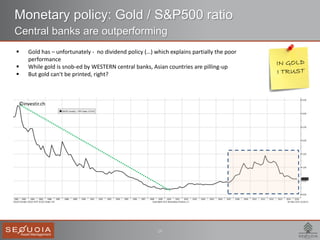

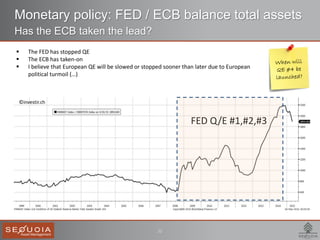

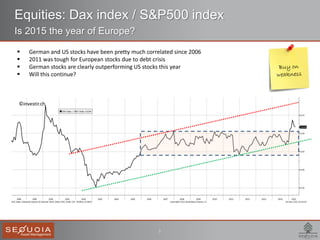

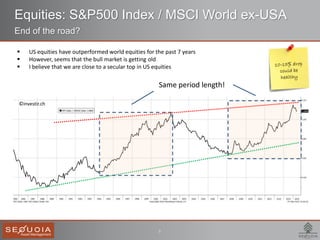

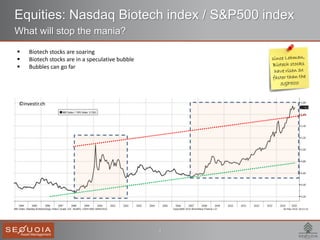

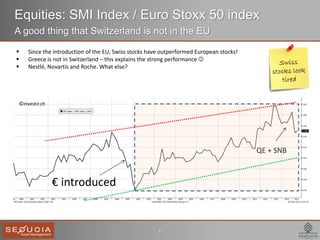

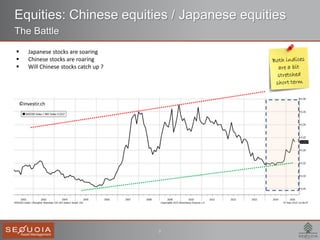

The document discusses various investment strategies and market outlooks as of April 2015, emphasizing opportunities in European and emerging markets while cautioning against US equities nearing their peak. It highlights the impact of monetary policy on different asset classes and suggests buying dips in commodities like gold and oil. Key takeaways include the potential for improvement in European stocks, while stressing volatility and cash management as critical factors in investment strategy.

![13

Equities: Apple / S&P500 index

What else?

Apple has been [massively] outperforming the S&P500 since 2005

Apple is an amazing cash machine

Apple is still cheap relative to its earnings growth potential!

PEG ratio (est) = 0.89x

iPhone introduced

©investir.ch](https://image.slidesharecdn.com/chartsthatmatter07-150511151505-lva1-app6891/85/Charts-that-matter-07-05-2015-bund-unloading_sequoia-13-320.jpg)

![15

Equities: Coca-Cola / PepsiCo

Long Zero / Short Max?

Since 1998, PepisCo shares have [surprisingly] outperformed its rival

The biggest difference between Coca-Cola and PepsiCo is that PepsiCo's food business is very

strong with good growth, particularly in emerging markets!

I drink coca-colas but I enjoy Doritos

©investir.ch](https://image.slidesharecdn.com/chartsthatmatter07-150511151505-lva1-app6891/85/Charts-that-matter-07-05-2015-bund-unloading_sequoia-15-320.jpg)