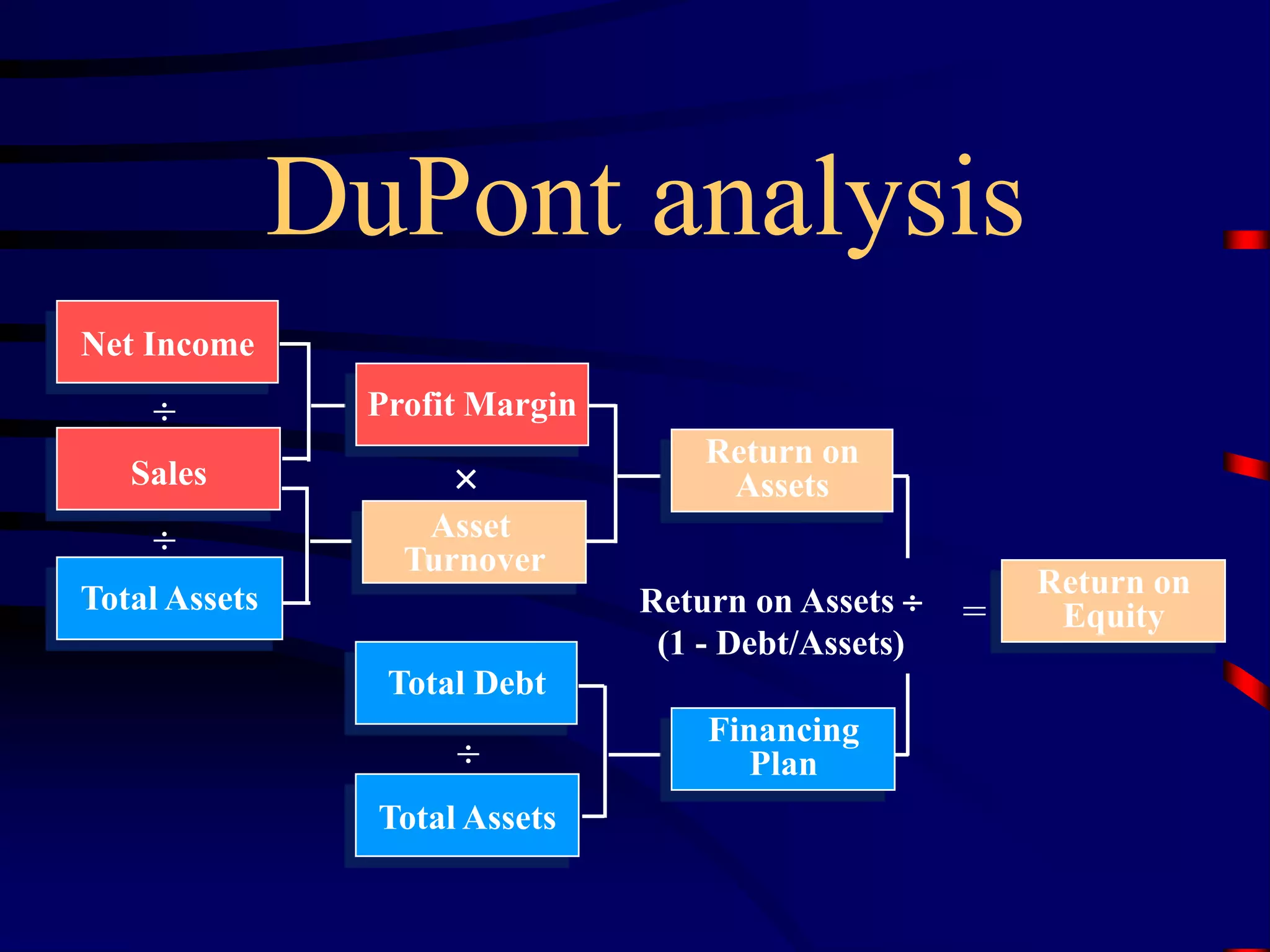

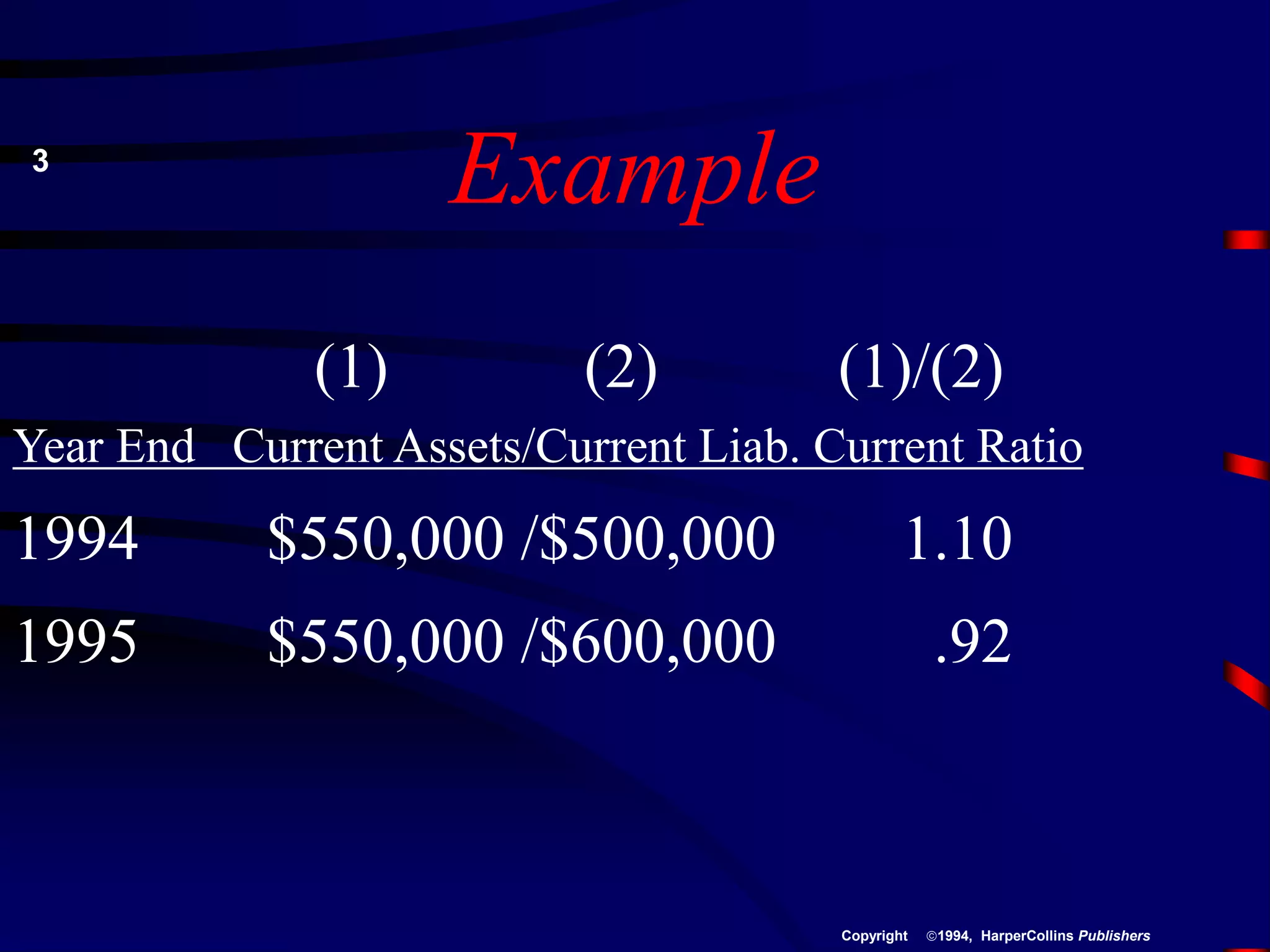

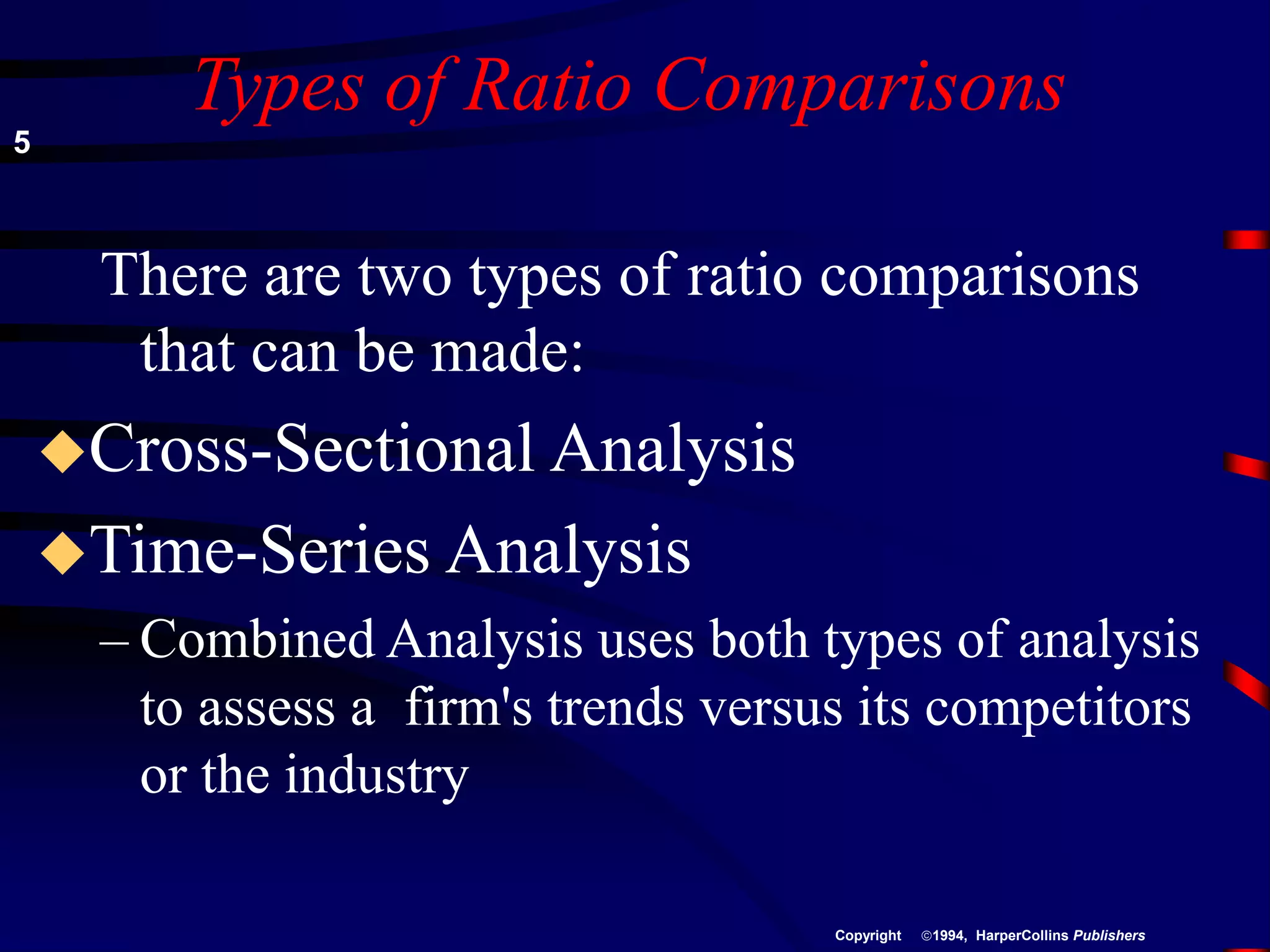

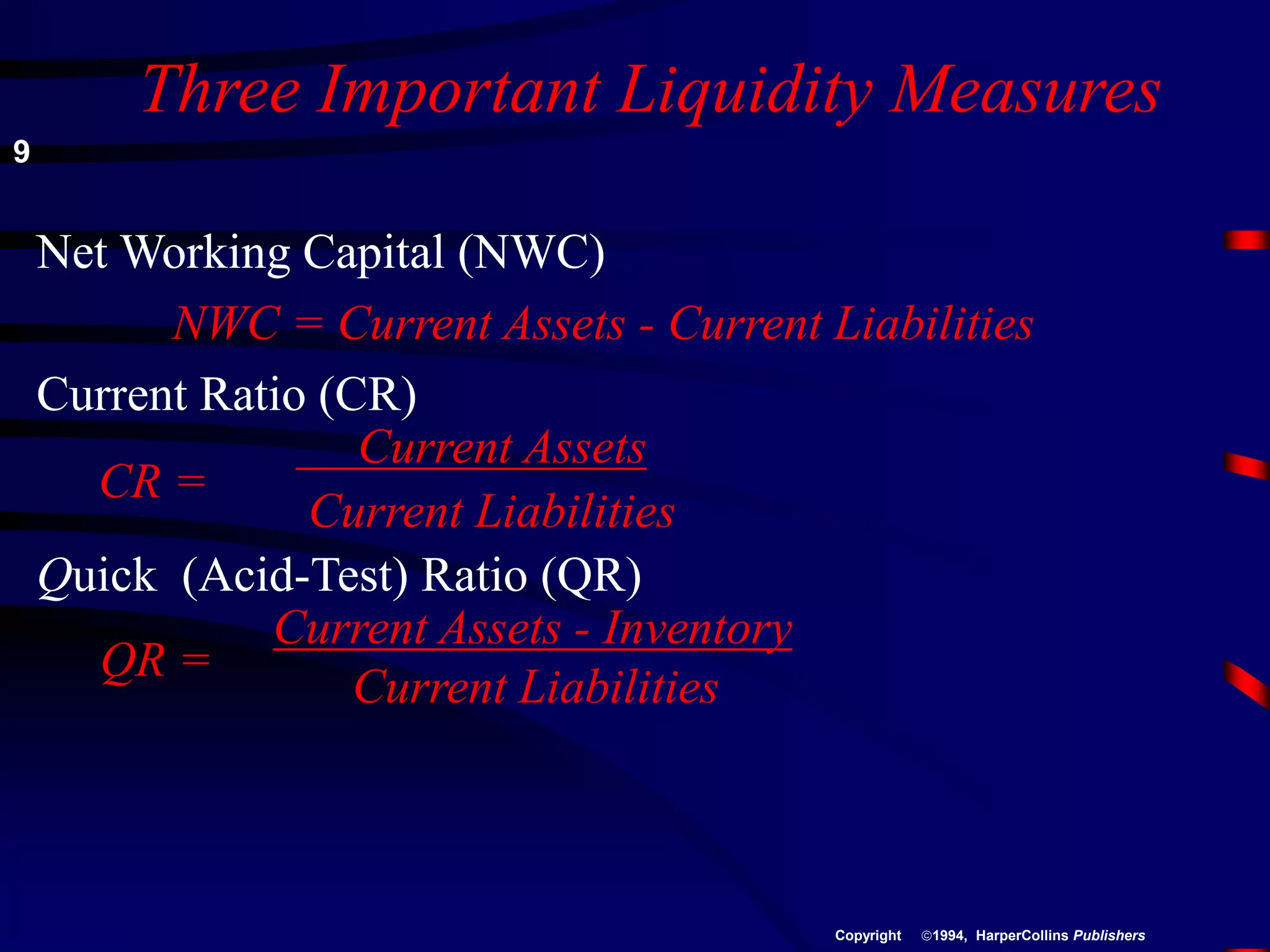

The document discusses various methods for analyzing financial statements, including the use of ratios to evaluate different aspects of a company's financial health and performance. It describes ratio analysis as using calculations and interpretations of financial ratios to assess a firm. It then provides details on specific ratios to analyze liquidity, activity, debt, and profitability. These include current ratio, inventory turnover, debt-to-equity ratio, and return on equity. Finally, it discusses the DuPont analysis system for a more integrated approach to evaluate a firm's overall financial condition using ratios from the income statement and balance sheet.

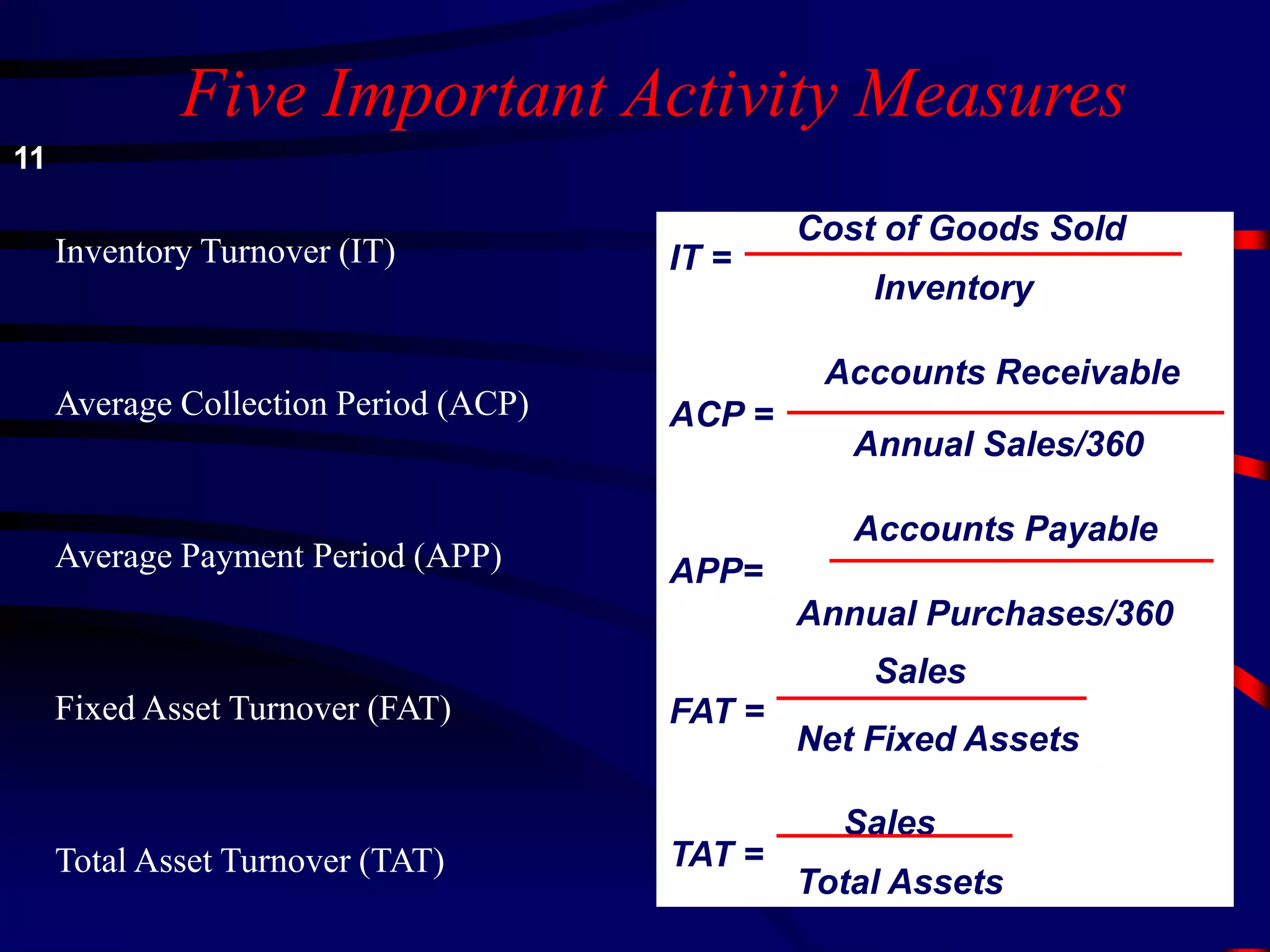

![Debt Ratio

(DR)

Debt-Equity Ratio

(DER)

Times Interest Earned

Ratio (TIE)

Fixed Payment Coverage Ratio

(FPC)

Total Liabilities

DR=

Total Assets

Long-Term Debt

DER=

Stockholders’ Equity

Earnings Before Interest

& Taxes (EBIT)

TIE=

Interest

Earnings Before Interest &

Taxes + Lease Payments

FPC=

Interest + Lease Payments

+{(Principal Payments +

Preferred Stock

Dividends) X [1 / (1 -T)]}

Four Important Debt Measures

14](https://image.slidesharecdn.com/ratioanal-230904221347-43f6b688/75/ratioAnal-ppt-13-2048.jpg)